Medium-Term Budget Framework

advertisement

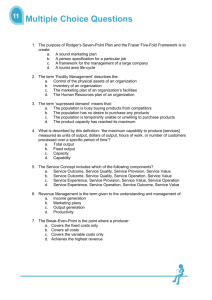

Medium-term Budget Frameworks Outline of Presentation I. What is Medium-term Budgeting? II. Four Main Elements I. II. III. IV. Commitment mechanisms Prioritization mechanisms Control mechanisms Accountability mechanisms III. Prerequisites IV. Classification and empirical results V. Conclusions 2 I. What is Medium-Term Budgeting? Why medium-term budgeting • Decisions today have consequences tomorrow – Capital investment – Changes in entitlement criteria – Mid-year changes • All policies are discretionary in the mediumterm – Legislative changes – Contracts and inertia • Lags in public decision making – Decision lags – Implementation and impact lags • Another decision-making dimension 3 I. What is Medium-Term Budgeting? Definition • A Medium Term Budget Framework (MTBF) is a set of institutional arrangements for prioritizing, managing and presenting revenue expenditure in a multi year perspective A top-down medium term resource envelope Consistent with macro stability and broad policy priorities Bottom-up cost estimate of policy. The current and medium term cost of existing national (sector) programmes & activities Reconciling costs with resources A decision-making process that reconciles these costs and new policy ideas with available resources 4 I. What is Medium-Term Budgeting? An illustration 2011 New Policy Proposals: Education and Research o/w 2012 250 2013 2014 2015 974 1 763 1 672 1 002 ‘Teacher package’ 73 120 215 115 Apprenticeship 44 146 277 327 Student health 250 400 Extended MNT-project 200 Extended support for basic subjects 400 Enhancing teaching, extended support 250 250 Vocational training 250 250 Adult apprenticeship 250 102 126 Increased student support to unemployed youth 50 25 12 Merging Teaching Standards Board and School Inspection Agency 30 -70 -130 157 -50 5 I. What is medium-term budgeting? Objectives What MTBFs Do 1. Reinforce aggregate fiscal discipline 2. Facilitate a more strategic allocation of expenditure How They Do It presenting deferred effects of today’s decisions imposing restrictions on future budgets early reaction to future adverse developments abstracting from annual legal and administrative constraints provide an additional dimension in policy making Who Benefits Finance Ministers Taxpayers Future Generations Prime Ministers Line Ministers Parliamentarians Line Ministries 3. Encourage more efficient intertemporal planning providing greater transparency and certainty to budget holders about their likely future resources Agencies Local Governments 6 II. Four Key Elements Commitment elements • Restricting medium-term discretion • Binding or indicative frameworks Prioritization elements • Expose effects of current and proposed policies in the budget • Set policy changes beyond the annual budget Control elements • Monitoring that policies are in line with overall commitments • Managing unexpected events Accountability elements • Creating ownership and legitimacy • Independent assessments 7 II. Four Key Elements Commitment elements COVERAGE COUNTRY Soc Sec Debt Interest Local Gov’t SPECIFITY % of CG spending DISCIPLINE TIME HORIZON Years Fixed or Flexible Frequency of Update 3 3 -4 fixed 3rd-4th year added each year 4 4 fixed Every 4 years 4 4 fixed Every 4 years AGGREGATE EXPENDITURE CEILINGS Sweden Yes No T’fers 96% Finland Some No No 78% Netherlands Yes No T’fers 80% Total Spending 27 Policy Areas Total Spending 13 Ministries 4 Sectors 26 Ministries FIXED MINISTERIAL PLANS United Kingdom No No T’fers 59% 25 Depts 3 3 fixed Every 3 years France No Yes No 39% 35 Missions 3 2 fixed + 1 Flexible Every 2 years 8 II. Four Key Elements Prioritization elements 1: Unit of estimates Ministries • • • • Provides direct link to implementation … … and typically set a manageable number of aggregations … … but is a compromise in the reflection of policies … … and can lock in existing allocations Programs • Has the potential to highlight policies above bureaucracy … • … but have to keep an unambiguous link to the implementing administration … • … and has to be kept at a manageable number Economic categories • Is only relevant for aggregate economic analysis … • … and does not support a prioritization between competing policies 9 II. Four Key Elements Prioritization elements 2: Level of detail Ensures accuracy in aggregate projections Appropriation: Water Sanitation t Provides the link to the annual budget t+1 t+2 t+3 Gives predictability at the micro-level 10 II. Four Key Elements Control elements 1: Managing Uncertainty • Integrity of the framework requires that overall commitments are not revised • Uncertainty grows with the timehorizon • New policy initiatives are part of the political reality • Margins are needed – Contingency margins – Planning margins 11 II. Four Key Elements Control elements 2: Reconciliation Reconciliation of General Government Fiscal Balance Estimates 2010-11 2009-10 Budget Fiscal Balance 2011-12 2012-13 2013-14 -39,598.0 -12,093.0 1,960.0 6,325.0 28.7 180.2 199.4 -1,482.8 Impact of Parameter Variations 282.0 2.682.0 3,387.0 5,092.0 Total Variations 310.7 2,862.2 3,586.4 3,609.2 -39,287.3 -9,230.8 5,546.4 9,934.2 Impact of Policy Decisions 2010-11 Budget Fiscal Balance Reconciliation of Expenditure 2011 Total expenditure in the Budget for 2010 2012 1 1001.2 2013 1 1003.3 2014 1 020.1 1 038.5 Decisions/Reforms 9.8 8.4 7.8 6.9 Wage indexation 0.0 0.1 0.1 -0.1 -14.2 -11.5 -10.2 -6.9 -0.5 0.6 0.1 0.5 Technical adjustments 9.0 9.0 9.0 9.0 Other 0.3 -0.7 -4.5 -4.9 Total expenditure change 4.4 5.9 2.3 4.5 Other macroeconomic changes Volume changes Total expenditure in the Budget for 2011 1 005.5 1 009.2 1 022.4 1 043.0 12 III. Four Key Elements Accountability elements Legislative endorsement Information only No legislative role Promotes parliamentary buy-in … Exposes the fiscal impact of the government’s budget … The medium-term framework is an internal instrument for the government … … and elevates the status of medium-term ceilings and estimates … … and increases the government’s accountability … … high risk of becoming a technical exercise with little impact on decision-making …but can make the framework rigid … but risks being treated lightly if no formal approval Example: Austria, Australia, Sweden Example: UK, Finland 13 III. Preconditions Objective Instrument Content Foundation for fiscal objectives Fiscal Rule or Responsibility Law Principles of fiscal management Numerical fiscal rule Disclosure requirements State multiyear fiscal policy targets Medium-term Fiscal Framework Multi-year macroeconomic forecast Multi-year fiscal forecast Medium-term fiscal target Set multi-year spending plans Medium-term Budget Framework Multi-year expenditure ceiling Multi-year spending allocations Planning margin Authorize annual expenditure Report actual expenditure Annual Budget Detailed expenditure appropriations Other budgetary controls Reconciliation of changes from MTBF Final Accounts Detailed expenditure outturn Reconciliation of change from Budget Explanation of discrepancies 14 III. Preconditions a. Credible Annual Budget b. Prudent Medium-term Macroeconomic Projections c. Stable Medium-term Aggregate Fiscal Objectives d. Comprehensive and Unified Budget Process 15 III. Preconditions for Effective MTBFs: a. A Credible Annual Budget Average Overspend Against Budget Total, 1998-2007 (% of GDP, Actual-Forecast) 0.8 0.6 0.4 0.2 0 -0.2 -0.4 Binding MTEF No Binding MTEF -0.6 Turkey Netherlands Poland Spain Japan Australia Denmark Austria Canada UK Sweden IRELAND Slovak Rep Portugal Belgium Czech Rep Germany Greece Luxembourg France Iceland Italy -0.8 16 II. Preconditions for Effective MTBFs: b. Prudent Medium-term Macroeconomic Projections Average Error in Forecasting Real GDP Growth, 1991-2006 (% age real growth, Actual-Forecast) 2.5 2.0 Binding MTEF No Binding MTEF 1.5 1.0 0.5 0.0 -0.5 Czech Rep Greece Estonia Netherlands Slovenia Latvia IRELAND Portugal UK Finland Poland Spain Cyprus Austria Slovakia Denmark Belgium Germany France Sweden Hungary Lithuania -1.0 17 II. Preconditions for Effective MTBFs: c. Stable Fiscal Objectives Characteristics of Good Fiscal Objectives/Rules a. Simple: Can be clearly explained, monitored, and assessed b. Clear Guide for Fiscal Policy: Direct link to annual fiscal stance c. Counter-cyclical: Allows fiscal policy to stabilize the economy d. Medium-term: Facilitates multi-year budget planning e. Sustainable: Ensures fairness between generations f. Stable & Robust: Avoid frequent revisions 18 II. Preconditions for Effective MTBFs: c. Unified Budget Process • Total expenditure is determined based on: 1. Total Expenditure • macroeconomic situation • balance objective • projected revenue • Subject to the decision on total expenditure in stage 1, a sectoral allocation is decided and formalized through ceilings 2. Sectoral Allocation • 15-40 sectors • no-policy-change assessment of existing policies • allocation of fiscal space/distribution of savings requirements • Subject to sectoral ceilings, the details of the budget are prepared 3. Budget Details • reallocations within ceilings can (normally) be allowed • proposals in addition to the ceilings are rejected 19 IV. Classification and empirical results Binding Indicative No Medium-Term Framework Australia Belgium Greece (pre 2010) Austria Canada Iceland (pre 2010) Finland (post 2003) Czech Republic Ireland (pre 2010) France (post 2009) Denmark Poland Netherlands Estonia Portugal (pre 2012) Sweden Germany Spain (pre 2012) United Kingdom Hungary USA Italy Japan Latvia Mexico New Zealand Slovakia 20 IV. Classification and empirical results Average Three-Year Ahead Forecast Error 1998-2007 percent of GDP 2.0 Binding Indicative None 1.5 1.0 0.5 0.0 -0.5 -1.0 -1.5 Expenditure Revenue Balance 21 V. Conclusion 1. While the budget is annual, a structured consideration of medium-term aspects is important 2. A medium-term budget framework can improve fiscal discipline, but also helps effective prioritization of policies and stability and predictability 3. Binding elements are crucial for the framework to generate expected results 4. Preconditions are demanding, and have to be addressed when introducing medium-term budgeting 22