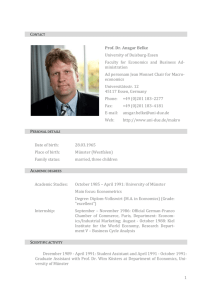

AP Economics Mr. Bernstein Equilibrium in the Loanable Funds

advertisement

AP Economics Mr. Bernstein Module 29: The Market for Loanable Funds February 2016 AP Economics Mr. Bernstein The Market for Loanable Funds • Objectives - Understand each of the following: • How the loanable funds market matches savers and investors • The determinants of supply and demand in the loanable funds market • How the two models of interest rates can be reconciled 2 AP Economics Mr. Bernstein Equilibrium in the Loanable Funds Market • D is downward sloping • as rates fall, projects become more profitable • S is upward sloping • Must earn higher rates to forego consumption • Based on indiv. decisions, unlike vertical MS line • Y axis: Real Interest Rate 3 AP Economics Mr. Bernstein Shifts in Demand, Supply of Loanable Funds • Shifts in Demand • D in perceived business opportunities • D in government borrowing (“Crowding Out”) • Shifts in Supply • D in private saving behavior • D in capital inflows • All shifts in Demand or Supply D Interest Rates…but… • Real interest rates are not affected by changes in expected inflation (only nominal rates are affected…”The Fisher Effect”) 4 AP Economics Mr. Bernstein Inflation and Interest Rates • D in Expected Inflation causes upward shift in D and in S • New equilibrium at higher nominal rate but same expected real rate 5 AP Economics Mr. Bernstein Reconciling LPF with Loanable Funds Model 6 AP Economics Mr. Bernstein Reconciling LPF with Loanable Funds Model 7