Tax Law & IRS Updates (Oct 22 2015 MACE)

advertisement

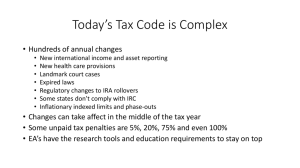

2015 Tax Law & IRS Updates Richard G. Furlong, Jr. Senior Stakeholder Liaison Main Line Association for Continuing Education Penn State Great Valley Conference Center October 22, 2015 Overview of Topics • • • • • • • ABLE ACA provisions Information return penalties Changes in due dates Expired provisions Web resources IRS Updates 2 ABLE Act Achieving a Better Life Experience • • • • The ABLE Act adds IRC Section 529A ‒ Creates tax-free savings accounts for individuals with disabilities A qualified ABLE program is established and maintained by a state, or agency or instrumentality thereof An individual must have qualified disability prior to age 26 or a disability certification to qualify for ABLE account Qualified expenses: education, housing, 3 transportation, employment training, etc. ACA - Reporting Coverage Check box and leave entry space blank if everyone on the return had coverage for the full year 4 Information Statements • • • Marketplace ‒ Form 1095-A, Health Insurance Marketplace Statement Insurers ‒ Form 1095-B, Health Coverage Large employers – Form 1095-C, EmployerProvided Health Insurance Coverage and Offer 5 6 7 8 Return Preparer Interview Best Practices • • Use Form 1095-A, B or C to – Verify coverage months and – Who is covered Determine eligibility for exemption – Marketplace Exemption Certificate Number – Income below return filing threshold or – IRS coverage exemptions 9 Common Errors • • • Eligible for coverage exemption but did not claim – Income below filing threshold – Not lawfully present – Coverage gaps Miscalculated Shared Responsibility Payment Shared Responsibility Payment on dependent returns 10 2015: What You Need to Know • • • • Forms 1095-A, B and C Apply for Marketplace exemptions early ISRP amounts increase 2016 Marketplace enrollment – Nov 1, 2015 to January 31, 2016 – Special enrollment periods 11 Increased Information Return Penalties • • • Revised penalty structure for information returns Penalties imposed for: – Failure to file information returns – Failure to furnish information returns – Filing incomplete information returns – Filing returns with incorrect information Effective for returns and statements required to be filed/furnished after 12/31/2015 12 IRC 6721 & 6722 Increased Penalties The penalty for failure to file correct information returns and provide payee statements is $250 (total not to exceed $3 million) • If corrected in 30 days penalty is $50 (total not to exceed $500,000) • If corrected after 30 days but before August 1, penalty is $100 (total not to exceed $1.5 million) IRC 6721 13 Form 1065 and 1120-S Due Dates Form 1065 and Form 1120-S Due Dates: • Fifteenth day of third month following close of tax year (March 15th for calendar year filers) • Beginning tax years after 12-31-2015 (2016 tax years) 14 IRC 6072(b) Form 1120 Due Date Form 1120 Due Dates: • Fifteenth day of fourth month following close of tax year (April 15th for calendar year filers) • Beginning tax years after 12-31-2015 (2016 tax years) • Special rule for years ending on June 30th – no change until after 12-31-2025 IRC 6072(b) 15 Form 114 (FBAR) Due Date • • • The due date of FinCEN Report 114 (relating to Report of Foreign Bank and Financial Accounts) shall be April 15 There is a maximum extension for a 6-month period ending on October 15 For taxable years beginning after December 31, 2015 PL 114-41 Section 2006(b)(11) 16 Refundable Child Tax Credit / Foreign Earned Income Exclusion • • The Child Tax Credit is not refundable for taxpayers electing to exclude foreign earned income from gross income This law applies to taxable years beginning after December 31, 2014 IRC 24(d)(5) 17 Six Year Statute of Limitations: Basis Six year statute of limitations for 25 percent omissions of income on tax assessments expanded to include: • Understatement of gross income by reason of an overstatement of unrecovered cost or other basis is an omission from gross income; – Tax may be assessed at any time within six years after the return was filed • Effective for returns filed after 7/31/15 IRC 6501(e)(1) 18 Form 1098 Reporting Requirements • • Information to be included on Form 1098: – Amount of outstanding principal on the mortgage as of the beginning of such calendar year – Date of the origination of the mortgage – Address (or other description in the case of property without an address) of the property which secures the mortgage For statements required to be furnished, after December 31, 2016 19 IRC 6050H(b)(2) Identity Protection Services • • • • Post-data breach protection services excluded from recipient’s gross income Does not include cash in lieu of identity protection services Proceeds received under an identity theft insurance policy are includable income Identity protection services for reasons other than a data breach are includable in income IRS Announcement 2015-22 20 Extenders • • Individual provisions Business provisions 21 Resources • • • • • IRS.gov/for-Tax-Pros IRS.gov/DraftForms IRS.gov/ACA HealthCare.gov IRS.gov/Form8965 (for info and links to Form 8965 and its instructions) 22 Issue 1: Dirty Dozen Tax Scams • • • Compiled annually List of common scams / schemes 2015 “Dirty Dozen” – Press releases over 12 consecutive days – Began on January 22 23 2015 Dirty Dozen 1. Phone Scams (IR-2015-5) • Criminals impersonating IRS agents 2. Phishing (IR-2015-6) • Fake emails / websites 3. ID Theft (IR-2015-7) • Fraudulent returns filed using someone else’s SSN 24 2015 Dirty Dozen 4. Return Preparer Fraud (IR-2015-8) • Unscrupulous return preparers 5. Offshore Tax Avoidance (IR-2015-9) • Hiding money and income offshore 6. Inflated Refund Claims (IR-2015-12) • Promise of inflated refunds 25 2015 Dirty Dozen 7. Fake Charities (IR-2015-16) • Groups masquerading as charities 8. Hiding Income With Fake Documents (IR-2015-18) • Falsifying documents to reduce tax or inflate refunds 9. Abusive Tax Shelters (IR-2015-1) 26 2015 Dirty Dozen 10. Falsifying Income to Claim Credits (IR-2015-20) 11. Excessive Claims for Fuel Tax Credits (IR2015-21) 12. Frivolous Tax Arguments (IR-2015-23) 27 Issue 2: Offshore Compliance Options Options: 1. Offshore Voluntary Disclosure Program 2. Streamlined filing compliance procedures 3. Delinquent FBAR submission procedures 4. Delinquent international information return submission procedures 28 FBAR Filing Requirements • Any United States person who: – Has financial interest in, or signature authority over financial accounts in a foreign country • If aggregate value of accounts exceeds $10,000 at any time during calendar year 29 Offshore Voluntary Disclosure Program • Counterpart to criminal investigations voluntary disclosure practice • Enables noncompliant taxpayers to: – Resolve their tax liabilities – Avoid substantial civil penalties, and – Generally eliminate the risk of criminal prosecution for all issues relating to tax noncompliance and failing to file FBARs 30 Streamlined Filing Compliance Procedures Available to taxpayers certifying that their failure to report foreign financial assets and pay all tax due with respect to those assets did not result from willful conduct on their part; provides: • Streamlined procedure for filing amended or delinquent returns • Terms for resolving their tax and penalty obligations 31 OVDP or SFCP? Taxpayers whose failure to report income, pay tax and submit information returns was due to willful conduct should consider OVDP • • An OVDP submission disqualifies a person from participating in SFCP An SFCP submission disqualifies a person from participating in OVDP 32 Delinquent FBAR Submission Procedures Eligible taxpayers: • • • • Do not need to use OVDP or SCFP Have not filed a required FBAR (FinCEN Report 114) Not under civil exam or criminal investigation Not contacted by IRS about the delinquent FBARs 33 Delinquent International Information Return Submission Procedures Eligible taxpayers: • • • • • Do not need to use OVDP or SFCP Have not filed required international information returns Reasonable cause for not filing Not under civil examination or criminal investigation Not been contacted by IRS 34 Issue 3: Trust Fund Recovery Penalty • Trust Fund Taxes – Withheld income and employment taxes; including social security taxes, railroad retirement taxes or collected excise taxes • Trust Fund Penalty – If a business uses those funds for another purpose, § 6672(a) authorizes a penalty equal to 100 percent of the collected tax on any responsible person 35 Trust Fund Recovery Penalty • • TFRP may be assessed against any person – Responsible for collecting or paying withheld income and employment taxes, and – Who willfully fails to collect or pay them For willfulness to exist, responsible person – Must have (or should have) been aware of outstanding taxes and – Intentionally disregarded the law 36 Trust Fund Recovery Penalty (Assessment) • • • • FTD Alerts sent to IRS Collections Case assigned to a revenue officer RO contacts the employer to schedule an interview(s) Letter 1153 sent to responsible parties 37 Trust Fund Recovery Penalty (Appeal) • • Small Case Request - total amount of the proposed assessment for each tax period is $25,000 or less Formal Written Protest - total amount of the proposed assessment for any one tax period is greater than $25,000 38 Issue 4: New Form 1023-EZ Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code (Form 1023-EZ) • • • • Three pages (standard version 26 pages) Filed electronically User fee = $400 Most small organizations qualify 39 Form 1023-EZ (Qualifications) • • • Organization must be operated exclusively for certain listed purposes Gross receipts of < $50,000 and assets < $250,000 Form instructions identify 26 instances which render an organization ineligible to file Form 1023-EZ 40 Form 1023-EZ (When to File) • • • Generally, within 27 months after end of the month the organization was legally formed If accepted, the legal date of the formation is the effective date of exempt status If not filed within 27 months, the effective date of exempt status is the date of filing 41 Issue 5: Online Tools for Tax Professionals 42 Tools for Tax Pros (Categories) Information You Need to File Returns for Your Clients Confirming Payment/Credits On Tax Account Tax Payment Alternatives Your Responsibilities As A Tax Professional Campus Responsibilities and Operations Reference Materials Representing Your Client Before the IRS After Returns Have Been Filed IRS Collection Tools and Your Clients’ Rights o Tools o Rights o Rules on Representation And Disclosure Requesting Transcripts and Other IRS Information on Clients Criminal Investigation Division and Enforcement Initiatives Treasury Inspector General for Tax Administration (TIGTA) Frequently Used Telephone Numbers for Practitioners 43 Keeping Current 44 Preparer Guidelines 45 Other Tax Pro Links 46 Issue 6: Directory of Federal Tax Return Preparers • • • Launched Feb. 5, 2015 Searchable / sortable listing featuring preparers name, city, state, and zip code Contains attorneys, CPAs, enrolled agents and those who have completed the requirements for the voluntary IRS Annual Filing Season Program 47 Searching the Directory 48 Issue 7: W-2 Verification Code Pilot • • • • • • One in a series of steps to combat ID theft and tax fraud Pilot will test capability to verify authenticity of W-2 data filed with federal tax returns in 2016 IRS will soon name Payroll Service Providers PSPs will reach out to some clients Algorithm generates alphanumeric codes from selected data fields of the W-2 Verification codes appear on employees’ W-2s 49 W-2 Verification Code Pilot • • • • • Taxpayers enter verification codes on their efiled federal tax returns When processing returns, IRS recalculates codes Matching codes = genuine W-2s Verification codes not included in W-2 data submitted to SSA, states or local departments of revenue Won’t affect state or local tax returns 50 W-2 Verification Code Pilot • • • We stress: – Omitting or using incorrect W-2 verification codes will not delay the processing of taxpayers federal tax returns “test-and-learn” review after pilot If integrity of W-2 information submitted by taxpayers increases, verification codes will remain an element of W-2s in the future 51 Contact Information Richard Furlong, Jr. 267-941-6343 richard.g.furlong@irs.gov 52