Document

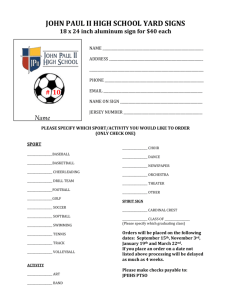

advertisement

Bonnie's Batting Cages and Softball Services Assets Liabilities Accounts Receivable Accounts Payable Cash Supplies Infield Blue Sox Opening Balances Transaction 1 Transaction 2 Transaction 3 Transaction 4 Transaction 5 Transaction 6 Transaction 7 Transaction 8 Transaction 9 Transaction 10 Ending Balances 15,000 3,100 Moosehead Sluggers 5,000 Owner's Equity Fighting Hawks 1,300 13,400 Sporting Equipment Trucks 21,000 60,000 Bats 'N' Gloves Co. Sport Store 30,600 23,700 B. Birch, Capital Zero Proof 64,500 0 Transaction Analysis Assignment Analyze each of the following transactions and record in the transaction analysis sheet below: 1. Bonnie's Batting Cages and Softball Services receives $1 000 cash from Fighting Hawks in partial payment of the amount owed by them. 2. Sport Store is paid $2 000 cash in partial payment of the debt owed to them by Bonnie's. 3. The owner buys herself a new computer (valued at $1 200) with the company's money. 4. Supplies costing $950 are purchased for cash from the Sport Store. 5. Bonnie's Batting Cages and Softball Services sells uniforms and equipment for Team Silkscreens and More. For this service, Bonnie's Batting Cages and Softball Services receives a commission of $4 700. 6. A set of bats (Sporting Equipment) is purchased from Bats 'N' Gloves Co. for $3 000 cash. 7. An employee from the company is asked to leave the company with no compensation. 8. A tournament is set up by the Bonnie's Batting Cages and Softball Services. For this service, the company receives $15 000 cash. 9. Bonnie's Batting Cages and Softball Services purchases a new batting cage from Sport Store valued at $8 000. Bonnie's Batting Cages and Softball Services gives a cash down payment of $4 000 and the remainder of the balance is to be paid at a later date. 10. Bonnie's Batting Cages and Softball Services sells one of its trucks for $15 000 cash. With this money, Bonnie's Batting Cages and Softball Services pays the remaining balance of the batting cage bought in transaction 9.