Income Tax Briefing for International Students

advertisement

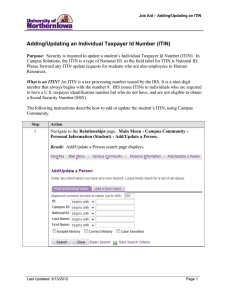

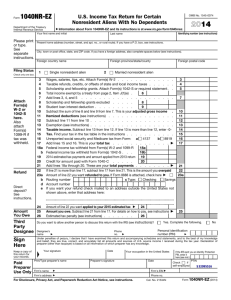

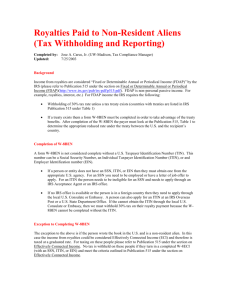

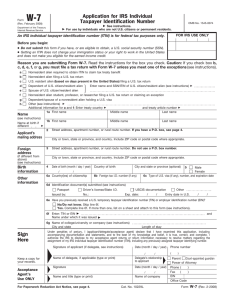

Income Tax Briefing for International Students MARIST COLLEGE Center for Multicultural Affairs Why ? • Federal government regulation for all residents and non-residents • Money is used to fund public works and services Form 8843 • International students and scholars must report their presence in the United States • Form 8843 must be filed by all individuals on F-1 visa, or J-1 visa, and their dependents, even if they have not earned any income in the U.S. Form 1040NR-EZ • Form 1040NR-EZ is the tax return form most frequently used by international students in United States. If you were a nonresident student during 2014 who had any U.S. source of income in 2014, you must file your tax return on IRS Form 1040NR-EZ or 1040-NR for more complex situations Where to Mail the Forms Department of the Treasury Internal Revenue Service Center Austin, TX 73301-0215 Please Note • Marist College staff are neither qualified nor permitted to give individual tax advice. • Students with complicated tax situations may wish to consult with a tax preparation service, professional tax accountant, or tax attorney who is knowledgeable about nonresident tax law. 2014 Tax Requirement • Any international students receiving a taxable scholarship i.e. room and board and • If they do not have a Social Security Number and are not eligible to apply for one (meaning not working) must apply for an Individual Tax Identification Number (ITIN) • Once they receive a Social Security Number, they should NOT use the ITIN Qualified Education Expenses • For purposes of tax-free scholarships and fellowships, these are expenses for: Tuition and fees required to enroll at or attend an eligible educational institution, and • Course-related expenses, such as fees, books, supplies, and equipment that are required for the courses at the eligible educational institution. These items must be required of all students in your course of instruction. Expenses That DO NOT Qualify • • • • • Room and board Travel Research Clerical help or Equipment and other expenses that are not required for enrollment in or attendance at an eligible educational institution. ITIN Procedure • Form W-7 Application (available at www.irs.gov) • Copies of identity and foreign status documentation • Copy of DS-2019 Certificate of Eligibility for Exchange Visitor Status (J-1 Status) OR • Copy of 1-20, Certificate of Eligibility for Nonimmigrant Student Status (F-1 Status) • Other supporting documents necessary to meet the Form W-7 application requirements Where to Enter the Information • Form 1040NR-EZ. If you file Form 1040NR-EZ, report the taxable amount on line 5 • Generally, you must report the amount shown in box 2 of Form(s) 1042-S • See the instructions for Form 1040NR-EZ for more information. Mailing ITIN Applications • ITIN applications should be mailed to: Internal Revenue Service ITIN Operation P.O. Box 149342 Austin, TX 78714-9342 Websites for Additional Information about Taxes Government Sites: www.irs.gov www.tax.ny.gov University Site: www.binghamton.edu/isss/taxes New York State Income Tax • The State of New York also collects income tax which is much less than Federal income tax • Your refund will be very small • For information on how to file, check: http://www.tax.ny.gov/ Tax Day April 15 Submit tax forms on or before this date