Creditors' Claims and Insolvent's Estate, By Yahne Miorini, LL.M

advertisement

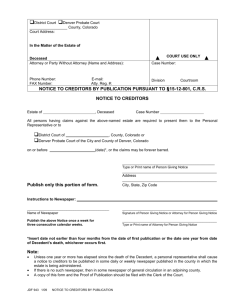

Creditors’ Claims and Insolvent’s Estate, By Yahne Miorini, LL.M. The Commonwealth of Virginia notice before the creditor’s rights form. does not have a notice of can be terminated. sample form posted on the publication of the appointment of a personal representative of the estate that will limit the period for creditors to file a claim against the estate, like the District of Columbia or the State of Maryland does. If a personal representative protected wants against to any be future website of Fairfax Commissioner 1.) Regular Payment of Creditors of Accounts. Please note first, that if there is a The Commissioner will endorse Last Will and Testament, the the date of filing on the claim executor is usually requested and sign the endorsement. under the said Will to pay the funeral It is recommended that the debt expenses first, prior to any be corroborated. In Noland Co. distributions. v. Wagner2, the Supreme Court testator’s debts and unknown claims, the personal representative will have denied the claim because there to One of the first responsibilities of request a Debts and Demands a personal representative is to hearing. secure the assets of the decedent, was no corroborated testimony. Mr. Wagner was a general contractor for the construction of then to assess the debts. buildings. The Noland Company However, in Tulsa Professional Collection Services, v. Va. Code Ann. §64.1-171 et seq. Pope1, the Supreme Court held provides instructions on how that if the identity of a creditor is creditors can secure their debts. known “reasonably Obviously, the creditor should ascertainable” by the personal submit the claim to the personal representative of the estate, then representative the due process clause of the Although there is no requirement Fourteenth Amendment requires that a claim be filed with the that the creditor be given notice Commissioner by mail or such other means as creditors should file their claims are reasonable to ensure actual or a written statement with the or Inc. Commissioner of of of the Incorporated filed a claim against the 485 U.S. 478, 108, S.Ct. 1340, 99 L.Ed. 2d 265 (1988) administratrix Mr. argued that it has a claim as assignee for the value of an open account which had been assigned estate. by the co-partner of Fred Hayes and J. Herbert Hayes. The Noland Company only provided Accounts, the testimony of J. Herbert Hayes. The Court held that the “precise nature of the required Accounts. corroboration or the weight to be some commissioners provide a Excerpts from teaching class, NBI 2008. All Copyrights Reserved. of Wagner, deceased. The company There is no statutory format but 1 See in Exhibit A the 2 153 Va. 254 (Va., 1929) Creditors’ Claims and Insolvent’s Estate, By Yahne Miorini, LL.M. corroborating basis that the “note evidencing evidence depends upon the facts the debt was lost therefore Mrs. of each particular case.” It further Pinnell was required to bring an noticed that Mr. Hayes needed action under Code §8-517 against corroboration because Mr. Hayes the executor, and precluded from could have been “the party proving her claim before the plaintiff in the motion”, and Commissioner.” court should hold on paying any debts, because of his present certain noticed that “Mrs. Pinnell filed a request the Debts and Demands direct interest as he may “either written statement of her claim, gain or lose by the direct legal setting forth clearly and fully its operation of the judgment.” basis”, notice was made, “…no given to the The 2.) Insolvent Estate and Debts and Demands Hearing If the personal representative is uncertain of the solvency of an estate, the personal representative proceedings, and obtain an Order of Payment of the debts. i. motion was made that the report In Bickers Pinnell3, v. the Supreme Court affirmed that the creditor had provided corroboration of her claim. Mr. Bickers had borrowed $4,500 from his daughter, Mrs. Pinnell. After his death, Mrs. Pinnell filed of the Commissioner husband and several checks that jury be empaneled to inquire into start the Debts and Demands the claim.” hearing Therefore the the estate excepted to the Commissioner’s report allowing the claim, on the office. The Commissioner will allowed the claim. set a time and place for receiving Accounts’ proof of debts and demands . against the decedent or the The vast majority of debts will be paid by the personal however, insolvent or certain claims are not ripen. In the situation of an insolvent estate, additional procedures should be followed by the personal representative. 3 of the order of the trial court and sometimes the estate may be of contacting Commissioner $4,500, 4%.” The Commissioner executor by Supreme Court affirmed the representative; The Hearing The personal representative shall had the mention: “Int. Bond of Accounts allowed her claim. Demands recommitted to him”… “or that a that she had lost or misplaced it. She provided testimony of her and be a claim. She could not provide the evidence of the note alleging Debts 199 Va. 444, 100 S.E.2d 20 (Va., 1957) Excerpts from teaching class, NBI 2008. All Copyrights Reserved. decedent’s estate. The notice will be posted at least 10 days before the date fixed for the hearing at the courthouse, and published in a local newspaper. The Commissioner of Accounts does not require having an account of the estate, but the personal representative should inform the Commissioner of any Creditors’ Claims and Insolvent’s Estate, known outstanding claims against the estate. The personal representative shall give notice in writing to any claimant of a disputed claim at The last known address of the creditor should be used. There is no specific form of notice. The notice shall inform the creditors their claim or a written statement is sufficient evidence of the before the Commissioner. This claim, the Commissioner may filing direct the personal representative limitations but only for the or a period of the Debts and Demand the hearing. Therefore, in order to validity or invalidity of a claim. prevent the claim from being Even though the Commissioner barred is not given explicit authority to limitations, the creditor should summon bring an action for recovery or the creditor to to start establish and compel the attendance of witnesses and take of their right to attend and tolls by the the statute statute of of enforcement of such claim. depositions, such powers are present their claims, and their implied from right to obtain another date if the receive Commissioner finds that the the Commissioners if the creditor would be bound by Within 60 days after the hearing, the power to proof However, initial date is inappropriate, and an adverse ruling. In certain situations where there procedure least 10 days prior to the hearing. By Yahne Miorini, LL.M. and Manual of the Commissioner of Accounts demand. will file a report of sufficiently for proven debts and demands with Accounts4 the court. Creditors have 15 days points to the facts that the Finally, the from the filing to file exceptions. Commissioner is “not equipped notice shall inform the creditors There is no particular form or to handle a hotly contested claim of their rights to file exceptions formality. with many witnesses on both with the judge in the event of an specify with reasonable certainty sides and complicated facts or adverse ruling. The notice may the particular grounds of the law.” The Commissioner will be sent “by regular, certified or objections. report to the court that it is registered mail, or by personal his/her recommendation that this service.” I recommend sending If there is an exception5, the claim needs to have a separate the notice by certified mail with court examines it and may procedure. choose to confirm the report in receipt requested because the Code The creditor must personal representative will have Va. Ann. to provide evidence of mailing a provides that creditors shall file whole or in part, return the report §64.1-173 to the same or another Commissioner, or empanel a jury notice to the Commissioner. 4 Virginia Practice Handbook, 4th Edition, by VA CLE Excerpts from teaching class, NBI 2008. All Copyrights Reserved. 5 See Va. Code Ann. §26-33 Creditors’ Claims and Insolvent’s Estate, to inquire into any matter which ii. By Yahne Miorini, LL.M. given by a testator who is a What kind of debts? debtor to his creditor, “equal to it deems appropriate. Verification of Debt. important the confirmed. personal representative should intent, However, the creditor has a right only pay the debts that exist. The satisfaction of the debt.” to appeal Finally, is the a 6 personal a ensure confirmation . creditor or note that representative that the the shall statute of beneficiary who did not file limitations has not run, because it exceptions to the report may file would eliminate the debt. Claim not yet due. Va. Code the report.” Ann. §64.1-174 set the rules for If the report shows that some claims that are not yet due. After debts have not been paid, then the account of the personal the court may order the payment representative has been approved of the debts. However, if the and the Debts and Demands personal representative learns of Hearing, the court may request a claim during this period, that the personal representative meaning before the order of reserve an amount “to meet any distribution is entered, this order other claim not finally passed shall not be entered until after upon.” “deemed the second separation the creditor within that 10-day period confirms his/her claim, the Commissioner shall schedule be clause agreement couple, in The of the of the Mr. Swan promised to pay $166.67 a month to Mrs. Swan until she died provided that unmarried. testate. she remained Mr. Swan died His Last Will and Testament provided a bequest of his ex-wife. After his death, Mrs. asked Swan that the executor be required to account to her the annuity of $2,000 a provided separation to the creditor shall be given. If to facts were the following: Under year expiration of 10 days, and notice under agreement. the The Compromise of Claim. Va. Code executor and the Commissioner Ann. the of Accounts considered that the personal representative authority bequest should be considered as to compromise claims. a satisfaction and performance of §64.1-57(g) gives the separation agreement and that a date for hearing the claim and Election of a Legacy. for reporting the claim. under Swan v. Finally, Swan 7 the Supreme Court held that a legacy See Va. Code Ann. §26-34 absence of proof of the contrary Swan “a suit to surcharge and falsify 6 or greater than the debt”, is in If no exception has been filed, report to It is 7 117 S.E. 858 (Va., 1923) Excerpts from teaching class, NBI 2008. All Copyrights Reserved. the ex-wife “could not have the benefit of both instruments, but must elect between the separation agreement and the provision in Creditors’ Claims and Insolvent’s Estate, By Yahne Miorini, LL.M. the will.” It was further held that a clear intention of the person passes by right of survivorship. “…it seems clear to us that, when from whom it derives one that he In Dolby v. Dolby,12 the Court these should not enjoy both.10” held that the mortgage was a two provisions are considered in the light of the testator's situation and surroundings, and the general plan which he had in mind in making his will, as disclosed by its various provisions, he did not intend to include the annuity among his debts, but designed to satisfy that claim by the gift in the sixth clause.” The Court personal liability of the estate Mortgages. type of Depending on the mortgage and the language in the Last Will and Testament, the mortgage may be a debt of the estate or not. depends upon testator has whether made It the himself personally liable for the debt. If the decedent is personally liable referred to the maxim “He who for seeks equity must do equity.8” intestate, the mortgage is the As a result, two principles of law were set: (1) “the general rule that a legacy given by a debtor to his creditor equals to or greater than the debt is, in the absence of proof of a contrary intention, deemed to be a satisfaction of the debt” 9; and (2) “the principle of equitable election whereby an obligation is imposed upon a party to choose between two inconsistent or alternative rights or claims in cases where there is the liability mortgage of the personal estate. and died decedent’s The surviving and did not pass to the surviving tenant. Mr. Dolby had purchased a real estate property in his sole name and executed a promissory note secured by a deed of trust. He later married and retitled the property into his name and his wife’s, as tenants by the entirety with the right of survivorship. Mrs. Dolby was not added as a joint obligor on the note. Last Will provided that and the His Testament personal joint owner or the legatee has the representative right to demand the payment of legally enforceable debts” but the mortgage from the estate. also said that the “executor shall If the decedent dies testate without any provision regarding the mortgage, there is a presumption that the mortgage passes with the bequest of the property unless the testator specifies otherwise11. This does not apply when the property shall pay “all not be required to pay prior to maturity any debt secured by mortgage, lien or pledge of real or personal property owned by me at my death, and such property shall pass subject to such mortgage, lien or pledge.” The executors filed a complaint for aid and direction regarding 8 9 1 Pom. Ea. Jur. (2d Ed.) §465. Stewart v. Conrad's Adm'r, 100 Va. 128, 135, 40 S. E. 624 10 Allison v. Allison, 99 Va. 472, 476, 39 S. E. 130 11 Va. Code Ann. §64.1-157.1 (A) Excerpts from teaching class, NBI 2008. All Copyrights Reserved. the payment of the mortgage. 12 694 S.E.2d 635 (Va., 2010) Creditors’ Claims and Insolvent’s Estate, By Yahne Miorini, LL.M. The Court considered that two liable for the obligation and the each person furnishing services questions were to be answered: land remains the primary source of goods (1) whether decedent Dolby had for the payment of the debt. 6. Debts and taxes due to the State a personal obligation to pay the debt, (2) whether the mortgage debt is secured by real property own by decedent upon his death. The Court considered that decedent was personally and of Virginia If the estate is insolvent, the Commissioner will want to have an interim accounting to be filed as soon as practical. iii. 7. Debts due as trustee for persons under disabilities: representative, personal guardian, conservator 8. Debts and taxes due to localities Order of Payment solely liable for the note that he of the state of Virginia signed. For the second question, Va. the Court noticed that because provides the order of payment in There is no preference within a the real estate property was held case of an insolvent estate, as class. jointly with right of survivorship, follows: Code Ann. §64.1-157 The rights are fixed at death. the real estate property was not owned by the decedent upon his death, because the real estate property passed by operation of law. Therefore, the debt could not follow the real estate property. If Mrs. Dolby would have been jointly liable for the note, then only half of the note would have been part of the 1. Cost and expenses of 2. Family property, allowance, and exempt homestead allowance 3. Funeral expenses not to exceed $3,500 the There is an exception to his order of payment. Va. Code Ann. §64.1-157.1 provides that existing liens at the date of death of the testator have priority over 4. Debts and taxes with preference under federal law the payment of other creditors and legatees. the last illness of the decedent, If There is no interest or attorney’s fees upon insolvency14. administration 5. Medical and hospital expenses of estate13. 9. All other claims This does not apply to liens that would be granted in the Will. decedent was not including liable for the persons attending to him not to Va. encumbrance, the estate is not exceed $400 for each hospital provides that creditors shall be and nursing home and $150 for paid personally compensation 13 See Brown v. Hargraves, 198 Va. 748, 751, 96 S.E.2d. 788, 791 (1957) Excerpts from teaching class, NBI 2008. All Copyrights Reserved. of 14 Code in Ann. the order §64.1-158 of their Virginia Surety Co. v. Hilton, 181 Va. 952 (Va., 1943) Creditors’ Claims and Insolvent’s Estate, classification. By Yahne Miorini, LL.M. If there is not show cause. The order of show surviving spouse will not enough to pay a class, the class cause must be published once a renounce the will and such intent will be paid ratably. week for two successive weeks shall be in writing. in one or more newspapers as the iv. Show Cause Order A contingent claim will not court may direct. prevent from distributing the After six months of qualification, the personal representative may motion the court to make an order to show cause against the Order of Payment of the estate to creditors and legatees of the estate. Under Va. Code Ann. §64.1-179, this action can also be brought by a legatee or distributee. Usually, a Debts and Demands hearing will first take place. The court will then order the estate. The court will set aside distribution with or without a enough reserve for such a claim. refunding bond. The statute requires a refunding bond if the distribution is made before the expiration of a one-year period. Depending on the statute, beginning of the one-year period starts from: (1) the date of death (for the family allowance, exempt property and homestead allowance, (2) the date of the This will provide an Order of Payment of the creditors and to all other persons interested in the estate of the decedent. Any person interested in the estate filing of the Will (for a newly discovered Will and its challenge), or (3) the date of the appointment of the personal representative (when no Will was will “show cause” to be named in probated). This one-year period the order “against the payment corresponds and delivery of the estate of the descendent to his legatees or to the right to challenge the Last Will and Testament probate. The statute provides that to be protected, the distributees.” personal representative have contacted the surviving provides a form of notice for spouse to ascertain that the Code Ann. Excerpts from teaching class, NBI 2008. All Copyrights Reserved. protects the personal representative against creditors but not against an improper distribution of the estate to legatees or distributes. H. Michael Deneka, Esq. in Winding Up and Settlement of an Estate15 addresses this issue and recommends that in order to be totally protected, the personal representative should seek an action for aid and direction. Actually, Va. Code Ann. §64.1179 provides that “every legatee or distributee …may, in a suit brought against [the personal representative] within five years afterward”. shall §64.1-180 Va. Please note that this procedure 15 Estate and Trust Administration in Virginia, 3rd ed., by VA CLE publications Creditors’ Claims and Insolvent’s Estate, I also recommend that By Yahne Miorini, LL.M. the personal representative obtain a letter from the IRS and a letter from the Virginia Department of Taxation stating that the decedent and the estate of the decedent do not owe any taxes. Excerpts from teaching class, NBI 2008. All Copyrights Reserved.