Making a Financial C..

advertisement

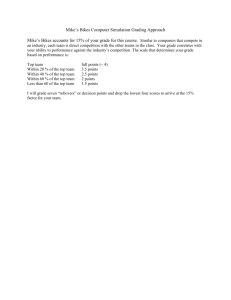

ILM Level 5 Making a Financial Case Presenter name Two financial units to the level 5 programme Making a Financial Case Understanding Financial Management 2 Your personal objectives... 3 Areas to be covered Over the unit we will be considering how to: Day 1: Differentiate between the direct and indirect costs of the business Identify the fixed and variable costs of the business Use break-even and contribution analysis Understand the principles of three costing systems Consider some simple strategies for profit improvement Day 2: Understand and apply the main investment methods used in business Discuss the strengths and weaknesses of each method Understand the importance of risk and the need for sensitivity analysis Identify a structure for controlling and reviewing capital projects 5 Day 1 7 Understanding Costs Direct Costs Direct Materials Direct Labour Direct Expenses Front Line Service Direct Costs Cost Direct Costs: These costs are normally directly attributable to the manufacture of the product, or the provision of the front line service. Code Cost Category Description A Direct Labour The people who directly make the product, or provide the front line service B Direct Materials Any materials consumed in the manufacturing process /provision of the front line service C Direct Expenses Associated directly with the manufacture of the product/ provision of the service, eg. hire of specialised equipment, any royalties payable as commission Indirect ‘Overhead’ Costs Indirect ‘Overhead’ Costs Indirect Costs: These costs are commonly known as ‘overheads’. They comprise those factors that are not directly attributable to the manufacture of the product, or provision of the front line service, eg. D Indirect labour Managers, supervisors, maintenance and cleaning staff E General administration General office staff and office materials F Reception Staff G Marketing and distribution Advertising, selling, promotions, transport costs, marketing and distribution staff H Buildings occupancy Rent/rates, property taxes, insurance, heating, lighting, water rates, electricity, repairs and maintenance Direct and Indirect Costs Activity: Now consider your own operational area and see if you can divide it up into the front line service and support service and, consequently, make a brief list of the direct and indirect costs. Direct Costs 13 Indirect Costs Fixed and Variable Costs Fixed Costs: in the short-term stay the same each month Variable Costs: vary with changes in activity Activity: workbook p.9 - For the focus of this activity, let’s use the example of the Olympic swimming pool. Working with a partner consider which of the following costs should be treated as fixed or variable by ticking the appropriate column. Fixed and Variable Costs Activity: Consider your own operational are – what are your fixed and variable costs? Fixed Costs 15 Variable Costs Break Even Analysis Break-even analysis helps the business to: 1. calculate the total costs of providing a service 2. forecast the revenue that needs to be generated in order to cover costs and start making a profit The break-even point occurs where total costs equals total revenue Any revenue below the break-even point is at a financial loss to the organisation for that particular product/service. Once revenue has exceeded the break-even point, then the organisation will be operating at a profit. Activity: Constructing a Break Even Table To illustrate the break even concept, you can construct a breakeven table. For this example we will use the University Sports Centre Activity: The centre has fixed costs of £10,000 per month It charges an entry fee to the centre of £1.50 It incurs variable costs per customer, eg electricity to power fitness machines, use of shower etc, of £0.50 per customer. The monthly break-even point can be calculated by completing the table below. Break-Even Analysis Demand no. of customers Fixed Costs £10,000 Variable Costs (£0.50 per customer) multiply by demand (customers) Total Costs (Fixed Costs + Variable Costs) Sales Revenue (£1.50 per customer) multiply by demand (customers) 0 10,000 0 10,000 0 2,000 10,000 1,000 11,000 3,000 4,000 6,000 8,000 10,000 12,000 Break-Even Analysis Demand no. of customers Fixed Costs £10,000 Variable Costs (£0.50 per customer) multiply by demand (customers) Total Costs (Fixed Costs + Variable Costs) Sales Revenue (£1.50 per customer) multiply by demand (customers) 0 10,000 0 10,000 0 2,000 10,000 1,000 11,000 3,000 4,000 10,000 2,000 12,000 6,000 6,000 10,000 3,000 13,000 9,000 8,000 10,000 4,000 14,000 12,000 10,000 10,000 5,000 15,000 15,000 12,000 10,000 6,000 16,000 18,000 REVENUE VARIABLE COSTS K EVE N REVENUE/COSTS B R EA TOTAL COSTS FIXED COSTS SALES(UNITS) The Contribution Method Need to know: Fixed cost allocation Variable costs per unit (customer) Sales price per unit (revenue per customer) Contribution = selling price less variable costs Contribution means the ‘contribution’ of each unit sale to: Payment of fixed costs The generation of a profit Example: £ Price 1.50 (Less) Variable cost 0.50 Contribution 1.00 Break-Even Point (BEP) = Therefore the BEP (customers) Fixed costs / contribution per unit = 10,000 / 1 = 10,000 customers Activity Using the contribution method, calculate the following break even points (BEPs). Complete the table in your workbook on p. 14. (The original figures may change for each subsequent calculation where stated. You should always use the most recent figure. The BEP should be expressed in units of demand. Use the table below, to enter your calculations.) The first BEP has been calculated for you. Follow exactly the same approach to calculate the BEPs for scenarios 2 to 6. Scenario: The Sports Centre has expanded and it is now including some premium extra value added services in the price charged to the customer, hence the increased entry price. This decision is taken in a bid to compete with two new private leisure centres which have opened locally. 22 Selling Price (less) Variable Costs = Contribution 1. 2. 3. 4. 5. 6. 9.00 6.50 2.50 Fixed costs / Contribution per customer 15,000/2.50 Break-Even Point (no. of customers) 6,000 Selling Price (less) Variable Costs = Contribution Fixed costs / Contribution per customer Break-Even Point (no. of customers) 1. 9.00 6.50 2.50 15,000/2.50 6,000 2. 7.00 6.50 0.50 15,000/0.50 30,000 3. 11.00 6.50 4.50 15,000/4.50 3,333 4. 11.00 8.50 2.50 15,000/2.50 6,000 5. 9.00 8.50 0.50 15,000/0.50 30,000 6. 9.00 8.50 0.50 9,000/0.50 18,000 Costing Methods Costing Methods The aim of a costing system is to ensure that all the costs of a business are recovered by being charged to that part of the business making the money, which is normally the front line operation. Absorption costing Marginal costing Activity-based costing Marginal Costing Vs Absorption Costing A technique for dealing with Absorbs all costs (the direct variable costs costs and a proportion of the indirect [overhead] Producing one extra unit will costs) into each unit of sale incur an increase in variable costs (direct labour, materials and expenses) = marginal cost 27 Absorption Costing The sports centre allows admission only through a one year membership scheme. It has 2 key income earning facilities: its gym and sports hall. It allocates the direct costs for each facility accordingly Gym Sports Hall 28 Direct Costs eg. £30,000 for the year based on 100 members Direct Costs eg. £25,000 for the year based on 100 members Absorption Costing If each of the above sports centre facilities accounted for 50% of sales, the decision could be made to allocate 50% of the centre’s indirect (overhead) costs to both the gym and the sports hall respectively Gym Direct Costs + 50% of Indirect ‘Overhead’ Costs = Total Cost Absorption Costing If total indirect (overhead) costs for the sports centre over the period are forecast to be £20,000, then: 50% of £20,000 £10,000 the total indirect costs to be allocated to the gym for the period = = Total Costs for running the Gym for a year (based on 100 members) 30 Direct Costs (£30,000) + 50% of Indirect ‘Overhead’ Costs (£10,000) = Total Cost (£40,000) Calculating the Total Cost to be allocated to each Membership Fee Scenario 1: Based on 100 paying members Direct costs for running the gym for the year = £30,000 Indirect costs allocated to the gym = £10,000 Direct costs to be allocated to each annual membership fee: £30,000 direct costs / 100 customers = £300 Indirect costs to be allocated to each annual membership fee: £10,000 indirect costs allocated / 100 customers = £100 Total costs per member: £300 direct costs + £100 indirect cost = £400 The membership card fee for the gym is, therefore, £400 plus the profit margin Pairs Activity: complete the financial calculations in scenario 2 on p.18 of the workbook Marginal Costing Vs Absorption Costing When is it appropriate to use each technique? Absorption Costing - when forecasting demand for the year ahead – because at this stage of planning, we need to ensure that all costs will be absorbed into the forecast demand for the period. Marginal Costing - when taking on a non-forecast job – assuming that forecast demand is on target, the indirect overhead costs will have already been accounted for; we have, therefore, the opportunity to cost the job only taking into consideration an increase in the variable costs (the marginal cost). Activity: To compare both costing techniques in action let’s look at the following mini case study on pps. 19/20 of the workbook 32 Sales Revenue per month: 100 bikes @ £100 each 50 bikes @ £60 each 100 bikes @ £40 each Total Sales Revenue Less Production Costs: Direct Materials (£20 per unit) Direct Labour (£25 per unit) Fixed Factory Overheads Total Production Costs Gross Profit (Total Sales Revenue less Total Production Costs) 33 Existing Production: 100 bikes @ £100 per bike Existing Production: 100 bikes @ £100 per bike Plus Option A: 50 bikes @ £60 each Existing Production: 100 bikes @ £100 per bike Plus Option B: 100 bikes @ £40 each £ £ £ Existing Production: 100 bikes @ £100 per bike Sales Revenue per month: £ Existing Production: 100 bikes @ £100 per bike Plus Option A: 50 bikes @ £60 each £ 100 bikes @ £100 each 10,000 10,000 50 bikes @ £60 each Existing Production: 100 bikes @ £100 per bike Plus Option B: 100 bikes @ £40 each £ 10,000 3,000 100 bikes @ £40 each 4,000 10,000 13,000 14,000 Direct Materials (£20 per unit) 2,000 3,000 4,000 Direct Labour (£25 per unit) 2,500 3,750 5,000 Fixed Factory Overheads 3,500 3,500 3,500 Total Production Costs 8,000 10,250 12,500 2,000 2,750 1,500 Total Sales Revenue Less Production Costs: Gross Profit (Total Sales Revenue less Total Production Costs) Marginal Pricing A contribution to fixed costs can be attractive Useful to gain market entry or increase market share Be careful, this is a short-term tactic Don’t let the marginal price become the market price Don’t undermine full paying customers ABC Costing Process: identify each necessary supporting activity in the production process and collect costs into a separate pool for each identified activity develop a measure for each activity, eg. a measure for the engineering department may be hours, whereas the measure for the maintenance department may be square metres use activity measures as cost drivers to allocate costs to products ABC in Action Product A 200 hours engineering time 91% engineering cost allocated Product B 20 hours engineering time 9% engineering cost allocated Profit Improvement Activity In what ways can the profitability of an organisation be improved? 39 Increase Profits? Increase Sales Volume Improve Selling Price Re-negotiate Supplier Prices Reduce Waste & Cut Bureaucracy! Improve Quality (right first time) Reduce COS & Overheads PRICE VARIABLE COSTS CLIENTS FIXED COSTS Price increase of 1% = Profit increase of 11% 10.1 101 66.4 VARIABLE COST PRICE 24.5 FIXED COST PROFIT 9.1 Cost Efficiency Activity: using the post-it notes and flip chart pens provided in the workshop, identify opportunities for greater cost efficiency within your operational area or other areas in the University that you have observed. Note the outcome of this exercise below. 43 Day 2 44 Investment Decisions Today’s Objectives Understand and apply the main investment methods used in business Discuss the strengths and weaknesses of each method Understand the importance of risk and the need for sensitivity analysis Identify a structure for controlling and reviewing capital projects Investment Projects Investment Appraisal Objectives Expected benefits Choice between competing alternatives If there is a shortage of funds available, which proposals should be chosen Project Evaluation Does the project fit within overall objectives of the business? How will it be funded? What other resources will be required and timescales? How long will the project last and what are its key stages? What is the expected pattern of cash flows? What are the ‘key sensitivities’ and what if… scenarios? How does the investment compare with other opportunities available? The opportunity cost! Investment Appraisal Methods Payback period (PP) Accounting rate of return (ARR) Net present value (NPV) Internal rate of return (IRR) Payback Period (PP) Payback Scenario 1 Activity: Let’s assume that the University’s Sports Centre has 3 projects in mind for developing the business, for example, different sports hall layouts combining different activities. Each project is forecast to generate different cash inflows but cost roughly the same at £10,000 per project. The business can only choose to go ahead with of the three projects and, therefore, constructs a table below to make a comparison in order to help the decision. See the following slide. If you were advising the Sports Centre management, which of the 3 projects would you recommend from a financial perspective? Explain your choice and reasons below. 52 Payback Period Project Initial Capital Outlay A B C £10,000 £10,000 £10,000 Cash Inflows: Year Cost less Cash inflows Cost less cash inflows Cost less cash inflows 1 1,000 (9,000) 7,000 (3,000) 1,000 (9,000) 2 1,000 (8,000) 2,000 (1,000) 8,000 (1,000) 3 1,000 (7,000) 2,000 1,000 2,000 1,000 4 7,000 0 0 0 0 0 5 10,000 10,000 0 0 0 0 Total 20,000 10,000 11,000 1,000 11,000 1,000 Payback Period 4 years 2.5 years 2.5 years Payback Scenario 2 Activity: Let’s assume that another opportunity for business expansion has been identified by the Sports Centre. Calculate the payback periods for each of the three projects below. We will be using exactly the same figures below throughout the rest of this section, to evaluate the 3 projects using the other financial appraisal methods. See p.28 of the workbook. If you were advising the Sports Centre management, which of the 3 projects would you recommend from a financial perspective? Explain your choice and reasons below. 54 Payback Period Answer Project A Initial Capita Outlay Year B £240,000 Cash Inflows: Cost less Cash inflows C £240,000 Cash Inflows: Cost less cash inflows £240,000 Cash Inflows: Cost less cash inflows 1 60,000 (180,000) 40,000 (200,000) 140,000 (100,000) 2 100,000 (80,000) 40,000 (160,000) 100,000/120,000 = 1.83 years 20,000 3 80,000/100,000 = 2.8 years 20,000 40,000 (120,000) 48,000 68,000 4 80,000 100,000 120,000/140,000 = 3.86 years 20,000 40,000 108,000 5 60,000 160,000 140,000 160,000 20,000 128,000 400,000 160,000 400,000 160,000 368,000 128,000 Total Payback Period 2.8 years 3.86 years 1.83 years Accounting Rate of Return (ARR) Accounting Rate of Return PP measures time not profitability ARR method actually measures profitability. An organisation will set a required rate of return on its investment. See example on following slide 57 ARR: Project A Project A: initial capital outlay - £240,000 Year Cashflow (less) £000 Depreciation = Net Profit £000 £000 1 60 48 12 2 100 48 52 3 100 48 52 4 80 48 32 5 60 48 12 Total Net Profit 160 Evaluation Total Net Profit 160 Rate of Return: Average Net Profit/ Capital Expenditure x 100 Average Annual Profit 32 (160/5 years) 32/240 x 100 = 13.33% Activity: now calculate the ARRs for projects B and C on p.31 of the workbook ARR: Project B Project B: initial capital outlay - £240,000 Year Cashflow (less) £000 Depreciation = Net Profit £000 £000 1 40 48 (8) 2 40 48 (8) 3 40 48 (8) 4 140 48 92 5 140 48 92 Total Net Profit 160 Evaluation Total Net Profit 160 Rate of Return: Average Net Profit/ Capital Expenditure x 100 Average Annual Profit 160/5 years = 32 32/240 x 100 = 13.33% ARR: Project C Project C: initial capital outlay - £240,000 Year Cashflow (less) Depreciation = £000 £000 Net Profit £000 1 140 48 92 2 120 48 72 3 48 48 0 4 40 48 (8) 5 20 48 (28) Total Net Profit 128 Evaluation Total Net Profit 128 Rate of Return: Average Net Profit/ Capital Expenditure x 100 Average Annual Profit 128/5 = 25.6 25.6/240 x 100 = 10.67% Discounted Cash Flow Methods: NPV Net Present Value The Net Present Value (NPV) measures the value of the money received at the end of the project, eg. in 5 years’ time. NPV takes into account all of the costs (except depreciation) and benefits of a project as well as addressing the issue of timing of cash flows. PERIOD 1 2 3 4 5 6 7 8 9 10 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 20% 0.833 0.694 0.579 0.482 0.402 0.335 0.279 0.233 0.194 0.162 NPV: Project A Project A: initial capital outlay £240,000 Year Cashflow (X) Present Discount Factor (=) £ 10% £ 0 -240,000 - -240,000 1 60,000 .909 +54,540 2 100,000 .826 +82,600 3 100,000 .751 +75,100 4 80,000 .683 +54,640 5 60,000 .621 +37,260 Net Present Value +64,140 Activity: now calculate the NPVs for projects B and C on p.35 of the workbook NPV: Project B Project B: initial capital outlay £240,000 Year Cashflow (X) Discount Factor (=) Present £ 10% £ 0 -240,000 - -240,000 1 40 .909 +36,030 2 40 .826 +33,040 3 40 .751 +30,040 4 140 .683 +95,620 5 140 .621 +86,940 Net Present Value +42,000 NPV: Project C Project C: initial capital outlay £240,000 Year Cashflow (X) Present Discount Factor (=) £ 10% £ 0 -240,000 - -240,000 1 140 .909 +127,260 2 120 .826 +99,120 3 48 .751 +36,048 4 40 .683 +27,320 5 20 .621 +12,420 Net Present Value +62,168 Discounted Cash Flow Methods: IRR Internal Rate of Return If the discount rate is increased sufficiently, eventually a rate will be identified which will cause the NPV to exactly equal zero at the end of the project life = the IRR Where there are competing projects, the one with the highest IRR should be preferred See example on following slide IRR: Project A Project A Year Cashflow (x) £ Discount Factor (=) Present 20% £ 0 -240,000 - -240,000 1 60,000 .833 + 49,980 2 100,000 .694 + 69,400 3 100,000 .579 + 57,900 4 80,000 .482 + 38,560 5 60,000 .402 + 24,120 Net Present Value + 40 Activity: now fill in the table on p.38 of the workbook with the summary of all the PPs, ARRs, NPVs and IRRs Final Investment Evaluation PP ARR NPV IRR Project A Project B Project C 2.8 3.86 1.83 13.33% 13.33% 10.67% +£64,140 +£42,000 +£62,168 20% 15% 24% Investment Appraisal Summary The choice of project will depend on the relative importance to the business of: Liquidity Profitability Cost of capital investment 71 Risk in Appraisal Investment Sales Prices and Margins Cash Inflows Project Life Project Investment Operational Costs Interest Costs Risk Analysis and Contingency Planning What is risk? the chance of exposure to the adverse consequences of future events … Risk Assessment Response What this means Examples Avoidance Taking the risk out of the project altogether Generally used on RED status risks Reduce the scope of the project to remove the risky task from it Buy in specialists to eliminate a skills gap Supplement a team to eliminate a capacity issue Cancel the project! Transference Transfer the risk to a 3rd party outside the organisation Could apply to any High Impact Risk regardless of RAG status Insure against the risk, we do this without thinking on our premises burning down! Use fixed price or shared risk contracts with 3rd parties where risk of overspend is identified (which in turn leads to other risks) Mitigation Do something to reduce the probability or impact of the risk Good for reducing Red to Amber or Amber to Green Introduce QA and Testing procedures to deal with product quality risks (Reduces probability) Develop change management processes to reduce risk of resistance to the project (Reduces probability) Bring tasks that could cause delay forward in the project schedule (Reduces Impact) Acceptance Accept the risk could happen and either ignore it or put a contingency plan in place for when it occurs “Ignore” should only be used for Green status risks “Contingency” best for Green status risks but can be acceptable for Amber. Most common use is low probability, high impact risks. Invest in backup and recovery solutions as a contingency for an IT system failure Risk Log Risk Description Probability Impact Response Amount allowed for in business plan is insufficient to purchase and implement the chosen tool Medium High Reduce amount of licences to essential number of users rather than optimum level Procurement process delays project delivery Low Medium Accept risk as delay would not be significant and project benefits would still be realised Project not delivered to programme Medium Medium Accept risk as delay would not be significant and project benefits would still be realised Performing a Risk Analysis Activity: Within your group, select a potential capital investment programme. Identify the potential risks Assess the risk using the probability/impact matrix Assess how you are going to respond to each risk by selecting one of the responses in the table on p.42 of the workbook Complete the risk assessment template on p.43 of the workbook Flip chart and feedback 77 Screening Other Criteria The Criteria Matrix Another method for screening decisions is the criteria matrix. An example of this is presented on the next slide. In this scenario, the purchasing department of an organisation has decided to renew its fleet of 4 wheel drive vehicles. It has shortlisted 4 vehicles from the original list of ten: 79 Honda CR –V Nissan X-Trail Toyota Rava Land Rove Freelander Price 10 £20,150 £19,800 £19,600 £22,000 MPG (Urban) 8 35 32 29 28 Cost per mile 7 45.7p 44.4p 46.0p 43.8p Service Intervals 5 12,500 12,000 10,000 15,000 0 to 60 Mph 3 10.5 secs. 12.4 secs. 12.6 secs. 15.2 secs. TOTAL SCORES 80 Score (W x R) Rating (R) Out of 4 Land Rover Freelander Score (W x R) Rating (R) Out of 4 Toyota Rava Score (W x R) Rating (R) Out of 4 Nissan X-Trail Score (W x R) Rating (R) Out of 4 Weighting (W) Honda CR – V Criterion Criteria Matrix Answer Land Rover Freelander Rating (R) Out of 4 2 20 £19,800 3 30 £19,600 4 40 £22,000 1 10 MPG (Urban) 8 35 4 32 32 3 24 29 2 16 28 1 8 Cost per mile 7 45.7p 2 14 44.4p 3 21 46.0p 1 7 43.8p 4 28 Service Intervals 5 12,500 3 15 12,000 2 10 10,000 1 5 15,000 4 20 0 to 60 Mph 3 10.5 secs. 4 12 12.4 secs. 3 9 12.6 secs. 2 6 15.2 secs. 1 3 74 Score (W x R) Score (W x R) Rating (R) Out of 4 £20,150 94 Toyota Rava Score (W x R) Rating (R) Out of 4 10 93 Nissan X-Trail Honda CR – V Score (W x R) Weighting (W) Price TOTAL SCORES Rating (R) Out of 4 Criterion 69 Management and Control of Projects Case Study 84 Module Learning Objectives Review By the end of this unit, you will be able to: Day 1: Differentiate between the direct and indirect costs of the business Identify the fixed and variable costs of the business Use break-even and contribution analysis Understand the principles of three costing systems Consider some simple strategies for profit improvement Day 2: Understand and apply the main investment methods used in business Discuss the strengths and weaknesses of each method Understand the importance of risk and the need for sensitivity analysis Identify a structure for controlling and reviewing capital projects 85