click here for the presentation slides ()

advertisement

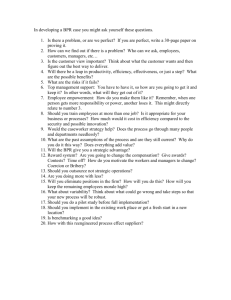

Welcome 7.00 p.m. Lloyds TSB Agriculture – David Fowler Banking after the Big Bang 7.20 p.m. Simpkins Edwards – Mary Jane Campbell Agricultural & Business Property Reliefs – are you up to date? 7.40 p.m. Luscombe Maye – Amanda Burden See your way through the planning maze 8.00 p.m. Simpkins Edwards – Mary Jane Campbell Furnished Holiday Lets 8.15 p.m. 8.30 p.m. Questions Light Refreshments Lloyds TSB Agriculture Banking after the Big Bang A banker’s perspective David Fowler Regional Agricultural Manager Devon DATE 31/12/2008 17/12/2008 03/12/2008 19/11/2008 05/11/2008 22/10/2008 08/10/2008 24/09/2008 10/09/2008 27/08/2008 13/08/2008 30/07/2008 16/07/2008 02/07/2008 18/06/2008 04/06/2008 21/05/2008 07/05/2008 23/04/2008 09/04/2008 26/03/2008 12/03/2008 27/02/2008 13/02/2008 30/01/2008 16/01/2008 % 02/01/2008 LIBOR v BASE RATE 2008 LIBOR V BASE RATE 6.7 6.5 6.3 6.1 5.9 5.7 5.5 5.3 5.1 4.9 4.7 4.5 4.3 4.1 3.9 3.7 3.5 3.3 3.1 2.9 2.7 2.5 2.3 2.1 1.9 Base rate 1 month LIBOR 3 month LIBOR 6 month LIBOR 12 month LIBOR 0.77% DATE 30/12/2009 16/12/2009 02/12/2009 18/11/2009 04/11/2009 21/10/2009 07/10/2009 23/09/2009 09/09/2009 26/08/2009 12/08/2009 29/07/2009 15/07/2009 01/07/2009 17/06/2009 03/06/2009 3.10 20/05/2009 06/05/2009 22/04/2009 08/04/2009 25/03/2009 11/03/2009 25/02/2009 11/02/2009 28/01/2009 14/01/2009 31/12/2008 LIBOR v BASE RATE 2009 LIBOR V BASE RATE 2.90 2.70 2.50 2.30 2.10 Base Rate 1.90 1 month LIBOR % 1.70 1.50 3 month LIBOR 1.30 6 month LIBOR 1.10 12 month LIBOR 0.90 0.70 0.50 0.30 Banking after the Big Bang • Has our lending policy changed? – No • Are we lending new funds? – Yes • Have we met are commitment to lend an extra 15% - Yes • Has the cost of borrowing increased? – Yes • Are all banks the same? – NO! Banking after the Big Bang Securing finance – be well prepared – Carefully prepared business plan – Accurate budgets & cash flows – sensitivity /stress test – Up to date Audited accounts – Security Lending to Agriculture We are here to help David Fowler Regional Agricultural Manager Devon 01392 424871 07802 655897 Gross Domestic Product Inheritance Tax Mary Jane Campbell Inheritance Tax (IHT) Fact or Fiction? Farmers don’t pay IHT FACT 100% / 50% Agricultural Property Relief (APR) available on the agricultural value of agricultural property Areas of difficulty: Assessment of agricultural value Existence of land & buildings no longer used for farming Farmhouse FACT 100% / 50% Business Property Relief (BPR) available on assets used in business. Aim in tax planning for farmers is for BPR to cover assets not already covered by APR. FACT Availability of BPR subject to strict criteria including Ownership periods Ownership arrangements for assets FACT Easy to slip up for entirely sensible commercial and personal reasons. Take advice, and then take it again when there is a change of plan - it will be cheaper in the long run. Fiction Farmers don’t pay IHT Fiction unless you work at the facts. BPR Recent Cases Nelson Dance Farmland with potential for residential development Transferred it to a family trust Subsequently ceased farming Settlor died shortly afterwards HMRC chased the trust for IHT High court decided in favour of the trust. BPR Recent Cases McCall Owned land with development potential Let land on annual grazing agreements Deceased arranged maintenance of hedges/ditches etc Grazier fertilised ground BPR Recent Cases McCall Judge decided the activity being undertaken was that of holding investment property. Deceased did nothing to maximise the value of the grazing. No BPR was available Farmhouses Is it a farmhouse? Tests • Centre of operations • Sufficient business activity and involvement • Character appropriate. Valuation issues Inheritance tax Succession/retirement plans Wills Partnership agreements Tax planning To ensure wealth protection and security of income for all involved See your way through the Planning Maze Amanda Burden B.Sc (Hons), FAAV, MBIAC Partner - Agriculture & Rural Planning Department, Totnes BACKGROUND • Degree in Agriculture with Countryside Management • Fellow of Association of Agricultural Valuers • Member British Association of Agricultural Consultants • Farmers’ Daughter & Farmers’ Wife • Joined LM in 1995, • Associate Partner 2000 • Equity Partner 2007 REASON FOR PLANNING • • • • • • • Expansion of Farm Business Diversification of Farm Business Capitalise on Assets/ Add Value Need for additional dwelling Lifestyle change/Retirement Wish to “get on” Asset for future generations PLANNING NEEDS PLANNING • Discuss with Agent early on…. – Timescale – Costs – Planning Policy • Option to go through “Front Door” or “Back Door” The Planning Maze Survey s Application Planning Local Officer Tim Politic e s Design & Access Highways Landscap Consultees e Drainage Contaminated Land Parish Council Nation al County/Loc al TYPES OF RURAL PLANNING • Agricultural Buildings – Full Planning – General Permitted Development - 28 day Determination • • • • Agricultural Dwellings Barn Conversion – Traditional or Modern Diversification Projects Green Issues AGRICULTURAL BUILDINGS • Full Planning – Levels – Justification – Plans • General Permitted Development Rights – – – – NO greater than 465 sq m 25 m from road For livestock 400 m from dwelling LPA notification AGRICULTURAL DWELLINGS • Planning Policy Statement 7 (PPS 7) Annex A – Permanent Dwellings • Outline Application - Agree Principle of Need • Reserved Matters application later – Layout – Scale – Landscaping - Appearance - Access – Temporary Dwellings PERMANENT DWELLINGS – Requirements • Functional Need • Financial Test • No other dwellings suitable and available (incl. “affordable”) • Full time worker • Suitable site (within “sight and sound”) – Conditions • Ag tie on new build and existing ? TEMPORARY DWELLINGS • Demonstrate intentions to develop enterprise eg. Farmbuildings • Show business can be viable eg. Business Plan • Functional Need • No Disposal of “suitable” dwellings or no other dwellings close by • Siting and access are acceptable TEMPORARY DWELLINGS cont’d • Permission for temporary dwellings normally 3 years – Meet Financial test for permanent dwelling – Extensions of time not normally given – Will have to be removed and occupants made homeless if criteria not fulfilled • Temporary permissions should not be given on sites where LPAs would not allow a permanent dwelling TRADITIONAL BARN CONVERSIONS • Local Authority Policy – Business ? Holiday Use ? Residential ? • • • • Marketing Viability Appraisal Proximity to farm activities/modern buildings Curtilage – Detailed Plans – Design & Access Statement – Structural Survey TRADITIONAL BARN CONVERSIONS cont’d – Wildlife Report – Archaeological/Architectural Historian Report – Highways/Access Improvements – Contributions • Affordable Housing ? • Open Space ? • Education ? – Listed Building Consent MODERN BUILDING CONVERSIONS • Change of Use • Yard Area/Potential Parking Area • Size & Structure – End Use – Need for alteration • Access/Highways • Specific End Use Condition DIVERSIFICATION PROJECTS • LET YOUR IMAGINE RUN WILD …. – – – – – – Barn Conversions Camping & Caravan Sites Fishing Lakes Farm Shops Dog Kennels/Catteries Tourist Attractions • AND TALK TO YVONNE ABOUT SOME POSSIBLE GRANT FUNDING …………… GREEN ISSUES • • • • • • Wind Turbines Solar Panels Ground Source/Geo-thermal Heat Pumps Rainwater Harvesting Slurry Storage/Covered Yards SPEAK TO YVONNE ABOUT POSSIBLE GRANT FUNDING ESPECIALLY IF IN DAIRYING vs CERTIFICATE OF LAWFUL USE (CLU) • Backdoor Planning – Think – What do you have now ? – Has 4 or 10 years passed ? CERTIFICATE OF LAWFUL USE • 10 year & 4 year Rule – 4 years if created a “dwelling” – 10 years if Change of Use • Onus of Proof is on Applicant • Based on Balance of Probabilities – – – – Statutory Declaration Diary Evidence Photographs Supporting Letters PLANNING FOR THE FUTURE • Seek advice from Professional/Agent not just from Planning Authority • Seek advice from Accountant – Capital Gains ?? – Inheritance Tax ?? • Get a Valuation – Options ? • Plan well in advance – it always takes longer than we both would like !! REMEMBER !!! • Planning History on Sites – Withdrawals – Refusals - Approvals - Appeals • Hope Value ? • Conditions – Ag tie - Personal Permission • Consents normally last 3 years – Commence development subject to conditions – Policy Changes – re-apply well in advance See your way through the Planning Maze Amanda Burden B.Sc (Hons), FAAV, MBIAC Partner - Agriculture & Rural Planning Department, Totnes Furnished Holiday Lettings Mary Jane Campbell Furnished Holiday Lettings Budget Red Book “Budget 2009 announces the repeal of the furnished holiday letting (FHL) rules from April 2010. Until the repeal takes effect the FHL rules will be extended to those qualifying furnished holiday lettings elsewhere in the EEA.” Furnished Holiday Lettings FHL rules apply if: Let on a commercial basis Available for letting for 20 weeks Let for 10 weeks Restriction to prevent continuous occupation for more than 5 months Furnished Holiday Lettings Tax results of applying FHL rules Activity is defined as a trade Capital allowances are available Trading loss relief apply Rollover, holdover & entrepreneurs’ relief all available for Capital Gains Tax. After 2010 Income Tax The old question “is FHL a trade?” Central issue “are the taxpayer’s activities sufficient enough to make her a trader and not a mere landowner who derived an income by exploiting her property” from 1982 case Class 2 and Class 4 National Insurance Registration as self employed After 2010 Capital Gains Tax reliefs if trading status Inheritance Tax, Business Property Relief - Reliant on definition of whether or not the activity amounts to a business - HMRC will be looking at level and type of services provided Action Points Make use of CGT reliefs before 5th April 2010 - sell to a 3rd party - sell at undervalue/gift - sell and roll over proceeds Questions….. For a chance to win a bottle of champagne, please remember to hand in your feedback form.