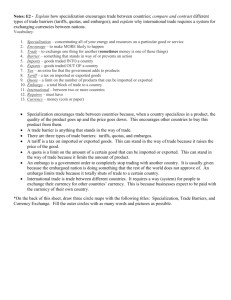

Trade Barriers: Tariffs, Quotas, and Embargos Explained

advertisement

Trade Barriers International Trade - Definition International trade involves the exchange of goods or services between nations. This is described in terms of – Exports: the goods and services sold in foreign markets. – Imports: the goods or services bought from foreign producers. Free Trade vs. Trade Barriers Nations can trade freely with each other or there are trade barriers. – Free Trade: Nothing hinders or gets in the way from two nations trading with each other. – Trade Barriers: Trade is difficult because things get in the way. There are costs and benefits related to free trade as well as trade barriers. Free Trade - Benefits When nations specialize and trade, total world output or sales is increased. Companies can produce for foreign markets as well as domestic markets (markets in the home country). This means there is potential for making more money as there are more markets to sell goods or services in. More variety of goods are available from a world market than just a domestic market. Prices of goods are decreased through increased competition. Free Trade - Costs The domestic country can lose money because more people are buying foreign goods – Example: In the U.S., people might want to buy a foreign automobile like a Honda or Toyota instead of an American made car. Less money will go into the domestic market place and this can cause factories to be closed and jobs to be eliminated. Trade Barriers – Three Types Trade barriers are things that hinder or get in the way of trading. They can be cultural, physical , or economic. – Cultural barriers: language, currency, belief system. – Physical barriers: mountains, deserts, canyons,etc. • Example: The Alps Mountains in Europe – Economic barriers: government rules that restrict, block or discourage international trade between countries. (tariff, quota, embargo) Trade Barriers - Economic The most common trade restrictions are: – tariffs--which are taxes on imports. – quotas--which are limits on the quantity that can be imported. – embargos--which are a complete trade block usually for political purposes. Tariffs A tariff is a tax put on goods imported from abroad The effect of a tariff is to raise the price of the imported product. – It makes imported goods more expensive so that people are more likely to purchase domestic products. – EXAMPLE: The European Union removes tariffs between member nations, and imposes tariffs on nonmembers Quotas A quota is a limit on the amount of goods that can be imported. Putting a quota on a good creates a shortage, which causes the price of the good to rise and makes the imported goods less attractive for buyers. This encourages people to buy domestic products, rather than foreign goods. – EXAMPLE: Germany could put a quota on foreign made shoes to 10,000,000 pairs a year. If Germans buy 200,000,000 pairs of shoes each year, this would leave most of the market to German producers. Embargos Embargos are government orders which completely prohibits trade with another country. If necessary, the military actually sets up a blockade to prevent movement of merchant ships into and out of shipping ports. Embargos The embargo is the harshest type of trade barrier and is usually enacted for political purposes to hurt a country economically and thus undermine the political leaders in charge. – EXAMPLE: the United Kingdom has placed an embargo on a Chinese toy-making company because they were using lead-based paint in their toys. UK no longer trades with this company. – EXAMPLE 2: US placed an embargo on Cuba after the Cuban Missile Crisis (still in effect today). Trade Barriers - Benefits Most barriers to trade are designed to prevent imports from entering a country. Trade barriers provide many benefits: – – – – protect homeland industries from competition protect jobs help provide extra income for the government. Increases the number of goods people can choose from. – Decreases the costs of these goods through increased competition Trade Barriers - Costs Tariffs increase the price of imported goods. Less competition from world markets means there is an increase in the price. The tax on imported goods is passed along to the consumer so the price of imported goods is higher.