SUPPLY CHAIN MANAGEMENT Online/Distance Learning Course

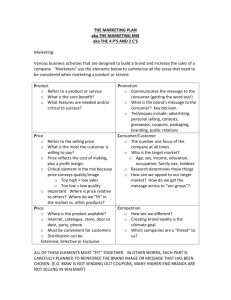

advertisement

BRAND MANAGEMENT AND NEW PRODUCT DEVELOPMENT SECTION 4B Brand Management and the Firm Brand Equity Models ALAN L. WHITEBREAD SEVEN BRAND MANAGEMENT APPROACHES 1. 2. 3. 4. 5. 6. 7. Economic Identity Consumer-based Personality Relational Community Cultural COMPANY SENDER FOCUS • THE ECONOMIC APPROACH – – – – – – Manages the brand with the traditional marketing mix Company identity helps shape a brand message Marketer is in charge of brand value creation A consumer is an “economic man” passively receiving and understanding messages from the sender exactly as intended. COMPANY SENDER FOCUS • Economic approach – The economic man – Human behavior is rational – Humans maximize their satisfaction and/or utility [self-interest is important] – Humans have perfect market information – The exchange is an isolated event and not related to any other event – Humans have limited income which causes them to maximize the utility of their income COMPANY SENDER FOCUS • THE IDENTITY APPROACH – – Brand is integrated into all organizational levels – Organizational culture and corporate identity heavily influence the brand HUMAN RECEIVER FOCUS • THE CONSUMER-BASED APPROACH – Brand is linked to customer associations – – Focus shifts to the message receiver – – Marketer can program the consumer through brand messages CONSUMER-BASED BRAND EQUITY [CBBE] • Ensure consumers identify and associate the brand with a specific type of product or solution. • Establish the brand in the mind of the consumer through associations to certain properties. • Assure brand identification and brand meaning are accurate. • HUMAN RECEIVER FOCUS • Consumer-based approach – – The brand is a consumer mental construct – – The consumer is the owner of the brand – Marketer can program the consumer through brand messages CUSTOMER-BASED BRAND EQUITY PYRAMID 4. RELATIONSHIPS RESONANCE 3. RESPONSE JUDGMENTS FEELINGS 2. MEANING PERFORMANCE IMAGERY SALIENCE Projecting the brand 1. IDENTITY BRAND IDENTITY RESONANCE JUDGMENTS FEELINGS PERFORMANCE • Brand salience SALIENCE Projecting the brand – How often is the brand recalled? – Is it easy to recall? – What reminders are necessary? – Dimensions of brand awareness • Depth: the likelihood of recall • Breadth: the range of purchase opportunities – How effective are the brand elements? • Identify and differentiate each one IMAGERY BRAND MEANING RESONANCE JUDGMENTS FEELINGS PERFORMANCE • Brand performance 1. Primary product and supplementary features 2. Product reliability, durability, and serviceability 3. Style and design 4. Value proposition using emotional and intangible elements [not price] IMAGERY SALIENCE BRAND MEANING RESONANCE JUDGMENTS FEELINGS PERFORMANCE • Brand imagery 1. User profiles – Demographics, psychographics, … 2. Purchase and usage situations – Channel, store, timing, … 3. Personality and values – Sincerity, excitement, competence, … 4. History, heritage, and memorable experiences IMAGERY SALIENCE BRAND RESPONSE RESONANCE JUDGMENTS PERFORMANCE • Brand judgments 1. Brand quality – Value, satisfaction, … 2. Brand credibility – Expertise, trustworthiness, likeability, … 3. Brand consideration – As a relevant solution, … 4. Brand superiority – Differentiation, associations, … FEELINGS IMAGERY SALIENCE BRAND RESPONSE RESONANCE JUDGMENTS PERFORMANCE • Brand feelings 1. 2. 3. 4. 5. Warmth Fun or excitement Security Social approval Self-respect FEELINGS IMAGERY SALIENCE BRAND RELATIONSHIPS RESONANCE JUDGMENTS FEELINGS PERFORMANCE • Brand resonance 1. Behavioral loyalty – Frequency of repeat purchases 2. Attitude attachment – Strong affection, pride of ownership, … 3. Sense of community affiliation 4. Active engagement – Regularly involved with some aspect IMAGERY SALIENCE CUSTOMER-BASED BRAND EQUITY PYRAMID RESONANCE What about you & me? JUDGMENTS FEELINGS What about you? PERFORMANCE IMAGERY What are you? SALIENCE Who are you? HUMAN RECEIVER FOCUS • Personality approach – Humans endow the brand with a human character / personality, thus giving it symbolism – A prerequisite for the relational approach – Models • David Aaker’s Brand Equity Model • Brand Personality [more in Section 7] and Corporate Brand Personality DAVID AAKER’S BRAND EQUITY MODEL • Brand equity is composed of distinct categories of brand assets and liabilities. – Brand loyalty – Brand awareness – Perceived quality – Brand associations – Other proprietary brand assets DAVID AAKER’S BRAND EQUITY MODEL • BRAND LOYALTY – Reduced [marginal] marketing expenses – Provides trade leverage [with resellers] – The ability to attract new customers and keep existing ones – Provides time to respond to competitive threats DAVID AAKER’S BRAND EQUITY MODEL • BRAND AWARENESS – It is an anchor to which you can attach other associations – It is familiar – It is an indicator of commitment to the brand – It indicates the brand should be considered if not already a customer DAVID AAKER’S BRAND EQUITY MODEL • PERCEIVED QUALITY – Provides a reason to buy – Differentiates the brand and its products – Part of the positioning – Provides value – – Provides the opportunity for extensions DAVID AAKER’S BRAND EQUITY MODEL • BRAND ASSOCIATIONS – Helps with information retrieval – – – Provides a reason to buy – Creates positive attitude or feelings – Provides the opportunity for extensions DAVID AAKER’S BRAND EQUITY MODEL • OTHER PROPRIETARY BRAND ASSETS – Establishes competitive advantage DAVID AAKER’S BRAND EQUITY MODEL • BUILDING A BRAND – Have a strong core brand identity that can be modified for different segments and products. – Have a strong value proposition using emotional and intangible appeals. – Establish a strong brand positioning that links to the brand identity. – Great execution • NPD, launch, product / family life cycle DAVID AAKER’S BRAND EQUITY MODEL • BUILDING A BRAND – Be consistent over time • Coca-Cola vs. RC Cola – Use the brand leverage that has been developed – only participate in strong cobranding programs – Measure and track various brand equity elements over time – Have a strong brand manager – Invest in the brand PRODUCT BRAND PERSONALITY • Defined in user imagery – Understand the characteristics of customers – – Customers can express their actual or desired self-image by association with the product CORPORATE BRAND PERSONALITY • Defined in the actions, values, and words of all its employees • Supersedes any product brand personality • Core dimensions [traits] – Heart [passionate and compassionate] – Mind [creative and disciplined] – Body [agile and collaborative] BRAND MANAGEMENT AND NEW PRODUCT DEVELOPMENT SECTION 5 Brand Management and the Firm Brand Types and Characteristics ALAN L. WHITEBREAD THE FOUR STEPS OF BUILDING A BRAND • Brand identity – Who are you? • Brand meaning – What are you? • Brand response – How do I think or feel about you? • Brand relationships – What type of a connection do we have? BUILDING A BRAND • BRAND IDENTITY FORMS – The company is the only brand name used • ? – The company and the brand are together • DuPont, IBM, Philips, Siemens – The brand by Company X • ? – The brand with minor mention of Company X • Clairol, Crest, Folgers, Noxzema, Pampers, Puffs, Tide – Proctor and Gamble – The brand represented / distributed by X • ? TYPES OF BRANDS GENERIC CORPORATE / FAMILY Pharmaceuticals, Vegetables Nike, IBM, GE, RCA INDIVIDUAL / PRODUCT COMBINATION Huggies, P&G soaps, Crest HP Deskjet, DuPont Stainmaster PRIVATE LABEL CO-BRANDING Post Oreo O’s cereal, Disney SUV Kenmore, Craftsman, Die-Hard Great Value, … BRAND LICENSE Disney PRIVATE LABEL BRANDS • Are generally a threat only to brands that are 1. The value equation is wrong because the real or perceived benefits are not sufficient. 2. Very small IMC relative to what is needed to build or sustain a brand. 3. Very poor differentiation [if any] and probably some combination of bad POP, IMC, … PRIVATE LABELS: SOME DISHWASHERS Electrolux® Whirlpool® GE® GE ProfileTM GE SpacemakerTM Hotpoint® GE Monogram® Electrolux Icon Gibson Kelvinator White-Westinghouse Frigidaire Frigidaire Gallery Frigidaire Professional Tappan® Roper® Estate® Whirlpool® Whirlpool Gold® KitchenAid® KitchenAid BRIVA® Kenmore GE Kenmore GE® [In-sink dishwasher] Kenmore Kenmore Elite Kenmore UltraWash® Maytag® Admiral Jenn-Air® Jenn-Air Pro-Style® Magic Chef Maytag Jetclean®III Maytag Jetclean®II Maytag Jetclean® Norge Hardwick See http://www.ajmadison.com/cgi-bin/ajmadison/item_list/cat00263/Built_In_Dishwashers.html for more. See http://www.appliance.com/dishwashers/list.html for a list of firms. PRIVATE LABEL BRANDS • PRIVATE LABEL NOTES – Some people differentiate a private label brand as one that identifies the source of the product and a generic brand as one that does not identify the source. – Private labels are called store brands for retailers. – Private labels for wholesalers and distributors may or may not have detailed specifications and identify the source of the product. BUILDING A BRAND • PRIVATE LABEL BRANDS – Manufacturer’s brands [OEM] • Manufacturer A makes products for Manufacturer B so the market believes Manufacturer B is making the products. –? – Reseller’s brands • B2B – Nearly all mail order firms • B2C – Sears Craftsman tools, DieHard batteries, and Kenmore appliances BUILDING A BRAND • PRIVATE LABEL BRANDS – Counter brands or Generic brands • Usually the same ingredients as the major brand and imitates it in nearly all aspects – same size package, information is identical and in the same place, etc. – Wal-Mart Equate – Fakes or Knock-offs • Illegal versions of usually major brands – CDs, movies, software, … B2B BRANDS • Most are unknown by the average consumer. – Known: Alcoa, Intel, – Unknown: FMC, Lexan, TIVAR • Important considerations – Company reputation and financial stability – Capacity, flexibility, service level[s] – NPD POSITIONING: BRAND IDENTITY • Vision [includes purpose / need fulfillment] • What makes it different? • What makes it recognizable? – This is a part of but not the same as identity – As seen from sender’s side! – Sight • Graphic symbol [logo] – Sound • Name – Must penetrate the noise. BRAND IDENTITY TRAPS • Each of these approaches is too limiting or tactical. How the brand is currently perceived [The customer determines who you are] How we want the brand to be perceived [Must be a visionary positive projection] The part of the brand identity and value proposition that is communicated to the target audience. [focus on attributes [features] restricts the brand identity POSITIONING: BRAND IMAGE • Brand image [as seen from receiver’s side] – Perceptions of the product – Must not be distorted by the noise – If you are doing a great communications job, brand image will be very close to the brand identity. – Understanding the receiver’s side • Use a Mental map / Mind map – A graphical technique that takes advantage of the brain associative capability not just is linear capability. MIND MAP Adult Children Thirst quencher Lemon Sticky Sweet Bittersweet Fresh 7-Up Cool Carbonated Sparkling POSITIONING: MIND MAP TOOL • To effectively use this technique 1. Get a very large sheet of paper. 2. Put the central idea at the center of the paper. 3. Write down every association where it first appears to belong. 4. Draw all known connections between ideas with various arrows, lines, markers, symbols, colors, etc. 5. Go very quickly. 1. NEVER PAUSE, JUDGE, OR EDIT DURING THE MIND MAP SESSION! 2. This maximizes the number of associations and minimizes the linear thinking aspect of the brain. REMEMBER THE BENEFITS OF STRONG BRANDS • • • • • • Increased customer loyalty Increased brand recognition Stronger competitive position Larger gross and pre-tax margins Increased trade cooperation Increased IMC effectiveness REMEMBER – STRONG BRANDS PROVIDE POTENTIAL FOR • a corporate brand • brand extensions • product line extensions • POSITIONING: FIRST STEPS • Four key questions must be answered before you begin to evaluate positioning alternatives. – Why does the brand exist? • – Who is the brand for? • Market segmentation; market descriptions – Why are the benefits meaningful? • – What are we competing against? • SWOT analysis; competitive analysis; product charts POSITIONING: FIRST STEPS • Why does the brand exist? – The brand vision [brand promise for the consumer]. – Brand benefits must be rank ordered by perceived value for each target market [segment]. • Who is the brand for? – Precise market segmentation and target marketing are required. POSITIONING: FIRST STEPS • Why are the benefits meaningful? – What proof exists? – How are those messages conveyed? • What are we competing against? – You must understand the nature of competition. • By level [direct, various indirect] • By product for direct competitors • By company [by probability of competing] SELECTING BRAND ELEMENTS • Six criteria should be used to do this. 1. 2. Meaningful / descriptive / interesting / rich in visual and verbal imagery 3. Likeable aesthetically and emotionally 4. Transferable within and across product, geographic, or cultural boundaries 5. Adaptable, flexible over time to keep from becoming stale or outdated 6. A SUCCESSFUL BRAND • When you have positioned a brand correctly, it has all of the following characteristics. – Recall [physically, imagery, familiarity] – Personality [character] – Culture [group] – Relationship [meaning to the customer] – Customer reflection [perception] – Self-image BRAND MANAGEMENT AND NEW PRODUCT DEVELOPMENT SECTION 6 Brand Management and the Firm New Product Development: Risk Assessment ALAN L. WHITEBREAD REASONS FOR NPD • Capitalize on existing market[s] • Capitalize on new technology • Erect competitive barriers • Establish a market presence • Expand the product offering • Improve the company’s image • Increase market penetration • Preemptive move in an emerging segment • Lower cost / higher value product • Offset a seasonal cycle • Utilize excess capacity • … NEW PRODUCT DEVELOPMENT [NPD] • NPD is risky and expensive. – More than 9 out of 10 new products fail in the first year. • Food Industry 1997 first year failure rate – Top 20 firms success rate is 76% – Food industry failure rate is nearly 80% – Large firm vs. small firm NPD performance • Medicines: Of 5,000 – Only 5 make it to clinical trials – Only 1 is approved for patient use • U.S. 2007 Fortune 1000 firms – Spend more than $60 billion in new product failures each year. – Even if a product survives its first year, it is likely to fail in the second year. NEW PRODUCT DEVELOPMENT [NPD] • New product development is crossfunctional – Marketing identifies unfilled customer needs – Marketing specifies the type of product that is needed – R&D develops conceptual alternatives for marketing to approve – R&D, engineering, and production develop the product with marketing’s guidance – Finance verifies the estimated cost and profitability MITIGATING RISK • Companies are faced with increasing levels of risk in today’s market. • – You must develop and introduce products faster! – Competitors have speeded up their NPD cycles. • – Product life cycles are shortening, increasing risk because: • more new products must continually be in development, and • there is less time to capture development costs and generate profits. • – New product development is expensive. – A large percentage of all quality problems stem from poor design. – Most of a new product's cost is determined during the design stage. KEYS TO NEW PRODUCT SUCCESS “THE DIMENSIONS OF INDUSTRIAL NEW PRODUCT SUCCESS AND FAILURE”, R. G. Cooper, Journal of Marketing, Vol. 43 (Summer 1979), pp. 100-101. • Product uniqueness and [perceived] superiority • Market knowledge and marketing proficiency • Technical and production synergy and proficiency CRITICAL GENERAL SUCCESS FACTORS FOR NEW PRODUCTS • • Exceptional product quality – Quality leader • Superior to competitors perceived ability to meet a need or solve a problem • Unique benefits that are highly visible, easily understood, and • CRITICAL SUCCESS FACTORS: PROJECT LEVEL • Unique [perceived] superior products • • Market research • Clear, early, and stable project and product definitions • Planning and resourcing the launch • Excellent execution from idea forward • CRITICAL SUCCESS FACTORS: PEOPLE AND THE ENVIRONMENT • Organizing the right project team • Strong team chemistry • Outstanding leadership QUALITIES PROMOTING CREATIVITY “A MODEL OF CREATIVITY AND INNOVATION IN ORGANIZATIONS”, Teresa M. Amabile, Research in Organizational Behavior, Vol. 10, pp. 128-129. 1988. • Personality traits – Persistence, curiosity, energy, and intellectual honesty • Self-motivation [3M intrapreneurship] – Self-driven and committed to the idea • Cognitive abilities – General problem-solving, tactics for creative thinking QUALITIES PROMOTING CREATIVITY “A MODEL OF CREATIVITY AND INNOVATION IN ORGANIZATIONS”, Teresa M. Amabile, Research in Organizational Behavior, Vol. 10, pp. 128-129. • Risk-orientation [Norm Dion, Dysan Corp.] – Unconventional, attracted to challenge, do things differently • Expertise in the area [Al Shugart, Finis Conner] – Talent, experience, and knowledge in a field • Qualities of the group – Synergy of intellectual, personal and social qualities of the group QUALITIES INHIBITING CREATIVITY “A MODEL OF CREATIVITY AND INNOVATION IN ORGANIZATIONS”, Teresa M. Amabile, Research in Organizational Behavior, Vol. 10, p. 129. • Unmotivated – Not challenged by the problem, pessimistic, complacent, lazy, do not believe in the idea • Unskilled – Lack of ability or experience in the problem area • Inflexible – Opinionated, unwilling to do things differently ENVIRONMENTS FOR CREATIVITY “A MODEL OF CREATIVITY AND INNOVATION IN ORGANIZATIONS”, Teresa M. Amabile, Research in Organizational Behavior, Vol. 10, pp. 146-147. • Freedom of what to do or how to do – #2 for inhibiting creativity • Good project management • Sufficient resources • Organizational characteristics – Cooperation and collaboration – Failure is not fatal • #1 for inhibiting creativity THE POWER OF VISUALIZATION • On the internet find any or all of the following to appreciate visualization. CRITICAL SUCCESS FACTORS: PEOPLE AND THE ENVIRONMENT • • • • Organizing the right project team Strong team chemistry Outstanding leadership Provide a supportive corporate environment – Climate – Culture • Top management support B2C TARGET MARKET SEGMENT CRITERIA 1. Measurable - Is it quantifiable ? 2. Substantial - Is it the right size for my firm? 3. Accessible - Does it use our existing channels of distribution? 4. Heterogeneous - Is it differentiable? Are there obvious customer benefits? 5. Actionable - Does my firm have a committed long-term desire to succeed? B2B TARGET MARKET SEGMENT CRITERIA 1. Measurable – The degree to which you can measure buyer characteristics 2. Accessible – The ability to focus on target market segments 3. Substantial – The degree to which target market segments are large enough and potentially profitable enough to pursue B2B TARGET MARKET SEGMENT CRITERIA 4. Compatible -The extent to which marketing and business strengths compare to current and expected competitive and technology states 5. Responsive -The extent to which target market segments respond to elements of the marketing mix WHAT IS A NEW PRODUCT? • Product improvements and modifications. – A different • • • • • • • • • Size Color Style Specifications Package A new product family or product line A new SBU Products that require a new technology … LARGE P R O FIVE TYPES OF DEVELOPMENT PROJECTS HARDEST R&D ADVANCED DEVELOPMENT PROJECTS: GENETIC ENGINEERING MORE C NEW CORE PRODUCT E S S ALLIANCES PARTNERSHIPS PROJECTS NEW CORE PROCESS R&D JOINT VENTURE NEXT GENERATION PROCESS PRODUCT CHANGE NEXT GENERATION PRODUCT ADDITION TO PRODUCT FAMILY LESS DERIVATIVES AND EXTENSIONS BREAKTHROUGH PROJECT: NEW FAMILY OF DRUGS C H A SINGLE DEPARTMENT UPGRADE N G PLATFORM PROJECT: APPLE iMAC: TRANSLUCENT PLASTIC COLORATION TECHNOLOGY INCREMENTAL CHANGE E SMALL For more information see Creating Project Plans to Focus Product Development, Harvard Business Review, Vol. 70, No. 2, p.74. DERIVATIVE PROJECT: SIMPLE SIZE CHANGE EASIEST NPD • New product development begins with the recognition of – an unmet customer need or want and – a potential market [segment] that is large enough to justify exploration. • NPD proceeds either in a sequential or concurrent fashion. – Sequential [completing one step before proceeding to the next] NPD is the traditional method. • It is time consuming, thus slow. • The lack of speed to market results in either not as much of a lead over competitors or it trails them further in the market. Either way, the firm does not realize as much profit from NPD as it could. NPD: A STAGE-GATE PROCESS 1. -Conduct necessary research [discovery] -Determine the type of project [scoping] 2. Gain project approval 3. Development activities 4. Testing and validating 5. WHERE DO IDEAS COME FROM? • MARKET RESEARCH / CUSTOMERS / PROSPECTS / EMPLOYEES • SUPPLIERS • ACQUISITIONS • UNDERSTANDING TRENDS / ISSUES / … – – – – – Demographics Problems Competition Market research Technology NEW PRODUCT IDEA STRATEGIES Acquire Companies Original Products Acquire Patents Product Improvements Acquire Licenses Product Modifications New Brands METHODS OF IDEA GENERATION • METAPHOR BUILDING • FREE ASSOCIATION – Fruit → Banana → Yellow → ? + – Fruit → Banana → Orange → ? + • • • • • BRAINSTORMING CATALOG TECHNIQUE ATTRIBUTE LISTING THINKING OUT OF THE BOX Techniques for creative thinking – http://members.optusnet.com.au/~charles57/Creative/Techniques/ ANSOFF’S PRODUCT / MARKET EXPANSION GRID Existing products Existing markets 1. Market Penetration / Saturation New markets 3. Market Development New products 2. Product Development 4. Diversification PRODUCT GENERATION MAP: HP DeskJet 560C Cost reduction DeskJet 300 DeskJet 550C DeskJet 500C DeskJet Plus Swap color and black cartridges Cost reduction DeskJet Quality improvement TIME One color and one black cartridge Portable with small footprint TECHNOLOGY ROADMAP Technology area Last year This year +1 year +2 years Weight/size 16-bit chip Micro controller Integrated unit Single chip Soft radio Ease of use 4 line screen 10 line screen VGA Touch screen Longevity Audio quality Video quality Vision Voice interface CONCEPT SCREENING • Sort and classify by type of project • Concept Screening: Does it fit with the portfolio? – Form, function, design, aesthetics –? • Risk analysis – Technological • Technology demands, engineering, operations, and quality – Business • Business analysis THREE KEY QUESTIONS 1. Who? What? Where? Why? When? How? How is it differentiated? Ø THREE KEY QUESTIONS 2. Utilizing which core competency[ies]? Utilizing which key success factor[s]? What operating model? How will it be made? What are the key hurdles? Ø THREE KEY QUESTIONS 3. Projected units Projected net revenue [including elasticity] Projected cost schedules Projected profitability Risk assessment – the potential to make considerably more or less than the projection[s] Ø BRAND MANAGEMENT AND NEW PRODUCT DEVELOPMENT SECTION 7A Brand Management and the Firm Market Research - 1 ALAN L. WHITEBREAD MARKET RESEARCH OVERVIEW Strategic Marketing for Market Research The collection and analysis of data for market decisions about COMPETITORS MARKETS PRODUCTS RESPONDENTS STRATEGY OPTIONS Evaluation data for -Strategy analysis -New business analysis Market Planning for Market segmentation Market potential / share Competitive analysis Product Management for New or enhanced products 4 P's decisions Product Development for Product concept testing Sales techniques Price testing FRAMING AN ISSUE McKinsey & Company • “Breakthrough Thinking from Inside the Box”, HBR, December, 2007, pp.71-78. – Create new boxes to think inside – Bound the range of acceptable ideas – Tailor the questions accordingly – Select participants capable of original insight – “21 Great Questions for Developing New Products” ELEMENTS OF A GOOD QUESTIONNAIRE • Most are short, simple, and quick – but some can be quite long • Precise wording of questions and answers • Avoids leading questions • Does not ask unreasonable questions • Does not alienate the respondent – Sensitive topics = ? • Readily lends itself to statistical analysis THE QUESTION MUST BE VERY CAREFULLY WORDED AND STRUCTURED! THE STRUCTURE OF THE ANSWER IS JUST AS IMPORTANT AS THAT OF THE QUESTION! TYPES OF QUESTIONS DICHOTOMOS QUESTION THE RESPONDENT MUST ANSWER ONE OF JUST TWO CHOICES DO YOU THINK TIDE GET CLOTHES CLEAN WITHOUT INJURING THE FABRIC? YES NO TYPES OF QUESTIONS OPEN-END or COMPLETELY UNSTRUCTURED QUESTION OBTAINS INFORMATION WITHOUT BIAS IT IS LIKE AN ESSAY EXAM IT IS VERY HARD TO ANALYZE FREE RESPONSE QUESTION ANSWERS ARE LIMITED TO A WORD OR A PHRASE TYPES OF QUESTIONS SENTENCE COMPLETION QUESTION THE ______ IS OBTAINED BY DIVIDING ______ BY ______. GOOD FOR ROTE MEMORY MEASUREMENT THE RISK IS THAT IS ALL THEY MEASURE! TYPES OF QUESTIONS MULTIPLE CHOICE QUESTION – you must know everything about an issue to properly write these structured questions. 1-VERY EASY ANSWER SET ONE CORRECT ANSWER 2-TO MEDIUM HARD ANSWER SET SEVERAL ANSWERS ARE ONLY SLIGHTLY DIFFERENT 3-TO HARD ANSWER SET COMBINATION ANSWERS ONLY SLIGHTLY DIFFERENT TYPES OF QUESTIONS RANKING, RATING, and CONTINUUM QUESTIONS FORCE A MORE PRECISE SCALE OF MEASUREMENT SCALE DETERMINES TYPE OF STATISTICAL ANALYSIS PROBLEM IS THE MEANING OF THE SCALE OF MEASUREMENT CHECK QUESTIONS QUALITATIVE RESEARCH • • • • • Words and images “Soft” or subjective data Exploratory in nature Understand unmet needs Heuristic analysis: search for themes and deeper meanings COMPETITIVE ANALYSIS Traditional competitors Evolving competitors New competitors to the industry The growing role of strategic alliances COMPETITIVE ANALYSIS Company #1 #2 #3 #4 #5 #6 #7 #8 #9 #10 OUR COMPANY Y Y Y N N Y Y Y GUI Win 5,000 MCS Y Y Y ? ? ? Y ? CLI Unix ? DMCS Y Y Y Y PROP Y Y Y CLI Unix 12,000 AS Y Y Y Y PROP ? Y ? GUI Unix ? API Y Y N N Y ? N ? GUI Win 5,080 PCSS Y Y Y Y PROP Y Y Y GUI Win 7,460 MAC Y Y N N N N N N GUI Win ? FMSI Y Y N N PROP Y Y ? GUI Win ? HTC Y Y N N Y N Y N GUI Win 3,980 LEGEND: Y=yes N=no GUI=graphic user interface CLI=command line interface PROP=proprietary 4 User $ PRODUCT LINE EXPLOSION MEN’S SHIRTS BRAND TYPE Dress, casual, sport, work SIZE S, M, L, XL Plus long and short Button down or not --Colors --Fabrics PRODUCT LINE EXPLOSION • Look at what happens with only a little changes to the previous slide. – Brands*types*sizes*collars*colors • 1*4*8*2*4 = • 3*4*8*2*6 = 1,152 256 CONTEXTUAL RESEARCH CONTEXT -Activities -Environment -Interactions -Other products -People -Processes -Relationships CONTEXTUAL RESEARCH: PRINCIPLES • Empathy for understanding • Rapport for true behavior and values • Subjects lead the session and identify what is important • Focus on what subjects do more than their opinions • General patterns should emerge CONTEXTUAL RESEARCH: THE PROCESS Defining the problem and research objectives Marketing Decisions Developing the research plan Present the findings Collect the information Analyze the information QUALITATIVE TECHNIQUES • INTERVIEW USERS • FREE ASSOCIATION – What does _________ mean to you? QUALITATIVE TECHNIQUES • FOCUS GROUPS – How do they work? • PROJECTIVE TECHNIQUES – Completion and interpretation tasks – Comparison tasks – To try and uncover true opinions and feelings – Example: Rorschach Test [inkblot] http://www.stupidstuff.org/main/rorschach.htm CONCEPT TESTING: What ideas should we pursue? “The universal carryall” • The unmet need or want – “The universal carryall” • • • • • What is it? How should it work? Feature[s] = ? Advantage[s] = ? Benefit[s] = ? CONCEPT TESTING: What ideas should we pursue? • Test as many ideas as possible • Test before any feasibility analysis • Do not mix innovative and very futuristic ideas in the same test set BRAND ATTRIBUTES AND BENEFITS User imagery Usage imagery Product-related attributes Brand personality PRODUCT OR SERVICE Symbolic benefits Functional benefits Experiential benefits TTU DELOITTE PROJECT, FALL 2008 SCALES OF MEASUREMENT SCALE STRUCTURE 1:1 correspondence Subjective data A scale exists No distance relation is known (e.g. 3-2 <> 4-3) EXAMPLE(S) Football numbers Lottery drawing numbers Military rank Quality of lumber, beans Upper-middle-lower class Ordinal scales are often used to evaluate consumer satisfaction. [Likert scale] How satisfied are you with PRODUCT X? 1. Not satisfied 2. Neither satisfied or dissatisfied 3. Satisfied 4. Very satisfied 5. Extremely satisfied SCALES OF MEASUREMENT SCALE STRUCTURE Equal Equaldistances distancesbetween items between items (e.g. (e.g.4-2=4-3) 3-2=4-3) EXAMPLE(S) Calendar days Calendar days Temperature Temperature Interval scales are often used to rank items. Which products do you prefer the most? Assign #1 to the most preferred and #5 to the least preferred product. PRODUCT A PRODUCT B PRODUCT C PRODUCT D PRODUCT E _____ _____ _____ _____ _____ A continuous scale of measurement Definite relationships A true zero point Measurement Loudness scale BRAND PERSONALITY IF PRODUCT __________ WAS YOUR FRIEND, HOW WOULD IT TALK TO YOU? THE BRAND PERSONALITY APPROACH SUPPORTING THEME: Brand-self congruence SUPPORTING THEME: Personality BRAND PERSONALITY SUPPORTING THEME: Consumer self BRAND PERSONALITY: Supporting theme: personality Recessive personality Quiet, reserved, shy, silent, withdrawn Personality dimensions Dominant personality EXTROVERSION Talkative, active, energetic, outgoing Fault-finding, cold, unfriendly, quarrelsome, hardhearted AGREEABLE Sympathetic, kind, appreciative, affectionate, softhearted Careless, disorderly, frivolous, irresponsible, slipshod CONSCIOUSNESS Organized, thorough, efficient, responsible Tense, anxious, nervous, moody, worrying EMOTIONAL STABILITY Stable, calm, contented, unemotional Commonplace, narrow interests, simple, shallow, unintelligent OPENNESS / CULTURED Wide interests, imaginative, intelligent, original, insightful BRAND PERSONALITY Brand Personality Central Theme Sincerity •Hallmark •Coke Excitement •Pepsi Competence Sophistication Ruggedness •HP •Wall Street Journal •BMW •Lexus •Grey Poupon •Nike •Wells Fargo THE POWER OF PASSIONS • The brand is what makes a product more than just a product – it makes it unique. • The brand goal is to be more than brand preference – a passionate brand insistence! • This is done through engagement and fulfilling self-concept and image to others. • CONNECTING WITH CONSUMERS • B2C – Needs and wants – Emotions and self-actualization – Hopes [dream realizations] – Fears [risk reduction, safety] – Familiarity and trust [brand loyalty] – Understanding demographic trends CONNECTING WITH CONSUMERS • B2B connections – Performance and reward [best solution] – Fears [risk reduction, improve safety] – Familiarity and trust [consistency → brand loyalty] – Understanding trends BRAND MANAGEMENT AND NEW PRODUCT DEVELOPMENT SECTION 7B Brand Management and the Firm Market Research - 2 ALAN L. WHITEBREAD QUANTITATIVE RESEARCH • • • • • Numbers based “Hard” data More confirmatory in nature Optimize the appeal of new products Statistical analysis QUANTITATIVE TECHNIQUES • ANALYSIS OF VARIANCE [ANOVA] – Closely related to multiple regression – Can examine multiple variables and their influence on some response • Analysis of - 1:A, 2:B, 1: [A & B], [1 & 2]: [A & B], etc. • CONJOINT ANALYSIS – Many tools including variance and regression analysis – Allows many variables and aspects to be analyzed simultaneously – Human perceptions and preferences • to single attributes and interactions such as price point, sales likelihood, and cannibalization • CORRESPONDENCE MAPPING – Graphically represent the relationship between brands or products and other variables such as psychographics, media, etc.. – Can be a preliminary step to cluster analysis, used in determining the most discriminatory psychographic statements QUANTITATIVE TECHNIQUES • FACTOR ANALYSIS – A data reduction technique to explain variability of factors – Finds commonality in sets of variables – Used to identify consumer lifestyle and personality types • PRINCIPAL COMPONENT ANALYSIS [PCA] – A type of factor analysis – Used to identify • the most independent variables • and relative strength/position of a set of linear variables • MULTIDIMENSIONAL SCALING – Similar to factor analysis – Human perceptions and preferences in relative perceptual space [e.g. perceptual map] FACTOR ANALYSIS AND PCA Deloitte study 2009 Rotated Factor Analysis [PCA] Rotated Common Factor Analysis Factor 1 by Sex; Single Factor 1 by Sex; Single MALE Exterior design 0.7829 FEMALE 0.5233 MALE 0.5833 GPS system Fuel efficiency Horsepower 0.4914 0.6915 0.4410 0.7468 0.6816 iPod link Leg room 0.5497 0.5856 0.6206 0.4816 Newest model Performance 0.5113 0.8633 0.5986 0.7602 0.8159 Quietness inside 0.8902 0.6436 0.7513 Sound system 0.5224 0.6015 0.4585 Steering wheel controls 0.4122 0.5275 Responsiveness / handling 0.7664 Tells you when it needs service Type of transmission FEMALE 0.4497 0.4054 0.4244 See what happens when you force the results to only one attribute! CORRESPONDENCE MAPPING 0 Degree Angle: 100% Correlation AWKWARD ABSENTMINDED FORGETFULUL MONEY IS THE BEST MEASURE OF SUCCESS MAGAZINES MAIN SOURCE OF ENTERTAINMENT MAXWELL HOUSE REG GRND READ INFO ON LABEL MOST MAGAZINES ARE WORTH THE MONEY WIN LOTTERY WOULD NEVER WORK AGAIN LITTLE I CAN DO TO CHANGE MY LIFE MAKE SURE I TAKE EXERCISE REGULAR PAY ANYTHING WHEN IT CONCERNS MY HEALTH MAXWELL HOUSE INST ON WHOLE PEOPLE GET WHAT THEY DESERVEE I AM A WORKAHOLIC ADV GIVES TRUE PICTURE • Maxwell House Regular Ground & Maxwell House Instant have a nearly 100% positive correlation, meaning if you buy more of one, you buy more of the other (the brands are perceived very similar in the marketplace). JOB SECURITY IS MORE IMPORTANT CORRESPONDENCE MAPPING 90 Degree Angle: 0% Correlation CHIPS AHOY CHUNKY CABLE TV HAS TOO MANY CHANN; NEVER KNOW LISTEN TO RADIO FOR QUICK NEWS UPDATE BUY PRODS USE RECYCLE SPANISH ADS RESPECT MY HERITAGE PLAN AHEAD FOR EXP PURCHASES I ENJOY TAKING RISKS NO GOOD AT SAVING MONEY SHOP FOR SPECIALS COMPUTERS CONFUSE ME WILL NEVER GET USEE MUCH INFO AS POSS BEFOR BUY ELECT ITEM LOYAL TO COMPANIES WITH ADS IN SPANISH • Chips Ahoy Chunky and Oscar Mayer Hot Dogs OSCAR MAYER HOT DOGS form near a 90 degree angle and therefore have no correlation. CORRRESPONDENCE MAPPING 180 Degree Angle: 100% Negative Correlation AWKWARD ABSENTMINDED FORGETFULUL MONEY IS THE BEST MEASURE OF SUCCESS MAGAZINES MAIN SOURCE OF ENTERTAINMENT READ INFO ON LABEL MAXWELL HOUSE REG GRND MOST MAGAZINES ARE WORTH THE MONEY WIN LOTTERY WOULD JOB SECURITY IS NEVER WORK AGAIN MORE IMPORTANT LITTLE I CAN DO TO CHANGE MY LIFE MAKE SURE I TAKE EXERCISE REGULAR PAY ANYTHING WHEN IT CONCERNS MY HEALTH ON WHOLE PEOPLE GET WHAT THEY DESERVEE I AM A WORKAHOLIC ADV GIVES TRUE PICTURE • Maxwell House Regular Ground and Starbucks are opposite, meaning they have a negative correlation. If you buy more of one brand, you buy less of another (brands are perceived as opposites in the market). This is particularly helpful when looking at competitors in a market. STARBUCKS CLUSTER ANALYSIS • USED FOR SEGMENTING MARKETS BY GROUPING INDIVIDUALS WITH SIMILAR RESPONSES INTO DISCRETE GROUPS. – Respondents will be more like their group than outside their group, e.g., no overlap. – There is a greater probability of being in one group than any other. • A POWERFUL STATISTICAL TOOL FOR UNDERSTANDING CHARACTERISTICS AND RELATIONSHIPS. CLUSTER 3: TOP MAGAZINES CONSUMER REPORTS NEWSWEEK NAT GEO MARTHA STEWART LIVING U.S. NEWS & WORLD RPT TIME SOUTHERN LIV. MODERN MATURITY PEOPLE WKLY BETTER HOMES AND GRDNS SPORTS ILLUSTRATED PARADE MAG COSMO 100 110 120 130 140 150 Expected Frequency of Interest 160 EXPECTED BUYER BEHAVIOR Try doing this for a product you like and one you know little about. • Describe the expected buyer behavior profile of the market. – CONSUMER - use key items like demographics, psychographics, POP behavior, the marketing mix, classification of your product, and other relevant items to generally describe how buyers would purchase this item. – B2B – use industry [NAICS], application, quantity, purchasing patterns, the marketing mix, classification of your product, and other relevant items to generally describe how buyers would purchase this item.