Red-Away

advertisement

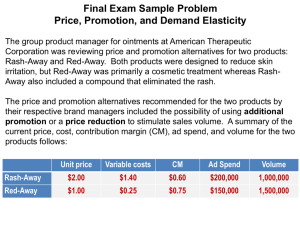

Final Exam Tuesday April 30, 6:30-9:00pm Georges Auditorium (175 Crow) • Directions: You may not use notes or text materials in completing this exam. You can use your own calculator but not someone else’s. You cannot use a smart phone. There are 4 sections. The three mini-cases are worth 5 points each and the multiple choice questions are worth a total of 5 points (1 point each). For the mini-case problems, be sure to answer the questions in the outlined boxes. You can use the back of the pages to make calculations or scribble notes, but • I will grade information provided in the boxes only. • Be sure that you respond directly to each question and be sure that you have completed all of the outlined boxes. Final Exam Course Learning Outcomes At the end of the course, students should be able to: • Understand how company strengths and weaknesses and external opportunities and threats influence the success of a marketing strategy; • Develop and communicate marketing action plans that effectively target, attract, and retain profitable customer segments; and • Conduct basic quantitative analyses to evaluate the outcomes associated with alternative marketing programs. Sample Final Exam Question: Acquisition Value and Customer Lifetime Value As the local Time Warner manager, you are considering two promotional campaigns, one targeting new students and the other targeting new faculty at SMU. The promotion includes free installation and set-up for new accounts. You normally charge $20 for setting up a new account, which barely covers the variable costs for installation, regardless of the type of service. To qualify for free installation, customers have to agree to a 12-month contract. Most students purchase the basic package at $20 per month but most faculty purchase the HDTV package for $50 per month. Variable cost is $10 per month for basic and $20 for HDTV. To encourage students to upgrade to the HDTV package, you will offer them 3 months of HDTV for just $30, with the price changing to the normal $50 after the first 3 months. You think that 50% of the new student accounts will take advantage of this offer. There are 3,000 new students and 200 new faculty at SMU every year. The student promotional campaign will yield a 20% acquisition rate and the faculty promotional campaign will yield a 50% acquisition rate. To target the 2 groups, you will have to buy mailing lists and generate a direct mail campaign. 1. Total number of customers targeted StudentStudentBasic HDTV 3000 Faculty 200 2. Acquisition rate 20% 3. Total # of customers acquired (#1 × #2, student split 50-50) 300 300 100 4. First-quarter contribution per month (i.e., Price - VC) 10 10 30 3 3 3 6. First-quarter gross contribution (#3 × #4 × #5) $9,000 $9,000 $9,000 7. Minus installation & set-up costs ($20 × #3) -$6,000 -$6,000 -$2,000 8. First-quarter net contribution (#6 - #7) $3,000 $3,000 $7,000 5. Number of purchases per quarter 50% $10 $10 $70 9. First-quarter net contribution per acquired customer (#8/#3) What is the most you would spend per acquired customer for the promotional campaign if you want a three-month payback? Six-month payback? To promote the campaign, you will spend $10 per targeted student and $20 per targeted faculty. You want to calculate the lifetime value of each new student and faculty customer using first-year expected contribution. Expected retention rates and risk factor (associated with students skipping out without paying and stealing the equipment) for the 3 customer groups are shown below. 10. First-year per-customer gross contribution $120 $300 $360 11. Total per-customer acquisition costs (AC) promotion + install 3000*$10/600+$20 3000*$10/600+$20 200*$20/100+$20 $70 $70 $60 12. Retention rate (r) 40% 20% 70% 13. Interest rate (i) 10% 10% 10% 2 3 1 14. Risk factor 15. CLVinfinite lifetime = CM/(i*+1-r) - AC i* = i × risk factor 16. Increase in Customer Equity $120/(.2+1-.4)-$70 $80 $300/(.3+1-.2)-$70 $203 $360/(.1+1-.7)-$60 $840 $24,000 $60,818 $84,000 Is the HDTV upgrade offer worthwhile? What is the total increase in the firm’s customer equity? Channel Margin Arithmetic After spending $300,000 for research and development, chemists at Diversified Citrus Industries have developed a new breakfast drink, called Zap, which provides the consumer with twice the amount of vitamin C currently available in breakfast drinks using all natural ingredients. Zap will be packaged in an 8-ounce container and will be introduced to the breakfast drink market, which is estimated to be equivalent to 21 million 8-ounce servings nationally. A major concern is the lack of funds available for marketing so management has decided to use newspapers to promote Zap and distribute Zap in major metropolitan areas that account for 65 percent of U.S. breakfast drink volume. Newspaper advertising will carry a coupon for $0.20 off the price of the first can purchased. The retailer will receive the regular margin and be reimbursed for redeemed coupons by Diversified Citrus Industries. Past experience indicates that for every five cans sold during the introductory year, one coupon will be returned. The cost of the newspaper advertising campaign (excluding coupon returns) will be $250,000. Other fixed overhead costs are expected to be $90,000 per year. Management has decided that the suggested retail price to the consumer for the 8ounce can should be $0.50. The only unit variable costs for the product are $0.18 for materials and $0.06 for labor. Retailers demand a margin of 20 percent of the suggested retail price and distributors a margin of 10 percent of the retailers’ cost. Channel Margin Arithmetic 1. Wholesale Cost = Manufacturer Price = $.50 – 20% × $.50 – 10% × ($.50 – 20% × $.50) = $.50 – $.10 – 10% × ($.40) = $.36 2. Zap contribution per unit $.36 - $.18 - $.06 - $.20/5 = $.08 3. B/E Volume = $340,000/$.08 = 4,250,000 4. B/E Share = 4,250,000/13,650,000 = 31% Net Income (Contribution) = Revenue (Price × Quantity) – Variable Costs (VC) – Fixed Costs (FC) Final Exam Sample Problem Price, Promotion, and Demand Elasticity The group product manager for ointments at American Therapeutic Corporation was reviewing price and promotion alternatives for two products: Rash-Away and Red-Away. Both products were designed to reduce skin irritation, but Red-Away was primarily a cosmetic treatment whereas RashAway also included a compound that eliminated the rash. The price and promotion alternatives recommended for the two products by their respective brand managers included the possibility of using additional promotion or a price reduction to stimulate sales volume. A summary of the current price, cost, contribution margin (CM), ad spend, and volume for the two products follows: Unit price Variable costs CM Ad Spend Volume Rash-Away $2.00 $1.40 $0.60 $200,000 1,000,000 Red-Away $1.00 $0.25 $0.75 $150,000 1,500,000 Both brand managers included a recommendation to either invest an incremental $150,000 in advertising or reduce price by 10 percent. 1. What level of unit sales and dollar sales will be necessary to recoup the $150,000 incremental increase in advertising expenditures. FC/(P – VC/unit) FC/CM = Q required to break even (BEQ) = Q required to break even (BEQ) Incremental Q + Original Q $150,000 = 250,000 + 1,000,000 $0.60 Unit Sales BER = BEQ * P 1,250,000 × $2.00 Dollar Sales Rash-Away: 1,250,000 $2,500,000 Red-Away: 1,700,000 $1,700,000 $150,000 = 200,000 + 1,500,000 $0.75 1,700,000 × $1.00 Net Income (Contribution) = Revenue (Price × Quantity) – Variable Costs (VC) – Fixed Costs (FC) 2. What level of unit sales and dollar sales will be necessary to maintain the level of total contribution dollars if the price of each product is reduced by 10 percent? Current Contribution $s Rash-Away: $0.60 × 1,000,000 = $600,000 Red-Away: $0.75 × 1,500,000 = $1,125,000 Required Quantity at New Contribution Margin Rash-Away: Red-Away: Rash-Away: Red-Away: $600,000 $0.40 × Q = $0.65 × Q = $1,125,000 Unit Sales 1,500,000 1,730,769 $1.80 × 1,500,000 Dollar Sales 2,700,000 1,557,692 $0.90 × 1,730,769 3. For the two proposed changes, you estimate that demand elasticity with respect to advertising is .5 and that demand elasticity with respect to price is -2.0. What would total unit and dollar sales be for each option? E = %DQ / %DPromo E = .5 E = %DQ / %DPrice E = -2 .5 = %DQ / (150,000/200,000) -2.0 = %DQ / -.10 .75 × .5 = %DQ = .375 -.10 × -2.0 = %DQ = .20 DQ = .375 × 1,000,000 = 375,000 DQ = .20 × 1,000,000 = 200,000 Q = 1,000,000 + 375,000 Q = 1,000,000 + 200,000 -2.0 = %DQ / -.10 .5 = %DQ / (150,000/150,000) -.10 × -2.0 = %DQ 1 × .5 = %DQ DQ = .20 × 1,500,000 = 300,000 DQ = .5 × 1,500,000 = 750,000 Q = 1,500,000 + 300,000 Q = 1,500,000 + 750,000 $150,000 Increase in Ad Spend Unit Sales Dollar Sales Rash-Away: 1,375,000 $2,750,000 Red-Away: 2,250,000 $2,250,000 10% Price Reduction Unit Sales Dollar Sales Rash-Away: 1,200,000 × $1.80 $2,160,000 Red-Away: 1,800,000 × $.90 $1,620,000 What Do You Recommend? $150,000 Increase in Ad Spend Breakeven Unit Sales Dollar Sales Rash-Away: 1,250,000 $2,500,000 Red-Away: 1,700,000 $1,700,000 10% Price Reduction Breakeven Unit Sales Dollar Sales 1,500,000 Rash-Away: 2,700,000 1,730,769 Red-Away: 1,557,692 $150,000 Increase in Ad Spend Forecast Unit Sales Dollar Sales Rash-Away: 1,375,000 $2,750,000 Red-Away: 2,250,000 $2,250,000 10% Price Reduction Forecast Unit Sales Dollar Sales Rash-Away: 1,200,000 $2,160,000 Red-Away: 1,800,000 $1,620,000 $.75 × 550,000 = $412,500 1,800,000 × $.65 – 1,500,000 × $.75 = $45,000 Rash-Away: Yes to increased ad spend because forecasted sales are greater than breakeven; no to price reduction… Red-Away: Might depend on the objective, but increased ad spend appears to dominate – unit sales, dollar sales, and contribution. Marketing Process Model SWOT Analysis Product-Market Definition Company Customers Competitors Collaborators Context Competitive Adv. & Capabilities Market Segmentation Creating Value Selection & Targeting Product/Service Offering Promotion/ Communicating Communication & Capturing Value Customer Acquisition Product/Service Offering Positioning Place/ Channel Pricing Customer Relationship Management Customer Sustaining Expansion/Retention Value Revenue & Profits Questions?