S - Meetup

advertisement

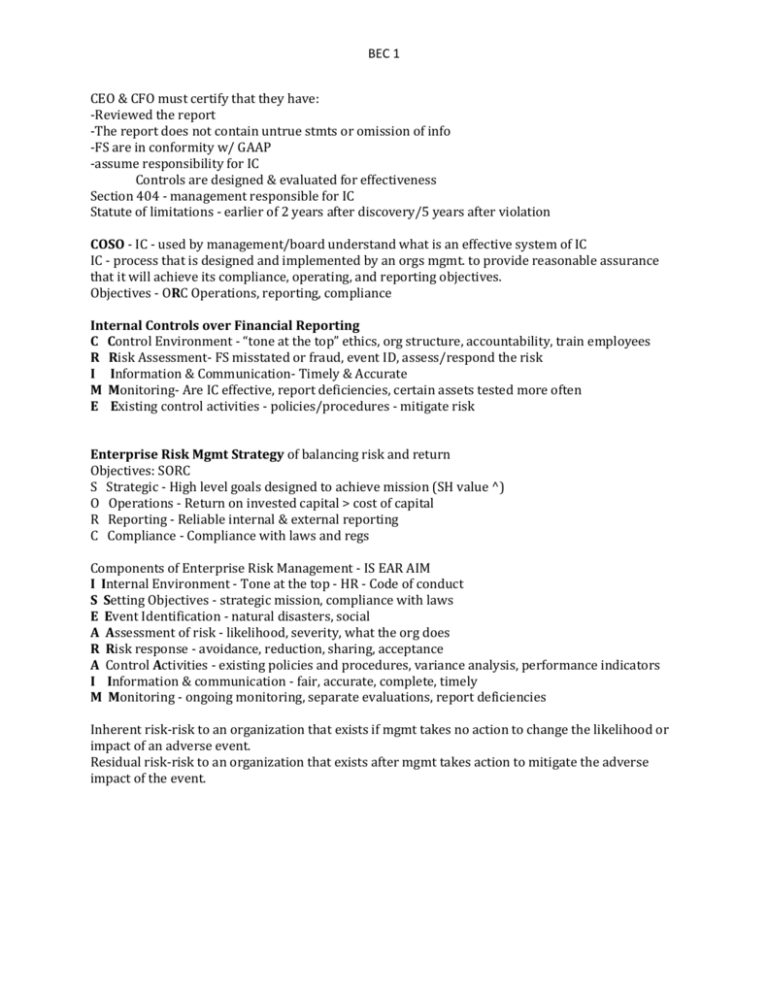

BEC 1 CEO & CFO must certify that they have: -Reviewed the report -The report does not contain untrue stmts or omission of info -FS are in conformity w/ GAAP -assume responsibility for IC Controls are designed & evaluated for effectiveness Section 404 - management responsible for IC Statute of limitations - earlier of 2 years after discovery/5 years after violation COSO - IC - used by management/board understand what is an effective system of IC IC - process that is designed and implemented by an orgs mgmt. to provide reasonable assurance that it will achieve its compliance, operating, and reporting objectives. Objectives - ORC Operations, reporting, compliance Internal Controls over Financial Reporting C Control Environment - “tone at the top” ethics, org structure, accountability, train employees R Risk Assessment- FS misstated or fraud, event ID, assess/respond the risk I Information & Communication- Timely & Accurate M Monitoring- Are IC effective, report deficiencies, certain assets tested more often E Existing control activities - policies/procedures - mitigate risk Enterprise Risk Mgmt Strategy of balancing risk and return Objectives: SORC S Strategic - High level goals designed to achieve mission (SH value ^) O Operations - Return on invested capital > cost of capital R Reporting - Reliable internal & external reporting C Compliance - Compliance with laws and regs Components of Enterprise Risk Management - IS EAR AIM I Internal Environment - Tone at the top - HR - Code of conduct S Setting Objectives - strategic mission, compliance with laws E Event Identification - natural disasters, social A Assessment of risk - likelihood, severity, what the org does R Risk response - avoidance, reduction, sharing, acceptance A Control Activities - existing policies and procedures, variance analysis, performance indicators I Information & communication - fair, accurate, complete, timely M Monitoring - ongoing monitoring, separate evaluations, report deficiencies Inherent risk-risk to an organization that exists if mgmt takes no action to change the likelihood or impact of an adverse event. Residual risk-risk to an organization that exists after mgmt takes action to mitigate the adverse impact of the event. BEC 1 IC over Financial Reporting R Risk Assessment 1.Financial Reporting Objectives 2.Financial Reporting Risks 3.Fraud Risk C Control Activities 1.Risk assessment integration 2.Selection & Development 3.Policies & Procedures 4.Information Technologies I Information & Communication 1.Financial Reporting Info 2.Internal Control Info 3.Internal Communication 4.External Communication Monitoring 1.Ongoing & separate evaluations 2.Reporting Deficiencies M ERM Framework-entity wide mgmt Objective Setting 1.Strategic Objectives 2.Related Objectives 3.Selected Objectives 4.Risk Appetite 5.Risk Tolerances Event Identification 1.Events 2.Influencing Factors 3.Event Identification Techniques 4.Event Interdependencies 5.Event Categories 6.Distinguishing risks & Opportunities Risk Assessment 1.Inherent & Residual Risk 2.Establishing likelihood and impact 3.Data Sources 4.Assessment Techniques 5.Event Relationships Risk Response 1.Evaluating possible responses 2.Selected responses 3.Portfolio view Control Activities 1.Integration w/ risk response 2.Types of control activities 3.Policies & Procedures 4.Controls over Info Systems 5.Entity Specific Information & Communication 1.Information 2.Communication Monitoring 1.Ongoing Monitoring Activities 2.Separate Evaluations 3.Reporting Deficiencies Organization Structure: no more than 3 layers of organization existed between the CFO and the individuals involved in financial reporting. Internal Audit: internal auditors should report directly to the CEO with direct access to the AC. How to Motivate Management: A. Financial Measures: Profit Return on Investment-expressed as % of profit to investment S E A R A I M BEC 1 Variance Analysis - compares performance to budget and is expressed by an amount Balanced Scorecard - measure of multiple perspectives. both financial and nonfinancial Critical success factors: FECH F Financial (measuring financial results) E Efficiency & Effectiveness of business processes (variance analysis) C Customer satisfaction H Human resource capabilities-learning & growth B. Productivity Measurements Total Productivity Ratios (TPRs)-(total output produced in a period/ by the total input of period) Partial Productivity Ratios (PPRs)-(total output produced/quantity of single input used) Control Charts: have acceptable range of defects (goalpost) Pareto Diagrams: frequency diagram of errors/issues BEC 1 Cause & Effect: analyzes source & location of problems and traces to source (Fishbone diagram) Elements of manufacturing process: 1) Machinery 2) Method 3) Materials 4) Manpower Marketing Practices & Methods Transaction Marketing: Customers are attracted for a single sale. Lowest price. Interaction-based Relationship Marketing: Repeat business. Ongoing relationship. Database Marketing-Segments customers into target markets E-marketing-uses internet Network marketing-relationships & referrals Cost Measurement: usefulness and future orientation focused Cost drivers: dynamic factors that have ability to change total costs. Based on volume (output) and activity (value added) Theoretical Cost Drivers: 1. Executional (short term) & 2.Structural (long term) Operational Cost Drivers: 1) Volume Base (Traditional): based on total volume of output (#DLH used or # production units) 2) Activity Base (Contemporary): by department, relates to an activity that adds value to output OPERATIONS MANAGEMENT Cost Objectives: PIE P: Product Costing (inventory & COGM) I: Income determination (profitability) E: Efficiency Measurements (comparisons to standards) DL+DM = prime cost DM+DL+OH applied = product cost DL+MOH applied = conversion costs Product costs not expensed until sold, inventoriable, DM, DL, MOH applied Period costs expensed in period incurred & not inventoriable Non-Manufacturing costs - treated as period costs, expensed when incurred, SG&A BEC 1 Direct Cost - easily traced to final product DM: cost of materials used in production, plus freight-in, & reasonable amt for normal scrap DL: cost of labor directly related to product, plus reasonable amt of downtime (breaks & training) Indirect Costs: in the factory = product cost/MOH: in the office = period cost SG&A Indirect materials - can’t be traced to final product easily. Ex. glue, cleaning supplies, etc. Indirect labor - not traced to final product - forklift worker etc. Other indirect costs - in the factory depreciation, rent etc. (all on factory) Overhead allocation - cost driver - assign factory OH to individual product Traditionally all MOH assigned in a single cost pool. Cost Behavior - Linear relationship Variable Costs change in total but remain constant per unit. Fixed Costs are constant in total but vary per unit. (Numerator is fixed) short term relevant range FC doesn’t change when cost driver changes BEC 1 Cost Accumulation Systems Job order vs process costing (homogeneous) COGM COGS Beg Raw Materials +Net Purchases Materials Available for Use (-EI raw materials) =DM used Beg WIP Beg FG Inv Add: DM used COGM (net purchases) DL used COGAS MOH applied (-FG EI) Total Manufacturing Costs COGS (-WIP, END) COGM Normal Spoilage: included in standard cost and is an inventory cost Balance Sheet Abnormal Spoilage: period expense, charged against income as a separate component of COGS Job Order Costing: used if few units produced & each unit is unique or easily identifiable (car). Cost Objective is the job: cost allocated to specific job. Application of overhead 1) OH rate=Budgeted OH costs/Estimated Cost Driver (machine hrs, DL hrs) 2) Apply OH=Actual cost driver (based on actual production) x OH rate BEC 1 Process Costing: mass production. All units same. How to determine the cost of goods remaining in WIP & cost of goods transferred: 1) Use Production Report to keep track of physical flow of units 2) Calculate Equivalent Unit - 75% complete etc. 3) Calculate total costs (production report) Equivalent Units of Production: Weighted Avg: (2steps) Units completed and transferred (100%) +WIP, End (#units x %) Total EU FIFO EU: WIP, Beg to complete (1-%complete) EU +Units completed & transferred -Units in beginning inv (100%) +WIP, End (#units x %) Total EU WA cost per unit= (Beg + current)/total EU WA cost per unit= (current)/total BEC 1 BEC 1 Activity-Based Costing (ABC or transaction-based costing): traditional systems use single cost pool and single allocation rate. Applies high amts of OH to product that places high demands on expensive resources. Activity: any work performed inside a firm. Ex. Surgical unit Resource: an element used to perform an activity. Ex. Staff hours Cost Driver: factor that has ability to change total costs Resource Cost Driver: amt of resources that will be used by an activity. Ex. Complex surgical proc Activity Cost Driver: amt of activity that a cost object will use. Ex. admissions Cost Pool: group of costs that are assigned Value Chain (value added activities): series of activities in which customer usefulness is added to the product. (Direct costs/mfg costs) Non-Value Added Activities: costs of moving, handling & storing individual products BEC 1 Direct method - Total cost allocated to production department Step down method - more sophisticated systems Joint product: two or more products generated from a common input Method 1 - Allocation by volume BEC 1 Method 2 - Allocation by sales value Method 3 - No sales value at split off - NRV By-products: minor products of small value that incidentally result from a main product (do not receive allocation of joint costs) A) Applied to main product: proceeds from sale are reduction to common costs for jointproduct costing. Revenue earned from sale is credited to joint costs at production or time of sale. B) Miscellaneous Income: proceeds from sale are credited to miscellaneous income. Split-off point: point in production where joint products can be recognized as individual products Joint product costs: costs incurred in producing products up to split-off point. (Costs are allocated to main product.) Separable Costs: costs incurred on a product after the split off point.