SOAR 2015 Presentation

advertisement

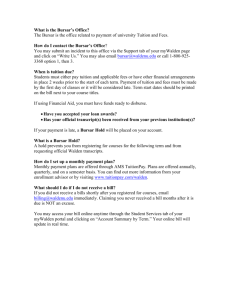

Tuition Billing & Financing Your Education Presented by: Marc Maniatis Director of Student Accounts & Risk Manager SOAR 2015-2016 Tuition Bills • Bills were mailed home in early June to all students who paid enrollment deposits. • Due date is July 8th. • All subsequent tuition bills will be available online. • The June bills reflect anticipated tuition and fee charges and a credit for anticipated financial aid. • Students will be required to sign a financial responsibility statement related to billing, privacy, and communication methods. Understanding The Bill • 2015-2016 Tuition & Fees Residential Student – Per Semester Tuition Full-Time (12 to 17 credits) General Student Fee Standard Double Room Housing Activity Fee Charger Unlimited Meal Plan Student Health Insurance $ 17,165.00 $660.00 $4,610.00 $50.00 $2,700.00 $1,315.00 Estimated Direct Charges for 2015-2016 $ 26,500.00 *Federal Work Study is NOT included in bill* Additional Charges & Expenses • Books and Supplies (approximately $500 per semester) • Lab fees range from $30 - $4,000 • Tuition differentials are $80.00 per credit (generally apply to engineering, computer science, & chemistry courses) • Tuition overtime charges (17+ credits) are $1,145 per credit Student Health Insurance • UNH student health insurance is $1,315.00 for the year. • The coverage can be waived with proof of existing coverage. • A waiver can only be processed online. • A waiver MUST be processed each academic year. The waiver deadline is August 28, 2015. Familiarize Yourself With ePay • Tuition billing and payment system • No paper bills are mailed • With ePay, you can view, print, and pay your bill online in a secure environment. • Set up Authorized Users/Payers • Receive billing notifications (email, text/SMS message) Using ePay • Student (and any Authorized User) will receive an email notifying you when your bill is ready to be viewed. • Make payment via MasterCard, Visa, Discover, American Express, debit card or a U.S. checking or savings account. Other options include: • Enroll in direct deposit for student refunds • Sign up for text/SMS message notifications ePay Authorized User • Student can create up to 5 Authorized Users. • You must be an Authorized User in order for Bursar’s Office to discuss your student’s tuition bill with you. • Receive billing emails as well. • Securely store your payment information. Paying Your Tuition Bill • Payments can be made: • Online through ePay via credit/debit card or a U.S. checking or savings account. • By phone or in person at the Bursar’s Office. • Checks should be made payable to UNH and mailed to the Bursar’s Office. • Wire transfer information is available upon request. Payment Options: Monthly Payment Plan • Administered by Tuition Management Systems (TMS). • Option allows you to spread out your payments over a 10 month period, interest-free, starting in July • Your monthly payments are remitted to UNH at the end of the month. • Enrollment fee of $75 includes life insurance for the person responsible for paying the bill. Monthly Payment Plan Tuition Management Systems (TMS) • You can catch up if you do not enroll in July by making a double payment to cover July and August. • The enrollment deadline is August 7, 2015. (888) 437-3430 or www.afford.com/newhaven Payment Options: Financial Aid • Federal Direct Parent Loan (Plus) • The parent is the borrower. • Private Alternative Loans • The student is the borrower and will most likely be required to apply with a co-signer. Parent Loans – PLUS Loans • A PLUS Loan is borrowed by one parent only. • The parent must pass a credit check – if the parent is denied the student will automatically receive an additional $4,000.00 unsubsidized Direct Student Loan. • The loan limit is the cost of attendance minus any other aid. • The interest rate is 6.84% and the origination fee is 4.27%. • The borrower can select from several different repayment options Private Alternative Loans • The student is the borrower and will most likely be required to apply with a co-signer. • The rates and terms vary based on the type of loan and the lender. • An alternative loan can be obtained for the cost of attendance minus any other aid. • Deferred repayment options may be available. Please consult with your specific lender for more information. • Please be sure to apply promptly and allow yourself enough time to complete the loan process. Which Option is Right for You? • All of these financing tools can be used together – you do not have to use one option exclusively. • Your personal financial situation will dictate which plan is best for you. • If you are contemplating loans, consider who will be borrowing. • Consider TMS to use funds from your monthly income to limit the amount you must borrow. University Refund Policy Students who have a credit balance on their account are eligible to receive a refund. • Excess Financial Aid • Overpayment or Cancellation of a Charge • Dropping Courses or Complete Semester Withdrawal • Credit card refunds Refund Process • Student receives the refund unless overpayment is due to excess PLUS loan funds. • Excess Title IV funds processed automatically after disbursement within 14 days of crediting a student’s account. • Refund request form needed if credit is from non-Title IV funds. • Direct Deposit Available • Not available early enough for books • Students should monitor ePay Withdrawal Refund Policy Date of Withdrawal Before Classes Begin First Week Second Week Third Week Fourth Week After Fourth Week Refund Amount 100% 80% 60% 40% 20% 0% Tuition Insurance A.W.G Dewar, Inc. • This is an optional insurance policy to cover a withdrawal due to medical reasons. • The policy reimburses 75% for a documented medical withdrawal. • The premium cost for the year is $428.00 for residential students and $ 303.00 for commuter students. • If you wish to purchase this you must do so prior to the first day of classes which is August 24, 2015. • www.collegerefund.com or (617) 774-1555 Summary of Major Points • Make sure your student sets you up to be an authorized user in ePay. • Review your health insurance plan and if you wish to waive UNH coverage do so by August 28, 2015. • If you have a question or a problem with your bill, please ask someone sooner rather than later. • Have your student try to solve a problem himself or herself and explain to your student how their bill will be paid. Bursar’s Office Office Location: Maxcy Hall Room 109 Office Hours: M-F 8:30 am - 4:30 pm (the office closes at 1:30 pm on Fridays in June, July and August) Phone: (203) 932-7217 or (800) DIAL-UNH ext. 7217 Fax: (203) 931-6086 Email Address: bursar@newhaven.edu www.newhaven.edu/bursar 300 Boston Post Road, West Haven, CT 06516