Title of Chapter

advertisement

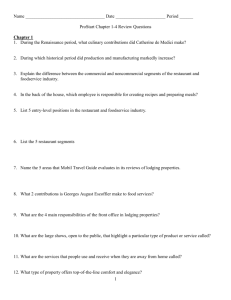

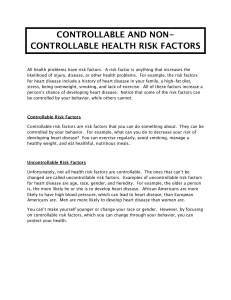

What Is Cost Control? 1 OH 1-1 1-1 Controlling Foodservice Costs Chapter Learning Objectives Describe the relationship between standards and controlling costs. Identify the types of costs incurred by a restaurant or foodservice organization. Classify foodservice costs as controllable or noncontrollable. Describe and give examples of controllable and noncontrollable costs. OH 1-2 Chapter Learning Objectives continued Classify foodservice costs as variable, semivariable, or fixed. Describe and give examples of variable, semivariable, and fixed costs. Explain the basic foodservice cost control process. OH 1-3 Characteristics of Controls Contribute to profit making Start with the menu Affect all areas of the operation Are formalized through a restaurant’s policies and procedures OH 1-4 Cost Standards Are used to compare actual results to planned results Are established by management Standards may be designed to Ensure a profit Stay within the budget Achieve planned quality levels OH 1-5 Costs Impact Profit Excessive costs reduce restaurant profitability. OH 1-6 Types of Costs Controllable Costs Food Insurance Labor Mortgage payments Cleaning supplies OH 1-7 Noncontrollable Costs Cost of licenses Types of Costs continued Fixed Costs Do not vary with sales volume Do not change from one accounting period to the next Variable Costs Increases and decreases are directly related to sales volume Semivariable Costs Increase or decrease with changes in sales volume, but not in direct proportion Contain both fixed and variable components OH 1-8 Variable Costs Directly affect profitability Can be controlled by management Are compared to an established standard OH 1-9 Prime Costs Include those expenses classified as Food Labor Are directly controlled by management Make up the majority of a restaurant’s total costs Are directly related to profitability OH 1-10 Prime Costs continued The costs of food and labor are a restaurant’s greatest expenses. OH 1-11 The Cost Control Process Steps Step 1 – Collect sales and cost data. Step 2 – Monitor and analyze sales and costs. Step 3 – Take corrective action as appropriate. OH 1-12 The Cost Control Process Step 1 – Collect sales and cost data. Yearly and monthly data are used for budgets and income statements. Weekly and monthly data are used for purchasing and scheduling. Meal period data are used for production planning. OH 1-13 The Cost Control Process continued Step 2 – Monitor and analyze sales and costs. Evaluate The line item’s name Budgeted cost Actual cost Cost difference Percentage difference OH 1-14 The Cost Control Process continued Step 2 – Monitor and analyze sales and costs. Compare actual sales and costs to Budget (line item review) Operational standards Historical information Identify variances OH 1-15 Computation of Percent Difference Actual cost of $48,000 Budgeted cost of $45,000 Actual cost – Budgeted cost $48,000 OH 1-16 – $45,000 = Cost difference = $3,000 Computation of Percent Difference continued Cost difference ÷ Cost budgeted = $3,000 ÷ $45,000 = OH 1-17 Percent difference 0.067, or 6.7% Cost Variations Can be preventable May be unpreventable Take corrective action on preventable cost variations OH 1-18 The Cost Control Process continued Step 3 – Take corrective action as appropriate. Variations from anticipated results may be Large and significant Small, but still significant Small and insignificant OH 1-19 Corrective Actions for Cost Control To reduce food cost Reduce portion size. Replace the item with a lower cost alternative. Feature menu items with higher profit margins (lower costs). Raise menu prices. OH 1-20 Corrective Actions for Cost Control continued To reduce food waste Monitor portion control. Monitor food storage and rotation. Monitor food purchasing (buy appropriate amounts). Minimize production errors. OH 1-21 Corrective Actions for Cost Control continued To reduce labor cost Reduce the number of employees on the schedule. Ask employees to end their shift early if they are not needed. Cross-train staff. OH 1-22 Corrective Actions for Cost Control continued Do you think food or labor costs are higher in this restaurant? Why? OH 1-23 How Would You Answer the Following Questions? 1. 2. Who is responsible for the size of a restaurant’s fixed expense? Which of the following vary with sales volume? A. B. C. D. 3. 4. OH 1-24 Fixed expense Semivariable expense Variable expense Both B and C Who is responsible for monitoring controllable costs? What two components make up “prime cost?” Key Term Review OH 1-25 Control Gross profit Controllable cost Income statement Corrective action Labor expense Cost of food sold Line item review Fixed cost Loss Key Term Review continued OH 1-26 Noncontrollable cost Semivariable cost Prime cost Standard Profit Total expense Sales Variable cost Chapter Learning Objectives— What Did You Learn? Describe the relationship between standards and controlling costs. Identify the types of costs incurred by a restaurant or foodservice organization. Classify foodservice costs as controllable or noncontrollable. Describe and give examples of controllable and noncontrollable costs. OH 1-27 Chapter Learning Objectives— What Did You Learn? continued Classify foodservice costs as variable, semivariable, or fixed. Describe and give examples of variable, semivariable, and fixed costs. Explain the basic foodservice cost control process. OH 1-28