Financial Institution Fraud Prevention & Education

advertisement

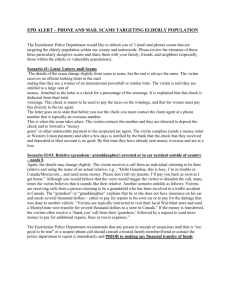

Fake Check Scams How to Protect Your Financial Institution and the Consumers You Serve Consumer Federation of America 2010 How Fake Check Scams Work • Victim is convinced by fraudster to accept a realistic-looking check or money order and deposit or cash it • Fraudster instructs the victim to wire a portion of the funds somewhere • Funds can’t be recalled once picked up • Scam takes advantage of consumer’s ability to access funds before counterfeit is discovered • Consumer is liable for loss, but financial institution may lose the money if consumer unable to repay • Losses generally range from $3,000 - $4,000 Types of Fake Check Scams • Work-At-Home – Victim “hired” to process payments from U.S. customers for a foreign company – Receives checks or money orders, sends money to “employer” minus % as salary/commission Or – Victim “hired” to conduct “mystery shopping” – Receives check or money order, instructed to make a small purchase or test a money transfer Types of Fake Check Scams • Foreign Business Offers – Scammer claims to be business person or government official/dignitary of a foreign country – Offers to make victim partner in lucrative business deal – Victim receives check or money order, instructed to send money to pay legal or other fees • Bogus Grants – Scammer claims victim selected to receive grant, sends check or money order for part – Victim instructed to send money for processing or other fees Types of Fake Check Scams • Sudden Riches – Scammer claims that victim has won lottery or sweepstakes – Victim receives check or money order as advance, instructed to send money for “fees” and “taxes” • Sweetheart Scams – Fraudster poses as a romantic interest online – After rapport is built, scammer asks victim to cash checks or money orders Types of Fake Check Scams • Overpayments – Scammer claims to want to buy item victim selling in print, online classifieds or auction – Victim receives check or money order for more than selling price – Victim instructed to send excess funds to someone for “shipping” or other reasons • Rental Schemes – Concept similar to overpayments – May target hotels and inns for extended stays Victims of Fake Check Scams • ANYONE can be victim • A pitch to lure every type of person – Person who is unemployed or wants to make extra money working at home – Retiree thrilled to win sweepstakes or get grant – Someone selling a car or offering a sublet online – Business person attracted to promise of lucrative deal – Trusting person willing to help a new “friend” • Fake check scams are equal opportunity crime! The Perpetrators • Most fake check scammers located in foreign countries • Often part of large, close-knit immigrant communities • Operate in small groups or “cells” • Use similar techniques, wording in letters and emails • Use false IDs to make it harder to identify and track them • Take advantage of difficulty pursuing law enforcement actions across borders Counterfeits are Easy to Produce • Increased availability of resources – Print shops or software programs – Materials • Check stock • MICR Ink • Versatile counterfeiting options – Business or personal checks – Cashier’s Checks or Official Checks – Money Orders – Traveler’s Checks or Gift Checks Counterfeits may be Hard to Detect • Quality has substantially improved – it is difficult to detect counterfeits simply by looking at them • Names of real companies or individuals often used in order to make them look legitimate • Valid account number or routing number not sufficient to verify item • Telephone number printed on item may be scammer’s Verifying Checks and Money Orders To verify authenticity, call the maker • Use phone books, directory assistance, or Internet to find valid phone number • Speak to someone in accounting department But be aware of limitations • Verifying account exists and sufficient funds not enough if stolen account # used • Scammers may use authentic checks/money orders and counterfeit repeatedly • Maker may be reluctant to provide information because of privacy concerns Verification Resources Certain types of checks and money orders can be verified by contacting the issuers: • American Express Travelers and Gift Cheques • Visa Travelers Cheques • MoneyGram money orders • Western Union money orders • Postal money orders • U.S. Treasury checks Item Processing Consumers Don’t Understand the Process How long does it take a check or money order to clear? The teller said that the funds are available – that means that the check or money order has cleared, right? NO! It can take 10 days or longer for it to “clear”– but under Reg CC, the funds must be made available quickly How Money is Sent to the Scammers • Scammers instruct victims to cash or deposit checks, send funds via money transfer services • Western Union, MoneyGram are largest, have the most physical locations worldwide • Money can be sent and received through agent locations • Cash required to send funds from agent locations, debit cards sometimes also accepted • Credit, debit cards may be used to send funds by telephone or online • In most cases, recipients receive funds in cash To Receive: To Send: Sending & Receiving a Money Transfer Go to agent location, fill out send form Provide form, money and ID to agent Go to agent, fill out receive form Present form and ID to agent Agent verifies ID Agent verifies ID Agent enters send form into system Agent locates transfer from info on form Sender receives receipt and copy of form Payee receives money Impact of Fake Check Scams • Amount of returned item debited from victim’s account • May cause overdraft, payments from account to bounce, fees • Account may be frozen or closed • May result in negative report about victim to databases for account abuses • If victim unable to cover loss, financial institution may try other legal means to collect, but not always successful • Some victims charged with check fraud Red Flags of Fake Check Scams • Customer or member may be victim if: – Making larger or more frequent deposits than usual – Depositing item from unusual source – Making large cash withdrawal or more frequent withdrawals than usual – Mentions winning a sweepstakes or lottery – Discusses sending money outside of the U.S. – Says anything that sounds like fake check scam scenario Get Involved • If you suspect fraud, try to verify by asking: – Did someone overpay you for something you advertised for sale or rent online and then ask you to send the excess funds somewhere? – Did someone ask you to send money to collect your winnings in a sweepstakes or lottery? – Did someone ask you to cash this for them as a favor? – Did someone hire you to process payments for their company through your personal account? – Did someone from a foreign country contact you unexpectedly and offer to make you a partner in a business deal? • Or comment, Wow – this is a large deposit, did you win the lottery or something? Other Opportunities to Prevent Fraud • If person asks: – Has the check cleared? – Is this money order good? • Explain how clearing process works – Funds may be available but check/money order may not be good – Customer’s/member’s liability if returned • Provide warning at point of potential danger, when funds deposited or withdrawn Diffuse Confrontational Situations • Express concern about possible victimization, desire to help customer/member avoid loss • Remind customer/member about responsibility if check or money order bounces • Refer to independent sources of information i.e. www.fakechecks.org, FTC, FBI, Postal Inspector, state or local consumer protection agency Help for Fake Check Victims • If customers/members become victims: – Designate specific personnel to handle situations – Consider whether to require repayment, develop reasonable repayment plan – Consider whether to close account or keep customer/member – Use ChexSystems coding to identify innocent victims Encourage Consumers to Report Scam Consumers can report fake check scams to: • National Consumers League’s Fraud Center • Internet Crime Complaint Center • Postal Inspection Service • Federal Trade Commission • State and local consumer protection agencies Important to manage victims’ expectations • May not result in law enforcement action • May not be possible to recover the money Suggestions for Managers: Staff • Review fake check scams with staff periodically • Provide training on communicating with customers/members, dealing with confrontational situations • Consider financial reward program for staff who stop fake check scams • Encourage personnel to report new trends in fake checks • Use internal communications to alert staff to new scams Suggestions for Managers: Customers/Members • Have posters, handouts at the teller line – when customers/members need the info the most • Send newsletters, statement stuffers to educate customers/members • Use advertising to highlight fake check scam prevention • Use your Web site, electronic communications with customers/members • Conduct fraud prevention programs in your community, partner with others Suggestions for Managers: Business Customers • Warn business customers that their company names may be used by fraudsters on fake checks • Recommend services such as positive pay • Educate businesses about risks of cashing checks and money orders, how to verify • Enlist businesses to help educate consumers in community • Partner in joint consumer education projects, programs Suggestions for Managers: Internal Policies • Consider implementing systems that may help detect suspect items • Back-end systems can be programmed to alert to suspect items • Some FI’s use UV light detectors at the teller line to detect fake money orders, traveler’s checks • Internal policy manuals should contain information about detecting fake checks Educational Resources Consumer Federation of America www.consumerfed.org/other/FakeCheckScams.asp National Consumers League www.fakechecks.org PhoneBusters www.phonebusters.com/english/index.html FBI Fraud Alert http://columbia.fbi.gov/fraudletter.htm Educational Resources Fraud Alert: Fake Check Scams American Bankers Association/NCL brochure www.bankstuffers.com/brochures.php Giving the Bounce to Counterfeit Check Scams Federal Trade Commission www.ftc.gov/bcp/edu/pubs/consumer/credit/cre40.shtm Don’t be the Victim of a Fake Check Scam! Postal Inspection Service www.usps.com/cpim/ftp/notices/not174.pdf