Luxury Segment Competitive Analysis

advertisement

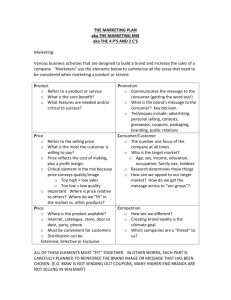

Luxury Segment Competitive Analysis Disclaimer: The material contained in this presentation is purely demonstrative and is not accurately representative of the relevant companies’ actual positions. Table of Contents Summary Overview Key Factors Competitive Analysis Summary Cadillac’s profit margins are lower than luxury segment industry leaders’ due to low price, high material cost, and low volume These can be combated with building stronger brand recognition and sharing components across brands and platforms Proposal: Implement architecture sharing between Chevy/Buick and Cadillac; deploy marketing scheme to strengthen brand Overview Cadillac’s profit margins are lower than luxury segment industry leaders’ due to three key factors • Sales price • Material cost • Sales volume These factors can be attributed to lack of luxury brand strength and cost creep due to material exclusivity. Key Factors: Sales Price Average effective sales price decreased 15% over last 20 years • Decrease in demand for Cadillac vehicles, especially following market crashes • Significant increase in incentives and discounts to clear lots Decrease in sales price due to lack of brand strength and recognition in the luxury segment Solution: implement new marketing strategy designed to display Cadillac as the premium luxury brand Key Factors: Material Cost Average material cost increased 10% over last 20 years • Lack of shared architectures and materials across brands • Cost creep due to reluctance to cut costs Increase in material cost due to lack of parts sharing and cost creep Solution: extend Chevy architectures to Cadillac brand Key Factors: Sales Volume Average sales volume stifled growth (5%) over last 20 years • Low dealer inventory turnover for Cadillacs • Leads to lower return on tooling capital Decrease in sales volume due to lack of brand strength Solution: implement new marketing strategy Competitive Analysis: Audi Audi has highest margins in luxury segment • Extremely high level of architecture and material sharing across brands • Highest segment volume (low average tooling cost) • Strong brand image across all developed markets Takeaway: Audi reuses many parts across platforms and can maintain its brand image as being a premium luxury brand Competitive Analysis: BMW BMW maintains margins over time with low investment • BMW redesigns utilize few new or changing parts • High segment volume • Strong brand image across all developed markets Takeaway: BMW redesigns change few parts, but historical brand strength inflates sales volume Competitive Analysis: Mercedes Mercedes has consistent redesign but utilizes cheap materials • High level of parts sharing across platforms • Very low material costs due to sharing and quality of materials • Arguably strongest brand strength in luxury segment Takeaway: Mercedes continues to have segment’s lowest material costs which inflates margins Competitive Analysis: Lexus Lexus is available in widest array of markets with solid margins • Lexus sells vehicles across both developed and developing markets • Popular for interior and exterior design • Strong brand image Takeaway: High market penetration and intelligent design can boost brand image and sales volume Proposal: Architecture Sharing Sharing architectures with Chevy/Buick • Can strategically target components to be shared based on user visibility and contact • Decrease Cadillac tooling cost by 35% • Decrease average material cost by 6% Impact: 8% increase in Cadillac profitability Proposal: Marketing Tactics Reintroduce Cadillac as high-end premium luxury brand • Targeted advertisement using fashion and arts industry • Move brand headquarters to SoHo, NYC for cultural shift • Eliminate incentives and eliminate fleet and rental volumes Impact: Increase effective sales price by 17% Q&A