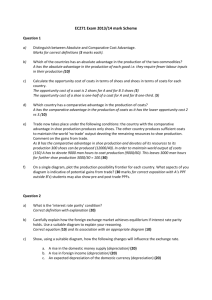

EC271 May 14

advertisement

s Brighton Business School Undergraduate Programmes BSc (Hons) Finance and Investment Level Five Examination May/June 2014 EC271: International Financial Economics ______________________________________________________________________________ Instruction to candidates: Rubric: You are required to answer THREE questions from a total of SIX All questions are weighted equally (mark allocations within questions are shown in brackets). Nature of examination: unseen/closed book Allowable material: non-programmable calculators Page 1 of 4 EC271: International Financial Economics (May/June 2014) Question 1 a) Distinguish between Absolute and Comparative Cost Advantage. (10 marks) Assume two countries A and B that produce two goods coats and shoes. With constant returns to scale the labour requirement for each good is shown below Unit labour requirements (hours per unit of output) Coats Shoes A 60 30 B 120 40 Suppose that there is no trade between A and B, and each economy has an endowment of 300 workers. Each worker works a 40 hour week. Initially each country devotes half of its resources to the production of each good. b) Which of the countries has an absolute advantage in the production of the two commodities? (10 marks) c) Calculate the opportunity cost of coats in terms of shoes and shoes in terms of coats for each country. (10 marks) d) Which country has a comparative advantage in the production of coats? (10 marks) e) Trade now takes place under the following conditions: the country with the comparative advantage in shoe production produces only shoes. The other country produces sufficient coats to maintain the world ‘no trade’ output devoting the remaining resources to shoe production. Comment on the gains from trade. (30 marks) f) On a single diagram, plot the production possibility frontier for each country. of you diagram is indicative of potential gains from trade? What aspects (30 marks) Page 2 of 4 EC271: International Financial Economics (May/June 2014) Question 2 a) What is the ‘interest rate parity’ condition? (20 marks) b) Carefully explain how the foreign exchange market achieves equilibrium if interest rate parity holds. Use a suitable diagram to explain your reasoning. (20 marks) c) Show, using a suitable diagram, how the following changes will influence the exchange rate. a. b. c. A rise in the domestic money supply A rise in foreign income An expected depreciation of the domestic currency (60 marks) Question 3 a) Using appropriate diagrams assess the effectiveness of fiscal and monetary policy in raising the level of output and employment under both flexible and floating exchange rate regimes. (80 marks) b) Briefly explain why a government may wish to fix its exchange rate. (20 marks) Question 4 a) Outline how a currency crisis may emerge in the context of Krugman’s first generation model. (70 marks) b) To what extent does this model explain the crisis experienced by South East Asian economies in the late 1990s? (30 marks) Question 5 a) Under what conditions will it be beneficial for a country to join an optimal currency area? Use an appropriate diagram to explain your answer. (60 marks) b) To what extent can the EU be described as an optimal currency area? (40 marks) Page 3 of 4 EC271: International Financial Economics (May/June 2014) Question 6 a) Briefly outline the key characteristics of Euro-currency and Euro-bond markets. (20 marks) b) What factors have contributed to the rapid growth of the Euro-currency and Euro-bond markets? (40 marks) c) Assess the impact that the growth in Euro-deposits has had on international debt and its potential effect on international financial stability. (40 marks) Page 4 of 4 EC271: International Financial Economics (May/June 2014)