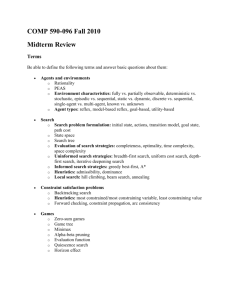

Constraining Medical Costs

advertisement

Is the American Health Care System Too Sick to Save? NAHU’s Healthy Access Plan—Our Vision for Affordable and Responsible Health Reform National Association of Health Underwriters 2000 N. 14th Street, Suite 450 Arlington, VA 22201 (703) 276-0220 (703) 841-7797 FAX www.nahu.org U.S. Medical Costs Are Rising Drastically What solutions address this cost increase? 2.5 Medical Inflation Rose 112.5% 2.0 1.5 1.0 General Inflation Rose 28.8% 0.5 '98 '99 '00 '01 '02 '03 '04 Year Kaiser Family Foundation, “Health Care Costs – A Primer,” August 2007; OECD Stats, 2007 '05 '06 Medical Costs Are Rising Drastically • How can we constrain medical costs? • How will we get access for all? • How about financing access? Constraining Medical Costs Constraining Medical Costs How Much Can Private Insurance Costs Be Affected? 1/3 Taxes Administration 14% Claims Cost 86% Centers for Medicare & Medicaid Services, 2004 Constraining Medical Costs How Much Can Private Insurance Costs Be Affected? Administration 14% Other Claims Cost 70.9% Behavior 15% Aon Consulting, Research Brief “The Impact of Consumer-Directed Health Plans with Integrated Health Improvement Services on Health Care Consumers,” October 2006 Constraining Medical Costs Determinants of Health Status Lifestyle Choices 50% Access to Care 10% Genetics 20% Environment 20% Mercer Management Journal 18, “The Case for Consumerism in Health Care” Constraining Medical Costs Behavior & Lifestyle: The Cost of Smoking Dollars (Billions) 180 160 $75 B. Direct Medical Costs 140 120 100 80 60 40 20 0 $88.8 B. Product Taxes & Revenue Tobacco Revenue $92 B. Lost Productivity Cost to Country Centers For Disease Control & Prevention, Tobacco Use Fact Sheet (July 2007) Constraining Medical Costs Behavior & Lifestyle: Weight Gain ’86-’06 No Country Can Fund All the Consequences: Hypertension Type 2 Diabetes Osteoarthritis Stroke Coronary Heart Gallbladder Sleep Apnea Respiratory Issues Some Cancers 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 Obesity Trends Among U.S. Adults (BMI>30%) No Data <10% 10%–14% 15%–19% 20%–24% 25%–29% ≥30% Centers for Disease Control & Prevention, 2006 Behavioral Risk Factors Surveillance System Constraining Medical Costs Behavior and Lifestyle: Solutions • Incorporate wellness and disease-management into all government employee programs – – – – – – Federal employees State employees Medicaid Medicare SCHIP Veteran Health System • Encourage employer wellness programs – Legal protection – Tax incentives – Premium incentives Constraining Medical Costs How Much Can Private Insurance Costs Be Affected? Administration 14% Other Claims Cost 67.6% Behavior 15% Inefficiencies 3.3% National Institute of Medicine, Report on Medical Errors, November 1999 Constraining Medical Costs System Inefficiencies: Solutions • Improve system inefficiencies in doctor and medical facilities – Pay for performance – Best practice guidelines – Evidence-based medicine • Federal standards for interoperable electronic medical records – Unify the system – Reduce errors – Improve patient satisfaction of the entire system Constraining Medical Costs How Much Can Private Insurance Costs Be Affected? Administration 14% Other Claims Cost 62.6% Behavior 15% Inefficiencies 3.3% Malpractice 5% Towers Perrin, “U.S. Tort Costs: 2005 Update,” March 2006 PricewaterhouseCoopers, “The Factors Fueling Rising Healthcare Costs 2006,” February 2006 Constraining Medical Costs Medical Malpractice: Solutions • Malpractice reform limits – Limit non-economic damages – Increase effectiveness of disciplining incompetent doctors Constraining Medical Costs How Much Can Private Insurance Costs Be Affected? Administration 14% Other Claims Cost 45.1% Behavior 15% Inefficiencies 3.3% Government Cost Shift Uninsured 9.5% Cost Shift 8% •Margaretann Cross, “Confronting the Medicare Cost Shift,” Managed Care, Dec. 2006 •2003 Health Affairs, “Kaiser Commission Report on Medicaid & the Uninsured” Malpractice 5% Constraining Medical Costs Government Cost-Shifting to Hospitals $14,000 $12,000 $10,000 Average 33% Less $8,000 $6,000 $4,000 Medicare/Medi-Cal Blood Poisoning Kidney Infections Esophagitis Gastrointestinal Hemorrhage Heart Failure Pneumonia Chronic Pulmonary $0 Intracranial Hemorrhage $2,000 Commercial Managed Care Magazine, December 2006: Confronting The Medicare Cost Shift Constraining Medical Costs Government Cost-Shifting to Hospitals 20.0% 14.3% 15.0% Profit Margin 10.0% Commercial Margin 5.0% 0.0% Medicare Margin Breakeven Medicaid Margin -5.0% -10.0% Hospital Breakeven Point -15.0% -20.0% -18.2% -18.5% -25.0% Premera Blue Cross, May 2006: Payment Level Comparison Between Public Programs and Commercial Health Plans for Washington State Hospitals and Physicians Constraining Medical Costs Who Is Supporting the Health Care System? 200 $5,477 Per Person Billions of Dollars $1,000 $12,913 Per Person 180 160 140 $800 120 $600 100 80 $400 60 $200 40 20 $0 $1,739 Per Person Commercial Uninsured Medicare/Medicaid Annual Expenditure $953 $80 $891 Number of Americans 174 46 69 0 2006 Chapterhouse, LLC: Census Bureau, “Current Population Survey,” CMS, Kaiser Family Foundation, EBRI, U.S. GAO, CBO Millions of People $1,200 Constraining Medical Costs Cost-Shifting: Solutions • Require Medicare, Medicaid & SCHIP to reimburse doctors and hospitals at same level as the Federal Employees Health Benefit Plan. • Provide incentives for states to streamline the application process for government programs. Constraining Medical Costs How Much Can Private Insurance Costs Be Affected? Administration 14% Other Claims Cost 45.1% Behavior 15% Inefficiencies 3.3% Government Cost-Shift Uninsured 9.5% Cost-Shift 8% Malpractice 5% Constraining Medical Costs Decreasing Utilization: Solutions • Expand consumerism – Health Savings Accounts (HSAs) – Health Reimbursement Arrangements (HRAs) – Flexible Savings Accounts (FSAs) • Increase health care cost transparency Constraining Medical Costs How Much Can Private Insurance Costs Be Affected? Administration 14% Other Claims Cost 45.1% Behavior 15% Inefficiencies 3.3% Government Cost Shift Uninsured 9.5% Cost Shift 8% Malpractice 5% Access for All Access For All Most Uninsured Not A Crisis 46 Million Considered Uninsured: Eligible for Government Program (but not signed up) 34% 80% $50,000+ Annual Income 32% Temporarily Uninsured 14% Long-Term Uninsured 20% February 2005 Blue Cross Blue Shield Association analysis of Census Bureau’s “Income, Poverty and Insurance Coverage” report Access For All Most States Have Guaranteed Access to Individual Coverage Guaranteed-Issue Market High-Risk Pool No Mechanism Other Insurer of Last Resort Access for All Recommendations for Guaranteed Access to Health Insurance in Every State • In a number of states there are individuals with serious medical conditions and no access to employer-sponsored health insurance – they cannot buy health insurance at any price. Most states (but not all) have at least one guaranteed option, with the most common being a high-risk health insurance pool. The federal government should require that all states have at least one private guaranteed purchasing option for all individual health insurance market consumers. • The federal government should provide seed grants to states creating high-risk pools and states that provide risk-pool premium subsidies to low-income citizens and older beneficiaries to help ensure continued coverage for early retirees. Access for All Important to Understand Claims Utilization Total Claims Incurred Insured Population 5% 50% 45% 45% 50% 5% Under the plans currently being offered by most employers, the majority of employees are not filing claims or using their benefits. However, we are paying premiums as if they do. Access for All Reinsurance • Making it easier and more affordable for carriers to reinsure expenses related to extraordinary claims could prove to be an effective way of lowering premiums. • In considering reinsurance as part of an overall reform package, Congress should conduct a study to thoroughly analyze the efficacy of reinsurance programs. Access for All Smart State Reforms Make a Difference Varying regulatory climates can have a profound impact on insurance affordability. Consider the differences in individual rates for two 30-year-old males living in a Philadelphia suburb located across the bridge from each other – in different states. PA September 2007 Lowest and Highest Rates for PPO Indemnity Plans: NJ $1000 Deductible 80/20% Coinsurance $70 - $260 Wayne, PA 19087 In Neighboring Philadelphia Suburbs $599 - $6,009 Haddonfield, NJ 08033 Access for All Affordable Access Grants to States • In some states, over-regulation of the health insurance market has decreased competition and increased premium costs. • NAHU believes states should be encouraged to create regulatory climates that ensure the availability of many affordable coverage options, as well as offer premium subsidies to targeted populations. • The federal government should make block grants available to states to encourage and reward state health insurance innovations that utilize the strengths of the existing private health insurance marketplace like: – Broadly funded high-risk pools – Allowing for the assessment of insurable risk in the individual and smallgroup health insurance markets – Statewide medical liability reforms – Limits on state mandated benefit requirements – Low-income subsidies and tax incentives for the purchase of private coverage – Premium assistance in Medicaid and SCHIP Access for All Tax Equity • The vast majority of privately insured Americans are happy with their employer-sponsored coverage. The preservation of the federal employer tax deduction and employee exclusion is critical. • But the employer-sponsored health insurance system does not work for everyone. • We should provide the same tax deductions to individuals and the self-employed that corporations have for providing health insurance coverage for their employees. – Remove the 7.5% of adjusted gross limit of medical expenses on tax filers’ itemized deduction Schedule A form – Allow the deduction of individual insurance premiums as a medical expense – Equalize the self-employed health insurance deduction to the level corporations deduct – Clarify federal requirements regarding individual policies sold on a list-bill basis regarding the establishment of Section 125 plans, HIPAA group insurance protections, and the applicability of state-based individual health insurance laws and regulations. Access For All Public/Private Producer Community Education Partnership • All health insurance consumers, both private and public, should have access to quality information and assistance regarding their health care coverage. • NAHU will assume responsibility for training insurance agents in all coverage options, both public and private, through the creation of a designation program—the Certified Health Care Access Advisor. Financing Access Financing Access • Raise public funds to prevent cost-shifting to private sector. • Raise them from activities that drive up health costs – – – – Cigarettes and tobacco products Alcohol Unhealthy food Handguns and ammunition Solutions Exist to Fix Health Care • Work to constrain medical costs • Continue increasing access to coverage • Decide how “access” will be financed NAHU Our Current Health Care System Is Not Dead. Healthy Access Can Fix It!