OnStar Helmet Business Plan

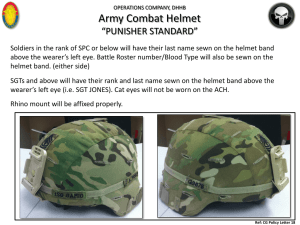

advertisement

OnStar Smart Helmet, LLC VT KnowledgeWorks 2200 Kraft Drive, Suite 1000 Blacksburg, Va 24060 MGT 4064: ITE Leadership 2:30 Section Team 6: Blair Priest – Project Coordinator CJ Babb Ryan Beach Lindsey Cartner Matt Shea Submitted to: Dr. Devi Gnyawali ITE Leadership, Management Department Virginia Tech April 20, 2012 1 Table of Contents Executive Summary................................................................................................................. 3 1.0 Company Description ........................................................................................................ 4 2.0 Industry Analysis ............................................................................................................... 6 3.0 Market Analysis ............................................................................................................... 11 4.0 Marketing Plan ................................................................................................................ 18 5.0 Management Team and Company Structure ................................................................... 21 6.0 Operations Plan................................................................................................................ 25 7.0 Product Design and Development Plan ........................................................................... 32 8.0 Financial Projections ....................................................................................................... 35 Bibliography .......................................................................................................................... 39 Appendix ............................................................................................................................... 43 2 Executive Summary Our company, OnStar Smart Helmet, LLC, offers a premiere helmet to the industry by providing OnStar capabilities which include crash detection sensors, a GPS locator, and handsfree calling. The company was formed by five entrepreneurial students at Virginia Tech; Blair Priest, Lindsey Cartner, CJ Babb, Ryan Beach, and Matt Shea. Due to the lack of similar products, our helmet will offer added value to the consumer, value that is not offered yet by our competitors. In order to launch our business, we plan to establish a partnership with OnStar in order to license the use of their equipment. The industry for our product is directly influenced by the motorcycle, recreational vehicle, and communication equipment industries. During the recent recession, these industries had a significant decrease in growth due to the fact that their products are viewed as a discretionary use of funds. Since the most significant growth decline in 2009, these three industries have rebounded and are now experiencing moderate, positive growth. This increase in growth indicates that the industry for our product will become increasingly more desirable as unemployment rates continue to decrease, resulting in an increase in disposable income for consumers. The target market for our helmet is made up of current and future motorcycle and recreational vehicle users. Our competitors include other helmet manufacturers that sell either standard or technology-based helmets, in addition to companies that sell helmet accessories that have the same GPS capabilities as our helmet. In order to create awareness about our product, we plan to utilize the motorcycle and recreational vehicle retailers to promote and distribute our product. We will also use other avenues including relevant magazines and periodicals and will rely heavily on word of mouth referrals and positive public relations. The partnership with OnStar will help us to legitimize our product ultimately building the credibility that is needed to stimulate sales. We will differentiate our product from competitors by highlighting the value added through the OnStar and GPS capabilities, as well as our competitive pricing. The management team is composed of the five original founders. Our various educational and occupational backgrounds allowed us to fill many of the necessary roles, except for in the areas of human resources and accounting. We plan to use the President’s Council offered through VT KnowledgeWorks as our Board of Directors in order to fill these gaps, as well as gain professional insight and leadership abilities. VT KnowledgeWorks will also be the location for our company, and we will outsource our manufacturing to Berlin Dynamic Industry Company, Ltd., a helmet manufacturer with the necessary equipment to produce our product. We are still currently in the product conception phase; therefore, the next step for our company is to create a prototype of our product and to conduct usability testing and to assess demand. We are also in the process of obtaining a patent to protect our intellectual property. The full production of our helmet is contingent on the licensing agreement with OnStar because without their services, our product is not viable. Over the course of conducting this business plan, we encountered many uncertainties that threatened the feasibility of our product. We feel that our management team lacks the necessary credentials to launch a business of this magnitude. In addition, our product is based around a service, OnStar, which is not our own, so our business cannot move forward without their partnership. Lastly, our costs have proved to be exceedingly high due to liability insurance, licensing costs, and manufacturing. At this point in time and with the resources that we currently have at our disposal, we feel that the business concept is not viable, but that it has the potential to be a very successful venture. 3 1.0 Company Description 1.1 Introduction The OnStar Smart helmet is a concept that was developed in 2012 in response to the need for increased safety for motorcycle and recreational vehicle users. We seek to provide a costeffective helmet and offer the option of having the OnStar service included in the helmet. Our company will partner with OnStar in order to offer their service with our helmets. The OnStar Smart helmet increases the functionality and utility of a standard helmet by introducing OnStar and GPS capabilities. This business concept was generated from a team of students, Blair Priest, CJ Babb, Lindsey Cartner, Ryan Beach, and Matt Shea. 1.2 Company History During an entrepreneurial course at Virginia Tech in 2012, the OnStar helmet idea was developed into a feasible business concept. Our team recognized a gap in the marketplace that would fulfill needs of the consumers. From our business idea, we conducted a feasibility analysis which returned positive results encouraging us to develop the idea into a business proposal. 1.3 Mission Statement The mission of the OnStar Helmet is to protect motorcyclists and recreational vehicle users in order to increase safety by preventing head injuries as well as providing GPS capabilities to locate victims of an accident. The company’s tagline will be “Protecting Your Loved Ones” which will create an emotional appeal with the consumers. The tagline will be an important component in reaching out and establishing a connection with the target market. 1.4 Product and Services Our product is the OnStar Smart Helmet which is equipped with OnStar and GPS capabilities. Using impact detection sensors, the helmet will be able to notify emergency 4 personnel if the user was in a crash. Due to the lack of similar products, our helmet will offer added value to the consumer, value that is not offered yet by our competitors. The increase in helmet use laws in the United States will aid in the growth of the helmet industry. We have sought out two well recognized companies, OnStar and Berlin Dynamic Industry Company, Ltd., to assist us with the manufacturing and production of our helmet. We are in the process of conducting a patent search and applying for a patent in order to protect our intellectual property. 1.5 Legal Status and Ownership We plan to explore the formation of a Limited Liability Company and to assess our options in obtaining this legal status. We plan to draft a founder’s agreement to dictate division of equity, salaries, buyback clauses, and other issues before initiating the conversion to a LLC. The LLC has favorable tax and liability components that would greatly enhance the profitability and opportunity for success for our venture. 1.6 Key Partners We also have chosen to partner with OnStar in order to obtain the rights to use their service. After communicating with an OnStar representative, in order to obtain a partnership agreement with OnStar, we would have to submit our service idea and wait for approval by OnStar. If they wish to partner with us, then negotiations would take place on the licensing costs as well as other components of the partnership agreement. In order to proceed with our business plan, we are assuming that OnStar will agree to a partnership in order to develop the OnStar helmet. In addition, we have chosen to outsource our manufacturing by partnering with Berlin Dynamic Industry Company, Ltd., a well-established and successful helmet manufacturer for brands such as Nexx and Icon. These two allies will help to launch our product quickly into the market because they already have clientele who either use OnStar or have purchased Nexx or Icon helmets. 5 2.0 Industry Analysis There has not been a clearly defined industry for our OnStar smart helmet because no other similar product exists. Due to the fact that our helmet would create a new industry, we explored the growth of three industries that will affect the success of our product the most, which include the motorcycle industry, the recreational vehicle industry, and the communication equipment manufacturing industry, which includes OnStar (NAICS 33422). Our product is dependent on the growth of these three industries, especially the motorcycle and recreational vehicle industries, because our product is merely an accessory that accompanies the purchases of motorcycles and recreational vehicles. 2.1 Industry Size/Growth rate The motorcycle industry has always had a strong niche following. Recently, however, motorcycles are becoming increasingly mainstream. Since 2003, the number of American households that own motorcycles has increased by 26%, and the number of motorcycles owned and used in America has increased by 19%, bringing the total to approximately 10.4 million people (Morris, 2009). There has also been an increase in the two lesser demographics of motorcycle ownership. Female ownership of motorcycles has increased from 9.6% to 12.3%, and women now account for approximately 23% of the 25 million Americans who rode a motorcycle in the past year ("More people riding," 2009). The second growing demographic is Generation Y motorcycle riders, which has increased 62% since 2003 (Motorcycle Industry Council, 2009). This growth is further enhanced by the fact that the U.S. motorcycle market was worth $14.6 billion in 2007 and that figure has risen to over $21 billion in 2011 (“The U.S. Motorcycle,” 2011). This is an increase of approximately 30%. This illustrates the potential that lies in the motorcycle industry, which is established yet still growing and evolving. 6 Despite the increase in worth of the motorcycle market, both the motorcycle and recreational vehicle industries took large hits in 2009 in terms of revenue growth. Motorcycle revenue growth decreased by 21.4% compared to 32.1% for the recreational vehicle industry, which was a result of a decrease in per capita disposable income of 3.2% (“IBISWorld: 33699a”; “IBISWorld: 33699c”). Despite this sharp decline in 2009, the recreational vehicle industry rebounded quickly in 2010 with 22.6% in revenue growth (“IBISWorld: 33699c”). The economic recession had a significant impact on these two industries due to the fact that they are discretionary products and the industry is “highly sensitive to changes in disposable income” (“IBISWorld: 33699a”). During this economic downturn and decrease in demand for these two industries, motorcycle retailers decided to tailor their efforts towards the high-end market composed of wealthier consumers who look for high-end, technology-based products. The firms that target these high end consumers “will continue to perform well in today’s market” and will experience higher profit margins (“IBISWorld: 33699a”). This focus on high end products and wealthier consumers should benefit our product since it offers significant technological capabilities that should coincide with the wants of this bracket of consumers. In regards to the communications (OnStar) industry, the economic recession also negatively influenced industry growth because consumers “opted to delay wireless infrastructure improvements or [they] purchased equipment from cheaper foreign manufacturers instead” (“IBISWorld: Communication”). Like the other two industries mentioned above, this industry suffered a significant decline in 2009, approximately -17.6% (“IBISWorld: Communication”). Over the past three years, the industry has had positive growth as consumers are recovering from economic hardship which resulted in an increase in consumer spending by 6.6% (“IBISWorld: 7 Communication”). All three of the industries, motorcycle, recreational vehicle, and communication equipment, are currently experiencing positive growth. 2.2 Industry Sales Projections/Structure The table below indicates the top five global companies and their motorcycle sales in 2011 as well as their projected sales in 2012. These sales projections coincide with our product’s demand because as motorcycle sales increase so will the sale of motorcycle accessories and equipment, such as helmets. Company 2011 Sales 2012 Sales(Projected) D & S Cycle of Arlington Inc 3,000.00M 3,005.68M MOTORCYCLE DISTRIBUTORS AUSTRALIA PTY LTD 2,269.59M 2,272.00M RED BARON CO.,LTD. 793.23M 795.85M YAMAHA MOTORCYCLE SALES JAPAN CO.,LTD. 487.85M 485.94M YAMAHA MOTOR FRANCE 422.82M 427.23M ("Motorcycle dealers," ) The US motorcycle dealer industry includes about 4,300 stores with combined annual revenue of $18 billion. The industry is highly fragmented: the 50 largest companies generate just 10 percent of industry sales. 2.3 Nature of Participants This industry has a specific set of key factors that sets a good helmet apart from a poor helmet. Some of the major key attributes that go into a helmet are the fit and comfort and the face shield effectiveness of keeping wind out. (JDP, 2011) There are 11 attributes to these key factors that 8 can be found in the appendix (See Helmet Attributes, p. 43). The major players in the industry rated by consumers are Arai, who has been ranked highest 13 years in a row, Shoei, Icon, and Harley Davidson. Arai has been able to be at the top of the charts for so long because their improvement in satisfaction is “driven mainly by increases in satisfaction with ventilation/airflow; fit and comfort; color/graphic design; and scratch resistance of the shell” (JDP, 2010). Harley has been able to stay at the top as well because of “increases in satisfaction with ventilation/airflow; fit and comfort; and color/graphic design” (JDP, 2010). It has been found that motorcycle helmet owners have been increasingly buying their helmets online. “The percentage of helmets purchased online has increased steadily during the past 10 years. As a result, it’s crucial to ensure that dealers have an e-commerce website available for customer use as their preferences change” (JDP, 2011). With this in mind, consumers all start out at the brick and mortar dealerships and once they have become accustomed with their helmet, they then buy online. This OnStar helmet fills a huge gap in the industry. Currently there are helmets that reduce brain swelling upon impact and helmets that have Bluetooth technology but none have an immediate impact response detection. Imagine the following scenario and you’ll be left wondering if you’ll feel completely comfortable riding in remote areas by yourself again. You take a nice ride by yourself on a beautiful day through the countryside on your ATV on a scenic back road. You are riding along enjoying this amazing day, sun is shining, trees have blossomed their flowers, empty farm fields with beautiful green grass is around you and the sun is brightening all the colors around you. You didn’t tell anyone where you were going; you wanted a peaceful ride to yourself. You didn’t even bring your cellphone because you didn’t want to be bothered. You get pretty far out into the country and all of a sudden a deer jumps out in front of 9 you and you hit it and get knocked out. Who’s there to help you? No one is around, no one knows where you are, you aren’t even around a phone IF you gain consciousness. What will happen to you? Now you have the OnStar helmet, they call for you, no response; they have detected a crash and immediately send out emergency vehicles to assist you. With the OnStar helmet, those worries of getting injured and stranded dissipate now that you have that guardian watching you in case something happens. You can enjoy that beautiful day with no worries at all. This industry is segmented towards product type since we are focusing on the benefit of the capabilities of our product. There are other competitors out there that also offer helmets that can help increase safety such as the Brain Cooling helmet and Hands free Bluetooth. 2.4 Key Success Factors In order for a helmet to sell well, using Arai’s helmet qualities as a guideline, they must have three key factors and 11 attributes that go along with the key factors. The three key factors are ventilation, face shield and design and styling. The quality of these factors contributes to the highest ratings for helmets; therefore, it is essential that we succeed in these areas not just with our OnStar capabilities. 2.5 Industry Trends Environmental Economic Trends- Since motorcycles and recreational vehicles are viewed as a discretionary use of funds, the economic recession in the United States over the past couple of years has hindered the growth of these two industries. For the helmet industry, research indicates that the satisfaction levels tend to rise as the price of the helmet increases. It is a product where you get exactly what you pay for in terms of comfort and fit (JDP, 2010). Social Trends- The use of helmets has increased over the years showing that it is more socially acceptable, or the norm, to wear a helmet to protect yourself. “Helmet use in States that require 10 all motorcyclists to wear helmets significantly increased from 78 percent in 2008 to 86 percent in 2009. The helmet use in these States continued to be higher than in those States without universal helmet use law” (NHTSA, 2009). Business Harley Davidson’s stock has risen 292% since its downfall in 2008, showing an increase in the purchasing of Harley Davidson’s products. From this information, we can base the idea that since Harley Davidson’s stock is rising, the use of motorcycles and associated products is increasing. 2.6 Long Term Prospects With new innovation (Brain cooling helmet and bluetooth) this industry is ready for the next step: OnStar helmets. Innovation in this industry is growing, and the rise of safety concerns fits this gap by eliminating the worry of being incapacitated and not being able to get help. With the stock market recovering and the unemployment rate decreasing, people are able to spend more money and are able to afford this luxury helmet. It is a necessary attribute for motorcycle helmets to ensure the safest ride possible 3.0 Market Analysis 3.1 Motorcycle Helmet and Accessories Market Premium motorcycle helmets tend to be priced in the general range of US$375-800. Also, according to PRWeb and IBIS World, the users of these helmets tend to have higher range salaries in comparison to the US average. Additionally, the worldwide motorcycle market is expected to reach sales of “$851 million by the year 2015” ("Global premium motorcycle," 2010). Helmet usage in the U.S. has continued to rise over the years despite ever changing helmet usage laws. “Overall, rise in motorcycle registrations, and enactment and enforcement of 11 helmet laws are providing significant market potential for manufacturers of helmets worldwide” ("Global premium motorcycle," 2010). The demand for high end, high tech helmets such as the OnStar enabled smart helmet will be driven by the success of the motorcycle and ATV industries. 3.2 OnStar OnStar, a “wholly owned subsidiary of General Motors Corp”, is the nation's leading provider of in-vehicle safety, security and information services using the Global Positioning System (GPS) satellite network and wireless technology ("OnStar reverses," 2011). OnStar services include vehicle crash, emergency services, and road-side assistance with location. OnStar Personal Calling allows drivers to make and receive hands-free, voice-activated phone calls through a nationwide cellular network ("OnStar reverses," 2011). OnStar is a rapidly growing business that dominates the navigational communication system industry. Ford’s Sync system is very similar to OnStar and is the only major competitor, and it will not be released until sometime next year ("Ford technology," 2011). OnStar’s Safe and Sound© plan is the plan most similar to what would be offered in our high tech helmet. The safe and sound plan costs $18.95 a month. This cost will also be reduced due to the fact that motorcyclists will likely receive substantial discounts for owning and using this equipment ("OnStar plans and,”). There are currently around 6 million OnStar subscribers in the U.S and Canada (“OnStar of GM”). 3.3 Demand and Buyer Behavior Demand for motorcycles, helmets, and accessories are affected by factors such as changes in per capita disposable income, consumer sentiment, and unemployment because 12 motorcycles are largely a discretionary product. An increase in consumer sentiment or income can lead to a subsequent increase in demand for new motorcycles. Other factors affecting demand include the price of products, the popularity of motorcycle riding, and seasonality patterns. The introduction of new models can also boost demand for new motorcycles. A large increase in the prices of motorcycles can result in consumers choosing to defer their purchase or looking for an alternative vehicle. In addition, the price of gasoline and fuel can benefit the motorcycle industry. As motorcycles are cheaper to run, consumer demand for motorcycles tends to increase in line with rising oil prices. As it becomes relatively more expensive to drive cars, consumers will switch to cheaper forms of transportation (IBISworld). 3.4 Safety as a Demand factor “According to a Hawaii Department of Transportation Study in 2004: Motorcycle accidents accounted for 3,244 fatalities in the U.S. Head injuries were the leading cause of death among the motor cycle riders. Riders without helmets are 40 percent more likely to sustain a fatal head injury. Motorcyclists without helmets are three times more likely than a helmeted rider to suffer a traumatic brain injury as a result of a crash.” (SMS Research and Marketing Services, Inc., 2003) 3.5 Industry Segmentation Our smart helmet will serve two primary markets, the motorcycle and the recreational vehicle, or motorized sports vehicles, consumer markets. These vehicles are designed to drive over rugged terrain such as trails, sand, snow and hills. The most common forms of ATV’s, and 13 the ones we’re primarily targeting, are four-wheelers, dirt bikes, and snowmobiles ("Ibisworld.com," 2012). The Motorcycle and ATV industry is segmented below. (IBISWorld.com, 2012). 3.5.1 Motorcycle Users Motorcycle sales make up the bulk of the industry, though in the past couple of years, they have been on a downturn due to the recent recession. The rising fuel prices are encouraging riders to invest more in this form of transportation because it is both money saving and environmentally more responsible. The current market share for motorcycles is 48.5% (IBISWorld.com, 2012). 3.5.2 ATV Users Unlike motorcycles, ATV purchasing has increased in the last few years, especially dirt bikes and four-wheelers. Racing recreational vehicles is a popular and trending hobby among the younger population. This sport, motocross, provides for important opportunities as the industry expands (IBISWorld.com, 2012). 14 3.5.3 Demographics Demographics of Motorcycle Users (“The U.S. Motorcycle,” 2011). Age 20 years and younger 21-25 26-30 31-40 41-50 51-60 61-70 71 and older 1% 7% 9% 22% 30% 23% 7% 1% Gender Male 90% Female 10% According to the Motorcycle Industry Council, in 2003, Baby Boomer riders outnumbered Gen Y motorcyclists almost four to one. “But Gen Y motorcycle ownership grew 62 percent since 2003, putting the current ratio of Baby Boomers to Gen Y at two to one” (Motorcycle Industry Council, 2009). The ages of motorcycle riders are changing, too. “In 2003, those 40 and over composed the majority of motorcycle riders. But from 2003 to 2008, the number of younger riders--those under age 40--increased about 62 percent, according to the MIC” (Hartmann, 2012). As the older riders, ages 40 to 50, begin to age, “demand for these products falls because of lessened physical ability and more safety concerns” (“IBISWorld: 33699a”). The industry recognizes the importance of reaching out to a younger demographic since their main customers, the baby boomers, are using their motorcycles less and less. 3.5.4 Income Brackets The average household income of motorcycle owners tends to be slightly higher than most Americans. The average American makes approximately $5,000 less than those owning twowheeled vehicles. Those individuals who purchased vehicles for sport spent more than those who use motorcycles for solely transportation purposes (Motorcycle Industry Council, 2009). 15 3.5.5 Preferences Whereas older generations tend to purchase more traditional “cruiser” vehicles, younger generations are leaning more toward sport bikes. While the older traditional riders are less likely to buy high-tech helmets, the sport bike riders are the ideal target. Sport bike riders, on average, are more likely to spend money for special features and additions to their motor-bike. The primary advantages of traditional riders are that they are more likely to travel long distances, and the GPS and crash features would be increasingly more relevant (Motorcycle Industry Council, 2009). 3.6 Positioning OnStar helmet will position itself as a leader in motorcycle safety, comfort, and technology. We are the first helmet of this type to be on the market and will be able to quickly establish ourselves as industry leaders in this area. We should be very effective when it comes to establishing this position in a consumers mind due to the fact that OnStar is already a very well-known and established brand that is synonymous with safety and high quality service. When marketing the OnStar helmet our primary focus will be the unique safety service we provide. The secondary focus will be on the other high tech features and luxury that differentiates us from our competitors. 3.7 The Competitive Market Currently, the competitive market for the OnStar enabled helmet is fragmented into two key areas, since the industry for technologically enhanced helmets has not developed enough. The first area is made up of the Motorcycle and ATV industries, which include manufacturing of vehicles and accessories. These industries have high and medium market shares, respectively. The number one key success factor in both industries is compliance with required standards. The motorcycle industry is dominated by Harley-Davison motorcycle products (50% market share), 16 whereas the ATV industry is much less concentrated (highest market share 21%) (“IBISWorld: 33699a;” “IBISWorld: 33699c”). The other area is technology. Enabling the helmets with OnStar and GPS capabilities brings the helmets into the technology industry. Communications technology equipment, the industry under which OnStar falls, is a low-concentration industry and the key success factor is a focus on quality (“IBISWorld: Communication”). 3.7.1 Direct Competitors The direct competitors are those that sell technologically enhanced helmets, such as those with GPS and OnStar capabilities. There are few companies that currently do this, however. The larger companies include ONeil, Vega, and HTC, which all have blue-tooth motorcycle helmets currently being sold. While none of these companies offer specific GPS features as part of the built-in technological option, there is a threat for future entry into this specific niche. The market on GPS enabled motorcycle helmets is new and growing, but still difficult to assess. 3.7.2 Indirect Competitors A very important indirect competitor to the GPS/OnStar enabled helmet are those who sell accessories that provide similar services as those built in to the helmets themselves. The company Cardo, who is at the forefront of GPS and audio-ready helmet attachments, is the leader in this industry. While they do not sell the helmets themselves, these attachments pose the largest threat to our GPS enabled helmets. Cardo just released their GPS-Bluetooth enabled accessory on March 20, 2012 (Ingold, 2011). It offers similar features to OnStar, including the GPS directions feature, but lacks the crash-safety feature that sets OnStar products apart. Other indirect competitors would be those companies selling high-safety motorcycle or recreational helmets. The market for regular motorcycle helmets is well-established and will need to be penetrated by the new technologically enhanced helmets. The combination of regular 17 helmets and add-on features like those offered by Cardo pose the largest threat to the development of the new industry. 3.7.3 Future Competitors As health and safety awareness grows, and technology continues to advance, the industry for technologically enhanced helmets will grow. As this technology becomes cheaper, and the markets will open up, more companies who already specialize in recreational-vehicle helmets will become a threat as they explore the more technological options. The companies also specializing in wireless devices will also become a threat as they begin to develop accessories similar to Cardo. See Competitive Analysis Grid (Appendix, p. 43). 4.0 Marketing Plan The overall objective for marketing the OnStar Helmet is to raise awareness of our product with current motorcycle and recreational vehicle users. This market segment will be our largest and easiest to reach because they are already well-educated and well-connected in this industry. In addition to reaching out to current helmet users, a secondary target market would be the family members or loved ones of motorcycle and recreational vehicle users who would encourage their use of our product. We will use motorcycle and helmet retailers to sell our product, so that our product is accessible to the consumers when they are purchasing motorcycles or other accessories. Before we launch the full production of the product, we plan to offer sample helmets to various retailers in order to gauge the demand for our product. This sample offering will encourage retailers to promote our product to their customers and will expose consumers to our product, either through viewing it in stores or through using it when they test drive motorcycles. Using the sales personnel at the dealerships will be crucial to getting our 18 name out there because they are viewed as reliable and knowledgeable about the industry. We would offer them incentives to sell our product by offering $5 per sale up to 6 helmets, then $8 per helmet after that. This would be a limited time offer just to get the brand known. In addition to using the retailers as distribution channels, we plan to sell directly to the customer via the internet. Offering an online distribution channel would ultimately eliminate the middleman and would reduce unnecessary costs that are associated with outside distributors. To advertise the OnStar helmet, we will be distributing to motorcycle manufacturer’s websites and to retailers that sell motorcycles and recreational vehicles. We will be attempting to get exposed in bike magazines as well as at motocross events. At the motocross events, we would focus on the parents and the safety needed for their children when they are out riding in the countryside. At these various events, we would look for sponsorship opportunities of either the riders or of the actual motocross event. We would set up a tent at these events in order to allow consumers to view our tangible product as well as hear about the services that it has to offer. In addition, we hope to get mentioned in trade journals by bike enthusiasts that will emphasize our unique attributes of safety through OnStar access. Another opportunity to advertise and market our product is to locate bloggers and other social media gurus with expertise in the motorcycle or recreational vehicle industries and send them our helmet. With this tactic, we would hope that the bloggers would make positive associations with our product which would result in a reliable word-of-mouth referral to their followers. Since OnStar is a well-established brand, we will benefit from the partnership with this company. We plan to license the OnStar services, which was discussed in the company description and is discussed in the product development plan section. Consumers understand the benefits associated with having OnStar capabilities in a car, and we feel that offering that same 19 sense of security to motorcycle and recreational vehicle users will result in a large amount of word-of-mouth referrals. In addition, with the overwhelming statistics on the number of fatalities caused from motorcycle accidents as well as the benefits of helmet use, we feel that our product will coincide with the increased helmet use laws in the United States. This collaboration between our helmet, which offers increased safety features, and the emphasis on promoting helmet use will result in an opportunity for free publicity and public relations, as long as consumers are satisfied with our product. 4.1 Methods to differentiate our product from competitors: Promoting the OnStar and crash detection capabilities - focusing on this enhanced safety feature o We want consumers to recognize the value added to our product through the increased functionality of our helmet Only helmet to wholly encompass all of the technological components available Competitively priced in regards to the value added Use of the OnStar brand In addition to highlighting the OnStar capabilities, we will also make sure to include the value added by our warranty which we will create based on the existing OnStar warranty as well as the warranties of our competitors (See OnStar Warranty, p. 44). Our warranty will ensure users that their helmet will perform all of the functions of a standard helmet while also including the crash detection and OnStar capabilities. This warranty will be essential in legitimizing our product in the market. In order to reduce marketing expenses, we are initially only going to use outlets that we are confident will reach our target market, such as the use of retailers and motorcycle magazines and 20 periodicals. By only using these narrow marketing techniques, we can guarantee that we are reaching the target market without overextending our message to consumers that may not be interested in our product. Ultimately, we want to establish our helmet as a high quality product that offers more amenities to the consumer in comparison to our other competitors. Price Table: Cost to OnStar Manufacture *Cost to Use Installation Total Margin Helmet OnStar FMV Cost Cost Price Difference % 300.00 299.99 100.00 699.99 1200.00 500.01 71% *This is retail value, which could be reduced with the OnStar partnership. (Ashe, 2011) (Mellor & StClair, 2005) Competitor Pricing Table: Competitor Arai- Corsair-V Icon-Variant Construct Harley Davidson-half Helmet SHOEI- RF-1100 Competitor Our Markprice Price Difference up 919.95 1,039.95 120 13% 370 490 120 32% 90 551.99 210 671.99 120 120 133% 22% This table reflects the prices that we would charge in comparison to our competitors. 5.0 Management Team and Company Structure 5.1 Management Team Our management team consists of the five founders, Blair Priest, Lindsey Cartner, CJ Babb, Ryan Beach, and Matt Shea. We have distributed the authority and responsibilities amongst the five founders in order to establish clearly defined roles within the company (See Organizational Chart, p. 46). The team has various educational and occupational backgrounds which allow us to have experience in many of the critical areas that are needed to launch and lead a business. The management team will construct a founder’s agreement that will award equal ownership and 21 compensation between the five founders for the first five years of business. After that time period, the management team will renegotiate their ownership and compensation according to the number of members who wish to continue on with the business. Below indicates the skills and relevant expertise of the management team: Management Team Matrix Exec Leadership Ryan Beach Blair Priest Lindsey Cartner CJ Babb Matt Shea Gap 1 Gap 2 FIN Opera tions X Mktg HR Customer Service & Relations Information Systems Account ing X X X X X O O Blair Priest, Co-founder and CEO, Age 21 As chief executive officer, Blair Priest will have the responsibility of overseeing the direction and formation of the company. We feel that with her leadership abilities, she was the most wellequipped to lead our management team and to facilitate the process of launching our venture. She has worked six jobs, and has experience in restaurant management, government contracts, and sports marketing. She is a junior at Virginia tech pursuing a double major in management and marketing as well as a Spanish minor, which has the potential to help our company expand on an international level. Excellent communicator and organizer Marketing expertise Strong leadership abilities 22 Ryan Beach, Co-founder and COO, Age 22 As COO, Ryan Beach is responsible for day-to-day operations of the company. He has experience in supply management, albeit limited, from previous employment at an Ace Hardware distributor. He is also graduating in December with a degree in management and a minor in leadership studies. Will handle daily monitoring and communication with manufacturing partner Will be accountable for processing orders and maintaining relationship with OnStar Possesses integrity and enthusiasm in forming and progressing business relationships CJ Babb, Co-founder and CFO, Director of Marketing & Sales, Age 22 CJ Babb is pursuing a degree in business management and marketing from Virginia Tech. He has acquired skills related to management administration, finance, customer service, market analysis, and entrepreneurial ventures and operations through classes and a 10 week management internship with Sherwin Williams. Responsible for raising capital for production and growth of company In charge of both short-term and long-term financial management of the company Promotes growth of company through domestic marketing campaigns Lindsey Cartner, Co-founder and Head of Customer Service & Relations, Age 22 Lindsey Cartner has a degree in business management from Virginia Tech. She has acquired skills and knowledge related to management, finance, entrepreneurial ventures and consulting. Additionally, she has experience in the field of recruiting through her internship with SieglLink, a recruiting firm in Blacksburg, Va. She also has management and customer service experience from her supervisory jobs at Kroger, Giant Foods, and Carvel. 23 Day-to-day liaison between management team and customer base Handles all issues with order processing Responsible for dealing with complaints and/or warranty issues with the product Matt Shea, Co-founder and Head of Information Systems, Age 23 Matt Shea has a degree in business management from Virginia Tech. He has acquired skills and knowledge related to management, finance, accounting, marketing, entrepreneurial ventures and operations. Matt also has work experience related to the financial services industry from when he interned at First Command Financial Services. In charge of verifying that manufacturing order process system is in accordance with incoming orders coming into business office Handles any glitches or security breaches with order processing program and order recognition program Experienced in IS and computer security 5.2 Board of Directors and Board of Advisors Two critical areas in which our management team lacks experience are in the fields of human resources and recruiting as well as accounting. We plan to address these gaps by utilizing the President’s Council which is a resource offered through Virginia Tech KnowledgeWorks for no additional cost. Virginia Tech KnowledgeWorks will be the location of our business because it offers a low cost facility in addition to access to essential resources that are necessary in launching a business. The informal board of directors that will be offered through KnowledgeWorks will consist of 8 to 10 board members who serve as executives for other companies. The experience of these other board members will surely fill our resource needs in the areas of human resources and accounting as well as strengthen our weak areas in information 24 systems and operations. We will also have one or two members of the management team serve on this President’s Council as internal board members. Having members of our management team on the board will allow for them to learn from the other board members as well as develop their leadership skills. The President’s Council offers our company a great resource without the extra expense incurred. To serve on our advisory board, we will ask representatives from OnStar as well as Icon, a helmet manufacturer, to provide our company with insight about the industry. We will also create a customer advisory board to provide feedback on our product throughout its developmental phases. As we have progressed through the stages of this business plan, we have discovered that our management team lacks the experience and expertise that is necessary to launch a venture of this magnitude. Although VT KnowledgeWorks will provide us with an informal board of directors, we feel that in order to launch this venture successfully, our board of directors must consist of individuals who are extremely experienced in the industry, especially since our helmet is an entirely new product. 6.0 Operations Plan 6.1 Introduction OnStar helmet is a fully functioning OnStar helmet that will be marketed to motorcycle, offroading, and snowmobile riders that will offer maximum safety to their riding adventures. The following will explain operating model and procedures for the helmet. 6.2 General Approach to Operations OnStar helmets are new to the market and will have to be delicately placed in a specific target market. The need for safe motorcycle helmets is always a hot topic since motorcycles and off road vehicles are much more dangerous than automobiles. The OnStar helmet takes away the concern of getting lost while riding these vehicles because you know that you are in safe hands 25 with OnStar. Their reputation as being reliable is a guiding factor into their success and why they are branching out to selling their equipment individually so they can be installed in non-GM automobiles. With this reputation, we hope to solidify trust in the consumers. Since there is definitely a need for this product, we will manufacture our product in Taiwan using Berlin Dynamic Industry Company, Ltd. We will be basing our company however at Virginia Tech’s VT KnowledgeWorks. This facility provides new entrepreneurs with a physical location that serves as an office. It has many incentives that can be used to enhance the experience of working with OnStar helmets and our potential clients. 6.3 Behind the Scenes Manufacturer Selection: Production will be taken place at a company called Berlin Dynamic Industry Company. Used by top competitor Icon as well. Shipping: Shipping will be done to individual customers; pricing varies depending on where the helmet is shipped to. Staff Selection: With our current budget, we will be using our management team to fill in the needed positions. If we cannot get necessary funds, for the positions not able to be filled in by our team, our company may not be viable. Advertising: Promoting our product through dealerships initially and with the launch of press releases and reports about our product, we hope to expand our business. Home Office Selection: Using VT KnowledgeWorks will be optimal until major growth is achieved because of the corporate address and the amenities offered. 26 6.4 The Experience Online: Easy user interface, with easy navigation throughout the website. Virtual tour of each attribute of the OnStar helmet and virtual demonstration. Also will have size chart to allow customer to pick appropriate size helmet. In Store/ Retail: Try on helmets and test the OnStar when test driving motorcycles Product: Experience having a guardian angel over you everytime you get on your motorcycle, snowmobile, or off-roading vehicle with OnStar’s capabilities. Helmet providing optimal comfort and safety ensures all around high quality experience. Shipping: Quick and cheap delivery offering accurate delivery times Customer Service: Start off with customer service as regular work hours 8-5pm and as we experience growth and hire employees, will move to 24/7 customer service. Option of outsourcing for cost benefits. Warranty: Helmet warranty guaranteeing product safety and durability to consumer with full refund with free shipping or replacement helmet with free shipping. 6.5 Inventory We will be having just-in-time inventory for our product since it is a specialized helmet. We want to keep inventory costs low, so the JIT inventory method seems most viable until we reach a steady demand. 6.6 Business Location OnStar Helmet LLC is proposing to operate a single office located in VT KnowledgeWorks at 2200 Kraft Drive, Suite 1000 in Blacksburg, VA. This location adheres to our cost-saving initiative in the beginning phase of launching the OnStar helmet, while still offering valuable services needed to expand the company. 27 Advantages of VT KnowledgeWorks location o Proximity to Virginia Tech: Since our entire team is comprised of current Virginia Tech students, this locale will cut down on transportation costs as well as allow our team to remain in an extremely familiar area. We also have a large percentage of our team’s collective network based in the Virginia Tech community, o Proximity to resources offered by the Virginia Tech Corporate Research Center: VT KnowledgeWorks is based in the Virginia Tech Corporate Research Center, which is located approximately 5 miles from the Virginia Tech campus. The research center offers features and support that far surpass any other facility in the extended area, which are detailed in the facilities and equipment section. o Economical pricing offered by VT KnowledgeWorks: Renting an office in the VT KnowledgeWorks Suite comes to a cost of $750 per month. This is very important in the start-up process for a company such as ours due to the high costs of licensing our helmets from OnStar and liability insurance, among others. They also offer access to the AttaainCl market intelligence software in a discounted package for $89 a month. This tool will provide a distinct strategic and competitive advantage to our company, since we are just entering the market and have limited experience. o Proximity to target market: Based on the survey we conducted in the feasibility analysis, approximately 15-20% of all residents of the Southwest Virginia/New River Valley area stated that they either own or have owned a motorcycle or ATV which makes them potential customers. This illustrates the conduciveness of the area to launching a product in the motorcycle/ATV accessory market. 28 o Ideal physical geography: The Southwest Virginia/New River Valley region is mostly rural, with many smaller towns and few cities. According to Virginia’s state government statistics from 2011, the central and southwest regions had the fewest percentage of their population in high-density areas, 22.9% and 28% respectively, in the entire state (“Gauging Effective,” 2011). Low-density areas are more advantageous to the use and/or ownership of off-road vehicles/ATVs, which comprises a large percentage of our target market. Another benefit of the area’s rural landscape and spread out population, it is more likely that if an ATV/off-road vehicle accident occurs, there will not be someone around to render aid. This fits the purpose of our OnStar helmet perfectly, to give the helmet owner the ability to receive help in remote locations. 6.7 Facilities and Equipment VT KnowledgeWorks office VT KnowledgeWorks is located in a 45,000 square foot, state-of-the-art facility that includes conference rooms, lab spaces for product development, and a secure server to protect important financial information. In addition, it includes 12 monthly meetings with a professional mentor with years of entrepreneurship experience, an invaluable resource since our team has limited real-world knowledge in that area. The KnowledgeWorks office makes available access to three powerful services including the AttaainCL market intelligence software, Presidents’ Council, and StrategicStudio. o The market intelligence software contains live updates of competitor activities, market segments, industry reports, and other useful features. 29 o The President’s Council offers a board of 8-10 company leaders that offer confidential meetings and act as an informal Board of Directors. o StrategicStudio offers leadership retreats run by the WilderWeber Leadership Group. This consulting service will further advance the leadership and entrepreneurial skills of each individual team member, which makes our management team exponentially stronger as a cohesive unit. It also offers a highly legitimate street address for a start-up due to the fact that Virginia Tech is among the premier research universities in the nation. This gives our company instant credibility. Costs of renting facility and services: o $750 per month for renting an office, which comes with conference rooms, lab spaces and a secure server. o $89 per month for Essential Marketing Intelligence Package. o $119 per month for Advanced Marketing Intelligence Package for first year; $149 per month for each year after. o Cost of StrategicStudio has large range, based on custom retreat programs (“VT Knowledgeworks”) Production Facility Our company will be outsourcing all production of the OnStar helmets in order to cut costs associated with buying/leasing equipment and leasing a manufacturing facility. The OnStar helmets will be produced by Berlin Dynamic Industry Company, Ltd. It is a Nexx and Icon brand helmet manufacturer and distributor/wholesaler. It is located in Taichung, Taiwan. 30 This facility was established in 1991 and currently employs 50 people, with a total sales volume of US$2.5 million (“Berlin,” 2011). It is a verified, listed manufacturer of both Nexx and Icon brand helmets, according to the Alibaba Global Trade website (“Berlin,” 2011). Since we are introducing a brand new product in the marketplace, the production will start minimally, and increase as demand starts to increase. After researching several manufacturers for Nexx and Icon motorcycle helmets, this is the best choice based on the fact that it is not a massive facility, which keeps costs down and allows us to start production slowly. However, it is big enough to be able to handle our order increase that is projected for the next two years. We are currently in the process of researching bigger facilities to handle growth past the two year period, but the main focus is to make sure we get to that point as a company where an upgrade will be needed. In addition to the facilities matching our needs, the country of Taiwan has the fourth lowest manufacturing hourly compensation costs in the world at US$8.36, according to the U.S. Department of Labor’s Bureau of Labor Statistics report (BLS, 2011). This makes Berlin Dynamic’s wage costs extremely low, which in turn decreases our outsource production costs. Our company is currently in the process of licensing OnStar which would allow our manufacturer to install their technology in our helmets. We understand that this is an enormously essential part of being able to produce our helmets. However, the reputation of Berlin Dynamic gives our company confidence in their ability to produce our helmets for a very economical price. The feasibility of our product depends on OnStar allowing us to license their technology, and until that happens, our product will not be viable. 31 7.0 Product Design and Development Plan Since our product would be new to the market, the product design and development plan is an essential component to our business model. Currently, we are in the product conception stage because we have not yet created a prototype of our product. Our product builds on the original design and capabilities of a standard motorcycle and recreational helmet while also adding the OnStar component which consists of crash detection technology and a GPS locator (See Visual Representation, p. 46). From this product conception step, we plan to contact Berlin Dynamic Industry Company, Ltd. in order to create a prototype of our helmet. We will have the manufacturer install the OnStar “4 My Vehicle” equipment, also known as FMV, into our helmets which will allow for the emergency service response as well as hands-free calling capabilities. This new equipment from OnStar allows for the OnStar product to be installed in products other than automobiles. After contacting OnStar, they ensured us that with this new FMV equipment it would be feasible to install their product into a standard motorcycle helmet and that it was “a great opportunity to reach motorcycle users” (OnStar Representative, 2012). After we create a prototype for our helmet, we will conduct thorough tests on the product in order to test its merit; in addition, we will allow prospective customers, who are current helmet users, to provide feedback on the prototype. Customers will be able to offer us feedback on areas such as the product’s functionality as well as their perceived value of our product. Through this usability testing and feedback from the customers, we can make necessary improvements to our product before we launch the initial production of the product. Another important factor in bringing our product to market is to create a warranty for our product. The express warranty will explicitly state the capabilities of the helmet as well as the quality and capacity of the helmet to function properly. 32 Timeline If funding is obtained, we will proceed by completing the various milestones in order to prepare our helmet for market. Completed Milestones: February – March 2012: - Created management team - Product conception - Complete feasibility analysis March – April 2012: - Selected board of directors and advisory board - Selected desired legal status Milestones to Be Completed: April – August 2012: - Obtain funding to support venture - Secure a manufacturer with the capabilities to produce helmet - Use initial funding to create prototype September – November 2012: - Usability testing of prototype - Make necessary improvements to launch initial production - Make contacts with distributors in preparation for initial launch December 2012 – March 2013: - Initial launch of product - Assess demand based on initial production and make improvement if necessary April – June 2013: - Full production of helmet (JIT production) 7.1 Intellectual Property The venture team has decided that the best patent for our product is a utility patent. The definition of a Utility patent is as follows: 33 Utility Patent- “invents or discovers a new and useful process, machine, manufacture, or composition of matter, or any new or useful improvement thereof” (Barringer, p. 394, 2010). Our venture team focuses on the latter half of the definition: new or useful improvement. The OnStar Smart Helmet is a new and useful improvement upon ordinary recreational and motorcycle helmets and the original OnStar technology. By combining the already-made software and hardware technologies offered by OnStar for crash safety, GPS, and other customer service utilities, with the familiar design of a motorcycle helmet, the new venture team has a unique product that plays into the newly formed and growing market for technologically enhanced products. While similar products feature GPS or Bluetooth abilities, the OnStarEnabled helmet features all the convenient amenities that are becoming standard for most car owners. This patent will be good for 20 years, giving the venture team plenty of time to establish ourselves in the market. To apply for the patent the team will write up all technological details and include detailed drawings of the entire helmet. OnStar will be consulted as the drawings are made up so that all features can be included. It is important that the team begins drafting the patent immediately, as it can take an average of two and a half years to be granted a patent in the U.S. The team will apply for the patent jointly, sharing patent agreements with the key partner: OnStar. The team has kept detailed records of the invention process in a logbook. We must then hire an attorney to oversee the process. We have previously conducted a patent search, and while a single similar product is currently patent-pending, the uniqueness of the elaborate features included in the OnStar helmet make it unique enough that no infringement will occur. 34 While the patent is being prepared in its entirety, the team plans to file a provisional patent application to protect the design and allow us the use of “Patent Pending.” Once the patent is written up fully, and has been approved by our patent lawyer, it will be submitted and the team will simply have to await the results from the USPTO. 7.2 Challenges and Risks In order to successfully create our product, we must license the technology from OnStar. Therefore, the success of our product is contingent upon OnStar allowing us to use their services with our helmet. According to an OnStar representative, in order to partner with OnStar, our company must submit our service idea to OnStar. If OnStar decides to approve the idea and further pursue the business proposition, then negotiations would take place between OnStar and our company. If we cannot license from OnStar, then we have ultimately hit a roadblock that will cease our business venture. Another challenge that hinders the viability of our business is the high costs of manufacturing, licensing, and liability insurance. The costs associated with this business model seem to be exceedingly high, much higher than we had anticipated in the feasibility analysis and during the product conception phase. Through conducting this business plan, we have discovered multiple uncertainties which we feel will reduce the viability of our business and hinder its full development. 8.0 Financial Projections 8.1 Assumptions Sheet The financial statements depend on assumptions influencing the outcome of our business. The assumptions assumed are as follows: 35 General (Assumptions) 1. OnStar helmets will grow in demand as they take the market in safety and reliability over time through user experience. 2. We assumed on a conservative note that angel investors will provide $200,000 from the start Financial (Assumptions) 1. Sales forecasts are viewed in both a pessimistic and a more optimistic view for comparison. Presumably OnStar helmets will start slow with an estimate of 5 customers the first month with growth at 6% for the second two months and then growing to 25% for the rest of the first year. Growth will increase to 50% in the second year following PR and news reports on our quality helmet. 2. Licensing fees vary depending on your product idea and negotiation with OnStar. Estimates are based off licensing for Google Maps with phone applications since it is a similar product in regards to customer service and location identification. Fees were estimated at $10,000 a year for Google Maps, so we tripled that amount for the OnStar helmet given that it has crash detection and Bluetooth. (Leach, 2011) 3. Owner salary is conservative and will vary depending on how well the product does and how well our costs are under control. 36 Source of Funds Source Angel Investors (VT KnowledgeWorks) 7(a) Loan Program Grant SBA Small Loan Advantage Program Grant Line of Credit with BB&T Bank ($150,000 LOC, $75,000 Disbursement when company starts) Virginia Microloan Program Grant Management Team Investment Total Funds Committed Total Funds Required Total Funds Needed from Equity Investor Amount $ 200,000.00 $ 65,000.00 $ 100,000.00 $ 75,000.00 $ 25,000.00 $ 20,000.00 $ 485,000.00 $ 766,600.00 $ 281,600.00 37 Use of Funds Monthly Costs Monthly Expenses Salary of owner-managers Total Cost for Year % of Total Source of Estimate $5,000 $60,000 7.8% Low end at first, invest in company 750 9,000 1.2% VT KnowledgeWorks site Advertising(TV&Internet) 5,000 60,000 7.8% Average advertising in starting new bus. Website Maintenance 2,000 24,000 3.1% Cost of Nexx/Icon website main. Sea Freight costs ($50 per order) 1,000 12,000 1.6% US International Trade Commission site Customs agent (shipment over $1000) 2,000 24,000 3.1% Approximate Taiwanese agency cost 20,000 240,000 31.3% SAB website 1,800 21,600 2.8% US Customs/Border Protection site 500 6,000 0.8% US Customs/Border Protection site 10,000 120,000 15.7% Berlin Dynamic website $576,600 75.2% Rent (KnowledgeWorks Office) Insurance(Liability) Import costs(Port fees,GST, entry/broker fees) Duty rate(0.035 kg/1.4% ad valorem) Outsourcing to Berlin Dynamic Subtotal One-Time Costs Projected OnStar licensing fee(TBD) Initial inventory (50 helmets * bulk price of $200 per helmet) Advertising and promotion for website launch Cash(working capital) Subtotal Total Required Funds Cash Needed to Start % of Total Source of Estimate 100,000 13.0% OnStar website/customer service 10,000 1.3% Base price in buying helmets in bulk 5,000 0.7% 75,000 9.8% $190,000 $766,600 Projected based on total advertising fee Group estimate based on monthly costs 24.8% 100% See Appendix, p. 48 for pro forma financial statements and relevant ratios. 38 Bibliography Arai. (2012). Arai helmets. Retrieved from http://www.araiamericas.com/. Arai helmet warranty. (n.d.). Retrieved from http://www.motorcycle-communications.com/araihelmet-warranty1.html. Ashe, S. (2011, July 19). Onstar for my vehicle coming to best buy july 24. Retrieved from http://reviews.cnet.com/8301-13746_7-20080412-48/onstar-for-my-vehicle-coming-tobest-buy-july-24/. Barringer, B. R., & Ireland, R. D. (2010).Entrepreneurship: Successfully launching new ventures. (3 ed., p. 394). Upper Saddle River: Prentice Hall. Berlin Dynamic Industry Co., Ltd. (2011, Dec. 21). http://www.alibaba.com/member/tw1002112227/aboutus.html. BLS. (2011, Dec. 21). International Comparison of Hourly Compensation Costs in Manufacturing. http://www.bls.gov/news.release/pdf/ichcc.pdf. Ford technology. (2011). Retrieved from http://www.ford.com/technology/sync/features/. Gauging Effective Land Use in Virginia - Virginia Performs. (2011, Aug. 4) http://vaperforms.virginia.gov/indicators/transportation/landUse.php. Global premium motorcycle helmets market to reach $851 million by 2015, according to a new report by global industry analysts, inc.. (2010, Feb. 09). Retrieved from http://www.prweb.com/releases/motorcycle_helmets/premium_helmets/prweb3489854.ht m. Harley-Davidson. (2012). Harley-davidson usa. Retrieved from http://www.harleydavidson.com/en_US/Content/Pages/home.html. Hartmann, A. (2012). Motorcycle industry trends. Retrieved from http://www.ehow.com/list_6891648_motorcycle-industry-trends.html. 39 IBISWorld: 33699a Motorcycle, Bikes and Parts Manufacturing in the US. Retrieved from http://clients.ibisworld.com.ezproxy.lib.vt.edu:8080/industryus/print/currentperformance. aspx?indid=856. IBISWorld: 33699c ATV, Golf Cart and Snowmobile Manufacturing in the US. Retrieved from http://clients.ibisworld.com.ezproxy.lib.vt.edu:8080/industryus/print/currentperformance. aspx?indid=858. IBISWorld.com. (2012). Retrieved from http://clients.ibisworld.com/industryus/productsandmarkets.aspx?indid=1008. IBISWorld: Communication Equipment Manufacturing in US. (2012, March). Icon. (2012). Icon. Retrieved from http://rideicon.com/product_group.jsp?category=3427. Ingold, J. (2011). Denver, boulder mark the pot for legalization push. Retrieved from https://global.factiva.com/factivalogin/login.asp?productname=global. JDP. (2010, May 20). Ultimate motorcycling. Retrieved from http://www.ultimatemotorcycling.com/2010/jd-power-motorcycle-helmet-satisfactionstudy. JDP. (2011, May 26). J.d. power and associates. Retrieved from http://www.jdpower.com/content/press-release-auto/STVKa8H/motorcycle-helmetsatisfaction-study.htm. Klein, R. Nexx X30 Helmet – WebBikeWorld http://www.webbikeworld.com/r2/motorcyclehelmet/nexx-x30/. Korzeniewski, J. (2011, January 04). Onstar goes aftermarket, coming to best buy in spring [Web log message]. Retrieved from http://www.autoblog.com/2011/01/04/onstar-goesaftermarket-coming-to-best-buy-in-spring-of-2011/. 40 Leach, A. (2011, October 27). Google maps api now costs $4 per 1,000 requests. Retrieved from http://www.theregister.co.uk/2011/10/27/google_maps_api_no_longer_free/. Mellor, A., & StClair, V. Department for Transport, (2005). Advanced motorcycle helmets (050329). Retrieved from TRL Limited website: http://wwwnrd.nhtsa.dot.gov/pdf/esv/esv19/05-0329-O.pdf. More people riding motorcycles than ever before. (2009, May 21). Retrieved from http://www.womenridersnow.com/pages/story_detail.aspx?lid=1221. Morris, C. (2009, May). Motorcycle trends in the united states. Retrieved from http://www.bts.gov/publications/special_reports_and_issue_briefs/special_report/2009_0 5_14/html/entire.html. Motorcycle dealers. (n.d.). Retrieved from http://www.hoovers.com/industry/motorcycledealers/1928-1.html. Motorcycle Industry Council. (2009, May 21).Motorcycling in america goes mainstream says 2008 motorcycle industry council owner survey. Retrieved from http://www.mic.org/downloads/newsreleases/2008_owner_Survey_LH_5-21-2009.pdf. NHTSA. U.S. Department of Transportation, National Highway Traffic Safety Adminstration. (2009).Motorcycle helmet use in 2009-overall results. Washington: National Highway Traffic Safety OnStar of GM. What is OnStar? (n.d.). Retrieved from http://editorial.autos.msn.com/listarticle.aspx?cp-documentid=1062268. Onstar plans and pricing. (n.d.). Retrieved from http://www.onstar.com/web/portal/planspricing. OnStar Representative. (2012, April 18). Interview by b Priest [Personal Interview]. 41 Onstar reverses decision to change terms and conditions. (2011, Sept. 27). Retrieved from http://media.gm.com/content/media/us/en/gm/news.detail.html/content/Pages/news/us/en/ 2011/Sep/0927_onstar. SHOEI. (2012). Shoei premium helmets. Retrieved from http://www.shoei-helmets.com/. SMS Research and Marketing Services, Inc. Department of Transportation: State of Hawaii, (2003).Motorcycle helmet use literature review. Retrieved from SMS website: http://hawaii.gov/dot/highways/safecommunities/safecommunities/reports/motorcyclehelmets/motorcyclehelmetslitreview.pdf/view. Terms and conditions of your onstar service. (2010, August). Retrieved from http://www.onstar.com/web/portal/termsconditions. The U.S. Motorcycle Market: Motorcycle Industry Research and Statistics. Version 235. Knol. (2011, Aug 8). Retrieved from: http://knol.google.com/k/bobbie7/the-u-s-motorcyclemarket/21yokwucnoqmb/6. U.s. census bureau: 1997 naics definitions. (n.d.). Retrieved from http://www.census.gov/epcd/naics/NDEF339.HTM. VT KnowledgeWorks. http://www.vtknowledgeworks.com/. 42 Appendix Helmet Attributes 1. quietness 2. ventilation/air flow 3. de-fogging performance 4. face shield ability to keep wind out 5. face shield ability to resist scratching 6. ease of replacing face shield 7. scratch resistance of shell 8. color/graphic design 9. weight 10. ease of fastening the strap 11. fit and comfort (JDP, 2011) Competitive Analysis Grid The grid above shows that the OnStar Helmet has a distinct advantage in terms of safety features and technological capabilities. This is due to the fact that we are the only product that offers this new and innovative service. In terms of design, aerodynamics, and comfort we are on the same level as most premium brand helmets. An area where Onstar Helmet has a major disadvantage is price. This is due to the fact that we will be paying more to manufacture these helmets than any of our competitors. 43 OnStar Warranty Below are clauses related to the OnStar Warranty that we will use in order to limit our liability. “NO WARRANTIES ON EQUIPMENT, INFORMATION, OR SERVICES. Warranties are special kinds of promises. WE DON’T MAKE ANY WARRANTIES, EXPRESS OR IMPLIED, ABOUT OnStar Equipmentor any other equipment used with OnStar service. You may have a warranty on OnStar Equipmentor other equipment from the maker of your Car, but not from us. In addition, OnStar cannot promise uninterrupted or problem-free service, and cannot promise that the data or information provided to you will be error-free. ALL DATA AND INFORMATION IS PROVIDED TO YOU ON AN "AS IS" BASIS. NEITHER WE, NOR ANY OF OUR Service Providers, MAKE ANY WARRANTIES, EXPRESS OR IMPLIED, ABOUT OnStar SERVICE OR ABOUT ANY DATA OR INFORMATION OR SERVICES PROVIDEDTHROUGH IT. THIS MEANS, AMONG OTHER THINGS, NO WARRANTIES OF CONTENT, QUALITY, ACCURACY, TIMELINESS, COMPLETENESS, CORRECTNESS, RELIABILITY, MERCHANTABILITY, OR FITNESS FOR A PARTICULAR PURPOSE. ALL SUCH WARRANTIES ARE EXPRESSLY EXCLUDED BY THIS AGREEMENT.” “LIMITATIONS OF LIABILITY. YOU AND OnStar ARE EACH WAIVING IMPORTANT RIGHTS. UNLESS FORBIDDEN BY LAW IN A PARTICULAR INSTANCE, WE EACH AGREE AS FOLLOWS: First, WE AREN’T LIABLE FOR THE ACTIONS OR INACTIONS OF ANY Service Provider WE CONTACT FOR YOU OR YOUR CAR, OR FOR OUR INABILITY TO CONTACT ANY Service Provider IN ANY PARTICULAR SITUATION.” “Second, WE AREN’T LIABLE TO YOU FOR (1) ANY INJURIES TO PERSONS OR PROPERTY ARISING OUT OF OR RELATING TO YOUR USE OF OnStar Equipment OR OnStar SERVICE, including but not limited to injuries to persons or property arising out of use of Stolen Vehicle Slowdown, Remote Ignition Block or Pre-Arrival Instructions (EMD-Emergency Medical Dispatch) capability OR (2) ANY DAMAGES ARISING OUT OF OR RELATING TO THE INSTALLATION, REPAIR, OR MAINTENANCE OF OnStar Equipment.” “Third, OUR MAXIMUM LIABILITY TO YOU UNDER ANY THEORY (INCLUDING BUT NOT LIMITED TO FRAUD, MISREPRESENTATION, BREACH OF CONTRACT, PERSONAL INJURY, OR PRODUCTS LIABILITY) IS LIMITED TO AN AMOUNT EQUAL TO THE PORTION OF THE CHARGES TO YOU FOR THE SERVICES RELATING TO THE PERIOD OF SERVICE DURING WHICH SUCH DAMAGES OCCUR.” ("Terms and conditions," 2010) Other OnStar Terms and Conditions: “HOW YOUR OnStar SERVICE WORKS AND SYSTEM LIMITATIONS. OnStar service is only available in the continental United States, Alaska, Hawaii, and Canada. OnStar service works using wireless communication networks and the 44 Global Positioning System ("GPS") satellite network. NOT ALLOnStar SERVICES ARE AVAILABLE EVERYWHERE, PARTICULARLY IN REMOTE OR ENCLOSED AREAS, OR ON ALL CARS, AT ALL TIMES.” “OnStar is not responsible for any delay or failure in performance if such failure or delay could not have been prevented by reasonable precautions. Additionally, OnStar is not responsible if such failure or delay is caused by acts of nature, or forces or causes beyond our reasonable control. Examples include public utility electrical failure, acts of war, government actions, terrorism, civil disturbances, labor shortages or difficulties (regardless of cause), or equipment failures including Internet, computer, telecommunication or other equipment failures.” “OnStar ADVISORS CONNECT YOU TO OTHER Service Providers. Our OnStar Advisors link you or your Car to other Service Providers such as the police, fire department, or ambulance service. We’ll use reasonable efforts to contact appropriate Service Providers for help as required by the situation or when the OnStar system in your Car signals for it, but we can’t promise that any Service Providers will respond in a timely manner or at all.” “You promise to use OnStar emergency and roadside services only for actual emergencies and roadside assistance needs. You promise you won’t abuse or do anything to damage our business operations, services, reputation, employees, facilities, or Service Providers. If you do any of these things, you agree you’ll be responsible for any amount anyone else claims from us, plus any expenses, resulting in whole or in part from that use or your actions.” ("Terms and conditions," 2010) Arai Helmet Warranty: “All Arai helmets are warranted against defects in materials and workmanship, and are serviceable only for the properly fitted* first user for 5 years from date of first use, but no more than 7 years from date of manufacture. It should be replaced within 5 years of first use. *As neither Arai or the consumer can be assured that helmets sold by mail order, phone or internet are properly fitted and delivered in original, as new condition, Arai cannot and does not extend its warranty to helmets purchased through these channels. The Warranty and date information can be found on your chinstrap (one of the chinstraps is shown in the photo above). The date-of-manufacture (month / year) is on the opposite strap, for example 08/01, 04/02, 10/02, etc.” ("Arai helmet warranty,"). 45 Visual Representation of the OnStar Helmet 46 Organizational Chart The senior staff reports to CEO Blair Priest. The Marketing & Sales, Human Resources, Operations, and Finance are all Senior Vice President Positions, and Customer Service, Information Systems, and Accounting are all Vice President Positions. All other employees will report to the VP’s of their respective departments. CEO Blair Priest Human Resources Operations Marketing & Sales Finance Vacant Ryan Beach CJ Babb CJ Babb Customer Service Information Systems Accounting Lindsey Cartner Matt Shea Vacant 47 See additional Excel document for the financial statements. 48