decision modeling with microsoft excel

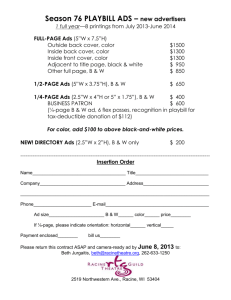

advertisement

DECISION MODELING WITH MICROSOFT EXCEL Chapter 5 LINEAR OPTIMIZATION: APPLICATIONS Part 1 Copyright 2001 Prentice Hall Introduction Several specific models (which can be used as templates for real-life problems) will be examined in this chapter. These models include: TRANSPORTATION MODEL Management must determine how to send products from various sources to various destinations in order to satisfy requirements at the lowest possible cost. ASSIGNMENT MODEL Allows management to investigate allocating fixed-sized resources to determine the optimal assignment of salespeople to districts, jobs to machines, tasks to computers … MEDIA SELECTION MODEL This model is concerned with designing an effective advertising campaign. DYNAMIC (MULTIPERIOD) MODEL These are models in which coordinated decision making must occur over more than one time period. FINANCIAL AND PRODUCTION PLANNING These business models illustrate the joint optimization of both production and financial resources. NETWORK MODELS These models involve the movement or assignment of physical entities (e.g., money). The Transportation Model In this example, the AutoPower Company makes a variety of battery and motorized uninterruptible electric power supplies (UPS’s). AutoPower has 4 final assembly plants in Europe and the diesel motors used by the UPS’s are produced in the US, shipped to 3 harbors and then sent to the assembly plants. Production plans for the third quarter (July – Sept.) have been set. The requirements (demand at the destination) and the available number of motors at harbors (supply at origins) are shown on the next slide: Assembly Plant (1) Leipzig (2) Nancy (3) Liege (4) Tilburg No. of Motors Required 400 900 200 500 2000 Supply Harbor (A) Amsterdam (B) Antwerp (C) Le Havre No. of Motors Available 500 700 800 2000 Balanced Demand Graphical presentation of Supply and Demand: 500 Amsterdam (A) 500 Tilburg (4) 400 Leipzig (1) 700 Antwerp (B) Liege (3) 200 800 Le Havre (C) 900 Nancy (2) The Transportation Model AutoPower must decide how many motors to send from each harbor (supply) to each plant (demand). The cost ($, on a per motor basis) of shipping is given below. FROM ORIGIN (A) Amsterdam TO DESTINATION Leipzig Nancy Liege (1) (2) (3) Tilburg (4) 120 130 41 59.50 (B) Antwerp 61 40 100 110 (C) Le Havre 102.50 90 122 42 The goal is to minimize total transportation cost. Since the costs in the previous table are on a per unit basis, we can calculate total cost based on the following matrix (where xij represents the number of units that will be transported from Origin i to Destination j): TO DESTINATION FROM ORIGIN 1 2 3 4 A 120xA1 B 61xB1 C 130xA2 41xA3 59.50xA4 40xB2 100xB3 102.50xC1 90xC2 122xC3 110xB4 42xC4 Total Transportation Cost = 120xA1 + 130xA2 + 41xA3 + … + 122xC3 + 42xC4 The model has two general types of constraints. 1. The number of items shipped from a harbor cannot exceed the number of items available. A constraint is required for each origin that describes the total number of units that can be shipped. For Amsterdam: xA1 + xA2 + xA3 + xA4 < 500 For Antwerp: xB1 + xB2 + xB3 + xB4 < 700 For Le Havre: xC1 + xC2 + xC3 + xC4 < 800 Note: We could have used an “=“ instead of “<“ since supply and demand are balanced for this model. However, the supply inequality constraints will be binding at optimality giving the same effect. 2. Demand at each plant must be satisfied. A constraint is required for each destination that describes the total number of units demanded. For Leipzig: xA1 + xB1 + xC1 > 400 For Nancy: xA2 + xB2 + xC2 > 900 For Liege: For Tilburg: xA3 + xB3 + xC3 > 200 xA4 + xB4 + xC4 > 500 Note: We could have used an “=“ instead of “>“ since supply and demand are balanced for this model. However, the demand inequality constraints will be binding at optimality giving the same effect. Here is the spreadsheet model using Excel and solved with Solver: =SUM(C9:C11) = C4*C9 =SUM(C16:C18) =SUM (C9:F9) =SUM (C16:F16) Here is the Sensitivity Report from Solver for the Transportation Model: Variations on the Transportation Model Solving Max Transportation Models Suppose we now want to maximize the value of the objective function instead of minimizing it. In this case, we would use the same model, but now the objective function coefficients define the contribution margins (i.e., unit returns) instead of unit costs. In the Solver dialog, you would check the Max radio button before solving the problem. Additionally, your interpretation of Solver’s Sensitivity Report would reflect the maximization of the objective function. Variations on the Transportation Model When Supply and Demand Differ When supply and demand are not equal, then the problem is unbalanced. There are two situations: When supply is greater than demand: In this case, when all demand is satisfied, the remaining supply that was not allocated at each origin would appear as slack in the supply constraint for that origin. Using inequalities in the constraints (as in the previous example) would not cause any problems in Solver. Variations on the Transportation Model When demand is greater than supply: In this case, the LP model has no feasible solution. However, there are two approaches to solving this problem: 1. Rewrite the supply constraints to be equalities and rewrite the demand constraints to be < . Unfulfilled demand will appear as slack on each of the demand constraints when Solver optimizes the model. Variations on the Transportation Model 2. Revise the model to append a placeholder origin, called a dummy origin, with supply equal to the difference between total demand and total supply. The purpose of the dummy origin is to make the problem balanced (total supply = total demand) so that Solver can solve it. The cost of supplying any destination from this origin is zero. Once solved, any supply allocated from this origin to a destination is interpreted as unfilled demand. Variations on the Transportation Model Eliminating Unacceptable Routes Certain routes in a transportation model may be unacceptable due to regional restrictions, delivery time, etc. In this case, you can assign an arbitrarily large unit cost number (identified as M) to that route. Choose M such that it will be larger than any other unit cost number in the model. This will force Solver to eliminate the use of that route since the cost of using it would be much larger than that of any other feasible alternative. Variations on the Transportation Model Integer Valued Solutions Generally, LP models do not produce integer solutions. The exception to this is the Transportation model. In general: If all of the supplies and demands in a transportation model have integer values, the optimal values of the decision variables will also have integer values. Variations on the Transportation Model Using Alternative Optima to Achieve Multiple Objectives Zeros in the Allowable Increase/Decrease columns for objective coefficients in the Sensitivity Report indicate that there are alternative optimal solutions. Using the AutoPower example, examine the effects of such occurrences. Suppose that due to a potential trucker’s strike, you need to find a cheaper transportation schedule that also minimizes the cost of shipping motors out of Le Havre harbor. You would need to shift costs away from Le Havre to reduce AutoPower’s risk. In this case, the presence of alternative optima would help avoid some of the risk without increasing total costs. From the previous solution, we find that there are an infinite number of alternative optima that produce a minimal cost of $121,450. So, the original objective can then be recast as an additional total cost constraint, thereby allowing Solver to be given a new OV to minimize. Here is the modified spreadsheet model. Note the additional constraint $G$19 < $H$19. Note that the new solution provides feasible alternatives (no more costly than the original solution), while minimizing Le Havre’s total costs (a shift of $18,000 to other routes). The Assignment Model In general, the Assignment model is the problem of determining the optimal assignment of n “indivisible” agents or objects to n tasks. For example, you might want to assign Salespeople to sales territories Service representatives to service calls Consultants to clients Lawyers to cases Computers to networks Commercial artists to advertising copy The important constraint is that each person or machine be assigned to one and only one task. The Assignment Model AutoPower Europe’s Auditing Problem We will use the AutoPower example to illustrate Assignment problems. AutoPower’s European headquarters is in Brussels. This year, each of the four corporate vice-presidents will visit and audit one of the assembly plants in June. The plants are located in: Leipzig, Germany Nancy, France Liege, Belgium Tilburg, the Netherlands The issues to consider in assigning the different vice-presidents to the plants are: 1. Matching the vice-presidents’ areas of expertise with the importance of specific problem areas in a plant. 2. The time the management audit will require and the other demands on each vicepresident during the two-week interval. 3. Matching the language ability of a vicepresident with the plant’s dominant language. Keeping these issues in mind, first estimate the (opportunity) cost to AutoPower of sending each vice-president to each plant. The following table lists the assignment costs in $000s for every vice-president/plant combination. PLANT Nancy Liege (2) (3) V.P. Leipzig (1) Tilburg (4) Finance (F) 24 10 21 11 Marketing (M) 14 22 10 15 Operations (O) 15 17 20 19 Personnel (P) 11 19 14 13 To determine total cost, make the assignment and then add up the costs associated with the assignment. For example, consider the following assignment: PLANT Nancy Liege (2) (3) V.P. Leipzig (1) Tilburg (4) Finance (F) 24 10 21 11 Marketing (M) 14 22 10 15 Operations (O) 15 17 20 19 Personnel (P) 11 19 14 13 Total cost = 24 + 22 + 20 + 13 = 79 The question is, is this the least cost assignment? The Assignment Model Solving by Complete Enumeration Complete enumeration is the calculation of the total cost of each feasible assignment pattern in order to pick the assignment with the lowest total cost. This is not a problem when there are only a few rows and columns (e.g., vice-presidents and plants). However, complete enumeration can quickly become burdensome as the model grows large. For example, determine the number of alternatives in the AutoPower (4x4) model. Consider assigning the vice-presidents in the order F, M, O, P. 1. F can be assigned to any of the 4 plants. 2. Once F is assigned, M can be assigned to any of the remaining 3 plants. 3. Now O can be assigned to any of the remaining 2 plants. 4. P must be assigned to the only remaining plant. There are 4 x 3 x 2 x 1 = 24 possible solutions. In general, if there are n rows and n columns, then there would be n(n-1)(n-2)(n-3)…(2)(1) = n! (n factorial) solutions. As n increases, n! increases rapidly. Therefore, this may not be the best method. The Assignment Model The LP Formulation and Solution For this model, let xij = number of V.P’s of type i assigned to plant j where i = F, M, O, P j = 1, 2, 3, 4 Notice that this model is balanced since the total number of V.P.’s is equal to the total number of plants. Remember, only one V.P. (supply) is needed at each plant (demand). Here is the spreadsheet model using Excel and solved with Solver: =SUM(C10:C13) =SUM (C10:F10) = C4*C10 =SUM (C18:F18) =SUM(C18:C21) As a result, the optimal assignment is: PLANT Nancy Liege (2) (3) V.P. Leipzig (1) Finance (F) 24 10 21 11 Marketing (M) 14 22 10 15 Operations (O) 15 17 20 19 Personnel (P) 11 19 14 13 Total Cost ($000’s) = 10 + 10 + 15 + 13 = 48 Tilburg (4) The Assignment Model Relation to the Transportation Model The Assignment model is similar to the Transportation model with the exception that supply cannot be distributed to more than one destination. In the Assignment model, all supplies and demands are one, and hence integers. Thus, Solver will not produce any fractional allocations. As a result, in the Solver solution, each decision variable cell will either contain a 0 (no assignment) or a 1 (assignment made). In general, the assignment model can be formulated as a transportation model in which the supply at each origin and the demand at each destination = 1. The Assignment Model Unequal Supply and Demand: The Auditing Problem Reconsidered Case 1: Supply Exceeds Demand In this example, suppose the company President decides to audit the plant in Tilburg. Now there are 4 V.P.’s to assign to 3 plants. Here is the cost (in $000s) matrix for this scenario: V.P. F M O P No. of V.P.s Required 1 24 14 15 11 PLANT 2 3 10 21 22 10 17 20 19 14 1 1 1 NUMBER OF V.P.s AVAILABLE 1 1 1 1 4 3 To formulate this model, simply drop the constraint that required a V.P. at plant 4 and Solve: Note that one of the V.P.s has not been assigned to a plant. The Assignment Model Unequal Supply and Demand: The Auditing Problem Reconsidered Case 2: Demand Exceeds Supply In this example, assume that the V.P. of Personnel is unable to participate in the European audit. Now the cost matrix is as follows: V.P. 1 PLANT 2 3 F M O 24 14 15 10 22 17 No. of V.P.s Required 21 10 20 4 11 15 19 NUMBER OF V.P.s AVAILABLE 1 1 1 3 1 1 1 1 4 Demand > Supply: Adding a Dummy V.P. In this form, the model is infeasible. To fix this, you can 1. Modify the inequalities in the constraints (similar to the Transportation example) 2. Add a dummy V.P. as a placeholder to the cost matrix (shown below). V.P. 1 PLANT 2 3 F M O Dummy 24 14 15 0 10 22 17 0 No. of V.P.s Required 21 10 20 0 4 11 15 19 0 NUMBER OF V.P.s AVAILABLE 1 1 1 1 4 1 1 Zero cost to assign the dummy 1 1 4 Dummy supply; now supply = demand In the solution, the dummy V.P. would be assigned to a plant. In reality, this plant would not be audited. The Assignment Model Maximization Models In this Assignment model, the response from each assignment is a profit rather than a cost. For example, AutoPower must now assign four new salespeople to three territories in order to maximize profit. The effect of assigning any salesperson to a territory is measured by the anticipated marginal increase in profit contribution due to the assignment. Here is the profit matrix for this model. SALESPERSON A B C D No. of Salespeople Required TERRITORY 1 2 3 40 18 12 25 30 28 16 24 NUMBER OF SALESPEOPLE AVAILABLE 20 22 20 27 1 1 1 1 4 1 1 1 3 This value represents the profit contribution if A is assigned to Territory 3. Here is the spreadsheet model using Excel and solved with Solver: =SUM(C10:C13) =SUM (C10:E10) = C4*C10=SUM (C18:E18) =SUM(C18:C21) The Assignment Model Situations with Unacceptable Assignments Certain assignments in the model may be unacceptable for various reasons. In this case, you can assign an arbitrarily large unit cost (or small unit profit) number to that assignment. This will force Solver to eliminate the use of that assignment since, for example, the cost of making that assignment would be much larger than that of any other feasible alternative. The Media Selection Model Advertising agencies use Media Selection models to develop effective advertising campaigns. The basic question that they try to answer is: How many “insertions” (ads) should the firm purchase in each of several possible media (e.g., radio, TV, newspapers, magazines, and Internet Web pages)? Constraints on the decision maker are typically: advertising budget the number of ads in each media other “rules of thumb” from management The Media Selection Model The law of diminishing returns may also influence the Media Selection decision. In other words, the effectiveness of an ad decreases as the number of exposures in a medium increases during a specified period of time. The objective function of this model is unusual. Conceptually, the model should find the advertising campaign that maximizes demand and satisfies the budget and other constraints. However, the approach most often used is to measure the response to an ad in a medium in terms of exposure units. The Media Selection Model An exposure unit is a subjective measure based on: The quality of the ad The desirability of the potential market In other words, it is an arbitrary measure of the “goodness” of an ad. An exposure unit can be thought of as a kind of economic utility. So the goal is to maximize the total exposure units, taking into account other properties of the model. The Media Selection Model Example: Promoting a New Product The RollOn company has decided to start a new product line of motorcycle-like machines with three oversized tires. An advertising campaign with a budget of $72,000 is planned for the introductory month. RollOn decides to use daytime radio, evening TV, and daily newspaper ads in its advertising campaign. The cost per ad in each media are given below: ADVERTISING MEDIUM Daytime Radio Evening TV Daily Newspaper NUMBER OF PURCHASING UNITS REACHED PER AD 30,000 60,000 45,000 COST PER AD ($) 1700 2800 1200 The Media Selection Model Total Exposures Example: Promoting a New Product RollOn arbitrarily selects a scale from 0 to 100 for each ad offering. It is assumed Total Exposures vs. Num ber of Radio Ads that each of the 1200 first 10 radio ads Slope = 40 1000 has a value of 60 800 exposure units, 600 and each radio Slope = 60 400 ad after the first 200 10 is rated as 0 having 40 0 5 10 15 20 25 exposures. Num ber of Ads The previous graph shows that radio adds suffer from diminishing returns (as evidenced by the change in slope from 60 to 40). RollOn subjectively determines that the first radio ads are more effective than later ones. In addition, they feel that the same situation will occur with TV and newspaper ads. The exposures per ad for each medium are given below: ADVERTISING MEDIUM Daytime Radio Evening TV Daily Newspaper FIRST 10 ADS ALL FOLLOWING ADS 60 80 70 40 55 35 Here is a plot of the total exposures as a function of the number of ads in each medium. Total Exposures vs. Num ber of Ads 1400 TV Total Exposures 1200 55 1000 35 800 600 70 400 Newspaper Radio 40 80 60 200 0 0 10 20 Num ber of Ads 30 RollOn wants to ensure that the ad campaign will satisfy the following important criteria: 1. No more than 25 ads per medium 2. A total of 1,800,000 purchasing units must be reached across all media 3. At least ¼ of the ads must appear on TV (blending requirement) Now, to model this Media Selection model as an LP model, let x1 = no. of daytime radio ads up to the first 10 y1 = no. of daytime radio ads after the first 10 x2 = no. of evening TV ads up to the first 10 y2 = no. of evening TV ads after the first 10 x3 = no. of newspaper ads up to the first 10 y3 = no. of newspaper ads after the first 10 The objective function is: Max 60x1 + 40y1 + 80x2 + 55y2 + 70x3 + 35y3 To determine the constraints, remember: x1 + y1 = total radio ads No. exposures x2 + y2 = total TV ads x3 + y3 = total newspaper ads Also remember that the total advertising expenditure cannot exceed $72,000 and the cost of each radio ad is $1700, each TV ad is $2800 and each newspaper ad is $1200. Therefore, the total expenditure constraint is: 1700x1 + 1700y1 + 2800x2 + 2800y2 + 1200x3 + 1200y3 < 72,000 The constraints are: Cost per ad Total advertising expenditure less than $72,000: 1700x1 + 1700y1 + 2800x2 + 2800y2 + 1200x3 + 1200y3 < 72,000 No more than 25 ads in a single medium: x1 + y1 < 25 x2 + y2 < 25 x3 + y3 < 25 The entire campaign must reach at least 1,800,000 purchasing units: 30,000x1 + 30,000y1 + 60,000x2 + 60,000y2 + 45,000x3 + 45,000y3 > 1,800,000 No. purchasing units per ad Blending Constraint (at least ¼ of the ads must appear on event TV) : x2 + y2 x1 + y1 + x2 + y2 + x3 + y3 >¼ Using this constraint in Excel will produce a Solver “Conditions for Assume Linear Model are not Satisfied” error message. You can make this constraint linear by multiplying out the denominator: x2 + y2 > .25(x1 + y1 + x2 + y2 + x3 + y3 ) Here is the Excel spreadsheet model after Solving: = M3*F5 = C3*C9 Here is=C5*I5 the Solver setup: = C3*I9 End of Part 1 Please continue to Part 2