Bills of Lading: Indemnities and Bank Guarantees

advertisement

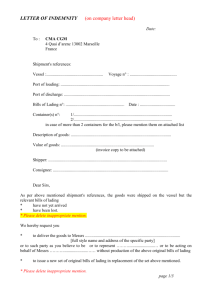

Bills of Lading: Indemnities and Bank Guarantees Prof Martin Davies Tulane Maritime Law Center, New Orleans International Seminar: Tanker Chartering – A Legal Perspective Intertanko Houston, 29 March 2007 Issuing and signing bills of lading • Owner undertakes that Master will sign bills of lading presented by Charterer • E.g., Shelltime 4, cl. 13: “The Master (although appointed by Owners)…shall sign bills of lading as Charterers or their agents may direct…without prejudice to this Charter.” 2 Charterers to indemnify Owners • Sometimes expressly stated in CP – E.g. Shelltime 4, cl. 13(a): “Charterers hereby indemnify Owners against all consequences or liabilities that may arise (i) from signing bills of lading in accordance with the directions of Charterers or their agents…” • If not express, then implied – Not expressly stated in NYPE but implied: The Berge Sund [1993] 2 Lloyd’s Rep. 453 3 Duty to indemnify strengthens power to command • Owner/Master has very limited right of refusal • because of indemnity The Nanfri [1979] 2 Lloyd’s Rep. 201, 206 per Lord Wilberforce: – “Clause 9, as is usual in time charters, contains an indemnity clause against all consequences or liabilities arising from the master signing bills of lading. This underlines the power of the charterers, in the course of exploiting the vessel, to decide what bills of lading are appropriate for their trade and to instruct the masters to issue such bills, the owners being protected by the indemnity clause.” 4 “Without prejudice to the charterparty” • Does not mean that Master may refuse to sign bills of lading exposing Owners to greater liability than under charter – Owners are protected by express or implied indemnity from Charterers • Means only that the relationship between Owners and Charterers is unaffected by the signature of bills of lading in different terms – Turner v. Haji Goolam [1904] AC 826 – The Nanfri 5 Only if “manifestly inconsistent” • Master may only refuse to sign if BLs contain • extraordinary terms or are “manifestly inconsistent” with charter Clean bills for obviously damaged cargo – Master has right under charter and duty to receivers to refuse to sign – The Nogar Marin [1988] 1 Lloyd’s Rep. 412 – Kennedy v. Weston & Co., 136 F. 166 (5th Cir. 1905) • Incorrectly dated bills – The Almak [1985] 1 Lloyd’s Rep. 557 • Bills misstating loaded quantity 6 Express limits on duty to obey Charterers’ orders • E.g., Shelltime 4, cl. 13(b): – “Notwithstanding the foregoing, Owners shall not be obliged to comply with any orders from Charterers to discharge all or part of the cargo • (i) at any place other than that shown on the bill of lading and/or • (ii) without presentation of an original bill of lading unless they have received from Charterers both written confirmation of such orders and an indemnity in a form acceptable to Owners.” 7 Why LoIs and guarantees are needed • Eg, Steamship Mutual Rule 25(xiii), Proviso (viii): “Unless and to the extent the Directors shall in their absolute discretion otherwise determine, there shall be no recovery from the Club under paras a-d of this Rule 25 xiii in respect of the Member’s liabilities, costs or expenses arising out of: (a) the discharge of the cargo or any part thereof from an entered ship at any port or place other than a port or place permitted by the relevant contract of carriage; (b) the delivery of cargo carried on an entered ship without the production of the relevant bill of lading” 8 Why LoIs and guarantees are needed • Delivery of cargo without production of original BLs is not covered by P&I Clubs – Not a mutual risk – No cover unless Directors agree – Or unless specially covered – eg, UK Club’s Extended Cargo Cover • Ditto delivery at a port other than that named in the BL 9 International Group LoIs • December 1998 Circular – “If you must do it, do it like this” • Later modifications • Agreement by British Bankers’ Association (BBA) on form of words for bankguaranteed LoI 10 International Group LoIs • Int Group A: delivery without production of original BL – Int Group AA: requestor plus bank • Int Group B: delivery at port other than stated in BL – Int Group BB: requestor plus bank • Int Group C: delivery at port other than stated in BL and without production of original BL – Int Group CC: requestor plus bank 11 Amount • If requestor alone, usually unlimited liability • If bank agrees to join, usually stipulates agreed maximum – IG recommends 200% of sound market value of cargo 12 Duration • For A and AA: until presentation of original BLs • For B, BB, C, CC: until shipowner is satisfied that no claim will be made – Because there can still be claim for wrongport delivery even if original BLs presented 13 Scope of security given • Bail or security to prevent or lift arrest of ship or surrogate/associated ship • Requestor only; banks do not join in giving of security, even under AA, BB, CC 14 Special tanker clauses • Paragraph 4 in A, AA, C, CC (not B, BB): • “If the place at which we have asked you to make delivery is a bulk liquid or gas terminal or facility, or another ship, lighter or barge, then delivery to such terminal, facility, lighter or barge shall be deemed to be delivery to the party to whom we have requested you to make delivery”. 15 Given to whom? Enforceable by whom? • Laemthong International Lines Co. Ltd v. Artis (The Laemthong Glory)(No. 2) [2005] 1 Lloyd’s Rep. 632 – Receivers ask voyage charterer-shippers to request delivery without original BLs – Charterers give LOI to owners; receivers give LOI to charterers (copy to owners’ agents); cargo delivered – Ship arrested at discharge port (Aden) by Yemen Bank alleging it had paid charterers but had not been paid by receivers – Owners sued charterers and receivers on LOIs – Preliminary question: could owners sue receivers directly on their LOI? 16 The Laemthong Glory (No. 2) • Contracts (Rights of Third Parties) Act 1999 (U.K.), s. 1 – Person not a party to a contract may sue in its own right to enforce a term of a contract if the contract expressly so provides • Receiver’s LOI was not an indemnity in respect of charterer’s liability under its LOI • Receiver’s LOI was an indemnity in respect of delivery by charterers “or their agents” • For purposes of delivery, owner was charterer’s agent, so LOI conferred a benefit on it • Act applied, owners could enforce receivers’ LOI directly 17 Issued by whom? Who signs? • “[A]n agent must have authority, whether apparent, actual or implied, to bind his principal” (Merrill Lynch Interfunding, Inc. v. Argenti, 155 F.3d 113, 122 (2d Cir. 1998)) • If person who signed had no actual authority, requestor or bank may refuse to honor LoI 18 Actual authority • Not enough that person who signs is an employee, even a senior management employee • Must have authority to bind requestor or bank to the liability being undertaken (which may be millions of dollars) 19 Actual authority • Pacific Carriers Ltd v. BNP Paribas (2004) 218 CLR 451 (High Ct Aus.) – Manager of Documentary Credit Department of BNP Paribas signed over bank “chop”: no actual authority for this purpose (US$8 million indemnity) • OOCL v. Kids International Corp., 1999 WL 76840 (S.D.N.Y.) – Carrier not entitled to summary judgment on LoI signed by “Director of Imports” – Requestor presented admissible evidence she did not have actual authority to bind it to LoI worth US$1 million 20 Actual authority • China Shipping Development Co. Ltd v. State Bank of Saurashtra [2001] 2 Lloyd’s Rep. 691 (U.K. Comm. Ct.) – Signature and bank stamps were forgeries – Bank not bound on basis of actual authority 21 Apparent/ostensible authority • Not enough that the person signing seems to • have authority For apparent authority to exist, there must be “words or conduct of the principal, communicated to a third party, that give rise to the appearance and belief that the agent possesses authority to enter into a transaction” (Standard Funding Corp. v. Lewitt, 656 N.Y.S.2d 188, 191 (N.Y. 1997)) 22 Apparent/ostensible authority • Thus, requestor or bank itself must give the impression that person signing has authority to do so • Difficult, if the only communication from the requestor or bank is the LoI itself – Agent/employee cannot clothe himself/herself with apparent authority 23 PCL v BNP Paribas • Delivery of legumes in Kolkata without presentation of original BLs • Voyage charterer gives disponent owner LoI, counter-signed by BNP Paribas • Receiver/buyer refuses to pay – Shipper claims aginst SO; TC indemnifies SO • TC/disponent owner claims on LoI • Voyage charterer now insolvent 24 PCL v BNP Paribas • Bank employee who signed LoI over bank • • “chop” had no actual authority to do so Trial court (SCNSW) held BNP counter-signature was not a guarantee at all CANSW held LoI was a guarantee but BNP not bound – No actual authority – No apparent authority – BNP had not given carrier any representation that she had authority to sign 25 PCL v BNP Paribas • High Ct Aust.: there was apparent authority • BNP itself made implied representations about • • • her authority by equipping her with her title, status and facilities, including the “chop” stamp Failing to take proper safeguards against misrepresentation can impart appearance of authenticity Carrier’s reliance on signature over bank “chop” was reasonable Bank bound 26 UK? • Similar argument about apparent authority made in China Shipping v. State Bank of Saurashtra – “[A]ble and…highly ingenious argument” made once it became apparent that signatures and stamps were forgeries – Failed: “not a shred of evidence” that bank (and actually authorised employee) had allowed forgery to happen 27 USA? • Similar argument made in OOCL v. Kids International Corp. – Plaintiff not entitled to summary judgment – Argument based only on employee’s job title “Director of Imports” and status in “senior management” – Not enough, says S.D.N.Y. 28 Practice tips • Be very careful, even if you get an LoI and even if it is (apparently) counter-signed by a bank • Fraud is already a concern if original BLs not present or different port requested • Requestor/bank not bound by fraudulent signatures (Saurashtra Bank) • If you can, question authority 29