Auditing report f

advertisement

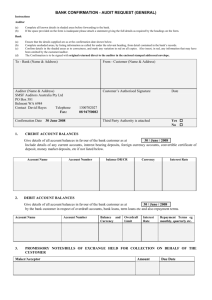

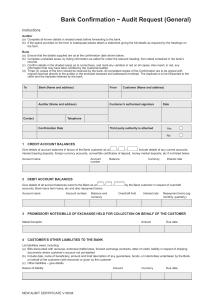

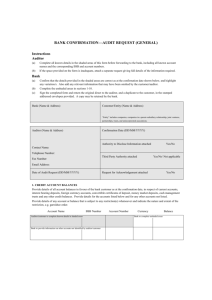

Situation f Detailed findings In the review of the cash section; Year end balances have been agreed back to copies of the monthly bank statements; Copies of the statements have been put on file as audit evidence; and Confirmation requests have been returned to the auditor via the client. Implications of the findings Tests of controls of cash receipt and cash payment transaction systems As both the cash receipts and cash payments directly affect the account balance of cash, tests of controls of both these systems should be undertaken in order to check whether these systems work efficiently and accurately then assess the level of the internal risk. These tests involve observing the process from opening mails and preparing deposits or cheques. Tests of cash transactions Substantive tests of detail of transactions should be undertakes to detect errors in order to test occurrence and completeness. For example, the client might have included any cash receipts made after year end in cash receipts of the current year. Through the tests of transaction, those errors may be detected. Tests of cash balances To ensure existence and completeness, test of bank reconciliations needs to be undertaken to substantiate that balance confirmed with the bank agrees with the client’s cash accounting records. If there are large or unusual items, the auditor should ask the client to explain the nature of the reconciling item. For example, an immaterial amount of item “net miscellaneous” might be a result of two material items offsetting each other. Inappropriate confirmation Confirmation requests should be returned to the auditor by the bank directly as a confirmation via the client does not test completeness. The auditor commonly confirms the year-end cash balance by direct correspondence with all banks with the client has had accounts during the period. AGS 1002 provides audit guidance on bank confirmation procedures. AGS 1002 Bank Confirmation Requests Appendix 1 Bank Confirmation – Audit Request (General) Three (3) copies of the form should be received by the bank. All completed copies of the Confirmation are to be signed with original returned direct to the auditor in the enclosed stamped addressed envelope. The duplicate is to be forwarded to the client and the triplicate retained by the bank. Also it is important that the auditor keep the original documents as audit evidence. Cash on hand Most of entities do not have substantial cash on hand thus it is not counted. However, in some industries such as banks or casinos have material cash on hand therefore a cash count may be necessary.