FCPA - Association of Corporate Counsel

advertisement

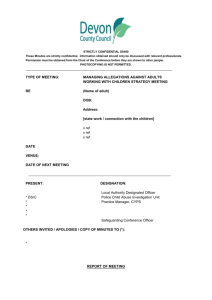

STRICTLY CONFIDENTIAL FCPA A Practitioner’s Perspective A Journey To Compliance STRICTLY CONFIDENTIAL Introduction • Objectives – Overview of the FCPA – Elements of an effective FCPA compliance program – Analysis of U.S. v. Kay – Expanding scope of the FCPA – Practical effects of Kay STRICTLY CONFIDENTIAL Overview Of The FCPA STRICTLY CONFIDENTIAL Overview Of The FCPA • Antibribery provisions of the Act prohibit payment or offer of payment by a covered person or intermediary to a foreign official to improperly act or influence an act that will obtain or retain business for the payor or any person • Accounting provisions require issuers to: – Maintain books and records that accurately reflect transactions and dispositions of assets – Devise and maintain reasonable internal accounting controls to prevent and detect FCPA violations • FCPA is enforced by DOJ and SEC STRICTLY CONFIDENTIAL Is There A Safe Harbor For FCPA Compliance? • No “safe harbor” but maybe a “calm inlet” – Federal Sentencing Guidelines for Organizations 1987 • SEC has endorsed the guidelines • DOJ has made it clear that it will use the guidelines to – Determine recommendations for leniency - OR – ALLOW A POTENTIAL DEFENDANT COMPANY TO AVOID PROSECTUION ALL TOGETHER http://www.ussc.gov/2007guid/8b2_1.html STRICTLY CONFIDENTIAL Is There A Safe Harbor For FCPA Compliance? • “To have an effective compliance and ethics program …. An organization shall: – Exercise due diligence to prevent and detect criminal conduct; and – Otherwise promote an organizational culture that encourages ethical conduct and a commitment to compliance with the law.” http://www.ussc.gov/2007guid/8b2_1.html STRICTLY CONFIDENTIAL Elements Of An Effective FCPA Program STRICTLY CONFIDENTIAL Compliance Program Ownership • Organization's governing authority (Board of Directors) must: – Be aware of the content and operation of the program – Exercise oversight of implementation and effectiveness • High level personnel must: – Ensure the organization has a program – Assign specific individuals to oversee the program – Assign specific high level individuals to have overall responsibility for the program STRICTLY CONFIDENTIAL Major Elements Of An FCPA Compliance Program • Written standards and procedures • Due diligence • Training and communication • Management STRICTLY CONFIDENTIAL Written Standards & Procedures • Expectations of Ethical Conduct – Employees – Third parties • How to engage – Automated intake process (web based) cuts cycle time and provides better initial information – Centralized decision making for high risk agents – Inform third parties of expectations early in the process • How to administer – Who has responsibility for what portions of the policy – Periodic reports and certifications • Red Flags – Lay Person’s Guide to the FCPA – List potential red flags and how to handle each (Relation to decision maker, requests by customer, cash advances, unusual payment terms, etc.) • Should take a risk based approach – Reasonable action is the standard set forth in the Guidelines – Credible http://www.justice.gov/criminal/fraud/docs/dojdocb.html STRICTLY CONFIDENTIAL Due Diligence • Conscious disregard or willful ignorance of the act is not a defense • “The organization shall use reasonable efforts not to include within the substantial authority personnel of the organization any individual whom the organization knew, or should have known through the exercise of due diligence, has engaged in illegal activities or other conduct inconsistent with an effective compliance and ethics program.” – On employees - HR Function – On all “danger” partners • Agents • Distributors • JV Partners/Acquisitions • Reps • Risk Based Approach – Vary due diligence based on risk • Use of third party due diligence – Avoid conflict of interest with field sponsors – Consistency of work product and professionalism STRICTLY CONFIDENTIAL Training & Communication • Management, not compliance personnel, is ultimately responsible for the program • “Sell” the program – Board of Directors – Senior management – Line personnel – Third parties prior to engagement – Periodic reinforcement STRICTLY CONFIDENTIAL Training & Communication • Five-part business analysis to demystify the relationship – Information gathering – Due diligence – Decision making – Contracting – Management • Not a “tick in the box” • In person if possible STRICTLY CONFIDENTIAL Management • Monitoring, Auditing, Investigating, and Consequences • We can no longer draft a policy and put it in a drawer-SOX • Monitor and manage on a continuous basis • Internal audit on a regular basis – Feedback up the chain with action as needed (systemic/individual) • Third parties for investigations (Red Flag/Violations) – Professional – Consistency of work product • Reporting structure (for suspected violations) – Open door – Anonymous if possible • Real and consistent consequences for non compliance STRICTLY CONFIDENTIAL Analysis of United States v. Kay STRICTLY CONFIDENTIAL United States v. Kay • American Rice Inc through Haitian subsidiary, Rice Corp of Haiti, imported rice to Haiti • Between 1995 – 1999, payments to officials to lower sales tax and reduce customs duties were an expected part of doing business • Rice Corp of Haiti made such payments, authorized by Douglas Murphy, President of ARI and David Kay, VP for Caribbean Sales • During an unrelated transaction, outside counsel discovered the practice • The company self reported and settled. Kay and Murphy were charged with violations of the antibribery provisions. At trial, they moved that their conduct was not a violation of the FCPA because the bribes were not for the purpose of “obtaining or retaining business”. The trial court agreed and dismissed the indictment. United States v. Kay, 200 F. Supp. 2d 681 (S.D. Tex. 2002) STRICTLY CONFIDENTIAL United States v. Kay • Government appealed to 5th Circuit, who overturned the ruling and held that the bribes could be a violation of the Act if they ultimately gave the payor an unfair business advantage in the marketplace. Court concluded the statute was ambiguous as a matter of law. Court then analyzed the SEC report that precipitated the Act as well as the legislative history and determined not all bribes to foreign officials were covered • Congress legislated the grease payment exception and affirmative defenses. • Based on legislative history, the Court held that if a bribe gave an unfair advantage e.g. lower taxes to make an unprofitable contract profitable, to stay in or improve one’s position in the marketplace, then there was a business nexus and the bribe was within the statute. United States v. Kay, 359 F.3d 738 (5th Cir. 2004) • On remand to District Court. Kay and Murphy were convicted and sentenced to 37 and 63 months respectively • Kay and Murphy appealed on other grounds. 5th Circuit denied appeal. United States v. Kay, 513 F.3d 432 (5th Cir. 2007), reh’g en banc denied, 513 F.3d 461 (5th Cir. 2008) • Their Petition for a Writ of Certiorari was denied by the Supreme Court. 129 S.Ct. 42 (2008), reh’g denied, 2008 WL 5046518 (December 1, 2008) STRICTLY CONFIDENTIAL Universe Of Bribes All Bribes • • • • Non FCPA Bribes to Foreign Officials Permitted by law Reasonable payments for business-connected travel expenses Grease payments Purely private Pre-Kay FCPA Settlements • • • • Refunds of previous tax payments Changes to law re: land development Reduction in general tax obligations Clearing illegally imported goods Forbidden By Kay • Aid payor in gaining an unfair advantage or to obtain or retain business •Reduction of customs and of sales tax liability FCPA Language • Used to directly obtain or retain business STRICTLY CONFIDENTIAL Expanding Scope Of The FCPA STRICTLY CONFIDENTIAL What Do We Do About The Gray Area? • Government has taken an expansive view of scope even before Kay • By expanding the scope of the FCPA beyond a literal reading of “obtain or retain business” the Kay Court has given judicial support to the government position STRICTLY CONFIDENTIAL SEC v. Delta & Pine Land Co. • In July 2007, the SEC issued a Cease & Desist Order against Delta & Pine Land Co., a US-domiciled public company and its subsidiary, Turk Deltapine, stating that, between 2001-2006, Turk Deltapine made payments valued at approximately $43,000 to multiple officials of the Turkish Ministry of Agricultural and Rural Affairs. These payments made is cash, kind, and reimbursement of expenses, were made in order to obtain false governmental inspection reports and irregular quality certificates that were necessary for Turk Deltapine to operate its business in Turkey. These payments were made both directly and through an intermediary and continued even after being discovered by Delta Pine & Land Co.. The books of Turk Deltapine and Delta & Pine Land Co. did not accurately reflect these payments. The Order state that there was time sensitivity with regard to the inspections and quality certificates but did not make a “but for” analysis. Nevertheless, the Order stated and Delta & Pine and Turk Delta did not object as part of the Cease & Desist Order, that Delta & Pine and Turk Delta violated the antibribery provisions of the FCPA, as well as the books and records and internal controls provisions. Delta & Pine and Turk Delta settled a related civil action based on the same facts and agreed to a $300,000 civil penalty. No. 07-cv-01352 (D.D.C. filed July 25, 2007); In the Matter of Delta & Pine Land Co., SEC Admin. Proceeding File No. 3-12712, Cease & Desist Order at 3 (July 26, 2007): http://www.sec.gov/litigation/admin/2007/34-56138.pdf STRICTLY CONFIDENTIAL The Matter Of Bristow Group, Inc. • In September 2007, the SEC issued a Cease & Desist Order against Bristow Group Inc., a US-domiciled public company, stating that its wholly owned subsidiary, AirLog International, Ltd., through its Nigerian affiliate, Pan African Airlines Nigeria Ltd. made improper payments during 2003 and 2004 to Nigerian State officials in order to influence them to improperly reduce the amount of expatriate employment taxes to the respective Nigerian States. These amounts were not properly recorded in AirLog's books and records and accordingly not properly recorded in Bristow’s books and records. An annual assessment was made based upon deemed salaries of expatriates. The affiliate then negotiated the State officials to lowered the assessed amounts. The assessed amounts were lowered and a separate negotiated cash amount was forwarded to the State official. Upon payment State receipts were issued only reflecting the amount payable to the State government. A new CEO of Bristow discovered the payments, ordered and internal investigation and self reported. Without analysis the Order stated and Bristow did not object as part of the Cease & Desist Order, that Barstow violated the antibribery provisions of the FCPA, as well as the books and records and internal controls provisions. • SEC Admin. Proceeding File No. 3-12833, Cease & Desist Order at 3 (Sept. 26, 2007), available at http://www.sec.gov/litigation/admin/2007/34-56533.pdf; Press Release, • SED Institutes Settled Enforcement Action Against Bristow Group for Improper Payment to Nigerian Officials and Other Violations (Sept. 26, 2007) available at http://www.sec.gov/news/press/2007/2007-201.htm STRICTLY CONFIDENTIAL The Matter Of BJ Services Co. • In March 2004, the SEC issued a Cease & Desist Order against BJ Services Company, a US-domiciled public company, stating that BJ Services, through its wholly owned subsidiary B.J. Services, S.A. made illegal or questionable payments, totaling approximately 72,000 pesos to Argentinean customs officials to improperly obtain customs clearance for equipment that had been improperly or illegally imported into Argentina. The payment was not accurately recorded in the books of the BJ Services group. Without analysis the SEC stated and BJ Services did not object as part of the Cease & Desist Order, that BJ Services violated the antibribery provisions of the FCPA, as well as the books and records and internal controls provisions. Proceeding File No. 3-11427, Cease & Desist Order (Mar. 10. 2004) available at http://www.sec.gov/litigation/admin/34-49390.htm STRICTLY CONFIDENTIAL SEC v. Monsanto Company • On January 6, 2005, the Commission filed two settled enforcement proceedings charging Monsanto Company, a US-domiciled public company, with making illicit payments in violation of the FCPA. First, the Commission filed a lawsuit in the United States District Court for the District of Columbia charging Monsanto with violating the FCPA and seeking a civil penalty. Second, the Commission issued an administrative order finding that Monsanto violated the anti-bribery, books-and-records, and internal-controls provisions of the FCPA. The facts alleged were that in 2002, an official of Monsanto authorized an intermediary to pay a bribe to an Indonesian official to influence him to repeal an decree requiring an environmental impact study before Monsanto authorizing cultivation of genetically modified crops. Although the payment was made, the unfavorable decree was not repealed. No. 1:05CV00014 (U.S.D.C., D.D.C) (filed January 6, 2005) available at http://www.justice.gov/opa/pr/2005/January/05_crm_008.htm STRICTLY CONFIDENTIAL United States v. Vetco Gray Controls, Inc. • On February 7, 2007, Vetco Gray Controls Inc., Vetco Gray Controls Ltd., and Vetco Gray UK Ltd., wholly owned subsidiaries of Vetco International Ltd., pleaded guilty to violating the anti-bribery provisions of the FCPA. The plea included the admission that from at least September 2002 to at least April 2005, each of the defendants engaged the services of a major international freight forwarding and customs clearing company and, collectively, authorized that agent to make at least 378 corrupt payments totaling approximately $2.1 million to Nigerian Customs Service officials to induce those officials to disregard their official duties with respect to goods that were either improperly imported into Nigeria, improperly documented or otherwise not in accordance with Nigerian customs laws. The effect was to give the defendants preferential customs treatment. No. 07-cr-004 (S.D. Tex. filed Jan. 5, 2007). STRICTLY CONFIDENTIAL Universe Of Bribes All Bribes • • • • Non FCPA Bribes to Foreign Officials Permitted by law Reasonable payments for business-connected travel expenses Grease payments Purely private • • • • Pre-Kay FCPA Settlements Refunds of previous tax payments Changes to law re: land development Reduction in general tax obligations Clearing illegally imported goods Post-Kay • Reduction in employment taxes • Customs clearance on illegally • Repeal of a requirement to perform or improperly imported goods environmental impact study • Obtaining false government • Preferential customs treatment inspection reports Forbidden By Kay •Reduction of customs and of sales tax liability • Aid payor in gaining an unfair advantage or to obtain or retain business FCPA Language • Used to directly obtain or retain business STRICTLY CONFIDENTIAL Universe Of Bribes • Where do these fall? – Foreign type certificates – Zoning variations for a new office building – Reduction in real estate taxes All Bribes Non FCPA Bribes to Foreign Officials Pre-Kay Settlements Post-Kay Forbidden By Kay FCPA Language STRICTLY CONFIDENTIAL Trap For The Unwary: Books And Records • SEC v. BellSouth Corp – Encourage the repeal; or amendment of national regulations limiting foreign investments • In the Matter of Baker Hughes Inc. – Reduction on general tax obligations • United States v. Halford: No. 01-cr-00221-SOW-1 (W.D. Mo. filed Aug. 3, 2001) • United States v. Reitz: No. 01-cr-00222-SOW-1 (W.D. Mo. filed Aug. 3, 2001) • United States v. King: No. 01-cr-0190-DW (W.D. Mo. filed June 27, 2001) – Beneficial changes to laws and regulations relating to land development No. 02-cv-00113-ODE (N.D. Ga. filed Jan. 15, 2002), available at http://www.sec.gov/litigation/litreleases/lr17310.htm STRICTLY CONFIDENTIAL Trap For The Unwary: Books And Records • In the Matter of Dow Chemical Company – Expedited government registration certifications required by law to produce, warehouse, or market products in the country SEC Admin. Proceeding File No. 3-12567, Cease & Desist Order (Feb. 13. 2007) available at http://www.sec.gov/litigation/admin/2007/34-55281.pdf STRICTLY CONFIDENTIAL Practical Effects of Kay STRICTLY CONFIDENTIAL Practical Effects Of Kay • Effect on Practitioner – Training for new areas of the corporation – A broader view would also include functional areas such as supply chain, program management, real estate and corporate – Due diligence on virtually every entity working on behalf of the corporation that may interface with any level of foreign government STRICTLY CONFIDENTIAL Practical Effects Of Kay • If type certification of a new product is required for import to a foreign market, does a bribe to a foreign official have enough business nexus to be a violation? • Does a bribe for a permit or a zoning variation for a new office space come within the business nexus rule? • Does your entity want to be the test case for one of these questions? STRICTLY CONFIDENTIAL Additional Information STRICTLY CONFIDENTIAL Additional Resources • The FCPA Blog – http://fcpablog.squarespace.com • Richard L. Cassin, and Cassin Law LLC • FCPA Professor – http://fcpaprofessor.blogspot.com • Mike Koehler, Assistant Professor of Business Law, Butler University STRICTLY CONFIDENTIAL MICHAEL C. OSAJDA ATTORNEY AT LAW ETHCS CONSULTANT BUSINESS CONSULTANT MOBILE: 224-628-4708 MIKE@OSAJDA.COM WWW.OSAJDA.COM STRICTLY CONFIDENTIAL www.world-check.com STRICTLY CONFIDENTIAL