When You Really Need to Know - Association of Corporate Counsel

advertisement

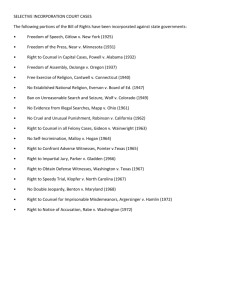

When You Really Need to Know: When, How and Why to Conduct Internal Investigations Robert Lavet Miriam Lefkowitz Victoria McKenney Summary In the current political and regulatory environment, government oversight and enforcement activities are increasing rapidly; internal and external scrutiny over corporate and accounting practices is at an all-time high. Prompt and thorough internal investigations of allegations of mismanagement and potential misconduct are critical to respond to a governmental investigation or threatened litigation. Panelists will discuss assessing the risks of fraud and the consequences of doing nothing, benefits of comprehensive investigations, effective investigative techniques and how to undertake necessary and appropriate remedial efforts to manage results of investigations at organizations of varying size. 2 Agenda • What is an “internal investigation” • When are internal investigations required by regulators, and when should they be conducted even though not required • Ethical considerations for in-house counsel investigating employees • Strategies for conducting an effective internal investigation • What to do once you have completed the investigation 3 What is an internal investigation? • Review of alleged misconduct by employees or others representing the company to determine what happened. – May arise from employee or third party allegations (raised anonymously, in person, via a hotline, etc.), audit findings, media reports, or the initiation of a government investigation. – Often conducted by in-house counsel or external counsel retained by management. – Seeks answers to the five W’s: Who, What, When, Where, Why. • Independent investigations are a type of internal investigation. – Usually commissioned when there is high reputational or economic risk or the specter of voluntary disclosure or a parallel government investigation, or when management may be implicated/interested. – Overseen by the board or an appropriate board committee or special committee comprised of independent directors. – Conducted by independent external counsel (i.e., a firm not historically retained by management to provide legal advice). 4 Required Investigations – Federal • Rarely* is a company required by federal law or regulation to conduct an internal investigation, but certain situations essentially demand as much: – Significant Compliance Issues – Regulators will have a negative reaction if a company learns of a significant compliance issue and does not thoroughly investigate to determine the cause and extent and to take remedial action. – Voluntary Disclosure – Regulators will expect detailed factual information about the conduct at issue, which would require a thorough investigation. – In response to government investigations – A company may learn that it is the target or subject of a government investigation, leading the company to conduct its own intensive investigation. – Cooperation Posture – Regulators may suggest expansion of an internal investigation (e.g., to additional markets) and consider the company’s response when considering cooperation credit and scoping their own investigation. 5 Required Investigations – Federal • Policies and procedures for investigating and remediating misconduct are key elements of an effective ethics and compliance program under the U.S. Sentencing Guidelines applicable to organizations, which include the following as among the minimum necessary components of such a program: – Promotion and enforcement of the organization’s compliance program, including through “appropriate disciplinary measures for engaging in criminal conduct and for failing to take reasonable steps to prevent or detect criminal conduct.” USSG §8B2.1(b)(6). – Following detection of misconduct, “reasonable steps to respond appropriately to the criminal conduct and to prevent further similar criminal conduct, including making any necessary modifications to the organization's compliance and ethics program.” USSG §8B2.1(b)(7). 6 FINRA Rules • All FINRA registered broker-dealers are subject to FINRA Rule 4530 which requires firms to “promptly report to FINRA, but in any event not later than 30 calendar days, after the member has concluded or reasonably should have concluded that” certain violations of the securities rules or regulations have occurred by the firm or persons associated with the firm. 7 ETHICAL CONSIDERATIONS FOR CORPORATE COUNSEL 8 CORPORATE COUNSEL ROLE BECOMING INCREASINGLY COMPLEX • Corporate Counsel are playing a critical role in protecting their organization from compliance risks. • Given recent attention on corporate scandals there is increased emphasis on governance issues. – Higher expectation on Corporate Counsel – Increased duty on Corporate Counsel to communicate wrongdoing to higher authorities in organization 9 CORPORATE COUNSEL ROLE BECOMING INCREASINGLY COMPLEX (cont’d) • General counsel’s office often directly accountable/responsible for: – Risk assessment – Document management – Code of conduct – Compliance training – Risk management 10 THE COMPANY AS CLIENT • Corporate Counsel role by its very nature leads to heightened risk of ethical dilemmas. This is particularly true in conducting or managing corporate internal investigations. – Aspect of being Corporate Counsel that is most attractive (working closely with one client/employer) is precisely what makes in-house ethical considerations challenging. • Company management likely to view Corporate Counsel as more than just an attorney providing legal services for the company. • Advice Corporate Counsel provides not exclusively legal. • Maintaining confidentiality to client creates ethical conflicts when constituents of client behave in manner adverse to client. 11 THE COMPANY AS CLIENT (cont.) • Overview of the organization as client – ABA model rule 1.13: “a lawyer employed or retained by an organization represents the organization acting through its duly authorized constituents.” • Who are the company’s duly authorized constituents? Board of Directors; senior management, employees. • Whether or not client is an organization or an individual, lawyer owes client the same duties: – Fiduciary duty of undivided loyalty – Duty to maintain client confidence and secrets – Duty to represent client competently 12 ETHICAL ISSUES FACING CORPORATE COUNSEL CONDUCTING INVESTIGATIONS • Company may ask Corporate Counsel to conduct internal inquires into allegations of employee or management misconduct. – Corporate Counsel conducting internal investigations will have actions and conclusions closely scrutinized. • Finding no misconduct may be viewed skeptically by regulators, etc. • Finding of misconduct has to be well supported to get approval within company, including board level – In real life Corporate Counsel invariably has strong personal relationship with company’s management. 13 ETHICAL ISSUES FACING CORPORATE COUNSEL CONDUCTING INVESTIGATIONS (cont’d) – Corporate Counsel may be too close to some problems to see them. • E.g., stock option backdating cases • Clarity is critically important when Corporate Counsel advises management and board on issues relating to start and ongoing conduct of an internal corporate investigation. 14 ETHICAL ISSUES ARISING DURING INTERNAL INVESTIGATIONS • Corporate Counsel’s Duty to Represent Entity in Internal Inquiries – Under ABA Model Rule 1.13, Corporate Counsel represents the organization acting through its duly authorized constituents. – A lawyer must, in matters within the scope of representation, “avoid impermissible conflicts of interest.” Restatement of the Law Governing Lawyers, Section 16. – Conflicts arise if employees of organization believe that counsel represents them, not the entity. – Attorney- Client relationship may arise by implication. See Restatement of the Law Governing Lawyers, Section 14. – New York Disciplinary Rule 5-109(a). 15 ETHICAL ISSUES ARISING DURING INTERNAL INVESTIGATIONS (cont’d) Duty to Inform Employees • Corporate Counsel should protect the Company by adequately disclosing who you represent, and the nature of the investigation. In Upjohn*, the Supreme Court recommended that counsel state: – Counsel is conducting an internal investigation on behalf of the organization. – Purpose of the investigation is to provide legal advice to the entity. – Counsel represents the entity and not any individual employee. – The employee may seek independent legal representation (note: this is not necessarily the case in all inquiries). – Any information disclosed to counsel may not be protected by attorney- client privilege, may be disclosed to the organization, and may even be disclosed to third parties at the organization’s discretion. 16 ETHICAL ISSUES ARISING DURING INTERNAL INVESTIGATIONS (cont’d) • Both ABA Model Rule of Professional Conduct 1.13(d) and New York Disciplinary Rule 5-109 [22 N.Y.C.RR § 1200.28] require attorneys to explain clearly whom they represent if interests of employee are or may become adverse to that of company. • Since internal investigations are means for determining whether employee engaged in illegal or improper conduct, interview of employees inevitably creates situations in which conflict between company and employee should be apparent. • When Corporate Counsel should advise employee of need for separate counsel. – Employee is target of investigation – Employee is probable whistleblower – Employee under risk of criminal liability 17 TAKING DIRECTION FROM THE ORGANIZATION • • • Corporate Counsel’s duty is to represent the Company. Generally this means acting under the direction of CEO and the Board and accepting their decisions. Corporate Counsel must not be persuaded by personal interests of company’s directors, officers and employees. Duties of Corporate Counsel where following directions may result in substantial injury to the organization. – Rules don’t favor disclosure to authorities – they actually limit disclosure outside of organization. • Example: Fair Laboratory Practices Act v. Quest Diagnostics* – former general counsel of defendant violated N.Y. Rule 1.9(c) (which prohibits lawyers from using confidential information of a former client protected by Rule 1.6 to disadvantage of former client) by participating as plaintiff in qui tam case against former employer. • Under New York Disciplinary Rule 5-109(b) and ABA Model Rule 1:13(b) lawyer must minimize disruption to the organization and risk of revealing information relating to representations outside organization. 18 TAKING DIRECTION FROM THE ORGANIZATION (cont’d) – Steps to take – ABA Model Rule 1:13(b) • • • Ask reconsideration Advise that separate legal opinion be sought for presentation to appropriate authority in organization Refer to highest authority in organization (usually the board) – NY D.R. 5-109(c) • • Permits attorney to resign if despite lawyer’s efforts, the highest authority that can act for organization insists on action or refusal to act that is clearly a violation of law and ultimately to result in a substantial injury to organization. Impact of Sox § 307 and SEC’s implementing rules. Do they trump state disciplinary codes? Difficult to do this under individual or family plays dominant role in a public company. 19 TAKING DIRECTION FROM THE ORGANIZATION (cont.) • Reporting Out: Amended ABA Model Rule 1.6: – A lawyer may disclose client confidences to the extent he reasonably believes it is necessary • To prevent the client from committing a crime or fraud that is reasonably certain to result in substantial injury to the financial interests or property of another and in furtherance of which the client has used or is using the lawyer’s services, or • To prevent, mitigate or rectify substantial injury to the financial interests or property of another that is reasonably certain to result or has resulted from the client’s commission of a crime or fraud in furtherance of which the client has used the lawyer’s service. 20 TAKING DIRECTION FROM THE ORGANIZATION (cont.) • Amended ABA Model Rule 1.13: • If a lawyer knows of a violation of law or a legal duty to the organization in a matter related to the representation that is likely to result in substantial injury to the organization • And the highest authority in the organization fails to timely and appropriately address the violation, then the lawyer • May reveal information relating to the representation, but only if and to the extent the lawyer believes necessary to prevent substantial injury. • Pitfalls of this evident in Quest Diagnostics case. 21 PRACTICAL CONCERNS FOR CORPORATE COUNSEL CONDUCTING INTERNAL INVESTIGATIONS • Protecting Privilege – UpJohn case • Answers to written questionnaires by UpJohn foreign managers prepared by GC conducting internal investigation into concerns of improper payments to foreign government held privileged. • Attorney-client privilege not limited to senior managers. • Attorney-client privilege protected information provided by middle and lower level employees used by counsel to provide legal advice protected. • Recognition that lower level employees acting within scope of employment can embroil corporation in serious legal difficulties. 22 PRACTICAL CONCERNS FOR CORPORATE COUNSEL CONDUCTING INTERNAL INVESTIGATIONS (cont’d) • UpJohn holds that factual investigations performed by attorneys acting as attorneys are protected by attorneyclient privilege. • Challenges to preserving privilege in internal investigations. • Perception that “expanded role of legal counsel within corporations has blurred the line between business and legal advice.” Acostou v. Target Corp., 281 F.R.D. 314, 322 (N.D. Ill. 2012). • UpJohn court: “the inclusion of general counsel does not transform all decisions into privileged attorney-client communication.” 23 PRACTICAL CONCERNS FOR CORPORATE COUNSEL CONDUCTING INTERNAL INVESTIGATIONS (cont’d) • Increasing inclusion of in-house counsel is business discussions and decisions has “increased burden that must be borne by the proponent of corporate privilege claims relative to in-house counsel. In re Vioxx Products Litigation, 501 F. Supp. 2nd 789, 799 (E.D. La. 2007). • Privilege waived if communication not kept confidential – Failure to create expectation of confidentiality can lead to waiver – Having third parties attend witness interviews can lead to waiver – sharing report beyond those who need to know 24 PRACTICAL CONCERNS FOR CORPORATE COUNSEL CONDUCTING INTERNAL INVESTIGATIONS (cont’d) • Privilege waivers in investigations of sexual harassment – Companies that premise defense on results of internal investigation. – Assertion of Faragher-Ellerton defense premised in whole or part on internal investigation can waive attorney-client privilege on report and all documents, witness interviews, notes and memoranda.* • Hotline complaints – Are communicated between in-house counsel and anonymous employee whistleblowers protected? * See e.g., Angelone v. Xerox, No. 09 CV. 6019 ( U.S.D. Ct., W.D. N.Y. Sept. 26, 2011) (“Xerox can not rely on the thoroughness and competency of its investigation and corrective actions and then try and shield discovery of documents underlying the investigation… ”) 25 PRACTICAL CONCERNS FOR CORPORATE COUNSEL CONDUCTING INTERNAL INVESTIGATIONS (cont’d) – Is complaint and subsequent communications between complainant and in-house counsel made by a client for purpose of seeking legal advice? – Do in-house counsel responding to hotline complaints represent interests of company or individual complainant. – Does hotline website tell potential whistleblower that a company attorney will review the submission? – Recent case - Freescale Semiconductor v. Maxim Integrated Funds, 2013 U.S.D. Ct. Lexis 155391 (W.D. Tex. 2013). • Issue raised on motion to compel discovery in copyright infringement dispute. • Submissions made via Ethics Point portal used by Maxim • Initial submission by whistleblower held not privileged. • Subsequent communications between Maxim GC and Whistleblower held privileged under UpJohn. 26 Who should be involved? • Board and/or management – Oversee the investigation and receive periodic status reports. • In-house counsel – Conduct the investigation or interface with external counsel conducting the investigation. • External counsel – Conduct the investigation, if necessary. – Significant issues, extensive scope. – Issues implicating specialized areas of law. – Voluntary disclosure/regulator interaction likely. • Independent external counsel – Conduct the investigation if circumstances warrant. – – – – Senior management potentially implicated/interested. High reputational or economic risk. Possible voluntary disclosure or parallel government investigation. Main benefit – No doubts/questions about impartiality and credibility of investigation. 27 Who should be involved, small firm considerations • Recognize and respect the relationships – Who can be most objective? • What if in-house counsel also serves in other role? • What if no budget for external counsel? • What if no one is independent? Strategies/Techniques • Document Preservation: – Issue a broadly worded preservation notice to all individuals who may have relevant documents as soon as an issue arises that may result in litigation or a government investigation. – Take steps to ensure that electronic documents are preserved (e.g., suspend periodic auto-delete/overwrite mechanisms). – Consider imaging hard drives of involved personnel. • Document Collection: – Develop an interview template/questionnaire to help employees identify responsive hard copy documents. – Ensure that electronic documents are collected in a forensically sound manner that preserves metadata. Use in-house IT resources or a third party vendor, as necessary. • Review relevant documents; assemble key documents binder and list of key individuals to interview. 29 Strategies/Techniques • Interviews: – Prepare outlines in advance of each interview to ensure that all key areas are covered. − Include an Upjohn warning to ensure that it is delivered consistently to all interviewees. − Include specific and open-ended questions. − Include questions about key documents, as necessary. − Include questions about other potentially relevant documents and other potential interviewees. – It often makes sense to speak with the complainant first, followed by the key witnesses and then the alleged wrongdoer(s). − Exceptions may be required if there is time pressure and/or if there is a risk that delay will undermine the investigation (e.g., loss of evidence, loss of access to witnesses). 30 Strategies/Techniques • Documentation of Investigation: – Document Preservation and Collection – Maintain a detailed log/timeline of all steps taken to preserve and collect documents. – Interviews – − Maintain all interview outlines, notes taken during interviews, and a copy of any documents provided by interviewees during interviews. − Draft a memorandum summarizing at least the key points from each interview, including the Upjohn warning provided. Include language to protect privilege (e.g., note that the memorandum is a summary and not a transcript, which was prepared to provide legal advice and contains mental impressions of counsel). − Investigation Report – Prepare a report describing the investigation process, setting forth factual findings with reference to relevant documents, analyzing the facts in light of applicable law or company policy, and make conclusions/recommendations. Include language and headers to protect privilege. 31 Strategies/Techniques Jack Quinn, et al., Corporate Compliance: Building a World-Class Borderless Ethics Compliance Program, 103 Corporate Practice Portfolio Series (BNA). These materials are part of Bloomberg BNA’s Corporate Practice Portfolio Series No. 103 and are being distributed with the permission of BBNA. 32 Strategies/Techniques • Remediation/Follow-up: – Where relevant, the investigation report should include recommended remedial measures, possibly including disciplinary action for wrongdoers and/or process/control enhancements. – The individual responsible for remediation should be clearly identified, and the results of the investigation should be communicated to that person, along with a deadline. – The investigator or another appropriate person should follow up with those tasked with remediation to ensure that all recommended actions have been addressed. – Implementation of all remedial measures should be documented, including precisely what was done, when it was done, and by whom. If any recommendations are not accepted/implemented, the reasons why should be documented. 33 Strategies/Techniques • Other Key Considerations: – Carefully consider whether and how to provide interim status reports to the board or senior management. – At all stages, limit distribution of information about investigations to those who have a need to know. − This can help protect the integrity of the investigation, reduce the risk of unauthorized release of information about the allegations or conclusions, and preserve privilege. − Consider whether and how the individual who raised the allegations should be informed of the results. – Consider whether oral reports may be more suitable for certain audiences (e.g., auditors or other third parties). – For cross-border investigations, be sure to consider foreign laws, especially those regarding privilege and data privacy. Consult local counsel, as necessary. 34 Trends – Internal Investigations • Board Oversight – – Increasing as a result of heightened enforcement climate and need to demonstrate independence/credibility to regulators. – In re: Caremark, Stone v. Ritter, and related cases raise the prospect of director liability for compliance program failures. – Sarbanes-Oxley empowered/required audit committees to have authority to retain independent advisors. • Involvement of external counsel – – Can help preserve privilege to the greatest extent possible. – May be viewed as more independent than in-house counsel and suggest to regulators that the company is taking the issue seriously. 35 Trends – Regulator Interaction • Voluntary Disclosure – – Encouraged by regulators as a way to build credibility and potentially avoid prosecution or receive reduced penalties. – May be valuable if the government is likely to learn of the misconduct through another channel. – But the benefits are often uncertain, and disclosure may result in a lengthy and costly government investigation. • Privilege Waivers – – May help build credibility with regulators and earn cooperation credit. – But beware of collateral consequences (e.g., in shareholder derivative lawsuits). – DOJ may no longer condition cooperation credit on privilege waivers post-Filip Memorandum. 36