Modern supply chains are making it easier for economies

advertisement

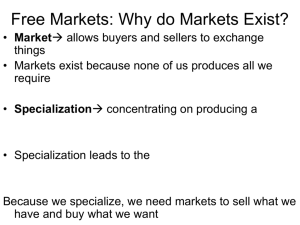

Free exchange Chains of gold Modern supply chains are making it easier for economies to industrialise Aug 4th 2012 | from the print edition http://www.economist.com/blogs/freeexchange/2012/08/growth GETTING rich used to be tough. For most of the past two centuries, few countries managed it. Lant Pritchett, an economist now at Harvard’s Kennedy School of Government, wrote in 1997 that “divergence, big time” between the rich and the rest was “the dominant feature of modern economic history.” But those stubborn gaps have begun to close. Industrialisation is suddenly everywhere. Since the mid-1980s, emerging markets have grown faster than advanced economies (see chart). Liberal reforms and sound macroeconomic management surely helped. Yet recent research by Richard Baldwin of the Graduate Institute in Geneva suggests it is not so much the developing world that has changed as development itself. Today’s emerging markets face a different sort of globalisation than their predecessors 50 or 100 years ago. Most advanced economies industrialised as part of what Mr Baldwin calls globalisation’s first great unbundling: the geographical separation of producers and consumers. Early in the industrial era, high transport costs restricted trade. Expensive shipping limited most manufacturers to sales within the same city or country. But as the industrial revolution progressed, steamships and railways slashed transport costs, exposing firms to foreign competition for the first time. The most productive firms were those best able to take advantage of economies of scale. A single large plant could produce goods at a lower unit cost than lots of smaller factories, and a cluster of large suppliers at lower cost still. Production clustered in massive cities in a few economies. Catching the leaders meant building an entire supply chain from the ground up—and in the teeth of competition. Development was slow, laborious and rare. Japan and South Korea grew industries from modest beginnings. They entered global markets with inferior but cheap products, often supported by state aid, then slowly improved their technical competence. Painstaking accumulation of technological skill eventually enabled innovative multinational firms to emerge. Japanese and South Korean incomes converged with those in western Europe. Other emerging economies tried gamely to duplicate this success, to little avail. Aggressive industrial policies often strained government resources without delivering a critical mass in industry or the human capital needed for development. A new model began to emerge in the 1980s. Lower transport costs were a catalyst. Yet more important, reckons Mr Baldwin, was a budding revolution in information and communication technology (ICT). Cheaper communications allowed firms to manage supply chains over ever greater distances. Companies discovered they could build plants in cheap locations, ship components there to be assembled and export the finished product around the world. While the first unbundling separated producing markets from consuming markets, the second broke up production entirely across long, multinational supply chains. That made industrialisation a cakewalk compared with earlier times. A business-friendly government and cheap workers were often sufficient to get started; foreign firms provided technology and management. Emerging markets quickly signed on. Trade data analysed by Robert Johnson of Dartmouth College and Guillermo Noguera of Columbia University track the shift. Along multinational supply chains, they note, a single component may be exported several times, adding to tallies of gross trade but not to measures of value added. A fall in the ratio of the two measures (which they call the VAX) signifies an increase in supply-chain fragmentation. On this score, 1990 seems a critical point, after which the VAX sinks while trade volumes soar (see chart). Emerging-market growth surged at roughly that time. Faster growth may be fickle growth, says Mr Baldwin. Whereas previous tigers built a deep technological capacity, many emerging markets now merely “borrow” technology from rich-world firms. Multinationals have an incentive to limit technology transfer, the better to preserve the bargaining power that comes with a credible threat to leave. Learning can still occur. China uses its size as leverage to extract concessions, often confining direct inward investment to joint ventures between foreign and domestic firms, for instance. Smaller markets lack that option. The limited spillovers from supply-chain industrialisation may leave them stuck in middle-income status. And there is always the risk that chains may shift again, leaving them high and dry. Some worry that sprawling supply chains may allow ill winds from abroad to blow in more easily. But evidence suggests that supply-chain trade may have declined less and recovered faster than overall trade during the financial crisis. Japan’s 2011 earthquake echoed across the world but also demonstrated the system’s capacity for quick recovery. The more tenuous nature of supply-chain industrialisation may encourage governments to work harder to support trade and recovery in response to a crisis. Ships and chips The second unbundling has yet to banish distance. In a different paper, Messrs Johnson and Noguera find that supply-chain fragmentation has been greatest among neighbours. This has given rise to regional industrial clusters. Regional trade agreements are partly responsible, but time costs may be more important. ICT improvements have also made production more nimble, capable of just-in-time manufacturing and frequent design changes. Timely shipments of components are indispensable. Indeed, an analysis by David Hummels of Purdue University and Georg Schaur of the University of Tennessee estimates that a day in transit is equivalent to a tariff of between 0.6% and 2.3%, with the largest effects for parts and components trade. Industrialisation is now within easy reach of poor countries, provided they’re within easy reach of industrialisation. The end of deep development Aug 6th 2012, 13:19 by R.A. | WASHINGTON IT IS amazing how quickly prevailing views of the challenge of economic development have changed. As recently as the 1990s, catch-up economic growth was widely seen as really difficult to achieve, at least on any sustained basis. Postwar Europe managed it, as did Japan, South Korea, Taiwan, and a couple of Asian city-states. But for most of last century, and despite the concerted efforts of developing-economy governments, rich economies grew faster than emerging economies, widening the broad gap in incomes. Then, everything changed. Since the early 1990s, emerging markets have routinely and often substantially outgrown the rich world. The assumption is now that a place must be very badly governed indeed not to participate in economic catch-up growth. What happened? This week's Free exchange column looks at an explanation offered by economist Richard Baldwin: Most advanced economies industrialised as part of what Mr Baldwin calls globalisation’s first great unbundling: the geographical separation of producers and consumers. Early in the industrial era, high transport costs restricted trade. Expensive shipping limited most manufacturers to sales within the same city or country. But as the industrial revolution progressed, steamships and railways slashed transport costs, exposing firms to foreign competition for the first time. The most productive firms were those best able to take advantage of economies of scale. A single large plant could produce goods at a lower unit cost than lots of smaller factories, and a cluster of large suppliers at lower cost still. Production clustered in massive cities in a few economies. Catching the leaders meant building an entire supply chain from the ground up—and in the teeth of competition. Development was slow, laborious and rare. Japan and South Korea grew industries from modest beginnings. They entered global markets with inferior but cheap products, often supported by state aid, then slowly improved their technical competence. Painstaking accumulation of technological skill eventually enabled innovative multinational firms to emerge. Japanese and South Korean incomes converged with those in western Europe. Other emerging economies tried gamely to duplicate this success, to little avail. Aggressive industrial policies often strained government resources without delivering a critical mass in industry or the human capital needed for development. A new model began to emerge in the 1980s. Lower transport costs were a catalyst. Yet more important, reckons Mr Baldwin, was a budding revolution in information and communication technology (ICT). Cheaper communications allowed firms to manage supply chains over ever greater distances. Companies discovered they could build plants in cheap locations, ship components there to be assembled and export the finished product around the world. While the first unbundling separated producing markets from consuming markets, the second broke up production entirely across long, multinational supply chains. That made industrialisation a cakewalk compared with earlier times. A business-friendly government and cheap workers were often sufficient to get started; foreign firms provided technology and management. Emerging markets quickly signed on. Trade data analysed by Robert Johnson of Dartmouth College and Guillermo Noguera of Columbia University track the shift. Along multinational supply chains, they note, a single component may be exported several times, adding to tallies of gross trade but not to measures of value added. A fall in the ratio of the two measures (which they call the VAX) signifies an increase in supply-chain fragmentation. On this score, 1990 seems a critical point, after which the VAX sinks while trade volumes soar (see chart). Emerging-market growth surged at roughly that time. One potential problem with this model, as Mr Baldwin points out, is the fragility of superfast, supply-chain development. At some point, additional shifts in technology may lead the supply chain to move again. If the developing economy has managed to accumulate less technological knowledge in the meantime, then it might find itself in a very difficult economic situation. This is no small concern. The paper concludes by pointing out that time costs continue to be an important factor in shaping the structure of supply chains. Because supply chains are meant to be nimble and it still takes some amount of time to physically move goods, supply chains still have a gravity that leads them to cluster into regions: Factory Asia, Factory Europe, and Factory North America, for instance. Proximity to Factory Asia is an extremely powerful developmental force for places like Vietnam. But what happens when firms are able to print components on demand? At some point, of course, 3D printing might eliminate supply chains entirely. One suspects that its first victims, however, will be places that have relied on low labour costs and geography to capture the most basic of supply-chain roles. Though it's possible, of course, that low-wage assembly jobs will be the last thing to go and actual component manufacture, which could include more highly skilled work, will be the most vulnerable. Either way, one suspects that the change will help rich-world designers and consumers capture some of the value (if not the employment) that has in recent decades been shifting to distance supply chains.