Final Employee Guide (SWWPennon)

advertisement

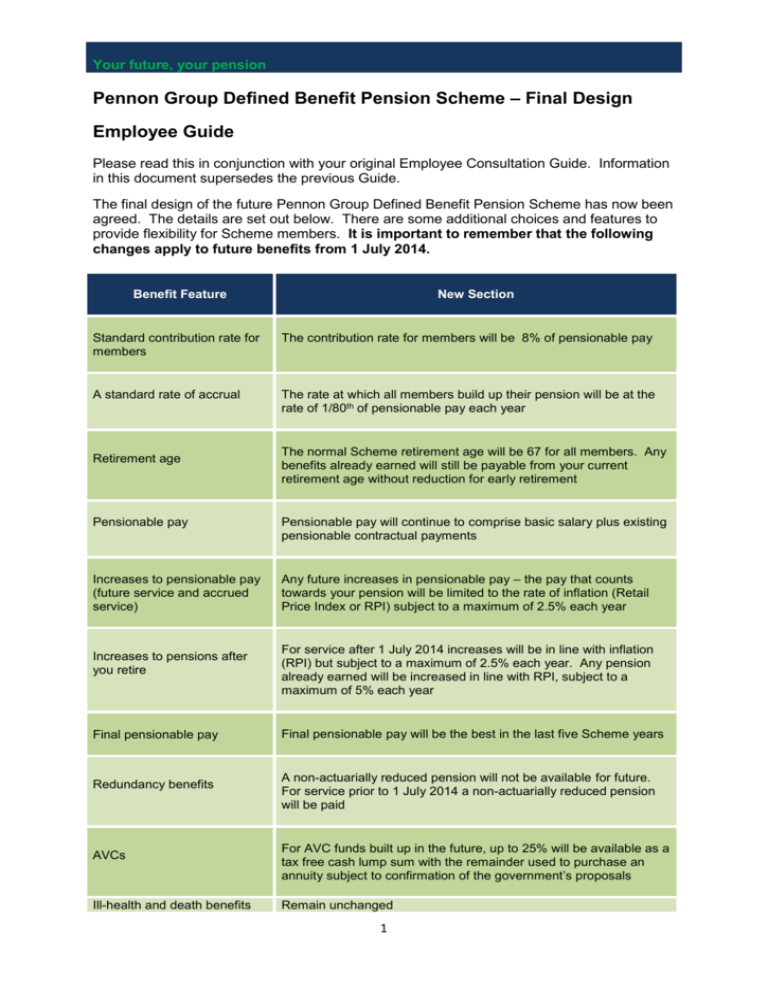

Your future, your pension Pennon Group Defined Benefit Pension Scheme – Final Design Employee Guide Please read this in conjunction with your original Employee Consultation Guide. Information in this document supersedes the previous Guide. The final design of the future Pennon Group Defined Benefit Pension Scheme has now been agreed. The details are set out below. There are some additional choices and features to provide flexibility for Scheme members. It is important to remember that the following changes apply to future benefits from 1 July 2014. Benefit Feature New Section Standard contribution rate for members The contribution rate for members will be 8% of pensionable pay A standard rate of accrual The rate at which all members build up their pension will be at the rate of 1/80th of pensionable pay each year Retirement age The normal Scheme retirement age will be 67 for all members. Any benefits already earned will still be payable from your current retirement age without reduction for early retirement Pensionable pay Pensionable pay will continue to comprise basic salary plus existing pensionable contractual payments Increases to pensionable pay (future service and accrued service) Any future increases in pensionable pay – the pay that counts towards your pension will be limited to the rate of inflation (Retail Price Index or RPI) subject to a maximum of 2.5% each year Increases to pensions after you retire Final pensionable pay Redundancy benefits AVCs Ill-health and death benefits For service after 1 July 2014 increases will be in line with inflation (RPI) but subject to a maximum of 2.5% each year. Any pension already earned will be increased in line with RPI, subject to a maximum of 5% each year Final pensionable pay will be the best in the last five Scheme years A non-actuarially reduced pension will not be available for future. For service prior to 1 July 2014 a non-actuarially reduced pension will be paid For AVC funds built up in the future, up to 25% will be available as a tax free cash lump sum with the remainder used to purchase an annuity subject to confirmation of the government’s proposals Remain unchanged 1 Your future, your pension Additional member choices Low cost choice allows members to reduce their contributions to 4% with corresponding reduction in accrual and benefits. Retirement age choice allows members who want to retire earlier than 67 the opportunity to do so without a corresponding early retirement reduction factor being applied to new benefits. Name Description When is choice available Low cost choice Retirement age choice Employee contributions rate: 4% Pension grows at rate of 1/120th Also accrue State Second Pension with extra 1% NI contribution Employee contributions: extra 1% p.a. for each year the chosen retirement age is below age 67 (minimum retirement age for WPS members: 62. Minimum retirement age for 2006 members: 65) Once at go-live date and up to two additional times in your career Defined Benefit ‘top up’ arrangement Defined Benefit members will have the opportunity to join the Pennon Group Defined Contribution Scheme and contribute 3%, 4% or 5% of any pay increase they receive above the cap on pensionable pay. The employer will make a corresponding 6%, 8% or 10% matching contribution (less 1.0% for Scheme administration). At retirement the member can take their total Defined Contribution Pension fund either all as a lump sum (subject to confirmation of the government’s proposals expected later this year) or to buy a pension or annuity with a 25% lump sum option. Example 1 Employee contribution 3.0% Employee contribution 5% Starting salary £23,000 Member contributes 3% of their pensionable pay above the cap into the DC Scheme until they either retire or leave the Scheme. The employer contributes 6%. Member contributes 5% of their pensionable pay above the cap into the DC Scheme until they either retire or leave the Scheme. The employer contributes 10%. Salary after 20 years £41,521 DC Pension fund £4,090 * DC Pension fund £7,165 * Example 2 Employee contribution 3.0% Employee contribution 5% Starting salary £23,000 Member contributes 3% of their pensionable pay above the cap into the DC Scheme until they either retire or leave the Scheme. The employer contributes 6%. Member contributes 5% of their pensionable pay above the cap into the DC Scheme until they either retire or leave the Scheme. The employer contributes 10%. DC Pension fund £13,203 * DC Pension fund £23,106 * Annual pay increase 3.0% Pensionable pay 2.5% DC ‘top up’ 0.5% Annual pay increase 3.0% 3 additional promotion increases of 10% each Pensionable pay 2.5% DC ‘top up’ 0.5% Salary after 20 years £54,852 * Estimated projected pension fund is the total employee and employer contributions with no account for fund growth. 2 Your future, your pension What do I need to do now? You now need to decide whether you wish to be transferred into the standard option, or opt out of this and take either the low cost choice or retirement age choice from 1 July 2014. To make your choice please complete the enclosed Pension Option Form, and return it to the Pennon Group Pensions Team at Peninsula House, by 1st July 2014. Soon after this date we will write to you to confirm which option you have selected. Please make a definite choice between the options: standard or low cost and retirement age. However, if you choose to do nothing or do not return your completed Form by 1st July 2014, you will automatically be transferred into the standard option with a Pension Scheme retirement age of 67 and an employee contribution rate of 8%. Should you then wish to change you will be able to do so in April 2015 as one of your two further choices. If you think you may want to take advantage of the Defined Contribution ‘top up’ arrangement in the future you do not need to do anything right now. If you do receive a future salary increase above the pensionable pay cap and wish to join the Defined Contribution Scheme you will need to contact the Pensions team. What help and support is available to me? The Pensions Helpline on 01392 442802 is available if you are not clear what you have to do or have questions about your updated personal illustration. No one in the Pennon Group of Companies can legally give you individual financial advice. If you want to talk to a financial advisor for impartial advice you can find one by visiting www.unbiased.co.uk. Don’t forget that South West Water’s confidential employee assistance programme can offer you help and where necessary specialist counselling and support. Help is available 24 hours a day, seven days a week, online or on the phone. Calls are free from a UK landline. To phone call 0800 282193. To access the website please visit: www.ppconline.info (Username: SWW, Password: employee). Help line: 01392 442802 Visit: www.yourfutureyourpension.co.uk 3