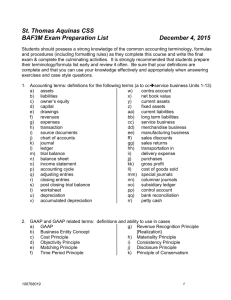

Elementary Accounting: Merchandising & Inventory

advertisement

โครงการติวเสริมเพิ่มกาลังใจ Elementary accounting 1Final / ธมนวรรณ ศศิธรสนธิ (เฟรนด์) Chapter 5 : Accounting for merchandising activity บัญชีสาหรับธุรกิจค้ าขายสินค้ า Merchandise (สินค้ า) consists of products, also called goods, that a company acquires to resell to customers. Merchandiser (ผู้ค้าขาย) earns net income by buying and selling merchandise A wholesaler (ขายส่ ง) is an intermediary that buys products from manufacturers or other wholesalers and sells them to retailers or other wholesalers. A retailer (ขายปลีก) is an intermediary that buys products from manufacturers or wholesalers and sells them to consumers. Many retailers sell both products and services. Manufacturers Sales (ยอดขาย) Wholesaler customer / consumer Retailer /หมวด revenue/ is revenues from selling merchandise cost of goods sold (ต้ นทุนของสินค้ าที่ขายไป) /หมวด expense/ is the term used for the expense of buying and preparing the merchandise Gross profit /gross margin,(ผลต่ างของราคาทุนกับราคาขายสินค้ า) = Net sales- costs of goods sold **Net sales (ยอดขายสุทธิ) = Sales – sales return & allowance – sales discount. Reporting Income for a Merchandiser Service Company : Revenue – Expense = Net income Merchandising company : Net sales – cost of goods sold = gross profit Gross profit – expense = Net income Merchandise inventory (คลังสินค้ า) /หมวด asset/, or simply inventory, refers to products that a company owns and intends to sell. Inventory Systems Beginning inventory(ของที่มีอยู่ในร้ าน) + Net purchase(ของที่ซื ้อเข้ ามาใหม่) = Merchandise available for sale (ของที่พร้ อมที่จะขาย) Merchandise available for sale – Ending inventory (ของที่เหลือในร้ าน) = costs of goods sold(ต้ นทุนของสินค้ าที่ขายไป) Or Beginning inventory + Net purchase – ending inventory = costs of goods sold The perpetual inventory system (ระบบต่ อเนื่อง) continually updates accounting records for merchandising transactions — specifically, for those records of inventory available for sale and inventory sold. The periodic inventory system (ระบบสิ้ นงวด) updates the accounting records for merchandise transactions only at the end of a period. ACCOUNTING FOR MERCHANDISE PURCHASES Purchase merchandise for cash Perpetual periodic Z-Mart records a $1,200 cash purchase of merchandise on November 2 Credit term include the amounts and timing of payments from a seller to a buyer. 1. 2. 3. “n/10 EOM,” when sellers require payment within 10 days after the end of the month of the invoice. “EOM” when sellers require payment at the end of month “2/10, n/60” mean that full payment is due within a 60-day credit period, but the buyer can deduct 2% of the invoice amount if payment is made within 10 days of the invoice date. Purchase merchandise on credit Perpetual periodic Perpetual periodic Paid Transportation costs Nov.2 Z-Mart pays transportation cost $75 Perpetual periodic Purchase Allowances Perpetual periodic Purchase Returns Perpetual periodic Nov.6 Z-Mart returns $100 of goods before paying the invoice. Paid for merchandise within discount period Nov.12 Z-Mart pays merchandise within discount period Perpetual periodic Perpetual periodic Z-Mart’s $1,200 purchase of merchandise is on credit with terms of 2/10, n/30. FOB shipping point If Z-Mart pays the amount due on (or before) November 12, the entry is Transportation Costs ค่าขนส่ง FOB shipping point = Buyer paid FOB destination = Seller paid Nov.5 Z-Mart (buyer) issues a $300 debit memorandum for an allowance from Trex for defective merchandise. Paid for merchandise after discount period Nov.12 Z-Mart pays merchandise in fulls. ACCOUNTING FOR MERCHANDISE SALES Sales of merchandise Nov.3 Z-Mart sold $2,400 of merchandise on credit on credit,1/10,n/60 FOB destination. the cost of the merchandise Z-Mart sold on November 3 is $1,600 Paid Transportation costs Nov.4 Z-Mart pays transportation cost Perpetual periodic Perpetual periodic $90 Sales Returns November 6, and the returned items sell for $800 and cost $600. Perpetual periodic Perpetual periodic Received collection within discount period Nov.13 Received collection within discount period. Perpetual periodic Received collection after discount period Nov.30 Received collection after discount period. Perpetual periodic Sales allowance Nov.6 Z-Mart offers credit memorandum a $100 price reduction of defective merchandise. Summary of Merchandising Journal Entries : Perpetual system Problem 5-1A Prepare journal entries to record the following merchandising transactions of Stone Company, which applies the perpetual inventory system. (Hint: It will help to identify each receivable and payable; for example, record the purchase on August 1 in Accounts Payable — Abilene.) Aug. 1 Purchased merchandise from Abilene Company for $6,000 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1. 4 At Abilene’s request, Stone paid $100 cash for freight charges on the August 1 purchase, reducing the amount owed to Abilene. 5 Sold merchandise to Lux Corp. for $4,200 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5. The merchandise had cost $3,000. 8 Purchased merchandise from Welch Corporation for $5,300 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8. The invoice showed that at Stone’s request, Welch paid the $240 shipping charges and added that amount to the bill. (Hint: Discounts are not applied to freight and shipping charges.) 9 Paid $120 cash for shipping charges related to the August 5 sale to Lux Corp. 10 Lux returned merchandise from the August 5 sale that had cost Stone $500 and been sold for $700. The merchandise was restored to inventory. 12 After negotiations with Welch Corporation concerning problems with the merchandise purchased on August 8, Stone received a credit memorandum from Welch granting a price reduction of $800. 15 Received balance due from Lux Corp. for the August 5 sale less the return on August 10. 18 Paid the amount due Welch Corporation for the August 8 purchase less the price reduction granted. 19 Sold merchandise to Trax Co. for $3,600 under credit terms of 1/10, n/30, FOB shipping point, invoice dated August 19. The merchandise had cost $2,500. 22 Trax requested a price reduction on the August 19 sale because the merchandise did not meet specifications. Stone sent Trax a $600 credit memorandum to resolve the issue. 29 Received Trax’s cash payment for the amount due from the August 19 sale. 30 Paid Abilene Company the amount due from the August 1 purchase. Check Aug. 9, Dr. Delivery Expense, $120 Aug. 18, Cr. Cash $4,695 Aug. 29, Dr. Cash $2,970 Problem 5-2A Prepare journal entries to record the following merchandising transactions of Bask Company, which applies the perpetual inventory system. (Hint: It will help to identify each receivable and payable; for example, record the purchase on July 1 in Accounts Payable — Black.) July 1 Purchased merchandise from Black Company for $6,000 under credit terms of 1/15, n/30, FOB shipping point, invoice dated July 1. 2 Sold merchandise to Coke Co. for $800 under credit terms of 2/10, n/60, FOB shipping point, invoice dated July 2. The merchandise had cost $500. 3 Paid $100 cash for freight charges on the purchase of July 1. 8 Sold merchandise that had cost $1,200 for $1,600 cash. 9 Purchased merchandise from Lane Co. for $2,300 under credit terms of 2y15, ny60, FOB destination, invoice dated July 9. 11 Received a $200 credit memorandum from Lane Co. for the return of part of the merchandise purchased on July 9. 12 Received the balance due from Coke Co. for the invoice dated July 2, net of the discount. 16 Paid the balance due to Black Company within the discount period. 19 Sold merchandise that cost $900 to AKP Co. for $1,250 under credit terms of 2y15, ny60, FOB shipping point, invoice dated July 19. 21 Issued a $150 credit memorandum to AKP Co. for an allowance on goods sold on July 19. 24 Paid Lane Co. the balance due after deducting the discount. 30 Received the balance due from AKP Co. for the invoice dated July 19, net of discount. 31 Sold merchandise that cost $3,200 to Coke Co. for $5,000 under credit terms of 2y10, ny60, FOB shipping point, invoice dated July 31. Check July 12, Dr. Cash $784 July 16, Cr. Cash $5,940 July 24, Cr. Cash $2,058 July 30, Dr. Cash $1,078 โครงการติวเสริ มเพิ่มกาลังใจ Elementary accounting 1Final / ธมนวรรณ ศศิธรสนธิ (เฟรนด์) Chapter 6 : Inventories and cost of sales Determining Inventory Items Goods in Transit ownership passes when goods are loaded on the transport vehicle. If the seller is responsible for paying freight, ownership passes when goods arrive at their destination. Goods on Consignment Goods on consignment are goods shipped by the owner, called the consignor, to another party, the consignee. A consignee sells goods for the owner. Goods Damaged or Obsolete Damaged and obsolete (and deteriorated) goods are not counted in inventory if they cannot be sold. If these goods can be sold at a reduced price, they are included in inventory at a conservative estimate of their net realizable value. Net realizable value is sales price minus the cost of making the sale. The company record inventory at cost. Not selling price. Inventory Cost Flow Assumptions ● FIFO assigns the lowest amount to cost of goods sold — yielding the highest gross profit and net income. ● LIFO assigns the highest amount to cost of goods sold — yielding the lowest gross profit and net income, which also yields a temporary tax advantage by postponing payment of some income tax. ● Weighted average yields results between FIFO and LIFO. ● Specific identification always yields results that depend on which units are sold. -------------------------------------------------------------Exhibit 6-1 We use information from Trekking, a sporting goods store. Among its many products, Trekking carries one type of mountain bike whose sales are directed at resorts that provide inexpensive mountain bikes for complimentary guest use. Perpetual and Periodic Compute the followings : Net sale? Cost of goods sold? Ending inventory? Gross profit? Gross profit rate? From 4 cost flow assumptions. (1) First-In, First-Out (2)Last-in,First-out (3)Weighted Average (4)Specific Identification August 14 August 31 Sold 8 bikes costing $91 each and 12 bikes costing $106 each Sold 2 bikes costing $91 each, 3 bikes costing $106 each, 15 bikes costing $115 each, and 3 bikes costing $119 each โครงการติวเสริมเพิ่มกาลังใจ Elementary accounting 1Final / ธมนวรรณ ศศิธรสนธิ (เฟรนด์) Chapter 8 Cash and Internal Controls Internal Control System Managers use an internal control system to monitor and control business activities. An internal control system consists of the policies and procedures managers use to ● Protect assets. ● Ensure reliable accounting. ● Promote efficient operations. ● Urge adherence to company policies. Principles of Internal Control Internal control policies and procedures vary from company to company according to such factors as the nature of the business and its size. Certain fundamental internal control principles apply to all companies. The principles of internal control are to 1. Establish responsibilities. 2. Maintain adequate records. 3. Insure assets and bond key employees. 4. Separate recordkeeping from custody of assets. 5. Divide responsibility for related transactions. 6. Apply technological controls. 7. Perform regular and independent reviews. Human fraud is driven by the triple threat of fraud: ● Opportunity—refers to internal control deficiencies in the workplace. ● Pressure—refers to financial, family, society, and other stresses to succeed. ● Rationalization—refers to employees justifying fraudulent behavior. CONTROL OF CASH Cash is a necessary asset of every company. Most companies also own cash equivalents (defined below), which are assets similar to cash. Cash and cash equivalents are the most liquid of all assets and are easily hidden and moved. An effective system of internal controls protects these assets and it should meet three basic guidelines: 1. Handling cash is separate from recordkeeping of cash. 2. Cash receipts are promptly deposited in a bank. 3. Cash disbursements are made by check. Cash Over and Short account, also called Cash Short and Over, which is an income statement account recording the income effects of cash overages and cash shortages. Nov.10 if a cash register’s record shows $550 but the count of cash in the register is $555, On the other hand, if a cash register’s record shows $625 but the count of cash in the register is $621, the entry to record cash sales and its shortage is Petty Cash System of Control Establish a petty cash fund Z-Mart establishes a petty cash fund on November 1 and designates one of its office employees as the petty cashier. A $75 check is drawn, cashed, and the proceeds given to the petty cashier. Reimburse petty cash The petty cash payments report and all receipts are given to the company cashier in exchange for a $71.30 check to reimburse the fund. The petty cashier cashes the check and puts the $71.30 cash in the petty cashbox Increasing or decreasing a petty cash fund. if Z-Mart increases the petty cash fund from $75 to $100 on November 27 if Z-Mart decreases the petty cash fund from $75 to $55 on November 27 Cash over and short. June 1 entry to reimburse a $200 petty cash fund when its payments report shows $178 in miscellaneous expenses and $15 cash remains. Bank Reconciliation When a company deposits all cash receipts and makes all cash payments (except petty cash) by check, it can use the bank statement for proving the accuracy of its cash records. Ex. Prepare a bank reconciliation for Jamboree Enterprises for the month ended November 30, 2011. The following information is available to reconcile Jamboree Enterprises’ book balance of cash with its bank statement balance as of November 30, 2011: a. After all posting is complete on November 30, the company’s book balance of Cash has a $16,380 debit balance, but its bank statement shows a $38,520 balance. b. Checks No. 2024 for $4,810 and No. 2026 for $5,000 are outstanding. c. In comparing the canceled checks on the bank statement with the entries in the accounting records, it is found that Check No. 2025 in payment of rent is correctly drawn for $1,000 but is erroneously entered in the accounting records as $880. d. The November 30 deposit of $17,150 was placed in the night depository after banking hours on that date, and this amount does not appear on the bank statement. e. In reviewing the bank statement, a check written by Jumbo Enterprises in the amount of $160 was erroneously drawn against Jamboree’s account. f. A credit memorandum enclosed with the bank statement indicates that the bank collected a $30,000 note and $900 of related interest on Jamboree’s behalf. This transaction was not recorded by Jamboree prior to receiving the statement. g. A debit memorandum for $1,100 lists a $1,100 NSF check received from a customer, Marilyn Welch. Jamboree had not recorded the return of this check before receiving the statement. h. Bank service charges for November total $40. These charges were not recorded by Jamboree before receiving the statement. Check Reconciled bal $46,020 Required Adjusting Entries for Jamboree Ex.8-2 Frederick Clinic deposits all cash receipts on the day when they are received and it makes all cash payments by check. At the close of business on June 30, 2011, its Cash account shows a $15,141 debit balance. Frederick Clinic’s June 30 bank statement shows $14,275 on deposit in the bank. Prepare a bank reconciliation for Frederick Clinic using the following information: a. Outstanding checks as of June 30 total $2,500. b. The June 30 bank statement included a $125 debit memorandum for bank services. c. Check No. 919, listed with the canceled checks, was correctly drawn for $645 in payment of a utility bill on June 15. Frederick Clinic mistakenly recorded it with a debit to Utilities Expense and a credit to Cash in the amount of $654. d. The June 30 cash receipts of $3,250 were placed in the bank’s night depository after banking hours and were not recorded on the June 30 bank statement. Check Reconciled bal., $15,025 Chapter 9 : Account Receivable A receivable is an amount due from another party. The two most common receivables are accounts receivable and notes receivable. Other receivables include interest receivable, rent receivable, tax refund receivable, and receivables from employees. Accounts receivable are amounts due from customers for credit sales. When a company does extend credit directly to customers, it (1) maintains a separate account receivable for each customer and (2) accounts for bad debts from credit sales. July1 Compstore sell merchandise on account to Polo Company for $950 term 2/10,n/30 and the cost of merchandise is $400 July1 Comstore received collection from RDA Electronics from credit sales $500 Credit card sale Cash Received Immediately on Deposit if TechCom has $100 of credit card sales with a 4% fee, and its $96 cash is received immediately on deposit, the entry is Cash Received Some Time after Deposit However, if instead TechCom must remit electronically the credit card sales receipts to the credit card company and wait for the $96 cash payment, the entry on the date of sale is When cash is later received from the credit card company, usually through electronic funds transfer, the entry is Valuing Accounts Receivable Estimating Bad Debts Direct WriteOff Method Percent of Sales Method Allowance Method Percent of Receivables Method Aging of Receivables Method Valuing Accounts Receivable—Direct Write-Off Method Recording and Writing Off Bad Debts if TechCom determines on January 23 that it cannot collect $520 owed to it by its customer J. Kent, it recognizes the loss using the direct write-off method as follows: Recovering a Bad Debt If March.11 the account of J. Kent that was written off directly to Bad Debts Expense is later collected in full, the following two entries record this recovery. Valuing Accounts Receivable—Allowance Method TechCom estimated that $1,500 of its accounts receivable would be uncollectible. This estimated expense is recorded with the following adjusting entry. The Allowance for Doubtful Accounts is a contra asset account. Recording and Writing Off Bad Debts TechCom decides that J. Kent’s $520 account is uncollectible and makes the following entry to write it off. Recovering a Bad Debt if on March 11 Kent pays in full his account previously written off, the entries are ----------------------------------------------------------------------------------------------------------------------------------------------------Estimating Bad Debts—Percent of Sales Method Musicland has credit sales of $400,000 in year 2011. Based on past experience, Musicland estimates 0.6% of credit sales to be uncollectible Estimating Bad Debts—Percent of Receivables Method Step 1 : Determine total account receivable Step 2 :Compute the estimate of the Allowance for Doubtful Accounts. Step 3 : If company already has allowance for doubtful accounts on debit balance + with step 2 If company already has allowance for doubtful accounts on crebit balance - with step 2 Step 4 : Prepare adjusting entries Musicland has $50,000 of accounts receivable on December 31,2011. Experience suggests 5% of its receivables is uncollectible. the account has a $200 credit balance before the December 31, 2011, adjustment. The adjusting entry to give the allowance account the estimated $2,500 balance is Estimating Bad Debts—Aging of Receivables Method Musicland has an unadjusted credit balance in the allowance account is $200. We estimated the proper balance to be $2,270. Musicland has an unadjusted debit balance in the allowance account is $200. We estimated the proper balance to be $2,270. Note receivable A promissory note is a written promise to pay a specified amount of money, usually with interest, either on demand or at a definite future date. Recognizing Note Receivable July1,2012 Company borrowed $1,000,3-month,12% promissory note from bank July1,2012 Company agreed to sign $1,000,3-month,12% promissory note to replace the account receivable. Adjusting of interest Interest Computation If the loan date and maturity date are on the same accounting period If the account period is between Loan date and maturity date Dec 31, 2012 Accrued interest on note receivable -No entry- When the maturity date. If company received payment in full at maturity date, Called Honored note. If company can’t receive payment in full at maturity date called Dishonored note. Honored note Honored note Dishonored note Dishonored note โจทย์แบบฝึ กหัด Clayco Company completes the following selected transactions during year 2011. July 14 Writes off a $750 account receivable arising from a sale to Briggs Company that dates to 10 months ago. (Clayco Company uses the allowance method.) 30 Clayco Company receives a $1,000, 90-day, 10% note in exchange for merchandise sold to Sumrell Company (the merchandise cost $600). Aug. 15 Receives $2,000 cash plus a $10,000 note from JT Co. in exchange for merchandise that sells for $12,000 (its cost is $8,000). The note is dated August 15, bears 12% interest, and matures in 120 days. Nov. 1 Completed a $200 credit card sale with a 4% fee (the cost of sales is $150). The cash is received immediately from the credit card company. 3 Sumrell Company refuses to pay the note that was due to Clayco Company on October 28. Prepare the journal entry to charge the dishonored note plus accrued interest to Sumrell Company’s accounts receivable. 5 Completed a $500 credit card sale with a 5% fee (the cost of sales is $300). The payment from the credit card company is received on Nov. 9. 15 Received the full amount of $750 from Briggs Company that was previously written off on July 14. Record the bad debts recovery. Dec. 13 Received payment of principal plus interest from JT for the August 15 note. Required 1. Prepare journal entries to record these transactions on Clayco Company’s books. 2. Prepare an adjusting journal entry as of December 31, 2011, assuming the following: a. Bad debts are estimated to be $20,400 by aging accounts receivable. The unadjusted balance of the Allowance for Doubtful Accounts is $1,000 debit. b. Alternatively, assume that bad debts are estimated using the percent of sales method. The Allowance for Doubtful Accounts had a $1,000 debit balance before adjustment, and the company estimates bad debts to be 1% of its credit sales of $2,000,000. โครงการติวเสริมเพิ่มกาลังใจ Elementary accounting 1Final / ธมนวรรณ ศศิธรสนธิ (เฟรนด์)