Annual Service Center Rate Review Process

advertisement

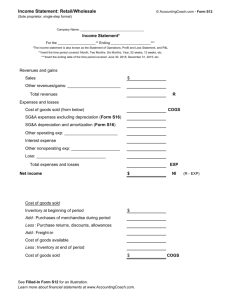

Annual Service Center Rate Reviews For FY2015 Presented by General Accounting Agenda Cost Pool Overview Why must we do the Service Center Rate Review? Address each tab of the rate review workbook Questions & Answers Cost Pool Know your costs Cost allocation Service Center Rate Review Direct labor Does the cost pool Supplies include all the actual Administrative Maintenance expenses that helped costs (payroll, generate revenue? purchasing, billing, Depreciation etc.) Expense Does the cost pool include expenses Utility Overhead that are not related (paid) to the business activities? A B C Costs per Service Line Costs Costs Costs Revenues per Service Line Revenues Revenues Revenues Revenues Costs +/- +/- +/- Why a Service Center Rate Review? Compliance with Federal OMB Uniform Guidance Cost Principles (Subpart E) Audit Requirements (Subpart F §200.500) Specialized Service Facilities (Subpart E §200.468) http://www.ecfr.gov/cgi-bin/text-idx?tpl=/ecfrbrowse/Title02/2cfr200_main_02.tpl Service Centers General Principles Established to recover actual costs. Cannot charge internal users more than cost May accumulate profits from external sales Rates do not discriminate between internal users, especially Federal Rate modifications, when necessary Charges should be based on actual usage Expected break-even over 3 years Service Centers General Principles Surpluses from the service center should not be used to fund unrelated activities Cannot accumulate cash in excess of established University guidelines Keep all appropriate documentation (usage log, invoices, expense record, etc.) Must maintain a published price list Principle Review Steps Identify all services provided Determine direct costs associated with each service Identify indirect costs associated with service center Administrative Surcharges are not recommended as they generally do not pass audit General Questions? Can we include a “reserve” amount in the rates to purchase new equipment? Can we charge internal users based on market rates, or what other institutions charge? Can we charge external users more than the cost of the good or service provided? General Instructions Use the Excel rate review workbook found at: http://www.fa.ufl.edu/wp-content/uploads/ga/ServiceCenter-Rate-Review-Template.xlsx Enter data in the worksheets as directed by the instructions found at: http://www.fa.ufl.edu/wp-content/uploads/ga/ServiceCenter-Rate-Review-Instructions.pdf General Instructions Who must complete the rate review workbook? Federal revenues greater than $200,000 AND/OR Total Internal Revenue exceeding $1,000,000 AND/OR Federal revenues greater than $50,000 that were not reviewed in the previous year. All Service Centers, large or small, are expected to be in compliance with the OMB Uniform Guidance and should not charge more than cost. Sheet 1a and 1b – Administrative and Operating Information Contact Information Operating Information (billing/customers) Description of services provided Sheet 1a – Administrative Information Sheet 1b – Operating Information Sheet 2 - Revenues A service line should be defined as a specific service or product a customer agrees to pay for. Administrative support is not a service line but a cost to allocate Each service line revenue is tracked in MyUFL (department, flex) or using another internal system. Unit should be a logical basis to establish rate(s). “Contract” type unit is not recommended Internal and external rates can be different with external rates greater than internal rates. Sheet 2 - Revenues Sheet 3a and 3b – Non-Payroll Expenditures Tab 3a shows expenses paid only by the Service Center chartfields Tab 3b shows expenses paid by other chartfields (subsidies) All expenses need to be allocated by Service Line Please specify the method used to allocate the expenses. Each service line does not necessarily consume resources (expenses) in the same proportion. Focus on GL accounts with large balances Allocation based on percentage of revenue is not appropriate. Sheet 3a – Non-Payroll Expenses Paid Only by Service Center Chartfields Sheet 3b – Non-Payroll Expenses Paid by Other Chartfields Sheet 4a and 4b – Salaries Paid by Service Centers and by Other Chartfields Tab 4a shows Salaries and Benefits paid from Service Center chartfields Tab 4b shows Salaries and Benefits paid from other chartfields (salary subsidies) Sheet 4a and 4b – Salaries Paid by Service Centers and by Other Chartfields Provide name, position title (description), chartfield and % of effort toward Service Center If individual is paid from multiple chartfields, list the individual and each chartfield separately Individual effort should correlate to allocations reported in the Effort Tracking System as Auxiliary/Other Institutional Activities (Aux/OIA) Please specify the method used to allocate salary. A distinction between direct labor and personnel with oversight and supervisory responsibilities may be useful. Sheet 4a – Salaries Paid by Service Center Chartfields Sheet 4b – Salaries Paid by Other Chartfields Sheet 5a & 5b – Equipment Depreciation Provide Asset ID/Tag # and other required information on Tab 5a Depreciation Report can be run from myUFL/Main Menu/Asset Management/MyAssets MyAssets/Reports/Depreciation Reports Enter required depreciation information on Tab 5a Enter Service Center % Usage on Tab 5a Allocate the depreciation by Service Line on Tab 5b Sheet 5a – Equipment Listing Sheet 5b – Allocation of Equipment to Service Lines Sheet 6 – Space Survey Should agree to Space Inventory and Allocation Survey submitted for the same fiscal year Identify all space used by or in support of the Service Center Sheet 7 – Unallowable Costs List any unallowable costs paid, so that these costs can be removed from the rate calculations. If your Service Center has not incurred any of these unallowable costs, check the box for “None of these costs occurred” at the top of the page. Sheet 7 – Unallowable Costs Sheet 8 – Total Costs This data is populated automatically from other Tabs Sheet 9 – Transfers Schedule Please list any transfers in (enter as a positive figure) and transfers out (enter as a credit figure) for the accounts listed. All overhead accounts 813xxx should not be included on this tab, but should be included on Tab 3a or 3b. Overhead charges are considered as allowable expenses and not as transfers out. Explain any transfer in/out > $5,000 or 10% of revenue whichever is larger Sheet 9 - Transfers Sheet 10 – Profit/Loss Calculation Shows profit/loss by Service Line Calculates whether Working Capital Balance (Cash Balance) is under/over amount permitted by University guidelines, which allow: 90 days average operating expenditures plus Profit from external sales plus Accumulated asset depreciation The Service Center needs to reflect prior year profit/loss by service line and total profit from external sales on this tab. Sheet 10 – Profit/Loss Calculation Additional Notes and Deadlines Refer to prior year review comments Please contact General Accounting with any questions Completed FY2015 workbooks should be returned by Friday, October 30, 2015. Queries and Enterprise Reporting Queries UF_GL_TB_BY_FUND_DEPT_AUX_QRY Trial Balance for ACTUALS ledger UF_GL_JOURNAL_DETAIL_QUERY2 Provides the details of entries making up the ACTUALS Trial Balance Enterprise Reporting (Navigation: Main Menu>Enterprise Reporting>Access Reporting) FIT Cube Cost Distribution Reports: Payroll or Fellowship Earnings and Estimated Fringe Benefits by Cost Center by Person Navigation: Public Folder> Human Resources Information>Pay Information>Current Pay Cycle>Prompted Cost Distribution Reports Provides earnings and fringe by person and cost center. Contact Information Jeremiah Carlson jccarlson@ufl.edu Ricabuena Gagné bea1127@ufl.edu Mike Johnson michaelsjohnson@ufl.edu General Accounting 33 Tigert Hall Box 113202 Phone 392-1326