Class notes growth convergence

advertisement

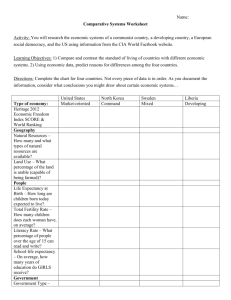

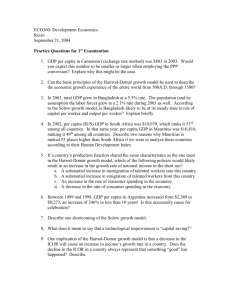

Growth and convergence Contents 1. The Solow model ............................................................................................................................. 2 1.1 The model .................................................................................................................................. 2 1.2 The steady state .......................................................................................................................... 3 2. Empirical evidence........................................................................................................................... 5 2.1 « Stylized facts » ........................................................................................................................ 5 2.2 Econometric evidence ................................................................................................................ 6 3. Conditional convergence ................................................................................................................. 7 3.1 The message ............................................................................................................................... 7 3.2 Empirical evidence..................................................................................................................... 8 4. Growth and poverty: long run tendencies ...................................................................................... 10 4.1 Growth per region .................................................................................................................... 10 4.2 Growth and global poverty ...................................................................................................... 14 References .......................................................................................................................................... 18 List of tables Table 1: Regression results of Mankiw, Romer and Weill (1992) ...................................................... 8 Table 2: Absolute and conditional convergence .................................................................................. 9 List of figures Figure 1: Graphical interpretation ........................................................................................................ 4 Figure 2: Evolution of the log of GDP per capita of a sample of countries from 1820 onwards ........ 5 Figure 3: Absolute convergence : growth as a function of initial GDP ............................................... 5 Figure 4: Initial GDP and growth, (a) 1980-90.................................................................................... 6 Figure 5: Distribution of national endowments in capital per worker, 1997 and 2007 ....................... 9 Figure 6: Divergence and convergence, 1990-2010 .......................................................................... 10 Figure 7: Growth across countries and time ...................................................................................... 11 Figure 8: Growth and poverty ............................................................................................................ 11 Figure 9: GDP per capita, 1960-95 .................................................................................................... 11 Figure 10: Real growth and price effects: Exports of East African countries, 2000-2010 ................ 12 Figure 11: Average growth per country and income growth of lowest quintile ................................ 14 Figure 12: Distribution of global household incomes, in dollars PPA .............................................. 15 Figure 13: Estimation of the absolute number of the poor, 1820-2020 ............................................. 17 Figure 14: GDP per capita and poverty in the DRC .......................................................................... 17 1 1. The Solow model Basic question: Do poor countries catch up to rich countries? « Should » they catch up (according to the models)? 1.1 The model Growth model with growth being « exogenous » (not determined in the model), as opposed to models with “endogenous growth”. Notation Y Aggregate output K Aggregate stock of capital L Labor force (# number of workers) k K/L : capital per worker y Y/L : output per worker I Investment s S/Y : Saving rate δ Rate of capital depreciation (7%) n Rate of growth in population. * k Capital per worker in steady state Production function Y K L1 (1) Y K L K / L L y k (2) K I K (3) L̂ n (4) Laws of motion Mathematical Digression: The derivative of the log of a variable with respect to time is approximately equal to its growth rate. In continuous time, the two are just equal. Take a process in time such as x f t 100t Where t denotes the time, which we take as continuous variable. The derivative of x with respect to time is given as 2 x f ' t dx 100 dt And its growth rate is xˆ 1 dx 100 100 1 x dt x 100t t But if we express this in logs ln x ln 100t ln 100 ln t The derivative of this log is d ln x 1 dt t Which is equal to the growth rate. Assumption about investment I sY (5) Investment equals savings, which in turn is a constant fraction of output. Strong simplification ! We assume a closed economy. 1.2 The steady state We can show that under certain not too unrealistic assumptions, there exists a steady state (true for the Cobb-Douglas function used in this chapter) Def. We define the steady state by k 0 (capital per worker K / L is constant) or k̂ n . K KL KL KL K L k 2 L L2 L L L K kLˆ L k (6) sY I K kLˆ L sY K kn L sy k kn sy n k k k sk n k 3 (7) By definition, k 0 in the steady state n k sy sy sk n n s k 1 n k 1 s 1 k n * s y* n 1 (8) The idea that the value of the capital stock per worker will at one day stop growing may sound a bit weird, but is ok in this context. Figure 1: Graphical interpretation Prop. 1. (steady state) If all countries have (more or less) the same rates of population growth, if the technology (denoted by α) is the same, then the differences in savings rates (which is to say also the rates of investment as investment and savings are equal in this model) completely explain the differences in output per capita if all countries are in their steady state. Prop. 2 (transition) For countries that are not yet in their steady state, the rate of growth of the capital stock and of output per worker slow down the more they approach the steady state. So if the poor countries are far away from their steady state, they should have a growth rate that is higher. One should therefore expect to observe convergence. Note that if we were to relax the 4 assumption that investment equals savings (no capital mobility), capital would migrate from rich countries (lots of capital, hence low return) to poor ones, which would reinforce convergence. 2. Empirical evidence 2.1 « Stylized facts » At a first glance, income levels seem to diverge instead of displaying convergence: Figure 2: Evolution of the log of GDP per capita of a sample of countries from 1820 onwards And at a second glance ? Baumol (1980) shows, using historical data of Maddison, that the OECD countries have experienced an astonishing convergence. The basic graph that we will use throughout the course is a scatterplot (one point per country) in a diagram o The initial GDP on the horizontal axis o The growth rate on the vertical axis. If the regression line has a positive slope, we abserve an unconditional divergence (which means divergence independent of other characteristics of the countries); if the slop is negative, there is convergence. Figure 3: Absolute convergence : growth as a function of initial GDP 5 Source : De Long (1988) But De Long (1988) has shown that the observation of Baumol (1980) that was limited on OECD countries suffered from a severe selection bias and that the data ofBen David (1991) does not suggest any convergence. The graph is very easy to reproduce with data of the World Development Indicators : -1 -.5 0 .5 1 Figure 4: Initial GDP and growth, (a) 1980-90 4 6 8 lggdppc1980 GDP per cap real growth 1980-1990 10 12 Fitted values Source : WDI 2.2 Econometric evidence Take as an example the classic paper of Mankiw, Romer et Weill (1992). sy n k 6 (9) where π is an adjustment factor of the differences in the productivity of labor. Slightly rewriting, 1 1 y y s s 1/ sy n k y or y 1 1 n (10) s s n 1 1 y s n (11) Finally we we take logs to get a linear expression in order to use OLS ln yi ln si ln ni i ui 1 1 1 (12) 2 We want to test the predictions of the model. Those are 1 0 , 2 0 , 2 1 . In addition, it can be shown (I spare you the proof) that α is the share of capital in GDP. We know from national accounts in most countries that this share is about one third. So we should have approximately 1 1 / 3 / 1 1 / 3 1 / 2 . All we have to do now is to take a cross-section of countries and to test Proposition 1. Results : ˆ1 1.42 , standard deviation 2 0.14. So t = 1.42/0.14 = 9, significant at 1%. Qualitatively (sign and significance of the coefficient), that’s alright. Quantitatively, however, the size of the coefficient is way too large (1.42 instead of about 0.5). So we have a problem. 3. Conditional convergence 3.1 The message We’re still using Mankiw, Romer and Weill. The idea is to go back to the model and argue that the steady state should depend on factors other than just the savings rate. For instance, suppose that the production function is Y K L1 H (13) where H is « human capital ». The steady state now depends on human capital: it is different for each country, and a poor country may have low growth if it is near its own, low steady state. 7 3.2 Empirical evidence We see in Table 1 that when including the initial level of education (ln(SCHOOL)) we get a coefficient on ln(I/GDP) that is closer to the theoretical value (0.69 for non-exporters of petrol, 0.7 for middle-income countries and 0.28 for OECD countries). The second part of the table shows the result of a regression in which the constraint on the equality of coefficients on the savings rate and on the term ln(n + g + δ) is imposed; this constraint is implied by theory, see (12). The test of this restriction has a p-value of 0.41, which means that we cannot recjet the null hypothesis of the equality of the coefficients. But ist that because they are really equal or is it that the sample is too small to reject the null? Finally, observe that if we regress growth on initial GDP and nothing else (equivalent to the scatterplot), convergence is not verified: The coefficient on initial GDP is positive in the first column of Table III (non-oil developing countries), insignificant in the second (intermediateincome countries, and negative and significant only for OECD countries—back to the “Baumol problem”. However, convergence is back once we include other factors as implied by theory. Table 1: Regression results of Mankiw, Romer and Weill (1992) 8 Table 2: Absolute and conditional convergence Error! Reference source not found. (continued) Having said this, the capital accumulation seems to follow more agglomeration forces than yield spreads, because the data on capital endowment indicates divergence. Figure 5: Distribution of national endowments in capital per worker, 1997 and 2007 9 .01 .008 .006 .004 .002 distribution World 1997 World 2007 Uganda 2007 0 Uganda 1997 0 50 100 150 200 Physical capital per worker, thousand dollars 250 Data source: UNCTAD 4. Growth and poverty: long run trends 4.1 Growth at the region level Despite this, we observe global and unconditional convergence in the last ten years (the first time since the data is collected) in Figure 6. Figure 6: Divergence and convergence, 1990-2010 (b) 2000-2010 -1 -1 0 0 1 1 2 2 3 3 (a) 1990-2000 4 6 8 lggdppc1990 GDP per cap real growth 1990-2000 10 12 4 Fitted values 6 8 lggdppc2000 GDP per cap real growth 2000-2010 Source : WDI … which explains the renewed growth in the last decade (Figure 7) 10 10 Fitted values 12 Figure 7: Growth across countries and time (a) all countries (b) Developed countries vs. Developing countries Note : Each point is an average for all countries of a category in one year. We could therefore connect all the points (or all the triangles, or all the squares) to get one curve. Instead of doing this, the plotted curves are smoothed over time to eliminate visible annual fluctuations in the dispersion of the points Source: Rodrik (2011) And the gain in growth is particularly spectacular for Africa : Figure 8: Growth and poverty (a) Growth of GDP per capita, 1950-2010, per (b) GDP per capita and absolute poverty rate in Subregion Saharan Africa Note : In the first panel (a), growth is displayed in algebraical value, so 0.02 = 2% etc. Source: Rodrik (2011) for panel (a) and Sala-i-Martin and Pinkowskiy (2010) for panel (b). …which begins to partly revers the « great divergence between Asia and Africa after the 1960s (Figure 9—compare what is measured on the vertical axes in Figure 8 and Figure 9) Figure 9: GDP per capita, 1960-95 (a) Base 100 = 1960 (b) Real 11 600 3'000 500 East Asia & Pacific (developing only) 2'500 East Asia & Pacific (developing only) 400 Sub-Saharan Africa (developing only) 2'000 Sub-Saharan Africa (developing only) 300 1'500 200 1'000 100 500 - - 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 Note : GDP per capita (constant 2005 US$) Source World Bank, World Development Indicators Is this just another “commodities boom”? Not only. During the previous commodities booms, the price effects dominated the quantity effects. This is not the case this time. Example: Growth of exports of a sample of East African countries, 2001-2010 Figure 10: Real growth and price effects: Exports of East African countries, 2000-2010 16.00 14.00 Volume 12.00 Price 10.00 8.00 6.00 4.00 2.00 0.00 -2.00 Uganda Tanzania Kenya Rwanda Mauritius -4.00 Source : World Bank (2012) However, all is not rosy for Africa. Rodrik (2014) argues that convergence takes place only in manufacturing, as shown in Figure 11: Figure 11: Absolute convergence, economywide and manufacturing sector only (a) Economy-wide (b) Manufacturing sector only 12 Croissance a/ Croissance suséquente a/ Log PIB par travailleur initial Log productivité par travailleur initiale Source: Rodrik (2014), Figure I and III This implies that only manufacturing is a growth engine sufficiently powerful to ensure convergence. The problem is that sub-Saharan Africa is not industrializing. In fact, it is deindustrializing. In general, the share of manufacturing value-added in GDP follows an inverse-U shape with the (log) level of income, as shown in Figure 12. In the case of African countries, the is a big difference between the resource-rich ones (red) and the resource-poor ones (blue ones), with the resource-rich attaining their peak very early. In the case of resource-poor ones, there doesn’t seem to be a peak but it’s all driven by two special cases, Mauritius (a middle-income country) and Swaziland (a South-African “colony”). .3 SWZ .2 VA manuf./PIB .4 .5 Figure 12: Manufacturing value-added and development 0 .1 MUS 4 6 8 Log PIB/hab Autres pays ASS PRR Tendance, ASS PPR 10 12 ASS PPR Tendance, autres pays Tendance, ASS PRR If one looks at individual trajectories, the de-industrialization is clear, even for countries that are considered, by and large, to be doing okay like Ghana (Figure 13): Figure 13: Ghana’s premature de-industrialization 13 15.0 1975 1976 . 1969 1970 1973 1971 1972 1974 1977 1986 1965 1993 1966 2006 . . . .. 2002 . . . 2003 1989 . 2000 . 2007 . 1978 2004 2005 1988 1991 1985 10.0 VA manuf., % du PIB 1967 1980 2008 1984 2011 2009 2010 2012 2013 5.0 1981 1982 300 400 500 600 700 800 PIB par hab. VA manuf., % du PIB VA manuf., % du PIB From this data, Rodrik concludes that Africa is not “out of the wood” yet. That’s probably true, but the idea that productivity in services never converges is probably a bit exaggerated, as shown by the example of the transportation sector in Figure 14. Figure 14: Productivity convergence in transportation Note: The horizontal axis is the log of labor productivity in the initial year of the database and the vertical one measures the growth in labor productivity over the subsequent 10 years or so. Source: Compiled from firm-level data from the Orbis database by Dany Bahar. 4.2 Growth and global poverty Does the growth imply a reduction in poverty? A cross sectional regression of countries (Dollar et Kray, 2001) suggests that the average income growth per country transmits more or less one to one to growth in income of poorest 20% of the population of each country – in other words, there is no divergence within countries (a bit sloppy as demonstration, but ok) Figure 15: Average growth per country and income growth of lowest quintile 14 Source : Dollar et Kray (2005) Sala-i-Martin (2003) reconstructs the distribution of global income from surveys of existing households in countries where they are available, repeating the exercise for 1970, 80, 90 et 98. The results were controversial, but nonetheless interesting: Figure 16: Distribution of global household incomes, in dollars PPA a) 1970 b) 1980 15 c) 1990 d) 1998 Source : Sala i Martin (2002) 16 For certain countries like China, there has been both an increase in average income and rising inequality (the distribution becomes “flatter”). In total, the share of the global population that lives in absolute poverty (less than one dollar PPA per day adjusted for inflation) has been substantially reduced over the last 30 years, especially in China and India. We find similar indications in Bourguignon (2004) who calculated the absolute number of the poor in the world since 1870. Whatever the uncertainties in the calculations for the 19th century, the surprising fact is the rapid decline in the number of poor people during the last 20 years. The global financial crisis has only partly distorted this trend. Figure 17: Estimation of the absolute number of the poor, 1820-2020 1800 1600 1400 1200 1000 800 Nombre absolu de pauvres sur la planète, en millions 600 400 200 1820 1830 1840 1850 1860 1870 1880 1890 1900 1910 1920 1930 1940 1950 1960 1970 1980 1990 2000 2010 2020 0 Sources : Data combined from the World Bank (2002), Globalization, Growth and Poverty: Building an Inclusive World Economy (until 2000) and Chandy, Laurence, and G. Gertz 2011, "Poverty in numbers: the changing state of global poverty from 2005 to 2015; Brookings, 2011, for 2000-2013 (estimations) The result is that the extreme poverty is more and more concentrated in «fragile states », where the most tragic is the Democratic Republic of Congo (Figure 18). Figure 18: GDP per capita and poverty in the DRC Source: Sala-i-Martin and Pinkowskiy (2010) 17 References Chandy, Laurence, and G. Gertz 2011, "Poverty in numbers: the changing state of global poverty from 2005 to 2015; mimeo; Washington: Brookings Institution. Dollar, David, and A. Kraay (2004), “Trade, Growth, and Poverty”; Economic Journal 114, F22F49. Rodrik, Dani (2011), « The Future of convergence »; Kennedy School Discussion paper RWP 11033; Cambridge, MA: Harvard University. — (2013), “Unconditional Convergence in Manufacturing”, Quarterly Journal of Economics Vol. 128(1), pages 165-204. — (2014) “An Africa Growth Miracle”, CEPR DP #10005. Sala-i-Martin, Xavier (2002), “The World Distribution of Income (estimated from Individual Country Distributions)”; NBER Working Papers 8933, Boston, MA: National Bureau of Economic Research. Sala-i-Martin, Xavier, and Maxim Pinkovskiy (2010), “African Poverty Is Falling...Much Faster Than You Think!” NBER Working Paper 15775; Boston, MA: National Bureau of Economic Research. World Bank (2002), Globalization, Growth and Poverty: Building an Inclusive World Economy; Washington, DC: The World Bank. 18