WAVE 2 - Open Evidence Project

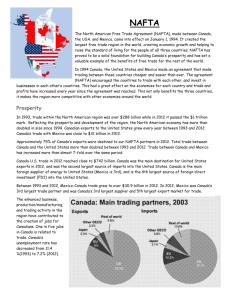

advertisement