Document

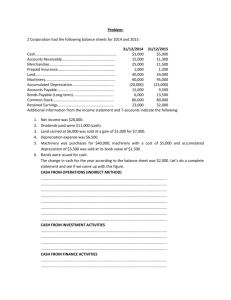

advertisement

Chapter 2 STATEMENT OF CASH FLOWS THE CONTENT AND VALUE OF THE STATEMENT OF CASH FLOWS The cash flow statement reconciles beginning and ending cash by presenting the cash receipts and cash disbursements of an enterprise for an accounting period. The receipts and disbursements are segregated into three classes of activities. Cash receipts and disbursements from operating activities report on the cash flows of the enterprise related to its business operations. Cash receipts and disbursements from investing activities report on the cash flows of the enterprise related to the acquisition and disposition of noncurrent assets. Cash receipts and disbursements from financing activities report on the cash flows of the enterprise related to the acquisition and repayment of debt and equity. The information contained in the statement is useful to creditors and investors for the following reasons: 1. To assess the entity’s ability to generate cash flows in the future 2. The ability of the entity to pay dividends and meet its obligations 3. Reconciliation between net income in the income statement as net cash flow from operating activities in the statement of cash flows. 4. To assess cash and noncash investing and financing activities of the entity during the accounting period. Classification of Cash Flows - There are three classifications of cash flows: 1. OPERATING ACTIVITIES Cash receipts and disbursements are transactions that relate to net income. More specifically these transactions relate to operating income. They include cash receipts from the sale of products or services, the payment to vendors for inventory and the payment of salaries and wages to employees. 2. INVESTING ACTIVITIES Cash receipts and disbursements are transactions that relate to noncurrent assets. They include the purchase and disposition of investments and long-lived assets and loans and collection of loans to outside parties. 3. FINANCING ACTIVITIES Cash receipts and disbursements are transactions that relate to long-term debt and stockholders’ equity. They include borrowing cash from creditors and repayment of such loans and the sale of capital stock and the payment of dividends and return of capital to equity investors. Exercise 1 Using the information below, to prepare a statement of cash flows for the December 31, 2012. Cash Accounts Receivables Inventory Prepaid expenses Long-Term Investments Land Buildings and Equipment Accumulated Depreciation Accounts payable Accrued Liabilities Bonds Payable Long-Term Note Payable Common Share, RO.2 per share Paid-in capital in Excess of Par value Retained Earnings 2012 (RO.) 30,000 410,000 300,000 20,000 50,000 560,000 2,000,000 (800,000) 300,000 40,000 500,000 150,000 200,000 710,000 670,000 2011(RO.) 50,000 460,000 320,000 15,000 25,000 300,000 1,900,000 (770,000) 120,000 50,000 800,000 160,000 550,000 620,000 Additional Information about 2012 transactions: 1. Net income was RO. 110,000 2. Depreciation expense on buildings and equipment was RO.60,000 3. Sold equipment with a cost of RO. 50,000 and accumulated depreciation of RO.30,000 for cash of RO.17,000 4. Declared and paid cash dividends of RO.60,000 5. Issued a RO.150,000 long-term note payable for buildings and equipment. 6. Purchased long-term investments for RO.25,000 7. Paid RO.300,000 on the bonds payable 8. Issued 20,000 shares of RO.2 per value common share for RO.200,000 9. Purchased land for RO.260,000. Exercise 2 Mars super market to find the cash flows for the year 31 December 2012 from following information and the company have the cash balance for the year 2012 RO.33,750. 1. The company to purchase a machinery RO. 15,000 and the depreciation charged for six months each are RO. 4,125 and RO.4,500. 2. The company to sale the old machinery RO.2,200 the original cost of the machinery is RO.3,000. 3. The company paid dividend to the shareholders RO.21,125 for cash. 4. Purchases of buildings for office purpose RO.11,250 for cash. 5. Company to repay the long-term note RO.10,000. 6. Company to make a profit RO.3,750 for sale the investments worth RO.28,750. Information below for current assets and liabilities, Accounts receivable for the year 2011 RO.58,500 and 2012 RO.68250 Accrued payable for the year 2012 RO.3,375 and RO.2625 for 2011. Inventory for the year 2012 and 2011 are RO.30,000 and 24,000 respectively. Accounts payable for the year 2012 RO.35,000 and 2011 RO.24,750 During the year 2012 company earn RO.42,500 as a net profit. Exercise 3 1. ABC Ltd cash flows for the year 31 December 2005 from following information and the company have the cash balance for the year 2005 RO.25300. Particulars Accounts receivable Accrued payable Inventory Accounts payable Profit & Loss A/C Additional information: 2004 43900 1900 22500 26000 25000 2005 51100 2500 18000 18500 31900 1. The company to purchase a machinery RO. 11,250 and the depreciation charged for six months each are RO. 3,100 and RO.3,400. 2. The company decide to purchase of investments RO.6,500 3. The company to sale the old machinery RO.1,650 the original cost of the machinery is RO.2,250 and purchase of machinery cost RO. 11,250 4. The company paid dividend to the shareholders RO.15,850 for cash. 5. Purchases of buildings for office purpose RO.8,500 for cash. 6. Company to repay the long-term note RO.7,500. 7. Company to make a profit RO.3,000 for sale the investments worth RO.21,500. Exercise 4 Towell company cash flows for the year 31 December 2015 from following information and the company have the cash balance for the year 2015 RO.1,100 and net income during the year RO. 810. Particulars Accounts receivable Accrued liabilities Inventory Accounts payable 2014 1300 250 1900 800 2015 1750 200 1600 1200 Additional information: 1. 2. 3. 4. 5. 6. Depreciation as on 31 December 2015 RO.30 To repay on bonds payable RO.250 Sale of investments RO.170 and RO.80 and gain from investments RO.80 Shareholders to get the dividends for investment RO.260 Purchase plant assets during the year 2015 RO.130 Company issue of shares RO.130 for improve the working capital.