Decision Support Tool & Market Outlook

advertisement

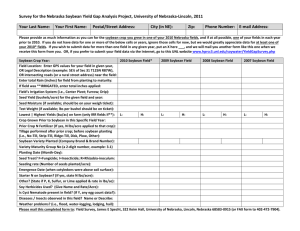

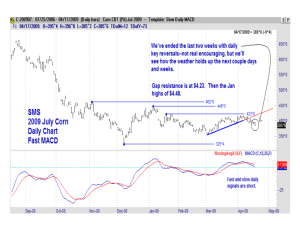

Decision Support Tool & Market Outlook USB – QSSB: Partnership Workshop May 30, 2013 Agenda Decision Support Tool (DST) ◊Conceptual Overview of the DST ◊Guided Tour of the DST Market Data ◊Strategy vs. Tactics 2 Decision Support Tool 3 What is the DST? The Decision Support Tool (DST) is designed to provide the USB Farmer Directors and stakeholders with information and to guide them through a logical thought process to help make better in-season and annual budgeting decisions, where annual budgeting and planning processes are aligned with the organization’s long range strategic objectives. It is not meant as a substitute for the unique insights that every farmer director will bring to the process. It is not something that is going to make a decision for you, but it’s something that will assist you in making good strategic decisions for USB. 4 DST Overview 5 STRATlink Survey Questions STRATlink Survey – Guided Information Thought Process ◊ Information from other DST elements is summarized in information modules preceding STRATlink questions, aimed to help directors make informed decisions regarding the survey budget allocation questions. Questions: Set 1 - Allocation across Strategic Objectives / Action Teams Meal 1. Impact on Farmer Profitability 2. USB Ability to Impact 3. Resource Need Customer Focus Oil Freedom to Operate Total Allocation across Action Teams 29% 24% 25% 21% 100% Allocation within Action Team by Target Area Thought Process 4. Budget Allocation by Strategic Objective / Action Team Domestic Opportunities 27% 38% 29% 29% 31% International Opportunities 28% 17% 27% 18% 23% Supply 29% 27% 20% 17% 24% Communications 16% 17% 24% 36% 22% 100% 100% 100% 100% 100% Total 6 STRATlink Results The two screenshots show how the allocations across action teams are displayed in the results section of the at the end of the STRATlink Survey. 7 STRATlink Survey Questions Questions: Set 2-4 - Allocation within Action Team by Target Area 1. Ability to Influence USB Strategic Objectives. 2. Target Area Resource Need within Action Teams. 3. Action Team Budget Allocation by Target Areas. Survey is repeated for Oil, Customer Focus, and Freedom to Operate Meal Customer Focus Oil Freedom to Operate Total Allocation across Action Teams 29% 24% 25% 21% 100% Allocation within Action Team by Target Area Domestic Opportunities 27% 38% 29% 29% 31% International Opportunities 28% 17% 27% 18% 23% Supply 29% 27% 20% 17% 24% Communications 16% 17% 24% 36% 22% 100% 100% 100% 100% 100% Total 8 STRATlink Results The two screenshots show how the allocations across target areas within action teams are displayed in the results section at the end of the STRATlink Survey. These are the results for the Meal action team, but the results pages for Oil, Customer Focus, and Freedom to Operate are similar. 9 Why is QSSB involvement important? USB Directors specifically asked for it – need your input. QSSBs have unique insights into regional-specific dynamics. The DST/STRATlink is a unique way to capture QSSB opinion. 10 Guided Tour of the DST http://USB.informaecon.com 11 Market Data Strategic insights vs. tactical considerations 12 Market Data: Strategic Insights Drawn from DST! 13 Strategy Versus Tactics They are often confused! Strategy: High level planning that uses the distinct advantages of an organization to allocate scarce resources to achieve specific goals. Tactics: A statement of specific actions, within the context of a strategy, that will lead to the achievement of goals. Information used in strategic decision making is similar but not the same as information used in tactical decisions. ◊ Timeframe differences ◊ Trends (e.g. price trends versus price fluctuations, consumption trends ◊ ◊ versus consumption fluctuations, etc.) Global versus local “What” the data is telling us versus “how” we should react (with tactics) to the data. 14 Strategic Insights Over time soybean acres in the US are expected to gain on corn. Meat consumption in the US has been flat. Domestic food use of soybean oil has been in decline. Biodiesel production has reached new levels. Given higher soybean acres and flat to lower domestic meal/oil levels, exports are going to be very important. Very tight US stocks. Controlling the supply chain as a way to achieve food security. 15 Over time soybean acres in the US are expected to gain on corn. • Impact of leveling off of the RFS. • Cotton and wheat have difficulty competing with corn/soy economics. • Can the US compete with Brazil for soy acres? 16 The US is increasingly a corn-soy farm economy. 17 Flat domestic meat consumption has kept meal consumption flat. • Meat exports have been a bright spot in the industry. • DDG impact has reached a peak? • Canola meal has made inroads-will this continue? • Why has canola use grown? 18 Flat domestic meat consumption has kept animal numbers slow growth to flat. 19 Poultry had been the main driver of increased meal demand. Cattle hit especially hard by the drought. Poultry profitability has been sustained. Many hog producers were able to forward contract in 2012 and lock in margins. How hard hit were non-US livestock operators by high prices in 2012/13? 20 Per capita domestic food use of edible oils has been in decline. Slow growth economy and efficiencies have hurt per capita consumption of edible oils. Soy oil has lost ground to other oils. Trans fat and price issues? Can high oleic soy oil recapture market share? How best to deploy quality enhancements? 21 Canola and palm oil have displaced soybean oil in food uses. Canola and palm oil have gained ground relative to soy oil. Should we compete on price or quality dimensions or both? 22 The bright spot: Biodiesel production has reached new levels. Soy oil has the lions share of biodiesel production. There is a limited volume of animal based material available. How will future energy policy shape biodiesel production in the future? How best to develop additional new uses for soy oil? 23 Biodiesel margins have rebounded but have been volatile. A direct relationship between biodiesel usage and margins. Are there ways to boost biodiesel margins outside of the policy area? Will we need additional biodiesel capacity? 24 Given higher soybean acreage and production, soybean exports are going to be very important. Soybean exports could go to 2.025 bil. bu. by 16/17 (see next slide). Which markets? China? Do we have the right infrastructure? 25 Long-term supplies look ample, but we have had very tight stocks and high prices the past two years. Have tight stocks/high prices done long-term damage to demand? Are we still viewed as a reliable supplier by both domestic and export customers? Given higher supplies in the future, how can we attract demand? Exporting beans/meal/oil versus exporting meat: which is better? 26 Controlling the supply chain as a way to achieve food security. MAY 29, 2013, 7:51 AM Smithfield to Be Sold to Chinese Meat Processor BY MICHAEL J. DE LA MERCED AND DAVID BARBOZA 1:07 p.m. | Updated Smithfield Foods, one of the country’s biggest pork producers, agreed on Wednesday to sell itself to one of China’s biggest meat processors for about $4.7 billion, a deal that would be the largest takeover to date of an American company by a Chinese one. The transaction will almost certainly face heightened scrutiny from American government regulators, including over issues of national security. Smithfield and Shuanghui plan to refer their transaction to a government panel that oversees foreign investments in the country. Still, Smithfield has argued that the deal will be good for itself and the American farm industry by opening a broad path to selling more pork into a country with a growing appetite for meat. The deal also fulfills one of the ambitions of the Chinese government: to encourage companies to go abroad by acquiring assets and resources and technical expertise. In North America, Africa and Australia, Chinese companies, flush with cash, are buying up land and resources to help a country that is plagued by water shortages and short of arable land, a situation exacerbated by a long running property and infrastructure boom. 27 Market Data Tactical Considerations 28 Overview US supplies tight in 2012/13 due to poor crop, strong demand before South American harvest. US soybean exports have fallen; meal exports competitive with Argentina until recently. US soybean oil stocks likely to drop sharply. 2013 South American harvest record large. US soybean stocks to rebuild in 13/14 on better yields, larger export competition. Soybean and meal futures have moderated from record levels in Sep. 2012; US basis strong. Lower prices expected after 2013 US harvest. 29 2012 US Soybean Crop Smallest in 4 Years 2012 crop of 3,015 million bushels smallest since 2008 Area up, but yield of 39.6 bu./acre was smallest in 9 years 2013 crop forecast at a record 3,388 million bushels on record acreage, yield of 43.9 bu./acre Only 24% planted as of May 19; 5-year average is 42% 30 Stocks Very Tight in 12/13, Rebuilding in 13/14 US supplies very tight due to small crop, strong exports before S. American harvest Stocks/use ratio has been no lower than 4.5% since 1970; USDA’s forecast of 4.0% seems unrealistic Imports forecast larger than normal Late planting may prolong the wait for this year’s crop Larger crop to allow stocks to rebuild in 2013/14 31 Soybean Exports Small After Strong Start 2012/13 US soybean exports started strong due to reduced competition from South American supplies Mar/Aug exports small due to high US prices, strong Brazil exports Similar pattern seen in 2003/04 China has cancelled some purchases of US soybeans 32 Soybean Crush Very Front Loaded US soybean crush strong first half of 2012/13 on large meal exports Similar to 2009/10, which also followed S. America drought Tight supplies to restrain crush until this year’s harvest, similar to 2003/04 Crush margins currently low due to high soybean prices 33 Soybean Basis Extremely Strong US cash soybean prices well above nearby futures with supplies very tight Central Illinois basis has been above recent years since November Soared this month because May futures (the nearby contract during Mar. & Apr.) were well above July futures, which became the nearby this month 34 2012/13 Meal Supplies Tight on Strong Exports Tight soybean supplies to limit 2012/13 crush Domestic meal use down on lower feeding rate (2011 crop had low protein content) Exports strong on reduced South America supplies Imports forecast at double normal Smaller exports, larger domestic use seen in 13/14 35 US Meal Competitive with Argentina Until Recently Argentina meal basis strong amid slow farmer selling of 2013 soybean crop Brazil basis weak, but soybean exports taking precedence there US basis strong, but competitive with Argentina until recently US export sales strong longer than expected 36 Biodiesel Growth to Reduce Soybean Oil Stocks Small crush this summer to restrain 2012/13 soybean oil production Exports well above last year Ending stocks forecast to drop to 1.7 billion pounds Moderation in oil yield from record level to limit 13/14 production Larger biodiesel production to offset smaller food use & exports, keeping stocks fairly tight 37 Biodiesel Production to Increase Further Biomass-based diesel usage mandate grows to 1.28 bil. gal. in 2013 from 1.0 bil. in 2012 Biodiesel also to help meet advanced biofuel mandate Return of blender credit has boosted production margins Soybean oil usage seen at 4.95 billion pounds in 12/13, 5.50 billion in 13/14 Industrial-grade corn oil usage rising, canola oil is price sensitive 38 Soybean Oil Stocks Expected to Plummet US soybean oil stocks currently large due to strong Sep/Feb crush, high oil yield of 2012 crop Stocks forecast to plummet this summer as tight supplies restrain crush & biodiesel production grows Strong biodiesel production to limit extent that stocks rebuild in 2013/14 39 US Soybean Oil Prices Well Above South American US soybean oil basis strong with stocks likely to fall Brazil basis weakest since early 2009 Argentina basis also weak due to drop in biodiesel exports to Europe US soybean oil exports likely small for the remainder of 2012/13 and during 2013/14 40 South American Soybean Crop Record Large South American soybean production increased from 115.8 million tonnes in 2011/12 to 148.6 million in 2012/13 Increased area, rebound in yields Brazil production of 82.0 million tonnes essentially matches US (82.1 million) 2013/14 South American crop forecast at 154.7 million tonnes 41 Brazils Soybean Exports Surge on Large Crop Record production on larger area, rebound in yields Soybean exports going strong (mainly to China) Crush expected to increase modestly on rebound in domestic soybean meal usage Meal exports slightly lower as soybean exports take precedence Growth in biodiesel production limiting soybean oil exports 42 Brazil Showing Huge Export Capability 43 Slow Farmer Selling of Argentina’s Large Crop 2013 production near 2010’s record on large area, rebound in yield Argentina more export oriented than Brazil, especially for products Farmer selling slow due to high inflation Slow start to export season for soybeans and meal Ending stocks to stay relatively large Soybean oil exports to rise on larger supplies, reduced biodiesel exports to EU (biodiesel import tax expected) 44 Argentina Soybean Meal Exports Slow Argentina soybean meal exports below average for most of 2012/13 marketing year after drought reduced 2012 soybean crop Despite large 2013 crop, slow farmer selling has kept meal exports below normal so far in 2013/14 Soybean exports also sluggish, but corn exports are large 45 China Drives Soybean Import Demand Growth Soybean exports from major exporters seen increasing 2.9 million tonnes in 2012/13 Forecast to increase 2.3 million tonnes for China, 0.8 million for Europe Total projected to increase 9.0 million tonnes in 2013/14 China seen increasing 9.6 million tonnes (rebuilding stocks) Europe down 2.0 million on larger meal imports 46 Meal Import Demand Down on Smaller Supplies World soybean meal import demand seen down 4.4 million tonnes in 2012/13 Tight supplies, slow start for Argentina Down 2.9 million tonnes for Europe (importing more soybeans due to Argentina’s smaller meal exports) Larger supplies to allow improvement in 2013/14, especially for Europe 47 World Biodiesel Production Growth Slowing World biodiesel production increased only slightly in 2012 Most of increase was in Indonesia EU-27, US, Brazil and Argentina flat Larger increase expected in 2013 US to account for most of growth (larger mandate) Argentina to drop on smaller exports 48 Palm Oil Dominates Vegetable Oil Trade Soybean oil exports have declined due to increased usage in biodiesel production Palm oil trade forecast at 39 million tonnes in 2013/14 vs. 20 million just ten years earlier Sunflower oil trade moderating from record in 2011/12 Rapeseed/canola oil trade boosted by growth in Canada’s crushing capacity 49 China Lowering Stocks in 12/13, to Rebuild in 13/14 China soybean imports grew 6.9 million tonnes to 59.2 million in 11/12 Smaller growth to 61.5 million tonnes expected in 2012/13 Reduction in stocks, slower meal demand growth amid high prices Larger meal exports Soybean imports forecast at 71.0 million tonnes in 2013/14 on lower prices, better meal demand growth and rebuilding of stocks Soybean oil imports rebounding, but still below late 2000s 50 China’s Stocks Reduced Amid High World Prices China’s soybean stocks at ports below 4 million tonnes for first time since Dec. 09 Well below peaks near 7 million tonnes in 2011/12 Large stocks allowing China to import less at high prices Stocks likely to rise in next few months as huge shipments arrive from S. America (mainly Brazil) 51 Soybean Futures to Decline into US Harvest Tight old-crop US supplies expected to limit downside for soybean futures until this year’s harvest Stronger basis, wider old-/new-crop inverses will be needed to achieve necessary rationing if futures drop earlier Lower prices expected in late 2013 & into 2014 if US yields rebound 52 Similar Outlook for Soybean Meal Tight supplies also likely to underpin soybean meal futures until new-crop soybeans are available to crush Strong exports could put rationing task on domestic livestock industry Soybean meal looks to have more downside potential than soybean oil 53 Decline in Stocks to Bolster Soybean Oil Prices Soybean oil futures expected to rise this summer as US soybean oil stocks plummet Basis has firmed, and likely will continue to Futures projected to decline as soybean prices drop this fall Less downside risk than soybeans and meal as biodiesel growth keeps soybean oil stocks fairly tight 54 Oilseeds Summary Old-crop US soybean supplies very tight Brazil’s soybean exports going strong; Argentina’s limited by slow farmer selling China’s soybean stocks declining in 2012/13, forecast to increase in 2013/14 Tight US supplies to underpin soybean and product futures & basis levels until harvest Late planting to prolong the wait for 2013 crop Soybean and meal futures to drop into harvest Large biodiesel production to limit rebound in soybean oil stocks and the downside for prices 55