File

advertisement

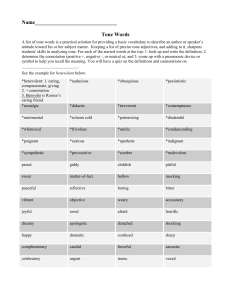

Executive Summary At TopShop, our Big Idea for the Markstrat Simulation is to create different products that are able to appeal to each segment of the market including High Earners, Professionals, Explorers, Shoppers, and Savers. We analyzed the five C’s in relation to our company. Our company is TopShop. We produce top-of-the line Sonites and Vodites for the Markstrat world. Our product line consists of TONE, TOPS, and Tock. We are best known for our product TONE. Sonite and Vodite collaborators tend to shop in the following three distribution channels: Specialty Stores, Mass Merchandisers, and Online Stores. TopShop’s products are mostly sold in Specialty Stores. These stores are most convenient for our customers as they are geographically close to them. Our customers mainly consist of High Earners, Professionals, and Explorers. Our competitors in the market include the firms of Lucky1s, MOOLAH, R, and SMU. Our major competitor is R. They have developed the product ROCK that is a major competitor for our TONE. Our company performed a S.W.O.T. analysis to analyze our internal and external strengths, weaknesses, opportunities, and threats. Our biggest strength is our TONE product. Even though it is the highest-priced product, it is still one of the most successful products in the market. Our biggest weakness is our product TOPS because it is losing money for our company. Our biggest opportunity is the opportunity of a wide market with different wants from consumers. We can create products to target all of these segments. Our biggest threat is ROCK as it is the product that competes the most with our products. Our objectives in the Markstrat Simulation for period 3 include that we want to increase our Revenue and Net Contributions and make modifications to Tock. We plan to increase advertising for Tock and TONE. The targeting strategy is that we are currently targeting the higher end of the economy. We also have the strategy to compete with ROCK in the creation of our Tock. Our targeting strategy for the rest of the simulation is to target each segment of the market with different products created by our company. Our positioning strategy is to have the market think of our products as high quality. Our new product development strategy in Period Two was to create Tock that competed against ROCK which is our highest competitor. Our tactics include our product line of TOPS, TONE, and Tock. The place for our products is that they are all sold mostly in Specialty Stores. TONE is our highest quality and highest-priced product. We created Tock to imitate ROCK except for Tock having a lower price. Most of our products are sold to Mass Merchandisers. Our implementation plan includes our new Sonite product of Tock created in Period Two. Our modifications include that in Period Three we will fix our Tock product to make it more consumer friendly. We dropped advertising for TOPS in Period Two, and in Period Three we are going to do more advertising for Tock and TONE. A summary of our pro forma statement includes a company analysis for company profit and loss statements and brand contribution statements for Period Zero, Period One, and Period Two. Our budget consists of the expected numbers for Period Three for TONE, TOPS, and Tock. Then we analyzed how much we spent on each product for each period, and lastly we took into consideration the net contribution for each product. Our goal as management is to maximize the wealth of our stockholders through the success of our products that will target each segment of the market. 1 Situation Analysis COMPANY TopShop is a company that produces top of the line Sonites and Vodites for the Markstrat world. Our product line consists of TONE, TOPS, and Tock. We are best known for our product TONE as it is popular among the market as it sold 96,000 units in Period Two. Our TOPS is our least-productive product in the market as it doesn’t bring in very much revenue. TOPS sold 35 thousand units in Period Two. Our Tock was recently introduced into the market and it has been off to a great start as it sold 48 thousand units in Period Two. It has already surpassed our TOPS in its first period. We want to become the most well-known company in the market that offers products tailored to each segment of the market. Our strengths are that we carry the TONE in our product line, we have higher-end products that reach the higher end of the market, and we plan on creating products that will meet the needs and wants of each group of customers. The sales of our products drive the success of our company as seen in the following sales reports: TONE TOPS Tock Sonites Sonites Sonites Volume Sold Period Zero 121 58 Volume Sold Period One 89 59 Volume Sold Period Two 96 35 48 Our TONE is our highest selling product that sells the most volume consistently each period. Our TOPS is consistently our worst selling product, and our Tock introduced in Period two is our second best selling product. We expect our Tock to make up for our sales loss in TOPS. Sonites Net Contribution Period 0 Net Contribution Period 1 Net Contribution Period 2 Vodites 14,62 6 13,55 8 15,89 8 0 0 0 Our Net Contribution started out strong in Period Zero, dropped in Period One, and then rose again to our highest in Period Two. We introduced a new product in Period Two, which helped boost our Net Contribution for the Sonites. Revenues Period Zero Revenues Period One Revenues Period Two 2 TONE TOPS Tock Sonites Sonites Sonites 38,05 7 31,11 6 32,67 13,98 7 13,94 0 7,522 9,832 The revenue brought in by each product reflects the volume of that product sold. Our TONE consistently brings in the most revenue as it has the most units sold. Our TOPS consistently has the lowest amount of revenue as it has the fewest number of units sold, and our Tock started out with 9,832 in revenue for the first period it was introduced. Our TOPS dropped in revenue for Period Two because we removed a lot of resources that we were using to promote TOPS and we used them to create Tock as a new product into the marketplace to compete with the number one selling product of ROCK. TopShop is consistently the third top selling brand the past two periods. Our Brand Awareness started out weak in the first period with 46% Brand Awareness for TONE and 39% awareness for TOPS. After lots of focus on advertising, we have increased to 58% awareness of TONE, 45% awareness of TOPS, and 13.4% awareness of Tock for Period Two. Our brand strength is increasing each period, but there is still room for improvement. Our company currently has many opportunities to meet the needs of the higher-end of the market that is willing to spend more money on products. We have our product TONE that is able to reach this segment of the market. COLLABORATORS According to Markstrat, Sonite and Vodite consumers tend to shop in the following three distribution channels: •Specialty Stores – These stores are usually small and may not necessary belong to organized chains. They are geographically close to their customers and can provide a high level of service and technical support. As they do not distribute many different product categories, Sonite products account for a large proportion of their sales. These stores usually carry a broad product line for each category, including the most expensive and/or high-performance products. Because of their high level of technological expertise, specialty stores are likely to be the preferred distribution channel for Vodite products. •Mass Merchandisers – These stores operate on a low-price, high-volume basis and try to minimize overheads. As a consequence, the level of service offered is lower than that of the two other channels. While mass merchandisers carry many different product categories, the depth of each product line is usually restricted to a few units. They often distribute the cheaper, low-performance products. Their lack of technical expertise and the low level of service may well prevent them from distributing Vodites in the early years. •Online stores – This category of stores includes the web-only merchants (such as Amazon.com and Newegg.com), as well as the e-commerce websites of traditional retailers (BestBuy.com and Wallmart.com). Although only a small percentage of consumer electronic sales are done on the web, this percentage is much higher for Sonites products, especially for highly connected consumers such as Shoppers. Convenience is the key advantage of online stores as consumers may shop from their home at the time of their choice. In addition, they have access to an almost unlimited choice and can compare features and prices very easily. 3 Privacy and security are the primary concerns of online shoppers, but new mechanisms are put in place by banks and e-commerce sites so as to reduce fraud. Online stores are likely to become more important in the next 5 to 10 years. There are approximately 10,000 specialty stores, 6,000 mass merchandisers belonging to 6 different chains, and 1,000 online stores. In Markstrat the distributor margins are 40% for specialty stores and 30% for the other ones. TopShop’s products are distributed mostly to Specialty stores. Specialty stores take up more than 50% of the market. This is a huge part of our market with 9,777 distributors of ours being Specialty Stores. 6,166 distributors of ours are mass merchandisers, and 1,027 distributors are online stores. When making decisions for each period, we tailor our sales towards specialty stores as this outlet provides most of our sales. It looks as if the markets of Shoppers and Savers is going to increase substantially in the next five periods, so our company is going to need to adjust to tailor more to mass merchandisers as this is a big part of the market for shoppers and savers. T Tock T TONE S onites Specialty Stores Mass Merchandisers Online Stores Specialty stores Number of Distributors 9,777 S onites 4 9.6 % 4 2 3 1.1 % 2 2.3 % 3 3.2 % S onites 5.0 % 5.1 % T TOPS 6 .4 % 2 7.1 % Mass merchandisers 6,166 1 4.4 % O Online Stores 1,027 CUSTOMER Sonite customers, according to Markstrat, are adults who purchase the products for personal or professional use. Market research studies show that the Sonite market can be divided into five major groups of customers or segments, having similar needs and purchasing behavior. •Explorers (Ex) – People in this segment show a high level of interest in Sonites and other similar products. They are extremely knowledgeable about Sonite technology and the different characteristics of the existing brands. Explorers were probably among the first to use Sonite products. They demand high-performance products, i.e. products with high processing power and/or large screens. They are less concerned by the convenience of the products (battery life, design or number of features). However, they are quite price-sensitive, 4 since they use Sonite products for their personal use and do not necessarily have high incomes. •Shoppers (Sh) – As the name of this segment indicates, Shoppers are doing a lot of shopping. They have a good knowledge of marketed brands and are doing extensive product comparison. They are looking for products with a high quality –price ratio and average levels of both performance and convenience. Like Explorers, they use Sonite products for personal purposes and are quite price-sensitive. This segment of the market is expected to almost double in size in the next five years. TopShop is looking to create products that will be tailored to the needs and wants of this market. •Professionals (Pr) – Individuals in this segment may use Sonite products for both personal and professional reasons. As a consequence, they are looking for high quality, high-performance and easy-to-use products. They can afford expensive products and often view price as an indication of quality. •High Earners (Hi) – This group is characterized by their high incomes, using Sonite products on a private basis. Studies show that they usually buy fairly expensive products, which they can afford, and that their purchase is partially motivated by social status. Although they tend to use their Sonites less than the average consumer, they demand performance and convenience from the products. •Savers (Sa) – This segment includes all consumers who are cautious in the way they spend their money. Although this segment is the largest and is composed of several sub-groups, most customers have similar needs. They are looking for cheap, low-performance products with average convenience. Experts believe that the penetration of this segment is not as high as the other segments. As a consequence, its future growth rate could exceed forecasts. This segment of the market is expected to almost double in size in the next five years. TopShop is looking to create products that will be tailored to the needs and wants of this market. Each segment has specific needs in terms of physical characteristics and price. 33% of the market share for High Earners purchased our product TONE in Period Two. 19% of the Explorers purchase TOPS, as well as another 12% of the market share for Explorers purchase Tock. Our products are sold mostly within the segments of High Earners and Explorers. This is a good distribution strategy for today’s market, but as the market will change in the future, we will need to adjust to target more Shoppers and Savers as these markets will increase the most. 5 COMPETITORS: Our competitors in the market include the firms of Lucky1s, MOOLAH, R, and SMU. Our major competitor is R. They have developed the product ROCK that is a major competitor for our TONE. The ROCK is almost identical to TONE with the same features except has a lower price and is much more successful. We created Tock to be a competitor to ROCK which has the same features as ROCK and a competitive price with Tock being about $10 cheaper. The only problem for our company is that ROCK has more brand awareness in the marketplace. The following charts include diagrams of our competitors’ products in comparison to ours for which products target which segments of the market. Our products TONE, TOPS, and Tock are in red. 6 7 Context- (P.E.S.T.) The P.E.S.T. analysis consists of an analysis of the Political, Economic, Social, and Technological impacts that consist in the market that might impact our company. Political: It is unlikely that inflation will reach much higher levels in the future. Should this be the case, the government may decide to impose price control on all brands. Economical: The economic environment in the Markstrat economy has an average inflation rate of 2%. It is unlikely that inflation will increase in the future. The growing rate of the economy is at 4% which is a slow growing rate, but could have a large impact over a long period of time. The population of Markstrat world is 80 million with 40% urban, 25% in smaller urban, and 35% rural residents. Social: There is no huge social event anticipated in the near future. There is a big upcoming demographic shift of an increase in Shoppers and Savers in the market. This will affect us because currently, we do not have a product that targets these markets. We are working on developing products that the Shoppers and Savers will purchase. Technological: The introduction of the Vodite into the market will be a huge factor in the future. TopShop hopes to be able to create Vodites so we can take advantage of the advancements of technology and provide them to our customers. SWOT Analysis Strengths The one strength that we believe team TopShop has is our TONE product. It is a successful product and even though it is the highest product price out of all of the teams it still one of the most successful products out of all the teams. We also believe that our ability to reach every group (Shoppers, Savers, Explorers, Professional, High Earners) with our three products that we have. We reach the higher end of the market with our products, and we are known to have higher end products. Weakness 8 One weakness that we believe we have is our Tock product. In creating the product we believed it would be able to compete with Rock because it was a very similar product just a lower price. Though after the results came out we found that it was not successful. This product if one of our weaker products. A new weakness we have found is our budget. Because we failed to create a successful new product we now have a negative budget to work with. Being so early in the game this is an extreme weakness for us. We have to figure out how to get back into positive numbers and turn our products into something consumers want to buy. A weakness we believe we have is the fact that we are a higher end product, and we are not able to reach a variety of different consumers that other products in this competition are able to reach. Opportunity One opportunity our market provides us with is a wide market with different wants. Because of this we have the opportunity to meet the wants of those different groups with different products and different price ranges. The desires of consumers all vary, this we believe is an opportunity to be able to reach all of those different desires We are able to work with a fixed economy. This opportunity helps in making decisions about our products, and what to do with our products. Threat Rock is one of our main threats in the competition because they have a very successful product that we are trying to compete with. As mentioned in one of our weakness’s we tried to add a product (Tock) to compete with Rock and it failed. Lately the segments seem to be shifting. The Shoppers and Savers group have been rapidly increasing whereas Professionals is also increasing though at a slower rate. Explorers group has been slowly decreasing. This will hurt us because our products are targeted more towards the Professionals and Explorers. We do have the option of repositioning our products though that will hurt our brand identity of offering higher quality products. Objectives Unit Objectives To sell 98,000 units in Period Three for TONE To sell 37,000 units in Period Three for TOPS To sell 50,000 units in Period Three for Tock Revenue Objectives To earn $50,300 million in Revenue in Period Three. To earn $32,800 million in Revenue in Period Three for TONE To earn $9,900 million in Revenue in Period Three for Tone To earn $7,650 million in Revenue in Period Three for TOPS Net Contributions 9 To earn $18,500 million in Net Contribution after Marketing in Period Three To earn $16,150 million in Net Contribution after Marketing in Period Three for TONE To break even for Tock in Period Three To earn $500 million in Net Contribution after Marketing in Period Three for TOPS New Product Development Modify Tock in Period Three Increase advertising for Tock and TONE in Period Three Strategy Our big idea for the simulation to create products that target every segment of the market. Our three products TONE, TOPS, and Tock target different segments of the market. TONE is one of our greatest strengths as it is our most successful product. We are targeting the Explorers the most but also a good percentage of Professionals as well with TONE. For TOPS we are targeting Explorers. At the end of Period Two, we added a new product, Tock, which targets High Earners and competed with ROCK. The market share is so diverse so our strategy is one of our strengths to accommodate a product that segments each of those targets which we plan to do with Tock in the coming month. We plan to take advantage of our strength of being able to reach the higher end of the market is put into action with TONE hitting High Earners and TOPS and Tock hitting Explorers. A big opportunity for our company is that we are able to work with a fixed economy. In doing this, Tock was part of our new product development. ROCK was our biggest threat in the market, so we created Tock to compete with the highest competitor, ROCK. In doing so, we lowered the price of Tock to be less than the price of ROCK, yet kept all the features, benefits, and battery life the same as ROCK in hopes of creating better sales than ROCK. Yet this plan failed and therefore we plan to modify Tock to target a specific segment of the market to eliminate this weakness. Our market consists of a variety of different wants and needs. At this point we have a weakness of only selling higher end products so we are unable to target different consumers that other products in this competition are able to reach. Our positioning strategy is to have the market think of our products as high quality. One of our other threats is that the segmentation of the market is changing. Our goal in the simulation to combat this threat includes our targeting strategy to target every segment in the market with different products. Product 10 For TONE, there are 16 features with 7 designs, 74 for battery, 24 for display and 75 for power. For TOPS we have 16 features with 4 designs, 35 for battery, 38 for display and 95 for power. For Tock, we have 16 features with 7 designs, 78 for battery, 33 for display and 75 for power. Tock was established in Period Two as a new product that would compete with ROCK. Each product is targeting a different segment of the market. TONE is aimed to attract the High Earners, while TOPS is targeted to Explorers. For Tock, we are targeting Explorers. Targeting different segments for each product is the beginning part of the process of our goal to create products that target everyone. Price For TONE, we created a high priced product and for TOPS we are selling the product for less in order to hit two different markets. When we first created Tock in Period Three, we set the price to be in competition with ROCK so we lowered the price to be less than what ROCK is sold for in hopes to sell more than ROCK. Tone is a high quality product therefore the product is being sold at a high price to be consistent. All our products are on the high quality end of the spectrum as we do not target lower economy at this point. Place We are selling TONE mostly in specialty stores to attract High Earners to a store with certain specific merchandise, which will make it more convenient to consumers to find our product. Since TONE is a high quality product, less will be sold in mass merchandisers. The product will also be sold online for convenience purposes for consumers. TONE is also sold in mostly specialty stores but also in some mass merchandisers and online stores. This way everyone in whichever way can have access to our product. Tock is going to be sold in the most total number of stores due to the fact that it is a competitive product with high quality. We want it to be available to a wide number of consumers. Promotion 11 We are spending the most money on advertising TONE since it is our most expensive product. Then next highest amount would be spent on Tock since it is our competitive product. From period 1 to 2, we decreased the amount of spending on advertising media for both TOPS and TONE since we brought in another product for period 2. Our advertising media spending for TONE went from $3,300 in Period One to 2,500 in Period Two. For TOPS, spending went from $1,600 to $1,000 in Period Two. We also decreased the amount of money spent on advertising from Period One to Two as well. Our goal for the integrated marketing campaign is to offer to promote products that target everyone in the market with various products. Implementation Plan Looking at the chart below for Periods Zero-Three, there are three criteria that our group will be focusing on: new products in the market, the modification and advertising. Information New Products Period 0 Sonites: (Tone & Tops) Period 1 None Period 2 New Sonite (Tock) Modification Advertising Dropped advertising for TOPS product. Period 3 None Have to fix Tock Product More advertising for Tock and TONE. Pro Forma When working on the Pro Forma statement, we had to look at the company profit and losses from Periods Zero-Three. These statements can help a group make an overall decision in the simulation. Below are the statements for Period Zero. Company Profit & Loss Statement: Period 0 Period 0 Cumulative Revenues 52,044 52,044 Cost of goods sold -31,630 -31,630 Inventory costs -319 -319 Contribution before marketing 20,095 20,095 Advertising expenditures -4,000 -4,000 Commercial team costs -1,224 -1,224 Contribution after marketing 14,871 14,871 Market research studies -245 -245 Research and development 0 0 Interests paid 0 0 Exceptional cost or profit 0 0 Earnings before taxes 14,626 14,626 12 Brand Contribution: Period 0 TOPS TONE Sonites Revenues Cost of goods sold Inventory holding cost 38,057 -21,306 13,987 -10,324 -2 -318 0 0 Inventory disposal loss Contribution before marketing 16,750 3,346 Advertising media -1,920 -1,920 -80 -80 -612 -612 14,138 734 Advertising research Commercial team costs Contribution after marketing Next, our group looked at Period One for company profit and loss statement and brand contribution. Company Profit and Loss Statement: Period One Revenues Cost of goods sold Inventory costs Contribution before marketing Advertising expenditures Commercial team costs Contribution after marketing Market research studies Research and development Interests paid Exceptional cost or profit Earnings before taxes 13 Period 1 45,057 23,759 -521 20,777 Period 0 52,044 31,630 -319 20,095 -5,580 -4,000 -1,390 -1,224 13,807 14,871 -250 0 -245 0 0 0 0 0 13,558 14,626 Cumulative 97,101 -55,388 -840 40,872 -9,580 -2,614 28,678 -495 0 0 0 28,184 Brand Contribution: Period 1 Tops TONE Sonites Revenues Cost of goods sold Inventory holding cost Inventory disposal loss Contribution before marketing Advertising media Advertising research Commercial team costs Contribution after marketing 31,116 13,940 -13,679 -10,079 -376 -145 0 0 17,061 3,716 -3,300 -1,600 -500 -180 -707 -683 12,554 1,253 For Period Two we looked at our TONE and TOPS product and decided to incorporate an new product. We came up with Tock to rival ROCK. Company Profit & Loss Statement: Period 2 Period 2 Period 1 Period 0 Cumulative Revenues 50,026 45,057 52,044 147,126 Cost of goods sold -25,645 -23,759 -31,630 -81,033 Inventory costs -1,184 -521 -319 -2,024 Contribution before marketing 23,197 20,777 20,095 64,070 Advertising expenditures -5,500 -5,580 -4,000 -15,080 Commercial team costs -1,444 -1,390 -1,224 -4,058 Contribution after marketing 44,931 16,253 13,807 14,871 -750 Market research studies -255 -250 -245 -100 Research and development -100 0 0 0 Interests paid 0 0 0 0 Exceptional cost or profit 0 0 0 44,082 Earnings before taxes 15,898 13,558 14,626 Brand Contribution: Period 2 TOPS TONE Tock Sonites Sonites Revenues Cost of goods sold Inventory holding cost Inventory disposal loss Contribution before marketing Advertising media Advertising research Commercial team costs Contribution after marketing 14 32,671 -13,556 -2 0 19,113 -2,500 -100 -518 15,996 9,832 -6,466 -997 0 2,368 -1,800 0 -734 -165 7,522 -5,622 -185 0 1,716 -1,000 -100 -193 422 Budget For Period Three we have to find the expected number of unites of Sonites for our products: TONE, TOPS and Tock. Period 3 # of Units Price Marketing Net Contribution TONE 98,000 $555.00 $4,000 $16,150 TOPS 37,000 $350.00 $1,200 $ 500 Tock 50,000 $335.00 $3,000 Break Even Next, our group has to look at how much we are spending in each period for each product. Period Zero Period One Period Two Total: TONE $ 23,919 $ 18,562 $ 16,575 $ 59,056 TOPS $ 13,253 $ 12,687 $ 7,100 $ 33,040 Tock Not Developed Note Developed $ 9,997 $ 9,997 Another factor that has to be taken into consideration is the net contribution from each product that we have developed. Period Zero Period One Period Two Total: 15 TONE $ 14,138 $ 12,554 $ 15,996 $ 42,688 TOPS $ 734 $ 1,253 $ 422 $ 2,409 Tock Not Developed Not Developed - $ 165 - $ 165