Risk Transfer Testing of Reinsurance Contracts

advertisement

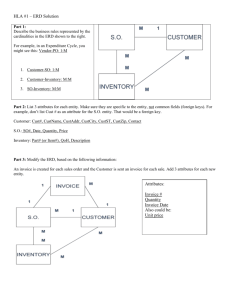

Risk Transfer Testing of Reinsurance Contracts A Summary of the Report by the CAS Research Working Party on Risk Transfer Testing CAS Ratemaking Meeting March 2008 David L. Ruhm, FCAS Background • AAA Committee on Property and Liability Financial Reporting (COPLFR) requested input on risk transfer testing, 2005 • CAS formed Working Party on Risk Transfer Testing to respond to AAA request (Michael Wacek, chair) • Working Party Report issued, Summer 2005 • More developments since – see AAA and NAIC websites Background, continued • Paper on Working Party Report published in Variance, Spring 2007 (Ruhm & Brehm) • Paper briefly describes 2 risk measurement methods in Working Party Report: – Expected reinsurer deficit (ERD) – Right-tailed deviation (RTD) • Paper also describes risk coverage ratio (RCR) method, which is related to ERD Scopes of WP report, Variance paper • Working Party took accounting rules as given – Merits of accounting rules not debated • Focus was on risk transfer testing methods • Variance paper provides a brief summary of some key material from WP Report – Also includes risk coverage ratio (RCR) – Interested parties should read the full WP Report Risk measurement: Practical uses • Better risk control, including ERM context – “You can manage only what you can measure” • Pricing and strategic planning – Ensure expected profit is adequate compensation for amount of risk assumed • Risk-based capital allocation – Capital ~ risk adequate price ~ adequate ROC Risk measurement: Accounting • If a contract “transfers risk” it can receive insurance accounting treatment – If not, premiums are treated as “deposits” and net results are amortized into earnings over time – Insurance accounting is often preferred • Risk transfer requirements are similar for GAAP and Stat – GAAP: FAS 113 – Stat: SSAP 62 SSAP 62 highlights • Reinsurer must assume “significant” insurance risk – Requires non-remote probability of significant variation in amount & timing of payments by reinsurer • “Reasonably possible” that reinsurer may realize a “significant” loss – Based on NPV of all cash flows between ceding & assuming companies under reasonably possible outcomes (emphasis added). WP proposed testing framework • Three-step process – 1. Determine if contract transfers “substantially all the risk” – if so, stop. • Assumed downside essentially same as cedant’s original – 2. Determine whether or not risk transfer is “reasonably self-evident” – if so, stop. • E.g., cat x/s, x/s w/no loss sensitive features – 3. Calculate recommended risk metrics and compare values to critical threshold values. Expected reinsurer deficit (ERD) • Uses probability distribution of net economic outcomes (NPV of cash flows) • Critical point = $0 gain = economic breakeven • Formula: ERD = pT / P – p = probability of net loss – T = average conditional loss severity – P = expected premium Expected reinsurer deficit (ERD) • Concepts inherent in ERD: – “Risk zone” is area in distribution where economic loss exists in terms of negative NPV – Risk = loss frequency x average loss severity – Base in denominator = expected premium, measuring risk per $1 premium ERD example • Simple example of ERD calculation – Aggregate excess $250m excess of $500m – Settlement 1 year after inception – Investment yield = 4.00% (1-yr risk-free rate available at inception) – Premium = $10m at inception ERD example • Loss distribution (dollars in $000) Ceded loss $ 0 $ 50,000 $150,000 $250,000 $ 5,000 Probability 96% 2% 1% 1% Expected value Cond’l loss severity NPV(gain) $ 10,000 ($ 38,077) ($134,231) ($230,385) $ 5,192 ($110,193) ERD example • Simple example of ERD calculation, continued – Probability of net loss = p = 4% – Average conditional loss severity: (38,077 x 2% + 134,231 x 1% +230,385 x 1%) / 4% – “T” = TVaR(96%) = $110,193 – ERD = pT / P = (4%) (110,193) / 10,000 = 44.1% – By comparison, 10% chance of 10% loss = 1.0% ERD ERD steps • 1. Produce the probability distribution of net present value gain, including all flows (real examples have more flows). • 2. Identify the “risk zone” part of the distribution containing net losses. • 3. Measure probability of loss and average conditional severity when it occurs. • 4. Apply the ERD formula. Comparisons to other metrics • Other popular metrics have a similar structure: – Based on distribution of a key financial item – Specific threshold point of the distribution – Measurement of frequency and/or severity • VaR (value-at-risk): – – – – – – – Key financial item: net gain / (loss) of capital Threshold point: Percentile, such as 5th Measurement is severity of percentile point “What level of loss is possible at an outside chance?” 10/10 rule: VaR(90%) > 10% of premium Fixes frequency independently of particular contract’s details Doesn’t measure severity beyond percentile Comparison to other metrics • TVaR (tail value-at-risk), CTE (conditional tail expectation): – – – – – – – Key financial item: net gain in capital, or net economic gain Threshold point: Percentile, such as 5th Measurement is average severity beyond percentile point (“tail”) “What’s the average loss of capital in the worst 5% of cases?” Fixes frequency independently of particular contract’s details Doesn’t capture the likelihood of a net loss ERD connection: T = TVaR(1-p), p = probability of loss • 10/10 rule: A contract passing 10/10 will pass a 1% ERD test, but not the other way around – cat excess example Risk coverage ratio (RCR) • Replace ERD’s premium denominator with expected gain from NPV distribution (“E[G]” in formulas below) • Formulas: As risk per $1 of return: RCR, % form = pT / E[G] As expected profit per unit of risk assumed: RCR = E[G] / pT • All components come from the economic gain distribution • Risk / return metric on economic value RCR example • Same example as above – Probability of net loss = p = 4% – Average conditional loss severity = T = $110,193 – E[G] = Expected gain = $5,192 – RCR % = pT / E[G] = (4%) (110,193) / 5,192 = 84.9% – Risk concentration embedded in expected return = 84.9% Advantages / applications • Advantages of ERD and RCR – Cutoff point is economic breakeven, rather than a statistical percentile • Realized impact of risk on companies is in dollar, rather than percentile, terms – – – – Includes all loss events, rather than only the most extreme events Captures both frequency and severity in one metric RCR is not affected by “traded dollars” in premium RCR measures the risk/return tradeoff in terms of economic gain • Applications of RCR – Risk-based pricing – Risk-based capital allocation (see paper for reference) Right-tailed deviation (RTD) • Some Working Party members prefer risk measures based on distributional transforms over ERD – Transforms may have added benefits, some added complexity • Right-tailed deviation (RTD) proposed by Shaun Wang Define F*(x) = 1 – [1 – F(x)] 0.5 • F* is F with the tail stretched out – a risk-loaded distribution F*(x) ≤ F(x), which means E* ≥ E RTD = E* – E = risk load RTD example • Loss distribution (dollars in $000) Ceded loss F(x) F*(x) $ 0 96% 80% $ 50,000 98% 86% $150,000 99% 90% $250,000 100% 100% Expected value $5,000 $34,000 RTD = $34,000 - $5,000 = $29,000 RTD example • RTD risk transfer test: Maximum qualified premium = α(RTD) • α parameter could be between 3 and 5; WP observed 4 may be too low. • In example, using α = 5: Maximum qualified premium = $145m RTD advantages • F*(x) is a new “loss” distribution – all the usual methods apply – Easy to risk-price layers of coverage – Other advantages – see Wang’s papers • “Maximum qualified premium” concept opens door to qualifying part of premium in some cases, instead of “all or nothing” Conclusion • The WP Report is a significant contribution to the literature on risk transfer: – Defined a structured process to narrow down contracts that have to be tested – Described two risk metrics that appear superior to the 10-10 test: ERD and RTD – 1% ERD suggested as one possible threshold Conclusion • Further research recommended: – Level 1: Consensus thresholds – Level 2: Other methods, including quantitative definitions of terms and incorporating parameter uncertainty • (Paper only) 3rd research area: Develop the actuarial perspective on risk transfer, independent of current accounting rules.