elastic - Andrew.cmu.edu

advertisement

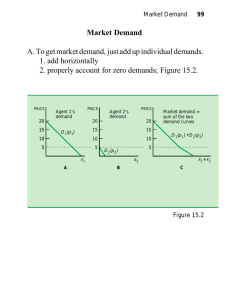

Your Suggestions Sample problems and examples in lecture. Download recitation problems before recitation. Complete exercises in recitations. Reorganize web site. Have power point slides available earlier. Overview class at the beginning. Your Suggestions Board/slides. Too fast/too slow. Book does not have enough examples. Market Demand From individual to market demand. Price elasticity of demand. Income elasticity of demand. An example: the Laffer curve. From Individual to Market demand Individual i ‘s demand function for good 1: x1i x1i p1, p2, mi Aggregate demand (market demand) function for good 1: n X 1 p1, p 2, m1, m2,..., mn x1i p1, p 2, mi i 1 Market Demand: Example Consider 2 consumers of CDs: i 1,2 Each consumer has the demand function: xi mi p Consumers have different incomes: m1 $100 m2 $200 Market Demand: Example Individual demand functions: x1 $100 p x 2 $200 p Market demand: X $300 2 p for p $100 X $200 p for $100 p $200 Inverse Market Demand: Example Market demand: X $300 2 p X $200 p for for p $100 $100 p $200 Inverse demand: p $150 X / 2 for p $200 X for p $100 $100 p $200 Market Demand Curve p Individual demand curves: Market demand curve: p 200 200 100 100 0 100 200 xi 0 100 300 X Aggregation Q:Is the sum of our demands (aggregate demand) for a good always equal to the demand of one individual whose income is given by the sum of our incomes? In other words is aggregate demand equal to the demand of some representative consumer who has income equal to the sum of all individual incomes? Aggregation A: No, for two reasons: 1. Individuals have different preferences 2. Even if individuals had the same preferences, some goods are necessary goods, and others are luxury goods. Aggregation: Example with a Necessary Good 2 consumers with same preferences m Equal income distribution: $144 X 1 10 10 20 $100 Unequal income distribution: $56 X 1 12 7.5 19.5 0 m x1 7.5 10 12 2 x1 Elasticity Looking for a measure of how “responsive” individual and aggregate demands are to changes in price and income. This measure is important to determine effects of taxes on prices. One Candidate One candidate measure of how “responsive” demand is to price changes is the slope of the demand function (at a given point): X 1 p1, p 2, m1, m 2,..., mn p1 Problem with Slope of Demand Function Example: X G 100 p where represents gallons of gasoline and of one gallon. X1 p is the price Change units and measure gasoline in quarts (1/4 of gallon). Let X Q represent quarts of gasoline. Demand is: X Q 400 4 p Elasticity Instead of using slope, use price elasticity of demand : X 1 p1, p 2, m1, m2,..., mn p1 p1 X 1 Advantage: independent of units Example Cont’d Demand for gasoline: X G 100 p p p Elasticity: 1 100 p XG Demand for gasoline: X Q 400 4 p Elasticity: 4p p p 4 400 4 p 100 p XQ Properties of Elasticity Elasticity changes with demand: p 100 p 100 p 1 50 0 0 50 100 X Properties of Elasticity A demand function is elastic if: A demand function is inelastic if: 1 1 A demand function is unit elastic if: 1 Example: Cobb-Douglas m Demand function: x c p x m Slope: c 2 p p x p mp c 2 1 p x p cm 2 Elasticity: Income Elasticity of Demand Describes how responsive demand is to changes in individual or aggregate income. Defined similarly to price elasticity: x1 p1, p 2, m m m x1 Income Elasticity of Demand Normal goods: Inferior goods: Luxury goods: x1 p1, p 2, m m 0 m x1 x1 p1, p 2, m m 0 m x1 x1 p1, p 2, m m 1 m x1 The Laffer Curve How do government tax revenue change when the tax rate changes? The Laffer Curve Tax R. If t 0 : zero revenues. If t 1 : zero revenues. There exists a tax rate * t that maximizes revenues. 0 t * 1 t The Laffer Curve Consider a population of identical workers * Each worker earns an hourly wage w Each worker has to pay a tax t on his/her wage Thus a worker’s net hourly wage is: w 1 t w * The Laffer Curve A worker decides how many hours to work according to the following labor supply function: Tax revenue: T twxh * a xh w (1 t ) w a The Laffer Curve Tax revenue: T twxh How do revenues change with the tax rate: T xh wxh tw t t The Laffer Curve How do revenues change with the tax rate: T xh wxh tw t t Compute: xh ((1 t ) w) a 1 a((1 t ) w) w t t a The Laffer Curve Compare with so that xh a 1 a((1 t ) w) w t xh a 1 a ((1 t ) w) 1 t w xh xh w t w 1 t The Laffer Curve We know that: Then: xh xh w t w 1 t T xh xh w wxh tw wxh tw t t w 1 t The Laffer Curve We want tax revenues to decrease with the tax rate: T xh w wxh tw 0 t w 1 t This occurs when: xh w xh t w 1 t The Laffer Curve This occurs when: Rearrange: xh w xh t w 1 t xh w 1 t w xh t The Laffer Curve Condition: xh w 1 t w xh t Compute elasticity of labor supply: xh w w a 1 a((1 t ) w) 1 t a w xh ((1 t ) w) a The Laffer Curve Thus we have that tax revenues increase when government reduces tax rate if: 1 t a t Elasticity of labor supply estimated to be at most 0.2 Tax rate on labor income is at most 0.5 The Laffer Curve Elasticity of labor supply estimated to be at most 0.2 Tax rate on labor income is at most 0.5 Plug into our condition and check that it is not verified: 1 t 1 0.5 a 0.2 1 t 0.5