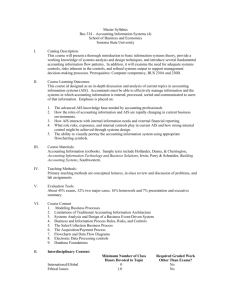

Latest Perspective on Basel II

advertisement

City University of Hong Kong Professional Seminar on Latest Perspective on Basel II Simon Topping Hong Kong Monetary Authority 19 July 2004 1 Outline • • • • • Timetable for implementation in Hong Kong Range of approaches to be offered Transitioning from Basel I to Basel II Qualifying criteria for use of basic & IRB approaches IRB validation – qualitative & quantitative aspects / use of benchmarking • Determining minimum CARs under Basel II • Changes to HKMA’s supervisory approach 2 Timetable for implementation in Hong Kong • Implementation targeted for end-2006 • Following consultation with LegCo FA Panel, preparing draft Banking Amendment Bill 2005 featuring “rule-making power” for HKMA in relation to capital adequacy & financial disclosure • Consultation on implementation approach, proposals for implementing IRB, draft Bill to commence shortly • Basel II Consultation Group established 3 Range of approaches to be offered • Clearly desirable for all AIs to adopt Basel II, but some smaller AIs have concerns about cost/benefits • “Default option” of standardised approach for credit risk (+ operational risk, Pillar 2 & Pillar 3) • AIs meeting qualifying criteria can apply for approval to use either basic approach or IRB approach • Therefore for credit risk there will be 4 options: basic approach; standardised; foundation IRB; & advanced IRB • While for operational risk there will be 2 options: basic indicator approach & standardised approach (not AMA) 4 Transitioning from Basel I to Basel II • While the regulatory regime will be “Basel II-ready” by end2006, some AIs, particularly those implementing the more advanced approaches, will require an extended period to make the necessary adjustments • Therefore proposing a 3-year implementation period from end2006 to end-2009 for IRB • During this period “transitional arrangements” will apply • Generally speaking, all AIs will adopt standardised approach at end-2006 unless they opt for basic approach or indicate their intention to adopt IRB • Pillars 2 & 3 will apply to all AIs from end-2006 5 Qualifying criteria for basic approach • Comprises “Basel I” treatment of credit & market risks plus operational risk plus Pillars 2 & 3 • Will be available to all AIs (primarily RLBs & DTCs, also some smaller banks) which are small (total assets less than HK$10bn) & whose business is simple • Not available for subsidiaries of larger banks • Also available as an interim measure for AIs planning to adopt IRB within the transitional period 6 Qualifying criteria for IRB • Available to all AIs that can meet rigorous qualitative & quantitative qualifying criteria • AIs’ rating systems need to rank order & quantify risk in a consistent, reliable & valid manner • Must provide for a meaningful differentiation of borrower & transaction characteristics, a meaningful differentiation of credit risk, & reasonably accurate & consistent quantitative estimates of risk • Must have been in “use” for 2 years; minimum of 2 years of data (within transitional period) • Must cover all material exposures (phased rollout allowable, but IRB coverage must reach a target level before transition to IRB allowed) 7 IRB validation (qualitative aspect) Qualitative Aspect Scope Coverage of asset classes Appropriate rating system design for AI’s exposures Credible rating operations and process Adequate corporate governance and audit Adequate use of the rating system HKMA’s validation methodologies Questionnaire for AI’s self-assessment Checklist for on-site examination 8 IRB validation (quantitative aspect) Quantitative Aspect I. Data quality • Data maintenance • Use of external data - sample data checking - data storage process II. AI’s internal stress tests used in assessment of capital adequacy • Benchmarking against HKMA’s internal stress-testing parameters III. AI’s internal validation of PD/LGD estimates & internal statistical tests on discriminative power of its credit scoring models IV. HKMA’s validation methodologies for PD/LGD estimates 9 IRB validation process A. HKMA’s benchmarking models for identifying underestimated PD/LGD: IV. HKMA’s validation methodologies for PD/LGD estimates • Listed companies (empirical testing a PD term-structure model) • Private companies including SMEs (model based on financial statements) • Retail exposures: RML (empirical testing a model based on expected-loss measures) Credit cards, small SMEs, personal loans (scoring systems) • Bank and sovereign exposures based on their external credit ratings • Standard VaR validation for equities B. Benchmarking among AIs • Comparing PD/LGD of same/similar exposures to identify “outlier” with “underestimated” PD/LGD measures • Results depend on individual AIs’ rating approaches C. Back-testing • Statistical tests (e.g. Gini coefficient) • A sufficiently long period of actual default history is necessary for meaningful tests 10 Validating PD estimates (corporates) • Among IRB AIs, we could compare PD of same/similar exposures to identify “outlier” with “underestimated” PD measures • However, it is possible that the use of benchmarking among AIs may be constrained by the widespread adoption of the same vendors, e.g. Moody’s KMV • AIs would not have enough actual default data for meaningful back-testing during the initial period • We therefore need to develop some benchmarking models which can be used to identify “underestimated” PD measures (N.B. not developing “super” credit risk models) 11 Benchmarking of PD estimation (listed company) Input market parameter: Listed company’s leverage ratio & its volatility Model Engine Generate PD term structure of company Mapping with S&P’s default rates Map model PD term structure of company to S&P’s default-rate term structures of different ratings (static pools cumulative average default rates) Empirical tests PD term-structure model based on 133 listed companies with credit ratings (BBB+ & below) in US with 1,337 data samples at different time Assigning model “S&P’s” rating Based on mapping result, a rating is assigned to the company Implied 1-year benchmarking PD of company Based on actual 1-year average default rate of assigned rating Compare 1-year benchmark PD with AI’s 1year PD of company based on its IRB system. Based on comparisons for a number of companies, the results will indicate any inconsistencies / systematic underestimation in the AI’s PD estimates. 12 Determining minimum CARs under Basel II • Charge for credit risk under standardised approach is likely on average to be slightly lower than under Basel I • However, this will be more than offset by the charge for operational risk • Charge for credit risk under IRB less certain, but unlikely to be significantly lower • Under Pillar 2, AIs will assess their target overall level of CAR by means of a capital adequacy assessment programme (CAAP); this will be subject to supervisory review • Possible that less “buffer” or “cushion” above the regulatory CAR will be maintained – so CARs may fall over time 13 Changes to HKMA’s supervisory approach • For AIs on standardised approach, capital adequacy requirements o/a credit risk will continue to be set by the regulator • For AIs on IRB approach, however, cap ad requirements o/a credit risk will be more internally set (N.B. closer to economic capital) • For all AIs, setting the target CAR (under Pillar 2) will in the first instance be the responsibility of the AI itself, rather than the regulator – although the regulator will conduct its own assessment, at least initially (N.B. a development of the risk-based approach) • Also for all AIs, market discipline (through Pillar 3 disclosures) will play an increasing role 14