02-27-2013 'Computron Industries: Financial Analyst

advertisement

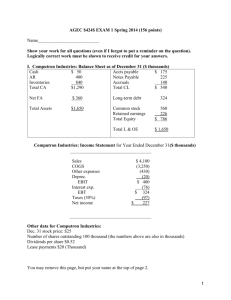

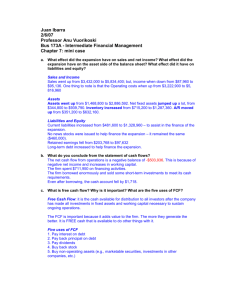

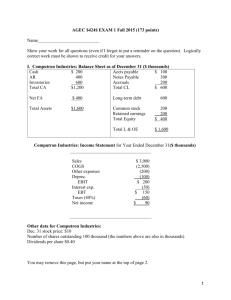

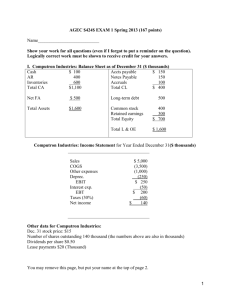

WMBA 507 - Managerial Finance Spring 2013 Session 1 Professor Tahmoures A. Afshar Financial Analyst Recommendation Cheung, Alley Le, Trung February 27, 2013 Introduction A Financial Analyst’s job is to assess financial data of a certain company, from then we find and understand current strengths and weaknesses of that company. After that, we draw out important attributes and conclusions about the current state of the company. Finally, based on our findings, we summarize collected data and recommend to potential investors and stockholder whether or not they should invest their money into the company and how they should approach this investment. One of the best methods to analyze a certain company is by calculating financial ratios based on the company’s financial reports. With these ratios, we can accurately compare the company’s performance with the industry average thus effectively presents the state of performance that the company is giving. The process of investing is crucial for investors. Any investments should be made with careful analyses and understandings. Investing without analysis and financial data also means that the investors will be taking unnecessary risks that can be eliminate easily. Investors should search for data that indicates the current and possible future financial performance of the company. Thus allow investors to make a smart investment and receive earnings in the near future. As financial analyst, when we assess financial data given by the company, we have to take into considerations as much possibilities and attributes as possible. This could include external factors that affect an investment such as, the state of the economy, government’s law and regulations, specific industry’s performances… But more importantly, as financial analyst we need to understand financial data and analyze internal factors from that information includes: company’s performance, assets and liabilities. Investors come to financial analysts to ask for deeper understandings of financial reports from the company and to receive valuable recommendations from us. Analysis Current Ratio Quick Ratio Inventory Turnover Days Sales Outstanding Fixed Asset Turnover Total Asset Turnover Debt Ratio Times Interest Earned EBITDA Coverage Ratio Net Profit Margin 2010 1.46 0.50 4.53 39.5 6.21 2.02 80.7% 0.10 2011 2.58 0.93 4.10 45.5 8.41 2.00 43.8% 6.28 Industry Average 2.70 1.00 6.10 32.00 7.00 2.50 50.0% 6.20 2.61 0.81 5.52 8.00 2.6% -1.6% 3.6% 3.6% 2009 2.33 0.85 4.80 37.4 9.95 2.34 54.8% 3.35 Operating Margin 6.1% 0.3% 7.1% 7.1% Gross Profit Margin 16.6% 14.6% 17.6% 15.5% Basic Earning Power 14.2% 0.6% 14.3% 17.8% Return on Assets 6.0% -3.3% 7.2% 9.0% Return on Equity 13.3% -17.1% 12.8% 18.0% Price-to Earnings Ratio 9.66 -6.31 12.00 16.20 Price-to-Cash Flow Ratio 7.95 27.49 8.14 7.60 Market-to-Book Ratio 1.28 1.08 1.54 2.90 Book Value Per Share 6.64 5.58 7.91 n/a In summary, Computron is a company that has clear financial data for 3 consecutive years 2009, 2010, and 2011. Computron’s past performance has not been an outstanding performance. If we use 2009 as the base year for comparison, we will find that in 2010 the company’s operation was in a terrible state which produced horrible financial data for the company. 2010 marks a performance of Computron that fills with liabilities decrease of inventories, cash flow, receivables, stock price, etc… However, in 2011, Computron made tremendous improvements in all their financial assets. They utilized well their assets and turned their inventories into cash and furthermore, pay off their debts. Compared to 2010, Computron’s performance in 2011 is the complete opposite with much better debt ratio, return of equity, and cash flow. In order to have a better understanding of the company’s performance, we analyze financial ratios found through data given to us. First of all, it is noticeable that the company’s current ratio is very close to industry average though it is a little bit lower. The current ratio indicates that the company is operating sufficiently and that there is no great problem with the current standard in operation of the company. However, current ratio alone will not show the deeper risks the company is facing thus we look furthermore into other financial ratios to tackle deeper emerging issues. In term of assets management ratios, we find that Computron is a company with the ability to make sales with their inventories. However, if we compared the ratio of inventory turnover for Computron we find that Computron’s ratio is lower than the industry average which indicate that they were unable to turn their inventories into cash thus also means that Computron’s products and services are not very attractive toward customers. Their competitors on the other hand hold better ratios and proven to capture more market shares than Computron. Computron’s days sales outstanding also tell us that Computron has difficulties collecting receivable from their consumers. It takes Computron longer than other companies to collect their money. This could mean that Computron’s policies allow consumers to make their payments with longer period of time but it would also mean that Computron’s free cash flow is much less than others thus they will have less cash to invest into their operations. On a positive note, Computron is utilizing well their fixed assets but their total assets ratio indicates that their performance is not great compared to industry average. Therefore, we can assume that they are not handling their variable assets well enough. As financial analyst, we consider debt ratio to be a very important indications for investors to look at to assess performance of a certain company. As for Computron, their debt ratio is actually lower than industry average in 2011, which means that they do not have a lot of debts and that prove the stability of their financial performance. In 2010, Computron debt ratio shows that they owned a lot but in 2011, it seems that they have paid off most of their debts to creditors. Time interest earn ratio also indicate that Computron has the ability to pay off debts. On the other hand, Computron’s EBITDA coverage ratio is lower than industry average indicating that if they borrow money, they will encounter difficulties to pay their interests. We can assume that the interest rate of the economy is currently to high for Computron’s operation. In term of profitability ratio, we concentrate on the value ratio of return on assets and return on equity of Computron and find that both of these ratios are lower than the average within the industry. ROA indicates that COmputron’s incomes are lower than their competitors and the more important attribute ROE indicates that stockholders are not receiving the desire return on their investments. Base on the ratio of return on equity we can confirm that Computron is not satisfying its stockholders because their earnings on their investments are lower than industry average thus other companies are able to give better returns to their stockholders. This will also mean that the price of stock of Computron will most likely drop and become unattractive for investors. From an investor’s point view, this is bad for Computron because they realized that there more many better options to choose from within this industry. Finally, we take a look at Computron’s market ratio including price per earnings ratio and market to book ratio. Both price per earnings ratio and market to book ratio of Computron are lower than industry average which points toward the fact that Computron is volatile and that it has small growth potential. Therefore, Computron is to be considered a risky investment with low return on investment. Investors should not be attractive to Computron’s stock since they will most likely grow very little in the near future. Furthermore, investors should consider paying less than market value if they were to buy Computron’s shares. Recommendation As financial analysts we recommend investors to not invest in Computron without careful understandings of its financial data. Even after analyze Computron’s ratio we as financial analysts will also recommend against investing into Computron due to its fluctuated operation, and low potential growth. From analyzed financial ratios of Computron, the company has proven to carry many risks associate with inventories, interest payments, equity, returns and stock price. At the end of the day, Computron’s ratios are low compared to industry average and from an investor point of view; Computron’s ratios should point toward a profitable future with outstanding growth. If our client is an investor that prefer risky investments that might hold high returns, we might consider to recommend Computron as a possible investment opportunity due to its low debt ratio and the ability to recover from bad situations. Furthermore, if an investor would like to invest into Computron, he/she can bargain to buy Computron’s share at a price that is lower than market value. If our client is a company that is looking to buy or merge with another company, we would recommend that our client do not merge with Computron due to the following reasons. First of all, 95% of merger and acquisition fail due to the fact that 2 companies are unable to synchronize their management strategy. Second reason is because Computron is too risky and volatile to merge with. On the other hand, we would recommend our client to consider buying 51% shares of Computron and become the biggest stockholder of Computron. Keep Computron’s management level and operation and invest into the company to create better potential growth for Computron as a long term investment.