EPRI Studies of IGCC

Impacts – Emissions, Economics

and Status

APPA New Generation Workshop

August 1, 2007

Portland, Oregon

Stu Dalton (sdalton@epri.com)

Director, Generation

U.S. Capacity Additions – All Types

Evaluation of Announcements, 1999 to 2015, as of Fourth Qtr. 2006

Capacity, MW

60,000

US Still

depends on

coal for >50%

of KWh

50,000

40,000

Other

Wind

Nuclear

Coal

Combustion Turbine

Combined Cycle

Retirements

30,000

20,000

10,000

0

-10,000

1999

2001

2003

2005

2007

2009

2011

2013

2015

“Other” includes biomass, solar, hydro, internal combustion, geothermal, pet coke or any other type with announcements available to investigator.

Capacity additions for each year prior to summer peak load season.

Source: Forthcoming “Power Plant Update” prepared for EPRI Program 67 by EVA.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

2

New Technology Deployment Curve for Coal

Research

Development Demonstration

Deployment

Mature Technology

Advanced USCPC Plants

Anticipated Cost of Full-Scale Application

1400°F

CO2

Capture

1150°F+

USCPC Plants

1150°F+

1100°F

IGCC Plants

Oxyfuel

<1100°F

SCPC Plants

CO2 Storage

Time and level of maturity

Not All Technologies at the Same Level of Maturity.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

3

1050°F

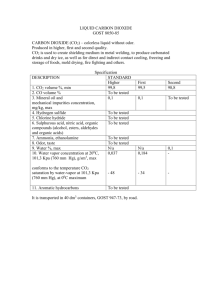

Coal Technology Options – w/o CO2 Capture

(approximate data)

NSPS = New Source Performance Standards

PC = Pulvervized Coal

SCPC = Supercritical PC

USPC = Ultra-Supercritical

IGCC = Integrated Gasification

NGCC = Natural Gas

Efficiency

(HHV Basis)

PRB

Bit.

Regulated

SO2

lb/MW-hr

NOX

lb/MW-hr

Particulate

lb/MW-hr

Mercury

NonRegulated

% Reduction

CO2

lb/MW-hr

Water Usage

gal/MW-hr

NSPS

2006

PC Fleet

Average

SCPC

USPC

IGCC

NGCC

(1050°F Steam)

w/ SCR

(1100°F Steam)

w/ SCR

(CoP E-Gas)

w/ SCR

(GE 7FB)

w/ SCR

--

33%

37%

38%

38%

39%

38%

39%

50%

1.4

13

0.3

1.1

0.3

1.1

<0.1

nil

1.0

6

<0.3

<0.5

<0.3

<0.5

<0.2

<0.1

0.2

1

<0.2

<0.2

<0.1

nil

--

~36%

80%

80%

90%

--

--

2,250

1,950

1,900

1,900

1,850

1,850

1,800

800

--

1,200

1,100

1,000

750

600

Relative Emissions Profiles for PC and IGCC are Very Low.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

4

Plant Construction Costs Escalating

Construction Cost Indices

(Source: Chemical Engineering Magazine, March 2007)

1,400

Chemical Engineering Plant Cost Index

540

1,350

Marshall & Swift Equipment Cost Index

520

1,300

500

1,250

480

1,200

460

1,150

440

1,100

420

1,050

400

1,000

380

Jun-98

Jun-99

Jun-00

© 2007 Electric Power Research Institute, Inc. All rights reserved.

Jun-01

Jun-02

Jun-03

5

Jun-04

Jun-05

Jun-06

950

Jun-07

Marshall & Swift Equipment Cost Index

Chemical Engineering Plant Cost Index

560

Capital Cost Estimates in Press

Announcements and Submissions to PUCs

2006-7 — All Costs Are Way Up!

Owner

Plant Name/

Location

Net MW

Technology/C

oal

Reported

Capital

$ Million

Reported

Capital $/kW

AEP

SWEPCO

Hempstead,

AR

600

USC PC/PRB

1680

2800

AEP

PSO/OGE

Sooner, OK

950

USC PC/PRB

1800

1895

AEP

Mountaineer,

WV

629

GE RQ IGCC/

Bituminous

2230

3545

Duke Energy

Edwardsport,

IN

630

GE RQ IGCC/

Bituminous

1985

3150

Duke Energy

Cliffside, NC

800

USC PC/Bit

2400

3000

NRG

Huntley, NY

620

IGCC/Bit, Pet

Coke, PRB

1466

2365

Otter Tail/GRE

Big Stone, SD

620

USC PC/PRB

1500

2414

Southern Co

Kemper

County, MS

600

KBR IGCC

Lignite

1800

3000

© 2007 Electric Power Research Institute, Inc. All rights reserved.

6

EPRI PC and IGCC Net Power Output With

and WithoutEPRI

COPC

#6 Coal)

and IGCC Net(Illinois

Power Output

2 Capture

With and Without CO2 Capture (Illinois #6 Coal)

800

No Capture

Net Power Output, MWe

.

700

Retrofit Capture

New Capture

600

500

400

300

200

100

0

Supercritical

PC

© 2007 Electric Power Research Institute, Inc. All rights reserved.

GE Radiant

Quench

GE Total

Quench

7

Shell Gas

Quench

E-Gas FSQ

EPRI PC and IGCC Capital Cost Estimates

With and Without CO2 Capture (Illinois #6 Coal)

600 MW

(net)

PC+10%

and IGCC

Capital Cost

Estimates

(All IGCCEPRI

and CCS

cases

have

Contingency

for FOAK)

With and Without CO2 Capture (Illinois #6 Coal)

5,000

Retrofit Capture

.

Total Capital Requirement, $/kW (2006$)

No Capture

4,500

New Capture

4,000

3,500

3,000

2,500

2,000

1,500

Supercritical

PC

© 2007 Electric Power Research Institute, Inc. All rights reserved.

GE Radiant

Quench

GE Total

Quench

8

Shell Gas

Quench

E-Gas FSQ

EPRI PC and IGCC Cost of Electricity

With and Without CO2 Capture (Illinois #6 Coal)

EPRI

600

MW have

(net) +10%

PC and

IGCC

Cost of Electricity

(All IGCC and

CCS

cases

TPC

Contingency

for FOAK)

With and Without CO2 Capture (Illinois #6 Coal)

30-Yr levelized COE, $/MWh (Constant 2006$)

.

130

No Capture

120

Retrofit Capture

COE Includes $10/tonne for CO2 Transportation and Sequestration

New Capture

110

100

90

80

70

60

50

40

Supercritical

PC

© 2007 Electric Power Research Institute, Inc. All rights reserved.

GE Radiant

Quench

GE Total

Quench

9

Shell Gas

Quench

E-Gas FSQ

Basis for EPRI CoalFleet Program 2006 PC & IGCC

Estimates Report 1013355 - Nth and FOAK

(First of a Kind)

• Total Plant Costs (TPC) include total field costs, engineering, and contingency.

Historically, usually estimated for Nth-of-a-kind plants.

• FOAK costs have not typically been included in previously reported estimates.

However, in view of the current SOA and rapidly escalating costs, an

additional 10% contingency has been added to the IGCC and CO2 capture

designs.

• TCR is also reported because it is believed to be closer to what is reported to

PUCs in project submissions

• For PC plants, EPRI has used a TCR/TPC multiplier of 1.16, and estimates are

shown as range -5% to +10%

• For IGCC plants, EPRI has used a TCR/TPC multiplier of 1.19, and estimates

are shown as range -5% to +20%

• Most previous studies reported cost of capture at the battery limit. In this report,

we have added $10/mt for transportation, monitoring, and storage. So reported

costs include CCS.

• We recognize that the use of these additional contingencies, multipliers, and

ranges for IGCC and CO2 capture is debatable. It is anticipated that they

should be reduced as the technologies mature.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

10

Challenge = Cost

… Recent EPRI Economic Evaluations of SOA Coal

Technologies with CO2 Capture and Sequestration (CCS)

• At the current state-of-the art (SOA) there is no “silver bullet”

technology for CCS. Technology selection depends on the

location, coal, and application.

• IGCC/Shift is least cost for bituminous coals

• IGCC/Shift and PC plants with amine scrubbing have similar

COE for high-moisture subbituminous coals

• PC with amine scrubbing is least cost for lignites

• CFBC can handle high-ash coals and other low-value fuels

• Oxy-fuel (O2/CO2 Combustion) and chemical looping are

technologies at developmental stage

© 2007 Electric Power Research Institute, Inc. All rights reserved.

11

Coal Characteristics Drive Technology

Selection

IGCC w/ CCS

Bituminous Coal

Sub-Bituminous Coal

PC w/ CCS

Usually Favored

Water use limits

Lower elevation

Lower moisture

Lower ash

Higher elevation

Higher moisture

Higher ash

Higher ambient temp.

Lignite Coal

Usually Favored

Nth Plant Economics

© 2007 Electric Power Research Institute, Inc. All rights reserved.

12

Integrated Gasification Combined Cycle

(IGCC) With CO2 Removal

Coal

Air

ASU

Gasifier

Sulfur

CO2

Gas

Clean

Up

Shift

O2

CC

Power

Block

Power

H2

Slag

Steam

IGCC with CO2 Capture

(e.g., FutureGen, Carson

Hydrogen Power Project)

Shift

Reactor

CO2 Compressor

Sulfur

Recovery

Needs Space, Energy and Integration.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

CO2

Sulfur Product

13

CO2

Recovery

(e.g., Selexol

2nd stage)

Coal Gasification Plants w/CO2 Capture (USA

Today)

• IGCC and CO2 removal offered commercially:

– Have not operated in an integrated manner

• Three U.S. non-power facilities and many

plants in China recover CO2

– Coffeyville

– Eastman

– Great Plains

The Great Plains Synfuels Plant

http://www.dakotagas.com/Companyinfo/index.html

• Great Plains recovered CO2 used for EOR:

– 2.7 million tons CO2 per year

– ~340 MWe if it were an IGCC

No Coal IGCC Currently Recovers CO2

© 2007 Electric Power Research Institute, Inc. All rights reserved.

14

Weyburn Pipeline

http://www.ptrc.ca/access/DesktopDefault.aspx

Pulverized Coal With CO2 Capture “Today”

Fresh Water

Coal

Air

PC

Boiler

Steam

Turbine

Reduce

NOx

Reduce

Ash

SCR

ESP

Fly Ash

Reduce

Sulfur

CO2 to Use or

Sequestration

CO2

Removal

e.g., MEA

FGD

Flue Gas

to Stack

CO2 to Cleanup

and Compression

Gypsum/Waste

Cleaned Flue Gas

to Atmosphere

CO2

Stripper

• Pre-condition Flue Gas (Clean)

less than 1 PPM SOx allowed?

• Absorb CO2

• Strip CO2

• Requires significant energy

Absorber

Tower

Flue Gas

from Plant

CO2

Stripper

Reboiler

Needs Space, Integration and Energy.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

15

US Coal Units Operating Units w/ CO2 Capture

(Today)

• Three U.S. small plants in operation today:

– Monoethanolamine (MEA) based

• CO2 sold as a product or used:

– Freezing chickens

– Soda pop, baking soda

– ~140 $/ton CO2 (claim by operators)

• 300 metric tons recovered per day:

– ~15 MWe power plant equivalent

• Many pilots planned and in development:

– 5 MW Chilled Ammonia Pilot

– Many other processes under development

AES Cumberland ~ 10 MW

EPRI

CO2

(Report 1012796)

Assessment of PostCombustion Carbon

Capture Technology

Only Demonstrated on a Small Scale to Date.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

16

Challenge- Regulatory Uncertainty on CO2

Emissions

•

•

•

•

Kyoto Signatory Countries post 2012. New G-8 Proposals

New Motion in Australia, EU

US proposed Federal legislation Intense in Washington – MANY bills

US Regional Initiatives

– Western Regional Climate Action (WA,OR,CA,AZ, and NM).

Western Governors Association (WGA)

– RGGI – East Coast Regional GHG Initiative (10 NE States)

– Powering the Plains (ND,SD,IA,MN,WI, Manitoba)

• California, Washington - others…

– New long term base load power or renewal (>5years)

commitments shall have CO2 emissions no greater than NGCC

(established as <1100 lbs/MWh ~ 500 kg/MWh).

• Liability of CO2 injection into geological formations? New questions

with BP “Carson Hydrogen Power Project” project in California

© 2007 Electric Power Research Institute, Inc. All rights reserved.

17

Preparing for Carbon Constraints

Variation of Plants

Variation Geology

CO2 Capture

• Plant Efficiency

• Capture Technology

• Capture Pilots

• Capture Demonstrations

Confirmed Long Term

Sequestration

Address Societal

Concerns

• Test Multiple Geologies

• Liability

• Well Integrity

• Health

• Monitoring

• Public Acceptance

Multiple Challenges Requiring Concurrent Resolution.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

18

CoalFleet for Tomorrow is an International

Collaboration on Clean Coal including CO2 Capture

• Participants from 5 continents , Asia, Australia, Europe,

Africa, North America (2/3 of all coal fired in NA)

• Best design guides developed by industry for industry

• Power Producers, Suppliers, Rail, Coal, engineering

firms, Governmental entities

• Many of the leading “early deployment” firms working with

us to assure successful designs that meet the

performance and operational goals

• New plants starting to look at designs for CO2 capture and

integration

© 2007 Electric Power Research Institute, Inc. All rights reserved.

19

CoalFleet Participants Span 5 Continents

>60% of U.S. Coal-Based Generation, Large European Generators,

Major OEMs (50 & 60 Hz) and EPCs, CEC, U.S. DOE

Alliant Energy Corp.

Alstom Power

Ameren Services Company

American Electric Power

Arkansas Electric Coop.

Austin Energy

Babcock & Wilcox Company

Bechtel Corp.

BP Alternative Energy International

California Energy Commission

ConocoPhillips Technology

Consumers Energy

CPS Energy

CSX Transportation

Dairyland Power Coop.

© 2007 Electric Power Research Institute, Inc. All rights reserved.

20

Doosan Heavy Industries (Korea)

Duke Energy Corp.

Dynegy

EdF (France)

Edison International

Edison Mission Energy

Endesa (Spain)

ENEL (Italy)

Entergy

E.ON UK

E.ON US

ESKOM (South Africa)

Exelon Corp.

FPL

GE Energy (USA)

Golden Valley Electrical Assoc.

CoalFleet Participants Span 5 Continents

(cont’d)

Great River Energy

Hoosier Energy

Integrys Energy Group (WPS)

Jacksonville Electric Authority

Kansas City Power & Light

Kellogg Brown & Root (KBR)

Lincoln Electric System

Midwest Generation

Minnesota Power

Mitsubishi Heavy Industries (MHI)

Nebraska Public Power District

New York Power Authority

Oglethorpe Power

PacifiCorp

PNM Resources

Portland General Electric

© 2007 Electric Power Research Institute, Inc. All rights reserved.

21

Pratt & Whitney Rocketdyne

Richmond Power & Light

Rio Tinto

Salt River Project

Siemens

Southern California Edison

Southern Company

Stanwell Corporation

TransCanada Pipelines Limited

Tri-State G&T

TVA

TXU

U.S. DOE (NETL)

We Energies

Wolverine Power

Xcel Energy

What’s Next – What’s Needed for Coal

• Acceleration of the Industry efforts worldwide in

addition to governmental efforts – new pilots,

demonstrations, initiatives

• Cost reductions and efficiency improvements for the

underlying technology

• Three “strata” of certainty/understanding

– Political/siting, economic, technical

© 2007 Electric Power Research Institute, Inc. All rights reserved.

22

Backup sides

© 2007 Electric Power Research Institute, Inc. All rights reserved.

23

IGCC with CO2 Removal

Steam

Coal

Prep

Gasification

C + H2O =

CO + H2

O2

Sulfur

Shift

CO+ H2O =

CO2 + H2

Gas Cooling

CO2 to use or sequestration

Sulfur and

CO2

Removal

Hydrogen

N2

Air

Separation

Unit

Gas

Turbine

Air

BFW

Air

Steam

HRSG

Steam

Turbine

© 2007 Electric Power Research Institute, Inc. All rights reserved.

24

BFW

IGCC CO2 Retrofit Considerations

• The ideal IGCC that you would build if you knew it would

later be retrofitted with CO2 capture would be quite

different from the ideal IGCC you would build if you knew

it would never capture CO2

– Direct water quenching over syngas coolers

– Coal-water slurry over dry feeding

– Higher gasifier operating pressure

– Physical solvents for acid gas removal

– Capability to handle additional pressure drop in syngas

production train

© 2007 Electric Power Research Institute, Inc. All rights reserved.

25

PC CO2 Capture Retrofit Considerations

• If you are designing a plant today with the idea that some time

during its life it will be retrofitted with capture, there are some

things you should do differently:

– Add space

– Place the plant near a suitable geologic storage site

– Make the plant as efficient as practical – higher efficiency

means less CO2 you will have to capture and compress

– Design emissions controls to either achieve ultra-low SOx

and NOx emissions today, or design the equipment to be

upgraded to ultra-low emissions

– Design steam turbine to accommodate very large extraction

lowadding

pressure

steam

solvent

regenerationmakes a

“Ifofjust

space

forforthe

CO2 equipment

coal power plant capture ready, then my driveway is

Ferrari-ready” – David Hawkins, NRDC

© 2007 Electric Power Research Institute, Inc. All rights reserved.

26

USC Worldwide Experience Curve

US Eddystone 1960 1135F

1112F

© 2007 Electric Power Research Institute, Inc. All rights reserved.

27

IGCC RD&D Augmentation Plan—Expected Benefits Case:

Slurry-fed gasifier, Pittsburgh #8 coal,

90% availability, 90% CO2 capture, 2Q 2005 dollars

Total Plant Cost ($/kW)

2200

2000

Mid-Term:

• ITM oxygen

• G-class to H-class CTs

• Supercritical HRSG

• Dry ultra-low-NOX

combustors

Plant Net Efficiency (HHV Basis)

40

1800

1600

1400

Near-Term:

• Add SCR

• Eliminate spare

gasifier

• F-class to G-class CTs

• Improved Hg detection

1200

2005

2010

© 2007 Electric Power Research Institute, Inc. All rights reserved.

38

Long-Term:

• Membrane separation

• Warm gas cleanup

• CO2-coal slurry

36

Longest-Term: 34

• Fuel cell

hybrids

32

2015

2020

28

2025

30

2030

USC PC RD&D Augmentation Plan—Expected Benefits Case:

Pittsburgh #8 coal, 90% availability, 90% CO2 capture,

as reported data from various studies (not standardized)

Total Plant Cost ($/kW)

2400

Near Mid-Term:

• Upgrade steam

conditions to

2200

4200/1110/1150

Near-Term:

• Upgrade solvent from MEA

to MHI KS-1 (or equivalent)

2000

• Upgrade steam conditions

from 3500/1050/1050 to

3615/1100/1100

1800

Plant Net Efficiency (HHV Basis)

40

Mid-Term:

• Upgrade steam

conditions to

5000/1300/1300,

and then to

5000/1400/1400/1400

36

34

Long-Term:

• Upgrade solvent

to advanced

sorbents

1600

1400

2005

© 2007 Electric Power Research Institute, Inc. All rights reserved.

2010

38

2015

29

2020

32

30

2025

EPRI’s CoalFleet for

Tomorrow Program

• Build an industry-led program to

accelerate the deployment of

advanced coal-based power plants;

members now span five continents

• Employ “learning by doing” approach;

generalize actual deployment projects Further information available

at www.epri.com/coalfleet

(50 & 60 Hz) to create design guides

• Augment ongoing RD&D to speed market

introduction of improved designs and materials

• Deliver benefits of standardization to IGCC (integration gasification

combined cycle), USC PC (ultra-supercritical pulverized-coal), and SC

CFBC (supercritical circulating fluidized-bed combustion)

–

–

–

–

–

Lower costs, especially with CO2 capture

High reliability

Near-zero SOX, NOX, and PM emissions

Shorter project schedule

Easier financing and insuring

© 2007 Electric Power Research Institute, Inc. All rights reserved.

30