Topic 17

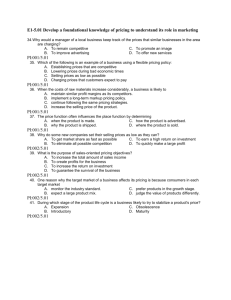

advertisement

Pricing of Services What Makes Service Pricing Strategy Different (and Difficult)? • No ownership - hard for firms to calculate financial costs of creating an intangible performance • High ratio of fixed to variable costs - cost to serve one extra customer may be minimal (but must still recover fixed costs) • Variability of inputs and outputs - how can firms define a “unit of service” and establish basis for pricing? • Many services hard for customers to evaluate - what are they getting in return for their money? • Importance of time factor - same service may have more value to customers when delivered faster • Use of physical or electronic channels - may create differences in perceived value What Do Customers Know about the Prices of Services? Wedding Advisor? Nutritionist? Pet Sitter? Braces? Customers Will Trade Money for Other Service Costs = or Time or Effort Psychic Costs Customer “expenditures” on service comprise both financial and non-financial outlays Financial costs: – price of purchasing service – expenses associated with search, purchase activity, usage • Time expenditures • Physical effort (e.g., fatigue, discomfort) • Psychological burdens (mental effort, negative feelings) • Negative sensory burdens (unpleasant sensations affecting any of the five senses) Increasing Net Value by Reducing Non-financial Outlays • Reduce time expenditures at each stage, especially waiting time • Minimize unwanted psychological burdens • Eliminate unwanted physical effort • Decrease unpleasant sensory burdens Net Value = (Benefits – Outlays) Effort Time e Perceived Benefits Perceived Outlays What Price Should We Charge for Our Service? • What costs do we have to recover? • What prices are competitors charging? • How sensitive are our customers to variations in price? • What out-of-pocket expenditures and non-financial outlays do customers incur beyond the price of our service? • Can we charge different prices at different times or to different customers? Alternative Pricing Objectives Revenue Oriented • Profit seeking - maximize surplus or achieve target profit • Cover costs – fully allocated costs – costs of providing a specific service – incremental costs of one extra sale Operations Oriented (fill productive capacity) • Vary prices to balance demand and supply at given times Patronage Oriented (understand demand factors) • Maximize demand subject to achieving revenue goal • Recognize different abilities to pay by segment • Offer payment methods that increase chance of purchase The Pricing Tripod Pricing Strategy Competition Costs Value to customer Four Approaches to Pricing • Cost-Based Pricing – set prices relative to financial costs (problem: defining costs) • Competition-Based Pricing – monitor competitors’ pricing strategy (especially if service lacks differentiation) – who is the price leader? (one firm sets the pace) • Demand-Led – Auctions – Requests for Bids • Value-Based – relate price to value perceived by customer Difficulties Associated with Basic Price Structures and Usage for Services Competition-based problems: 1. Small firms may charge too little to be viable 2. Heterogeneity of services limits comparability 3. Prices may not reflect customer value Cost-based problems: 1. Costs difficult to trace 2. Labor more difficult to price than materials 3. Costs may not equal value Demand-based problems: 1. Monetary price must be adjusted to reflect the value of non-monetary costs 2. Information on service costs less available to customers, hence price may not be a central factor Value Strategies for Service Pricing • Pricing strategies to reduce uncertainty – service guarantees – benefit-driven (pricing that aspect of service that creates value) – flat rate (quoting a fixed price in advance) • Relationship pricing--incentives to patronize one supplier – non-price incentives – discounts for volume purchases – discounts for purchasing multiple services • Low-cost leadership – Convince customers not to equate price with quality – Must keep economic costs low to ensure profitability at low price Four Customer Definitions of Value “Value is Low Price” “Value is Everything I Want in a Service” “Value is the Quality I Get for the Price I Pay” “Value is All that I Get for All that I Give” Pricing Strategies When the Customer Defines Value as Low Price “Value is Low Price” Discounting Odd Pricing Synchro-pricing Penetration Pricing Pricing Strategies When the Customer Defines Value as Everything Wanted in a Service “Value is Everything I Want in a Service” Prestige Pricing Skimming Pricing Pricing Strategies When the Customer Defines Value as Quality for the Price Paid “Value is the Quality I Get for the Price I Pay” Value Pricing Market Segmentation Pricing Pricing Strategies When the Customer Defines Value as All that is Received for All that is Given “Value is All that I Get for All that I Give” Price Framing Price Bundling Complementary Pricing Results-based Pricing Summary of Service Pricing Strategies for Four Customer Definitions of Value “Value is Low Price” Discounting Odd Pricing Synchro-pricing Penetration Pricing “Value is the Quality I Get for the Price I Pay” Value Pricing Market Segmentation Pricing “Value is Everything I Want in a Service” Prestige Pricing Skimming Pricing “Value is All that I Get for All that I Give” Price Framing Price Bundling Complementary Pricing Results-based Pricing Pricing Issues: Putting Strategy into Practice • What is the basis for pricing? • How much to charge? • Who should collect payment? • Where should payment be made? • When should payment be made? • How should payment be made? • How to communicate prices? Ethical Concerns in Pricing • Customers are vulnerable when service is hard to evaluate or they don’t observe work – may pay for unnecessary work – may pay for poorly executed work – may be charged for work that wasn’t actually performed • Many services have complex pricing schedules – hard to understand – difficult to calculate full costs in advance of service • Unfairness and misrepresentation in price promotions – misleading advertising – hidden charge • Too many rules and regulations – customers feel constrained, exploited – customers unfairly penalized when plans change