Total Retail Loss - ecr-shrink

advertisement

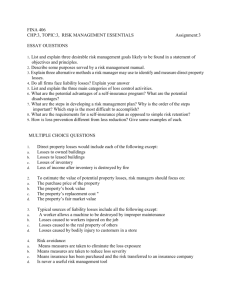

Total Retail Loss: Developing a Global Standard for Measuring Loss in Retail Organisations Project Update and Discussion Professor Adrian Beck University of Leicester, UK BACKGROUND • Little consensus on what constitutes retail ‘loss’. • The term ‘Shrink’ is widely used across the world but no internationally agreed definition exists. • Rapidly changing nature of retailing requires a reconceptualization of how retailing defines loss. • Role of LP teams needs to change to reflect growing business complexity. WHAT’S IN A NAME? Shrink definition varies enormously between companies, sectors and countries – it even varies within some companies! What is included, excluded? Unknown loss? Mark downs? On line frauds? Known loss? Vendor fraud? Voucher scams? Process errors? Losses from out of stocks? Counterfeit notes?? Cash Loss? Damage? Missed returns? Theft? Wastage? Customer compensation? Non Theft? Till errors? In-store use? Also little agreement on how shrink is measured Retail? Cost? Cost Plus? WHY IS THIS NEEDED? • This ambiguity of definition: • Makes benchmarking unpredictable, unreliable and unhelpful • Blurs boundaries of accountability • Fragments control processes which provides opportunities for theft • Can create a culture of ‘acceptable’ loss • Growing retail complexity requires a radical review of what generates loss. • Huge opportunity to identify the true cost of loss – realise the size of the profit growth opportunity ‘locked’ within the business. • Growing budget pressure requires a better understanding of where to prioritise LP spend. • Opportunity to make greater use across the business of the loss management expertise within LP teams. METHODOLOGY • Review of existing literature. • Meetings with retailers • Electronic survey of retailers • Retailer case studies to populate new model NEXT STEPS • Roll out of project to US retailers – broaden buy in and improve applicability of model • Write interim report to update European retail community • Prepare for broader global survey of Total Retail Loss FEEDBACK AND QUESTIONS • Key questions raised by electronic survey • Opportunity for this group to contribute to the process Total Retail Loss Known Operational Losses Malicious Nonmalicious Unknown Operational Losses Supply Chain Losses Malicious Nonmalicious Corporate Liabilities Corporate Policy Losses Product Contamination Customer Guarantees Unplanned Sales External Theft Waste Internal Theft Waste Criminal Damage Internal Theft Damage Vendor Fraud Damage Burglary Cash Loss Out of Stocks 3rd Party Logistics Theft Counterfeit Notes Mark Downs Natural Disasters Voucher Scams Pricing Errors Health & Safety Staff Discount Abuse Customer Compensation Fire Missed Returns Corporate Fraud In-store Use Currency Exchange Losses Bomb Threats Demonstrations Online Fraud Total Retail Loss Should the word ‘retail’ appear? How to measure loss? Retail Prices 1 Cost 2 Cost Plus 0 Both (Retail and Cost) 2 Total Retail Loss Known Operational Losses Unknown Operational Losses Supply Chain Losses I would go for Corporate Liabilities, Corporate Policy Losses, Supply Chain Loss and Store Loss. Split Store loss into Malicious, NonMalicious, Unknown. Corporate Liabilities Corporate Policy Losses Total Retail Loss Known Operational Losses Nonmalicious Malicious 100 100 100 External Theft 100 Internal Theft 100 100 100 100 100 Corporate Liabilities 88 75 Staff Disc/Loyalty Card Abuse 100 100 88 90 88 Customer Compensation Missed Returns 90 75 In-store Use 90 Corporate Policy Losses Food Surplus - A few other retailers that, like us, provide food that would be waste to charities (who sell the food on at a reduced rate to the poor for want of a better word). Whilst this is a loss, I believe it should come under a separate section to waste as although it is actual loss it is also Brand enhancing. We make an assumption here that the offending staff member has not been caught during their first offence. We assume they make up some of our Unknown Losses. “Loss Value of Incident” *15 [The average amount of times they have committed the same offence without being caught] Mark Downs Voucher Scams 90 75 100 Pricing Errors 100 Supply Chain Losses 100 Damage Counterfeit Notes 100 100 Waste Cash Loss 88 Unknown Operational Losses 100 Out of Stocks Should we be including non malicious cash loss? Counterfeit Vouchers? Voucher & Coupon Scams? How do we make this comparable? Total Retail Loss Known Operational Losses Unknown Operational Losses Supply Chain Losses 62 100 100 Internal Theft 100 Waste 62 100 Vendor Fraud 88 Corporate Policy Losses Nonmalicious Malicious Do we need to capture unknown loss here as well? Corporate Liabilities 100 100 Damage 62 3rd Party Logistics Theft I am confused as to why this is called out as separate line Feels like there should be more here....one I can think of would be shortage claims / credits given to the stores. Some retailers don't allow for this but if a pallet does not arrive, and the DC cannot find, then the store has to be credited and the retailer needs to guess what happened to that pallet. Total Retail Loss Known Operational Losses Unknown Operational Losses Supply Chain Losses Should it be trying to measure reputational damage costs? Corporate Liabilities Corporate Policy Losses 100 100 Product Contamination 100 100 Criminal Damage Include counterfeit in this category 88 100 Burglary Is criminal damage the same as vandalism? 90 81 Bomb Threats 100 100 Natural Disasters 100 100 Health & Safety 100 100 Fire 100 100 Corporate Fraud 90 Currency Exchange Losses 100 50 88 Demonstrations 88 100 Online Fraud Total Retail Loss Known Operational Losses Unknown Operational Losses Supply Chain Losses Not relevant to us; moving to measure these Corporate Liabilities Corporate Policy Losses 80 80 Customer Guarantees Unplanned Sales 62 50 DISCUSSION POINTS • How does this fit with your organisation’s current thinking on measuring loss? • How measurable is this typology in your organisation? • In what ways can it be further improved?