Medical Provider

advertisement

Brant J. Stogner Board Certified - Personal Injury Trial Law Presents: PRESENTING, RECOVERING & CHALLENGING PAST MEDICAL EXPENSES By: Brant Stogner & Joshua Hilbe THE EVOLUTION OF THE ADMISSIBILITY OF PLAINTIFF’S MEDICAL EXPENSES I. The Era Prior to “Paid or Incurred” A History Lesson If a Plaintiff received a favorable verdict for personal injury damages, he or she would submit: Affidavits and medical billing records of providers (or live testimony); “Reasonable and Necessary” standard. Third party payments on behalf of the Plaintiff was not an issue and not admissible at trial. If the Plaintiff prevailed, he or she was entitled to recover up to the full amount of the medical charges no matter what his or her insurance company paid. . What if a Third Party Paid for the Plaintiff’s Medical Expenses? Under prior law, the fact that a plaintiff’s insurance paid for the charges would be inadmissible in the trial. Additionally, the amount that was paid to satisfy the past medical expenses would also be inadmissible. Both would violate the Collateral Source Rule. . The Collateral Source Rule “The collateral source rule is both a rule of evidence and damages. Generally, it precludes a tortfeasor from obtaining the benefit of, or even mentioning, payments to the injured party from sources other than the tortfeasor. In other words, the defendant is not entitled to present evidence of, or obtain an offset for, funds received by the plaintiff from a collateral source.” Taylor v. Am. Fabritech, Inc., 132 S.W.3d 613, 626 (Tex. App.—Houston [14th Dist.] 2004, pet. denied). . The Collateral Source Rule Governmental Assistance Plaintiff Worker’s Compensation Healthcare Provider Medicare Private Insurance . Recovery v. Evidence Because the Collateral Source Rule has traditionally been both a rule of recovery and evidence, the defendant may NOT introduce evidence at trial of collateral sources of compensation for a plaintiff’s injuries. “As a rule of evidence, the collateral source rule has excluded such things as evidence of payments and downward adjustments in accordance with Medicare guidelines.” Haygood v. De Escabedo, 2011 WL 2601363 (Tex.) at *8 (Medina, J., Dissenting) . How Long Have We Had the Collateral Source Rule ? Texas – Since the 1800s Tex. & Pac. Ry. Co. v. Levi & Bro., 59 Tex. 674, 676 (1883) This is deeply rooted in Texas jurisprudence. Texas Governor John Ireland . How Does Insurance Affect Trial? It is generally considered error for insurance coverage of either party to be mentioned by the other party during trial of a personal injury cause of action; if insurance is mentioned, the trial court may either order a mistrial or instruct the jury not to consider the improper statement. See, e.g., TEX. R. EVID. 411; Tex. R. Civ. P. 226a(II)9; Dennis v. Hulse, 362 S.W.2d 308, 309 (Tex. 1962) . How Does Insurance Affect Trial? This rule applies not only to evidence of a defendant’s liability insurance, but also whether the plaintiff has applicable health insurance coverage. See, e.g., Myers v. Thomas, 186 S.W.2d 811, 813 (Tex. 1945) This has been referred to as the “balance in trial evidence.” . Policy for the Collateral Source Rule “The theory behind the collateral source rule is that a wrongdoer should not have the benefit of insurance independently procured by the injured party, and to which the wrongdoer was not privy.” Brown v. Am. Transfer & Storage Co., 601 S.W.2d 931, 934 (Tex. 1980) “A benefit that is directed to the injured party should not be shifted so as to become a windfall for the tortfeasor.” RESTATEMENT (SECOND) OF TORTS § 920A cmt. b . Policy for the Collateral Source Rule In other words, the windfall, if any, should not go the tortfeasor. If the injured party was prudent enough to obtain health insurance – the injured party should get that benefit, if any. The injured party paid premiums to obtain this benefit. As a society, we want to encourage the citizens to procure insurance to cover medical expenses. . The Result – Prior to §41.0105 Thus, prior to the paid or incurred statute, a plaintiff could: Provide evidence of his or her total past medical expenses incurred; AND Recover up to the full amount of those incurred expenses despite how much was actually paid by plaintiff or on plaintiff’s behalf by a third party. Standard was “Reasonable and Necessary.” . II. “Paid or Incurred” Tort Reform June 11, 2003 Governor Rick Perry signs HB 4. HB 4 was an omnibus tort reform bill that was originally aimed at capping non-economic damages that could be recovered from doctors and hospitals. Included in HB 4 was the new “paid or incurred” statute. CPRC §41.0105 . CPRC § 41.0105 Evidence Relating to Amount of Economic Damages: “In addition to any other limitation under law, recovery of medical or health care expenses incurred is limited to the amount actually paid or incurred by or on behalf of the claimant.” . Why Did it Matter ? The new “paid or incurred” language created much controversy as to its meaning. It was no longer clear what damages a plaintiff could recover for past medical expenses based on the language of the statute. Statute did not mention anything related to presentation of evidence – just “recovery.” . Consider an Example Plaintiff John Doe had a total of $100,000.00 in past medical expenses incurred; John Doe’s insurance company paid $50,000.00 at a reduced rate to satisfy his charges in full with no remaining balance. . Consider an Example Under the old law, John Doe could: Put on evidence of the full $100,000.00 in medical expenses that he was charged; AND Recover up to the full $100,000.00. Both of these were allowed, despite the third party payment, pursuant to the long-standing Collateral Source Rule. The tortfeasor did not get to reduce his or her liability due to John Doe’s payment of insurance premiums. . Interpretation Issue Under § 41.0105, no one knew how to apply the “paid or incurred” language to either admissible evidence or recovery. . Defendant’s Interpretation Aggressive defendants argued that this statute only allows John Doe the ability to present evidence of past medical expenses of $50,000.00 – the amount that was actually paid, despite $100,000.00 being incurred. Additionally, defendants argued that John Doe’s recovery as to his past medical expenses should, at most, be $50,000.00. . Defendant’s Other Arguments John Doe should not be allowed to recover more for his past medical expenses than was actually paid. Defendant’s interpretation furthers the alleged purpose of § 41.0105 – to limit recoverable damages in a civil case (but ignores the word “OR” in the statute). Although not in the statute, aggressive defendants also maintained that this statute affected the presentation of evidence and limited that presentation to the amount actually paid. . Plaintiff’s Interpretation - Recovery The word “OR” has a clear and plain meaning: John Doe is entitled to recover any amounts that were actually paid (50K) OR incurred (100K) – John Doe just cannot recover more than 100K. John Doe cannot recover more than what was actually paid OR incurred. Therefore, John Doe is allowed the same benefits under the previous rule and this codifies existing and long-standing law. It also addresses the situation with unpaid balances. . Plaintiff’s Interpretation - Evidence Defendant’s interpretation would swallow the collateral source rule completely. Pursuant to the Plaintiff’s interpretation, the collateral source rule is left intact and prevents the interjection of insurance coverage into trial. Defendant should not benefit from the fact that John Doe has his own insurance. Defendant’s interpretation would not give an accurate guidepost of medical expenses when determining how much to award John Doe on noneconomic damages. . Courts’ Initial Interpretation § 41.0105 should be applied post-verdict and pre-judgment: Evidence of John Doe’s providers’ adjustments and/or write-offs should be inadmissible before a jury; Such evidence should be handled after the verdict has been rendered to reduce John Doe’s medical expenses recovery. . Courts’ Initial Interpretation Evidence: A jury would see John Doe’s total incurred medical expenses and enter a verdict. Recovery: Before judgment would be entered, the court would look to see what was actually paid by John Doe or on his behalf and reduce his past medical expenses award accordingly based on evidence of write-offs and adjustments presented by defendants. . The Effects The courts’ initial interpretation settled in the middle of the two competing arguments: Defendants would not have to pay more for a plaintiff’s past medical expenses than was actually paid to the health provider(s); and Plaintiffs could still submit evidence of the full amount of his or her medical charges – giving a jury an accurate guidepost for awarding non-economic damages and assessing the severity of the injury. . III. Haygood v. De Escabedo Argued: September 16, 2010 Opinion Delivered: July 1, 2011 Facts Involved an automobile collision in which Escabedo pulled out of a grocery store parking lot and collided with Haygood’s vehicle; Haygood’s injuries required surgical treatment; Haygood sued Escabedo for injuries he sustained in the collision, resulting in total incurred medical expenses of $110,069.12; Haygood was a Medicare beneficiary, and his health care providers adjusted his bills, leaving Haygood with an outstanding balance of $27,739.43; By the time of trial, Medicare had paid approximately $13K with the rest remaining outstanding. . Facts, cont’d… Escabedo, relying on § 41.0105, moved to exclude evidence of health care bills other than those paid or owed; In response, relying on the long-standing Collateral Source Rule, Haygood moved to exclude evidence of health care bills other than those charged (incurred); Trial Court granted Haygood’s motion and denied Escabedo’s (allowed full incurred amount); The jury found Escabedo’s negligence caused the accident and awarded the full amount of past medical expenses incurred; and Tyler Court of Appeals reversed, and Haygood petitioned to the Supreme Court of Texas. . Issues Whether § 41.0105 precludes recovery of expenses that a health care provider billed to a plaintiff, rather than expenses actually paid or owed by or on behalf of a plaintiff; and Whether § 41.0105 precludes admitting evidence of expenses that a health care provider billed to a plaintiff, rather than expenses actually paid or owed by or on behalf of a plaintiff. . Respondent’s Arguments Escabedo first argued that the court of appeals’ decision should be affirmed because the plain language of § 41.0105 indicates that a claimant cannot recover medical care expense damages which have been written off, discounted or adjusted. Next, Escabedo maintained that § 41.0105 properly measures damages and limits the admissibility of medical care expenses to the amount a plaintiff owes or has paid, rather than the amount billed. . Petitioner’s Arguments Haygood first argued that the plain meaning of § 41.0105 clearly indicates that a plaintiff can recover the past medical expenses incurred: In support of this contention, Petitioner pointed to the actual wording of the statute and argued that “actually” only applies to “paid” and not to “incurred.” Petitioner also argued that this was consistent with long-standing law regarding the Collateral Source Rule and recovery of past medical expenses. . Holding The Supreme Court of Texas affirmed the Court of Appeals’ decision on both evidence and recovery; § 41.0105 Texas Civil Practice and Remedies Code limits recovery to expenses that a medical provider has a legal right to be paid; Further, only evidence of recoverable medical expenses is admissible at trial – otherwise, not relevant; and Lastly, the collateral source rule continues to apply and juries may not be told whether the parties to the suit are covered in whole or in part by insurance. . John Doe Example Under the Current Law Plaintiff John Doe has a total of $100,000 in past medical expenses; and John Doe’s insurance company paid only $50,000, at a reduced rate, to satisfy the charges in full. . John Doe Example Under the Current Law Under the current law, John Doe may only submit evidence of and recover up to: What was actually paid by him or on his behalf, AND Any outstanding medical charges. . John Doe Example Under the Current Law John Doe may only submit evidence of what was paid by his insurance company ($50K) and may not submit evidence of the actual total amount incurred ($100K); Additionally, John Doe can only recover, if any, up to the reduced amount of $50,000 paid on his behalf – which must then be paid to his insurance company due to the contractual right of subrogation contained in his policy; and John Doe does not get his premiums back or any recovery whatsoever for having insurance. . What are the Practical Consequences? . Facilitating Tort Reform Haygood v. De Escabedo facilitates the purpose of the 2003 tort reform: In 2003, the Texas legislature enacted § 41.0105 as an attempt to cap plaintiffs’ non-economic damages; Haygood took a further step towards reaching this goal by precluding juries from using a plaintiff’s total incurred medical charges as a guidepost on awarding non-economic damages. . Non-Economic Damages The Rationale – What’s the Big Deal? The lower the amount of medical expenses that a jury sees, the lower the amount it will award for non-economic damages. There is an underlying presumption that a plaintiff with $50,000 in medical charges is not as severely injured as another plaintiff with $100,000 in medical charges. It is presumed that the first plaintiff did not endure as much pain and suffering or physical impairment as the second plaintiff because his medical expenses were not as substantial. . Correlation of Damages To Dollars From Sense: Qualitative to Quantitative Translation in Jury Damage Awards Cornell Law School Legal Studies Research Paper Series, 2011 (Hans & Reyna) . Overall Damages The Rationale A jury instructed or inclined to use the multiplier method of calculating noneconomic damages will automatically calculate a lower award for non-economic damages if the “amount actually paid” is the only admissible evidence. If Medicare pays 15 cents on the dollar for the injured party’s treatment – the actual severity of the injury is distorted. . Non-Economic Damages Henderson v. Spann, Amarillo COA 2012 The trial court allowed the incurred past medical expenses to be submitted, then post-verdict, reduced the verdict dollar for dollar for the writeoffs. Defendant appealed and Plaintiff argued that any error was harmless due to the post-verdict reduction. This was a brilliant argument. Indeed, if the goal of 41.0105 was simply to prevent plaintiffs from recovering for expenses that the provider had no right to be paid, this approach accomplishes that. . Non-Economic Damages Henderson v. Spann, Amarillo COA 2012 However, the court held that “the post-verdict adjustment method is inadequate to account for or remedy any effect the inadmissible evidence of unadjusted past medical expenses may have had on the jury’s assessment of non-economic damages.” Accordingly, it is clear that the appellate courts ARE using this statute to limit noneconomic damages. . Where Does the Collateral Source Rule Fit In? . Using the Collateral Source Rule The long-standing rule in Texas has been that neither party is permitted to mention anything regarding insurance coverage. How do we follow this rule while also complying with the Haygood v. De Escabedo opinion, which is centered around the admissibility of a plaintiff’s medical expenses that may or may not have been paid by an insurance company? How do we enter evidence of past medical expenses? . Using the Collateral Source Rule Before: Prior to Haygood v. De Escabedo and under “paid or incurred,” a plaintiff would have a strong interest in applying the collateral source rule. Since a plaintiff was allowed to submit evidence of the total amount a plaintiff was actually charged (incurred), a plaintiff wanted to preclude a jury from seeing what was actually paid by an insurance company or Medicare (most likely at a reduced rate). . Using the Collateral Source Rule Now: A plaintiff may seek to have the collateral source rule waived in trial and a defendant has a compelling interest to apply it. Since a plaintiff, who had his or her healthcare treatment covered by his or her insurance or Medicare, is only permitted to submit evidence of what the insurer paid for those expenses, a plaintiff may find it to his or her benefit to waive the collateral source rule. . Are We Rewarding the Uninsured? . Rewarding the Uninsured A possible unintended consequence of Haygood v. De Escabedo is that an uninsured plaintiff, or one that has not had anything paid by a third party, may obtain a higher verdict than if he or she were insured. . Rewarding the Uninsured The John Doe Example: John Doe’s twin sister, Jane Doe, was also in the car with him when they were negligently struck by the Defendant; John Doe incurred $100,000 in medical expenses and his insurance satisfied these charges in full with a payment of $50,000; Jane Doe incurred the exact same injuries, received the exact same treatment, and incurred the exact amount of medical expenses ($100,000) Jane Doe, however, has no insurance. . Rewarding the Uninsured At trial, John Doe, is awarded $50,000 to cover the amount actually paid towards his medical expenses; The jury, not seeing John’s total incurred amount of $100,000, awards John $100,000 in noneconomic damages, including pain and suffering and physical impairment at a 2X multiplier; John Doe’s Judgment = $150,000 . Rewarding the Uninsured Jane Doe goes to trial in front of the exact same jury, however, she is not precluded from submitting her total amount of medical expenses incurred because no third party paid them on her behalf ; Therefore, the jury awards her $100,000 to cover her past medical charges; The jury then awards her $200,000 in noneconomic damages based on the amount of expenses they saw for her using the same multiplier; Jane Doe’s Judgment = $300,000 . Rewarding the Uninsured Result: The courts may be setting precedent that it is better to be uninsured for the purposes of being awarded more in non-economic damages. From the example, it is easy to see how a jury may be influenced by the amount of expenses a plaintiff incurred. Jane Doe could have easily been awarded twice as much in non-economic damages as her twin John Doe, who sustained the exact same injuries and received the exact same treatment at the exact same hospital. . Big Bird Tree Services v. Gallegos Plaintiff (Gallegos) is working for Defendant (Big Bird) on a ladder that breaks, injuring his foot and requiring multiple surgeries. Plaintiff is indigent, without health insurance, and receives $86,882.11 in medical care from a charitable program administered by Parkland Memorial Hospital. Plaintiff did not have to pay for the medical care, and there was no balance. Plaintiff brings a nonsubscriber case against his employer for negligence . Big Bird Tree Services v. Gallegos At trial, Plaintiff sought damages for the past medical expenses incurred – including the charity care. To provide his R&N past medical expenses, Plaintiff submitted billing records affidavits and the billing records into evidence – including the expenses from Parkland Memorial Hospital. Plaintiff was awarded $86,882.11 in past medical expenses by jury (total verdict award of $171,762.11) . Issue on Appeal by Defendant In light of Haygood, does § 41.0105 preclude the recovery of medical expenses for “free” medical care so as to prevent a Plaintiff from recovering the value of the medical services received? In this specific case, it was medical expenses paid for or born by a charitable program administered through the treating hospital. . Holding No. Unlike in Haygood v. De Escabedo, there was no evidence of any contract or statute that would have prohibited Plaintiff’s medical providers from charging Plaintiff the full cost of his medical care. Furthermore, the custodian of records for one of Plaintiff’s providers testified that the providers could attempt to recover their full costs from Plaintiff’s eventual recovery. Finally, allowing tortfeasors to avoid liability for medical expenses born by a charity would result in a windfall to the tortfeasor. (public policy) . Questions from Big Bird The holding seemed to turn on the fact that the hospital could reverse its decision and decide to collect the past medical expenses from Plaintiff. Indeed, the hospital also testified through its records custodian that it expected to be paid if Plaintiff did recover. However, if there were a contract or statute that prohibited the hospital from charging for the full value of services rendered, the holding would likely have been different. . Huston v. United Parcel Service, Inc. Plaintiff (Huston) was rear-ended by a UPS delivery driver and sustained personal injuries. Plaintiff had outstanding balances with several medical providers. Plaintiff entered into an agreement with A/R Net, who purchased the accounts receivable for some of Plaintiff’s medical providers at a discounted rate. . Huston v. United Parcel Service, Inc. Pursuant to the agreement, Plaintiff remained liable to A/R Net for the full amount of the medical services billed by her medical providers, not the discounted rate at which A/R Net purchased the accounts. Receivables Purchased by A/R Net: $240,849.44 Amount Paid by A/R Net: $81,589.00 . Huston v. United Parcel Service, Inc. Prior to trial, Plaintiff and Defendant could not agree on the amount of past medical expenses to be submitted to the jury. Plaintiff wanted to submit the gross total amount of her bills, since was liable to A/R Net for the total amount. Defendant argued that Plaintiff could only submit the amount that A/R Net paid those providers for their receivables. . Huston v. United Parcel Service, Inc. The court agreed with the Defendant, and the parties stipulated on the amount that Plaintiffs medical providers had been paid or were entitled to be paid. The jury returned a verdict on past medical expenses that was significantly lower than the stipulated amount. On appeal, the 1st COA held that Plaintiff’s complaint on this issue, even if valid, amounted to harmless error. The court punted. . The Great Unknown . Complying With Both § 18.001 and § 41.0105 In Texas, a victim may recover reasonable and necessary accident-related medical expenses. § 18.001 now provides that admission of medical expenses is limited to paid and unpaid amounts, but allows admission through affidavits – even from a custodian of records. Follows Haygood v. De Escabedo § 41.0105 provides that “recovery of medical or heath care expenses incurred is limited to the amount actually paid or incurred by or on behalf of the claimant.” . The § 18.001 Affidavit a. $________Total Amount charged by (Medical Provider) b. $________Total amount written off from the total charges, which (Medical Provider) agrees that it will never seek to collect from any source. c. $________ Total amount paid to date on the referenced account by or on behalf of John Doe. d. $________________ Total amount presently outstanding on the referenced account or which (Medical Provider) is legally entitled to collect. e. $________________ Total amount paid plus total amount presently outstanding on the referenced account that (Medical Provider) has the legal right to collect (item c plus item d) . Changes to 2014 Rules a. $________Total Amount charged by (Medical Provider) b. $________Total amount written off from the total charges, which (Medical Provider) agrees that it will never seek to collect from any source. c. $________ Total amount paid to date on the referenced account by or on behalf of John Doe. d. $________________ Total amount presently outstanding on the referenced account or which (Medical Provider) is legally entitled to collect. e. $________________ Total amount paid plus total amount presently outstanding on the referenced account that (Medical Provider) has the legal right to collect (item c plus item d) . Changes to 2014 Rules § 18.001(b-1) now provides a sample affidavit specifically for proof of medical expenses; What about § 18.001(c)?; “The form of an affidavit provided by this section is not exclusive and an affidavit that substantially complies with Section 18.001 is sufficient.” Pre-trial Stipulations . What do we do now? Defendants: File controverting affidavits; Reach stipulations with opposing counsel on the amounts of past medical expenses that can be presented and ultimately recovered; and Send depositions on written questions to the plaintiff’s healthcare providers – confirm the adjustments/write-offs, amounts paid, owing, etc. (timing is important!) . What do we do now? Defendants: See the Adley v. Privett case. In that case, the Plaintiff submitted “flawed bills” from 3 providers. One bill was unadjusted (whose burden?) One bill showed write-offs Object to any past billing records that show or contain charges that are unrecoverable. This is reversible error. . What do we do now? Plaintiffs: See the Metropolitan Transit Authority v. McChristian. In that case, the Defendant objected to Plaintiff’s past medical bills entered into evidence. Defendant claimed that there was no evidence that the bills were “actually paid or incurred.” . What do we do now? The Plaintiff offered 15 medical bills into evidence. Some of the bills showed “billed amounts and affirmatively indicate on their face that no adjustments or write-offs have been made to the billed amounts; others show only billed amounts with no indication that ‘list prices’ have been reduced or written off pursuant to insurance reimbursement discounts or other reasons.” . What do we do now? The 14th COA held that the admission of the medical bills did not violate 41.0105 because there was no evidence that these medical expenses included “list price charges for which the service providers billed but had ‘no right to be paid.’” There was no evidence of any contract or statute that would have prevented these medical providers from charging Plaintiff the full value of the services rendered. . Issues Coming… Write-offs (real or illusory?); Premium recovery; and Refusing to plead or ask for recovery of medical expenses? Future medical expenses – does the statute apply to this too? . Future Medical Expenses? On 1/1/2014, the Individual Mandate of the Affordable Care Act became effective By law, virtually everyone required to have health insurance, so everyone’s future medical care could have some adjustments or write-offs . Discovery Different insurance carriers have different discounts with different providers. re Jarvis (14th COA) – Defendant was entitled to discover the insurance contracts between the plaintiff’s insurer and healthcare providers “to aid in determining whether the providers are required to accept payments of less than the amounts billed.” (Past Medical Expenses) In . Issues Coming… Other considerations… Settlement Client Trial negotiations; screening; strategy; What will be allowed by the courts; and Plaintiff’s billing record affidavits. . Brant J. Stogner Abraham, Watkins, Nichols, Sorrels, Agosto & Friend 800 Commerce St. Houston, TX 77002 Tel: 713-222-7211 Tel: 1-800-870-9584 Fax: 713-225-0827 References Haygood v. de Escabedo… Henderson Trial v. Spann, strategy; What will be allowed by the courts; and .

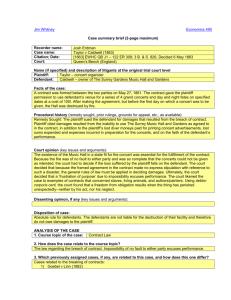

![[2012] NZEmpC 75 Fuqiang Yu v Xin Li and Symbol Spreading Ltd](http://s3.studylib.net/store/data/008200032_1-14a831fd0b1654b1f76517c466dafbe5-300x300.png)