Name of Presentation Here

advertisement

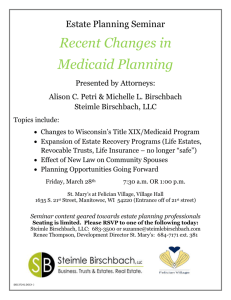

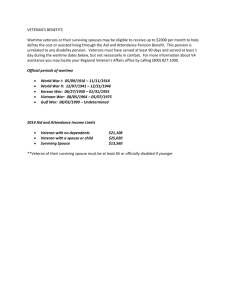

Estate Planning For The 21st Century Presenter’s Name Event Date IMPORTANT SLIDE INFORMATION NAELA Members The following slides were graciously provided by NAELA Member Rajiv Nagaich from Washington state. NAELA members have permission to reuse these slides for their own firm’s purpose. Use of the NAELA logo is limited to active NAELA members only. The slides were created to provide a foundation for presenting information on Estate Planning and Long Term Care Planning and MAY NOT provide accurate or current information for your specific state To ensure the accuracy of your presentation, you MUST review and update the contents of the slides with your state’s legal requirements Traditional Notions of Estate Planning Who gets what when I die Who manages my checkbook and health needs when I can no longer attend to those needs myself Do I want to be kept alive if I am comatose and cannot communicate ASSUMPTIONS Go to sleep and not wake up My agents will know what to do Biggest issues are: Providing for quality of life Avoiding probate Avoiding estate taxes Making it easy for beneficiaries Assumptions do not apply today We are living longer – but not necessarily living healthier One out of eight Americans over 65 dependent on others for day-to-day living activities One out of every two Americans over 85 dependent on others for day-to-day living activities Source: Alzheimer’s Disease Facts and Figures, 2007, Alzheimer’s Association Issues Created Financing health care costs, many of which may not be covered by Medicare or health insurance Managing Quality of Life Financing Long Term Care Medicare / Health Insurance Cover acute care needs Do not cover chronic care needs Unless . . . Where Medicare or Health Insurance leave off: Private assets (including Long Term Care Insurance) VA Medicaid Limitations Long Term Care Insurance is NOT widely embraced VA and Medicaid benefits are limited VA Benefits Aid and Attendance – non-service connected disability is dependent upon your qualification* up to: Veteran: $1,645 per month Spouse of Veteran: $1,057 per month Married Veteran: $1,945 per month *http://www.canhr.org/factsheets/misc_fs/html/fs_aid _&_attendance.htm Medicaid Benefits Food, shelter and medicine Income used as deductible towards care costs; $55.45 / $60.78 /$90.00 per month personal needs allowance [state specific, changes annually – please update with your state’s requirements] All clients treated the same DME Semiprivate rooms Limited personal care needs What is missing? - Eligibility is Not Automatic ESTATE PLANNING VA Eligibility Service Requirements 90 days in active duty with 1 day in war time period World War I: April 6, 1917, through November 11, 1918 World War II: December 7, 1941, through December 31, 1946 Korean War: June 27, 1950, through January 31, 1955 Vietnam War: August 5, 1964 (February 28, 1961, for veterans who served "in country" before August 5, 1964), through May 7, 1975 Persian Gulf War: August 2, 1990, through a date to be set by Presidential Proclamation or Law. 24 months if enlisted after September 7, 1980 VA Eligibility 65 years old or permanently disabled Income less unreimbursed medical expenses less than: $1,945 for married veteran $1,645 for single veteran $1,057 for spouse of veteran VA Eligibility Net Worth: Unfortunately, there is no asset limit set by law, and the determination of eligibility can be made at the discretion of a VA caseworker. All personal goods are exempt from the net worth and include: the home in which claimant lives; a vehicle used for the care of the claimant; and household goods and personal effects such as clothes, jewelry and furniture. Resource Test [state specific, changed every year – please update with your state’s requirements] Married Applicant: $2,000 Spouse of Applicant House (any value) One automobile (any value) Between $74,820 and $109,560 Prepaid funeral plan (irrevocable and of reasonable value) – burial plots for family members $1,500 cash value in life policy Personal property (any value) Single Applicant: $2,000 House (with equity of up to $500,000 [$750,000 in some statee]) One automobile (any value) Prepaid funeral plan (irrevocable and of reasonable value) – burial plots for family members $1,500 cash value in life policy Personal property (any value) BUT- Assets subject to state Medicaid lien Who Should Worry? Middle class Americans Between $50,000 and $1,500,000 in assets Estate Planning Solutions Pre-crisis options Crisis planning options Pre-Crisis Planning Utilize Special Needs Trusts Utilize Income Only Trusts Typical Estate Plan (married) Decedent’s share Surviving Spouse’s share Surviving spouse owns all assets Entire estate subject to spend down to access. Way Around the Problem Decedent’s share Surviving spouse’s share To Testamentary Special Needs Trust for surviving spouse Surviving spouse owns only half estate Special Needs Trust protected Surviving spouse’s share subject to spend down Typical Estate Plan (unmarried) Decedent’s estate Assets owned by testator during life Nearly entire estate must be spent down to access VA or Medicaid benefits Way Around the Problem Gift of some assets to irrevocable trust or trusted individual Settlor cannot be a beneficiary of the principal Trustee can provide funds to beneficiary, who can use funds as beneficiary sees fit. Assets in irrevocable trust or Safe Harbor Trust protected (subject to look back period) Pre-Crisis Planning Update Community Property Agreements (only in community property states) Revocable by one party Update Powers of Attorney Gifting Powers Care Management mandate No authority to enter into arbitration agreements Living Wills Update Living Wills after Terry Shiavo Update Health Care Proxy in states where they are separately required Pre-Crisis Planning Discuss your plan with named fiduciaries Crisis Planning Financing the costs Medicare VA Medicaid Develop plan to address quality of life issues Address Estate Planning issues