Fiscal Policy 101 (1) - outlawclass

advertisement

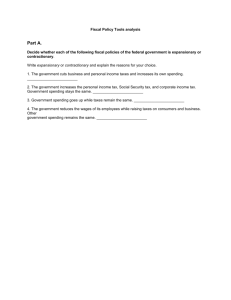

FISCAL POLICY 101 Most economists believe the economy is self-correcting in the long run. When output gaps occur, eventually wages will become unstuck and aggregate supply will shift returning the economy to potential output. However, some economists believe that this process takes a very long time – perhaps a decade or more. In the case of a recessionary gap (when aggregate output is below potential output) the economy can suffer a long painful period of high unemployment during the time it takes the economy to return to potential or long-run equilibrium. Concern about the damaging consequences of a long recession is the background to one of the most famous quotations in economics: John Maynard Keynes’s declaration, “In the long run we are all dead.” Economists usually interpret Keynes as having recommended that governments not wait for the economy to correct itself. Instead many, but not all, economists argue that the government should use fiscal policy to get the economy back to potential output in the aftermath of a shift of the aggregate demand curve. This is the rationale for active stabilization policy, which is the use of government policy to reduce the severity of recessions and rein in excessively strong expansions. FISCAL POLICY TOOLS Congress and the President have access to powers that can change components of gross domestic product (GDP) and, in turn, shift aggregate demand. If you recall the formula for calculating GDP (C+I+G+X-M = Y), G stands for government spending on final goods and services. If Congress and the President decide to increase or decrease government spending, then aggregate demand will shift. Congress and the president can also impact C (consumer spending) by adjusting policies related to taxes and transfer payments1. Changes to tax policy and transfer payment programs can increase or decrease disposable income for households, which in turn, leads to changes in consumption. EXPANSIONARY FISCAL POLICY When the economy is facing a recessionary gap, like the one illustrated by E1 in the figure below, the government could use fiscal policy to increase aggregate demand. Shifting aggregate demand to the right would increase real GDP, making it equal to potential real GDP (YP). Fiscal policy that increases aggregate demand is called expansionary fiscal policy. 1 Transfer payments are payments for which the government receives no goods or services in return. Examples of transfer payments include unemployment compensation and the Supplemental Nutrition Assistance Program (“food stamps”). Expansionary fiscal policy normally takes one of three forms. An increase in government purchases of goods and services (increasing G) A cut in taxes (increasing C) An increase in government transfers (increasing C) Expansionary fiscal policy is an attempt to stimulate the economy – to increase real GDP and decrease unemployment. During the last recession in the U.S. (2008-2009) Congress and the President pursued expansionary fiscal policy. The 2009 American Recovery and Reinvestment Act dedicated $787 billion to a combination of changes in tax policy and increases in government spending. Tax breaks for firms and individuals amounted to $287 billion. Payroll taxes were reduced for the majority of workers. First-time home buyers and new car buyers received tax credits. Unemployed workers receiving unemployment benefits no longer had to pay federal income tax on the first $2,400 of benefits. Beyond the benefits of supporting valued activities and vulnerable individuals, the tax cuts were intended to stimulate the economy. With more money in their pockets, consumers would visit stores to buy more goods, thus decreasing store inventories. The stores would then order replacement goods, which would cause manufacturers to buy more raw materials and hire more workers. Fiscal policy’s effect on aggregate demand is expanded by additional rounds of spending by individuals and firms. CONTRACTIONARY FISCAL POLICY When the economy is facing an inflationary gap, like the one illustrated by E1 in the figure below, the government could use fiscal policy to decrease aggregate demand. Shifting aggregate demand to the left would decrease real GDP, making it equal to potential real GDP (YP). Fiscal policy that decreases aggregate demand is called contractionary fiscal policy. Contractionary fiscal policy normally takes one of three forms. An decrease in government purchases of goods and services (decreasing G) A tax increase (decreasing C) A decrease in government transfers (decreasing C) Contractionary fiscal policy is an attempt to slow down an overheating economy – to decrease real GDP and decrease inflation. A classic example of contractionary fiscal policy occurred in 1968, when U.S. policy makers grew worried about rising inflation. President Lyndon Johnson imposed a temporary 10% surcharge on income taxes – everyone’s income taxes were increased by 10%. He also tried to scale back government purchases of goods and services, which had risen dramatically because of the cost of the Vietnam War. AUTOMATIC STABILIZERS There are policies in place that automatically increase government spending in a time of recession and automatically decrease government spending in times of economic expansion. These policies and programs are known as automatic stabilizers. Unemployment compensation is one kind of automatic stabilizer. When the economy shrinks and enters a recession, more Americans lose their jobs and become eligible for unemployment benefits. Because more individuals are now eligible, the government will pay out more in benefits. The reverse is true when the economy is booming. Food stamps, Medicaid, and the progressive tax code (where an individual pays a higher marginal tax rate as his/her income rises) are other examples of automatic stabilizers. So when economists discuss fiscal policy, they generally mean discretionary fiscal policy. That is, fiscal policy above and beyond automatic stabilizers, where policy makers take a direct, deliberate action in response to economic conditions. A CAUTIONARY NOTE While fiscal policy can help an economy achieve its macroeconomic goals, its ability to successfully smooth the business cycle is limited. Fiscal policy faces a serious challenge of time lags, that is, fiscal policy takes a long time to take effect. First, Congress must recognize that the economy is entering a recession or that the economy is overheating. The economy does not officially enter a recession until real GDP has been falling for two consecutive quarters (six months). Then Congress must develop a plan, pass the plan, and implement the plan. If, for example, expansionary policy doesn’t take effect until the economy has already corrected itself, the policy can send the economy into an inflationary gap.