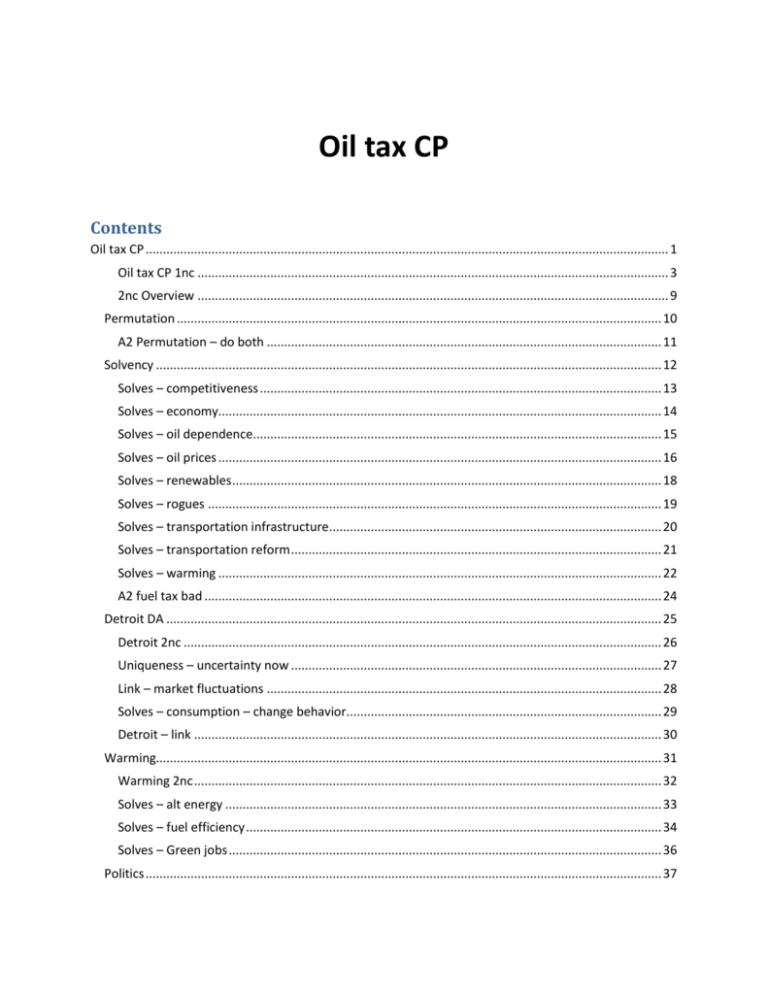

Oil-tax-CP-NCPA-holiday

advertisement