ERP

advertisement

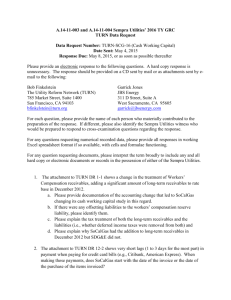

Credit and Receivables Risk Management 1 Credit Management Credit Management is a cross-functional activity between SD and FI SD Sales People want to sell C R E D I T FI Credit is an independent function in the SAP R/3 system FI People want to reduce risk 2 Credit/Risk Process Credit Management Cust: Health Express Risk: Medium Credit Limit: $10,000 Ttl. Commit: $6,000 SD, FI Order: 5923 Order Amount: $5,000 Credit Limit Exceeded Block order E-mail to credit rep. (opt.) Blocked document list or E-mail (opt.) Review situation Release order Pick, pack & ship order Bill Customer Credit control (blocks) can be applied at order entry, delivery creation or goods issue 3 Total Commitments Open Credit Limit order value Open Delivery items not yet billed delivery value Open Not transferred to FI (optional) billing value Special Short payments, down payments commitments Receivables Unpaid bills 4 Static vs. Dynamic Checks Credit Limit Open order Open order Open order Open delivery value Open order Open delivery value Receivables Receivables Static Check Open order Open order Dynamic Check Credit Horizon 5 Other Checks: Open Items Health Horizons Max. open items: 20% Number of days: 30 Credit Limit: $100,000 Ttl. Commit.: $30,000 Health Horizons Receivables Days in arrears Amount 10 17 <30 28 >30 33 46 $4,000 $6,000 $5,000 $10,000 $5,000 $15,000 = 50% > 20% $30,000 Why Total Commitment and not credit limit? 6 Other Checks: Oldest Open Date Health Horizons Health Horizons Receivables Days in arrears Amount Oldest Open Item: 45 Credit Limit: $100,000 Ttl. Commit.: $30,000 45 10 17 28 33 $3,000 $6,000 $5,000 $10,000 46 $5,000 7 Other Checks: Next Review Date Health Horizons Health Horizons Order Next check date: 6/01/04 Number of days: 10 Credit Limit: $100,000 Ttl. Commit.: $30,000 Date: Amount: 6/6/04 $3,000 Health Horizons Order Date: Amount: 6/14/04 $4,000 8 Credit Control Area The credit control area is the organizational unit that specifies and controls the credit limit for a customer Credit control areas can be used to create centralized or decentralized credit control in a company with more than one company code A company code can be assigned to only one credit control area, but each sales area within a company code can be assigned to a different credit control area 9 Decentralized Credit Management Credit Control Area 1 Company Code 1 Credit Control Area 2 Company Code 2 Sales Org.1 Sales Org.2 Health Express Limit: $50,000 Health Express Limit: $100,000 Each company code sets and monitors a credit limit independently 10 Centralized Credit Management Credit Control Area 1 Company Code 1 Company Code 2 Sales Org.1 Sales Org.2 Health Express Health Express Limit: $150,000 Transactions with each company code apply to the single credit limit set for the single credit control area 11 Exchange Rates Credit Control Area 1 Currency: USD Company Code 1 Currency: USD Company Code 2 Currency: EU Sales Org.1 Sales Org.2 Health Express Health Express Limit: $150,000 Receivables for Company Code 2 are converted from Euros to US Dollars when credit is checked 12 Automatic Credit Control Determine points at which credit check is carried out (order creation, delivery creation or goods issue) Determine type of check Based on: Credit control area Risk category Document (credit group) 13 Automatic Credit Control Sales organization Company Code Customer Transaction Type Credit Control Area Risk Category Credit group As of release 4.0, Credit control area can also be Determined via: user exits payer sales area When Credit is Checked Why Credit is Checked What the system does (warning, error) 14 Receivables Types Letters of Credit Credit and Procurement Cards Export Credit Insurance Guaranteed Payment Transactions using these payment methods/guarantees do not affect Total Commitment Credit Management 15