Assignment 3 – Treasury Regulations Question 1 (10 points) The

advertisement

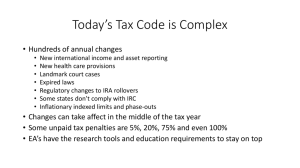

Assignment 3 – Treasury Regulations Question 1 0 (10 points) 26 MC 1 4 The Internal Revenue Code contains the statutory law imposing federal income tax laws. The Code, however, cannot provide specific guidance for the wide variety of transactions engaged in by taxpayers nor for the myriad circumstances in which taxpayers engage in these transactions. Additional guidance is often necessary to make the system functional. The Code delegates the authority to issue additional guidance to the Secretary of the Treasury. In some cases, the Code expressly delegates to the Treasury the authority to determine what the law should be. For example, last week, we read Section 121(c)(2)(B), which authorizes the Treasury Department to issue regulations defining what constitutes "unforeseen circumstances" which might require a taxpayer to sell his or her principal residence before living in it for 2 years. In such cases, the statute essentially pre-approves of the rules that the IRS subsequently issues with regard to a particular issue. Regulations issued under specific authority of a statute of the IRC are often called "legislative" regulations. In other cases, the authority of the IRS to issue regulations is indirect, but still supported by statutory authority. Section 7805 of the IRC expressly provides the power to issue additional guidance to the Secretary of the Treasury. Specifically, this statute gives the Secretary the general power to prescribe "all needful rules and regulations for the enforcement of this title." Regulations issued under this more general authority are often referred to as "interpretive regulations." Both types of regulations generally are presumed to have the force and effect of law so long as they are consistent with and reasonably interpret the statute under which they are issued. As a result, Treasury Regulations (like statutes, but unlike case law) are binding on both taxpayers and the IRS. Not only are Treasury Regulations generally accorded the same authority as statutory law, they also tend to be much more detailed, and thus can provide much needed clarity in interpreting a particular statute. It is therefore important to understand how to find and interpret the Regulations, if any, associated with a particular Code section. As discussed in the first exercise, Treasury Regulations follow the same numbering convention as the Internal Revenue Code, so that the Regulations for Section 121 will be numbered 1.121. The prefix indicates the type of regulation represented -- here, the prefix "1" indicates that these are final regulations issued under an income tax statute. A prefix of "301" indicates that a regulation is a final procedural or administrative regulation. A prefix between 5 and 18 indicates that the regulation is a "temporary" regulation (discussed later in this exercise). Regulations are also issued under other titles of the United States Code -- for example, regulations are issued under the Bankruptcy Code and the Federal Criminal Code. These regulations will have different prefixes than regs issued under the Internal Revenue Code (Title 26 of the U.S. Code). Regulations often have suffixes as well as prefixes. For example, the regulations under §162 (Itemized Deductions for Individuals and Corporations) are numbered §1.162-1 through §1.162-29. These suffixes do not correspond to any particular sequence of subsections of the Internal Revenue Code. (For example, §162 itself, while relatively lengthy, only has 16 subsections). The suffixes merely represent different topics within the regulations for a particular statute. For example, §1.162-1 addresses the general rule for allowance of deductions, while §1.162-8 addresses the proper treatment of excessive compensation payments (not addressed in the Code itself), and §1.162-29 governs the tax treatment of expenditures incurred to influence legislation. Let's use the regulations to address a specific tax question. Assume that our client purchased a home in California two years ago to be used as her personal residence. The housing market in the area where she purchased her home has entered into a pronounced slump. This year, she sold the house for $78,000 less than she paid for it. Factoring in the realtor's commission and other closing costs, she incurred a net loss on the purchase and sale of her home of ($115,000). She wants to deduct this loss in preparing her 2009 federal income tax return. Code Section 165, governing the deductibility of losses, does not address this issue directly. Section 165(c) suggests that individuals can deduct losses "incurred in any transaction entered into for profit, though not connected with a trade or business" and our client argues that she purchased her home with the expectation that she would subsequently sell it for a profit. She therefore believes that she should be allowed to deduct this loss. While that seems a reasonable proposition, we would like some assurance that the tax law will actually allow this loss to be deducted. Scroll back to the top of Section 165, and click on the box labeled "Regulations" at the top of the page. This will take you to a list of related regulations. There are 13 different regulations under Code Sec. 165. Read the relevant regulations. Can our client deduct the loss realized on sale of her personal residence? a. Yes. §1.165-1(a) allows a taxpayer to deduct "any loss actually sustained during the taxable year and not made good by insurance or some other form of compensation ..." b. Yes, but the loss will be subject to the capital loss limitations of Code Sec. 1212. c. No. No loss is deductible on the sale of residential property used by the taxpayer as his or her personal residence. d. Our client can deduct the ($78,000) loss on sale of the house, but not the additional expenses incurred for realtors' commissions and other closing costs. Question 2 (10 points) 1 14 MC 1 4 As we will see as we proceed through this course, Treasury Regulations are not always sufficient to answer a question that we may have. First, regulations have not been issued for every Code section. For example, there are as yet no regulations accompanying Code Sec. 36 (first-time homebuyer’s credit). Many statutes are not accompanied by regulations. Moreover, even where they have been issued, regulations sometimes fail to expand upon the language of the Code, or they may address only portions of the statute rather than the entire law. Finally, it is very important to recognize that regulations are often outdated. They are not updated every time the Code is revised. For that reason, it is crucial to verify the content of a regulation by carefully reading the Code section upon which it is based. An excellent example is provided in Code Sec. 213, governing the deductibility of medical, dental and related expenses. Read Reg. §1.213-1(a)(3). Assume our client had adjusted gross income of $100,000 in 2008. She incurred qualified medical expenses of $20,000, of which $8,000 were reimbursed by her insurance provider. Assuming that she itemizes deductions, and that these were her only medical expenses for the year, what is her allowable deduction for medical expenses for 2007? a. $9,000 b. $20,000 c. $4,500 d. $12,000 Question 3 2 (10 points) 16 MC 1 4 As noted above, there are many Code sections for which no regulations have been issued. Surprisingly, it is also possible to find regulations where there is no Code section! For example, find Code Section 1034. This statute was repealed by the Taxpayer Relief Act of 1997. (It was replaced by Code Sec. 121). The regulations under Section 1034, however, have not been repealed or withdrawn. Although the underlying Code section has been repealed, the regulations are still relevant in answering some important tax questions. For example, consider the following questions. For which of them would the practitioner need to consult the "old" §1034 regulations? a. Taxpayer sold the house he purchased for his daughter to live in during her college years. He wonders if he can exclude his gain on the sale under §121 since the house qualified as his daughter's principal residence for the past 4 years. b. Taxpayer sold his home in 2007. He needs to determine the applicable period within which he must purchase a replacement home in order to defer recognition of his gain under §1034. c. Taxpayers are married and have lived in their current house for 1.5 years. They are planning to purchase a new house, and will hold the current house as rental property. They wonder if §121 will apply if they sell this house in 2 years. d. Taxpayer sold his principal residence in 2009 for $750,000. He originally purchased the residence in 1995 using proceeds from the sale of his first home (used as his principal residence prior to 1995). He deferred recognition of some of the gain from the 1995 sale under Code Sec. 1034. He now needs to compute the tax basis of the home he sold in 2009. Question 4 3 (10 points) 20 MC 1 4 One way to evaluate the probability that a particular regulation may be out of date is to check the date the regulation was issued. This information is provided at the end of the regulation. For example, go to Internal Revenue Code Sec. 104, and click on the Regulations box at the top of the Code Section. Scroll down to the very bottom of the regulations to the box summarizing the Treasury Decision(s) with which the regs were issued. (T.D. …) This box effectively summarizes the history of the regulations. Note that this set of regulations was issued in 1956 and amended in 1964 and 1970. The warning at the top of the screen indicates that the regulations have not been updated to reflect changes in the law implemented by Public Laws (P.L.) 107-134, 104-188, 101-239, 97-473 or 94-455. (Note that these laws are listed in reverse order, with the most recent listed first). In other words, five tax acts have implemented changes in Code Sec. 104 since the last time the regulations were amended. It is therefore very important to read the statute carefully in conjunction with the regulations. The most significant changes in the statute occurred in 1996. Read Code Sec. 104(a)(2) and Reg. Sec. 1.104-1(c). Which of the following revisions would not be necessary to bring the regulation into alignment with current law? a. Insert the word "physical" before the word “sickness.” b. Add a sentence or phrase indicating that payments received as punitive damages are not excludable under §104. c. Insert the word "physical" before the word "injuries." d. All of these revisions are necessary to bring the regulations into alignment with current law. Question 5 4 (10 points) 18 MC 1 4 Final regulations are issued by the Treasury Department in documents referred to as "Treasury Decisions" (TDs). Oftentimes, the Treasury Decision begins with a "preamble" summarizing the regulations and the Treasury's rationale in writing them in the particular way they are phrased. The preamble is sometimes as useful as the Regulations themselves. Indeed, in some cases, we can learn things from the preamble that may not be in the regulations directly. For example, go to Regs. §1.121-3(e) Sale or exchange by reason of unforeseen circumstances. Assume that our clients, a married couple, purchased their home in July 2005 when they married. Eighteen months later, they adopted twins and sold their home in order to purchase a larger house to accommodate their larger family. The regulations do not clearly indicate whether the adoption of twins constitutes an "unforeseen circumstance" for purposes of §121. (The closest the regulations come to addressing this issue is §121-3(e)(4), Example 3, where the taxpayer gave birth to twins). Scroll down to the end of §1.121-3 to the box summarizing the history of these regs. These regulations were issued in 1965, and amended in 1979, 2002, and 2004. Click on T.D. 9152, issued on August 13, 2004. (This Treasury Decision issued Reg. §1.121-3). Read the section labeled “Explanation and Summary of Contents.” What does this discussion suggest with regard to whether adoption of twins qualifies as an unforeseen circumstance? a. This discussion does not distinguish between natural born and adopted children, implying that the two events are equivalent for purposes of §121. b. This discussion indicates that adoption of a single child would not qualify as an unforeseen circumstance, but that adoption of multiple children should qualify. c. This discussion suggests that adoption is a voluntary event that typically lacks the degree of unforeseeability common to events identified in the regulations as unforeseen circumstances, and implies that our clients would therefore not qualify for a partial exclusion under §121. d. This discussion indicates that adoption is equivalent to giving birth for tax purposes, and no distinction should be made between giving birth to multiple children vs. adopting multiple children. Question 6 5 (10 points) 22 MC 1 4 The Treasury Department is required to issue new regulations first in proposed format. The public must be provided an opportunity to comment on the proposed regs before final regulations are issued. Accounting firms, law firms, the AICPA, and the American Bar Association, among others will often make suggestions or ask the IRS to clarify or revise specific provisions before issuing final regulations. The IRS will consider these comments, and may (or may not) incorporate them into final regulations. The significance of proposed regulations is questionable. They presumably reflect the Treasury Department's view of how a particular transaction should be treated for federal income tax purposes, but it is understood that the Service may change its position when final regulations are ultimately issued. The significance of the regulations is even more ambiguous the longer the Service takes to issue final regulations. Indeed, the Service has been known to wait years to issue final regulations. Perhaps the best way to think of proposed regulations is that while they do not have the force of law, they do give tax advisers a good idea of the IRS' position on an issue. Taxpayers are free to disregard proposed regulations, but must recognize that final regulations can be, and often are, issued retroactively to at least the date of the proposed regulations. Disregarding them can come with a high price. Finally, it must be recognized that the IRS itself does not always follow the positions taken in proposed regulations, especially when those regulations are relatively old. For example, find and read the following case: Soliman v. Commissioner, 94 TC 20. In this case, the IRS challenged the home office deduction taken by an anesthesiologist on grounds that he conducted his primary business activity (anesthetizing patients) at the hospital rather than in his home office. This position was inconsistent with the Service's position, stated in proposed regulations, that traveling sales reps could claim a home office deduction if they had no other office space available. The Tax Court ruled in favor of the taxpayer, partly on grounds that his position was consistent with the proposed regs. The Appellate Court agreed, and the case was eventually overturned by the Supreme Court in the most famous tax case of the 1990s. Read the Tax Court case (cited above). What does the Tax Court say about the authority of proposed regulations? a. The Tax Court stated that the IRS is obligated to follow proposed regulations, but taxpayers are not. b. The Tax Court states that it is bound to follow the position taken by the IRS in its proposed regulations, whether it agrees with that position or not. To do otherwise would unreasonably place the court in the position of writing the laws rather than merely interpreting them. c. The Tax Court stated that proposed regulations have no force or effect, but merely state a "considered position" by the IRS. d. The Tax Court stated that Proposed Regulations are deemed to have the force and effect of law until replaced by Final Regulations. Question 7 6 (10 points) 34 MC 1 4 The Service also issues Temporary Regulations. Temporary Regulations are issued in "proposed" form, allowing the public the opportunity to comment and the IRS the opportunity for revision. However, unlike proposed regulations, temporary regulations are deemed to have the force and effect of law. Temporary regulations are issued whenever the IRS determines that new regulations need to be issued, and satisfying the requirements of prior public notice would be "impracticable, unnecessary, or contrary to the public interest." Temporary regulations are most often issued following the implementation of a new statute in the IRC which needs, in the opinion of the IRS, to be accompanied by regulations to provide clarity and guidance to taxpayers or tax professionals. Temporary regulations are designated with the letter "T" following the regulation number (e.g., §1.199-5T). Under IRC §7805(e), temporary regulations automatically expire three years after the date of issuance, whether or not they have been replaced with final regulations. Until they expire or are superseded by final regulations, however, they are authoritative. For example, Regs. §1.195-1T Election to amortize start-up expenditures (temporary), were issued on July 7, 2008. To find these regulations, go to §199 and click on "Regulations" at the top of the screen. Have Regs. §1.195-T been superseded by final regulations yet? a. No, not yet. b. Yes, Regs. §1.195-1 has now been issued. c. No, but they have expired. d. Yes, Regs. §1.195-1T have been replaced by Prop. Reg §1.195-1. Question 8 7 (10 points) 30 MC 1 4 As discussed above, temporary and final regulations are deemed to have the force and effect of law, so long as they are reasonable and consistent with the statute. Taxpayers and tax preparers can be subject to financial penalties for taking positions on tax returns that are knowingly inconsistent with the regulations (see §6694(b) for the preparer penalty). Occasionally, courts have overturned regulations on grounds that they are not consistent with the statute, or that they do not reflect Congressional intent. For example, find and read Mayo Foundation for Medical Education and Research v. U.S., 100 AFTR 2d 2007-5449. The court in Mayo is faced with the issue of the Secretary’s Authority to Issue Regulations (among other issues). It discusses two types of regulations—“legislative” regulations issued under Congressional delegation of authority to write the law, and “interpretive” regulations issued under the general authority vested in the Secretary of the Treasury under §7805(a). The court determined that the regulations in question in this case, those governing the application of the FICA tax, are interpretive in nature. In general, interpretive regs are more susceptible to taxpayer challenge. In assessing the validity of the regulations at question in this case, the court refers to the Supreme Court's decision in Chevron U.S.A., Inc. v. Natural Resources Defense Council, Inc., 467 U.S. 837 (1984), which identified the key issues which must be addressed in determining whether a regulation is valid. Which of the following are not issues identified by the Supreme Court in Chevron? a. Whether Congress has directly spoken to the precise question at issue. If it has, the regulation must give effect to the "unambiguously expressed intent of Congress." b. The most relevant considerations are the length of time the regulation has been in effect, the reliance placed on it, the consistency of the Commissioner's interpretation, and the degree of scrutiny Congress has devoted to the regulation during subsequent re-enactments of the statute. c. If the statute is silent or ambiguous with respect to the specific issue, the question for the court is "whether the agency's answer is based on a permissible construction of the statute." d. All of these are issues raised by the Supreme Court in the Chevron case which must be considered in assessing the validity of a regulation. Question 9 8 (10 points) 24 MC 1 4 Now let's do some research using the Code and Regulations. Our client, Eddie Jones, was hospitalized last year for injuries incurred as the result of a motorcycle accident. When he was discharged from the hospital, Eddie moved into his parents' home where he is still living today. Although he returned to work this year (2009), and expects to have AGI of $20,000, he plans to continue living in his parents' house until at least the early part of 2010. (His 2008 AGI was $15,000). Eddie is 32 years old. Because he was unable to work for an extended period of time, Eddie could not afford to pay his medical expenses. This year, Eddie's parents, Joe and Estelle Jones, paid $25,000 to the hospital to satisfy Eddie's medical expenses. Their AGI will be about $100,000 in 2009 (and $80,000 in 2008). How much of the $25,000 payment can Eddie's parents deduct on their 2009 income tax return? a. No deduction is allowed in 2009. The expenses were incurred in 2008 and must be deducted in that year. b. Joe and Estelle may deduct $22,000 -- the amount by which the $25,000 medical expenses exceed 3% of their AGI -- on their 2009 income tax return. c. Eddie's parents cannot claim a deduction in 2009 because his gross income exceeds the exemption amount and they therefore cannot claim him as a dependent. d. Joe and Estelle may deduct $17,500 as a medical expense on their 2009 tax return. Question 10 9 (10 points) 28 MC 1 4 OK, let's adjust the facts in question 9. Assume that Eddie was involved in a motorcycle accident. Because he was not wearing a helmet, his insurance company did not reimburse his medical expenses, which ran to $250,000. As before, when Eddie was released from the hospital, he moved in with his parents. To pay his medical expenses, Eddie used his life's savings of $75,000, and borrowed the rest from the local bank. Upon learning of Eddie's debt, his parents went to the bank and paid the loan, transferring $175,000 from their own savings account. How will Eddie's parents treat the transaction for federal gift tax purposes? (To answer this question, search for medical expenses and gift in the Code and read the applicable statute and regulations). a. Under the gift tax regulations, the transfer is subject to the gift tax if Eddie's parents are reimbursed by their insurance company. b. Under the gift tax regulations, the transfer is subject to the gift tax only if Eddie is subsequently successful in getting his insurance company to reimburse him for the expenses incurred. c. The payment constitutes a taxable gift to the extent it exceeds the annual exclusion ($10,000, plus adjustment for inflation). d. Since the payment was paid for medical care "on behalf of" their son, it is not subject to the gift tax