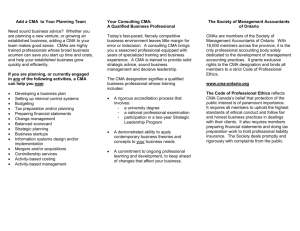

CMA Certification - Institute of Management Accountants

advertisement

CMA Certification What it Can Mean for You Institute of Management Accountants (IMA) Vision – The world’s leading association for management accounting and finance professionals Building Your Career • CMA Certification Program • Professional Development Opportunities • Networking & Leadership Opportunities • Local Chapter Meetings • Virtual Communities • IMA Ethics Center and Ethics Helpline Management Accountants – Who are we? • Chief Accounting Officer/DaimlerChrysler • Chairman, a Hong Kong Bank • KPMG consulting partner • VP, Operational Excellence, Merck • Third in command at the FBI • VP, Investor Relations, Johnson & Johnson Source: The Diverse Roles of Professional Accountants in Business, IFAC, New York, November 2004, Available at www.ifac.org. Management Accountants – What do we do? • Act as trusted business advisors • Support business management and strategic development • Provide accurate information for better decisions • Act as conscience of last resort • Work “hands on” to add value in organizations • Plan for the long-term Source: The Diverse Roles of Professional Accountants in Business, IFAC, New York, November 2004, Available at www.ifac.org. IMA & the Profession • Empower professionals inside organizations who create economic value • Foster unique role as the ones responsible for “building quality in” • Outside audit works best when the “inside” job is done correctly • Ethical and responsible corporate governance must come from the “inside” CMA – CPA Comparison CMA: • Preparer/User of accounting information • Concept based • “Inside” corporate professionals • Higher quality, lower costs • Forward-looking • Player CPA: • Auditor of accounting information • Rule based • Public practice licensure • Attesting to the accuracy of financial records • Historical • Referee CMA Certification The appropriate “gold standard” for accountants working inside organizations A CMA Professional Has… • Demonstrated ability to work across the breadth and depth of the entire accounting process within organizations • Proficiency in decision-making, planning, and control functions • Agreed to maintain professional competence through annual continuing professional education • Committed to a code of ethics How Does CMA Certification Benefit You? • Opportunity to assess and demonstrate capabilities and expand knowledge base • Distinguishes you from your peers and increases credibility and productivity • Recognition of achievement • Expanded career options and greater earning potential – CMAs earn 27% more than professionals without certification (IMA’s 18th Annual Salary Survey, June 2007) Certification Benefits to the Company • Identify motivated professionals for hiring, recognition, and advancement • Higher level of service and increased credibility among clients • Achieve and maintain a high level of knowledge, competence, and business understanding Objective Validation of CMA Program • CMA continues to be relevant to the on-the-job responsibilities of management accountants (IMA Job Analysis Study, 2006) • Compared to U.S. CPA, CFA, CMA in Canada, CMA in U.K, and ACCA in U.K. • Multi-national corporations are incorporating the CMA certification as part of their professional development programs for employees • CMA program is “valid, reliable, rigorous, and fair” 2006 Job Analysis Study • Periodic validation of content relevance as practice changes over time • Survey determines current job tasks and skills required to perform these tasks • Compare skills required to exam content • CMA continues to be relevant to practice • Minor changes to content likely implemented in 2008 Profile of a CMA Candidate • 70% have a Bachelors Degree • 29% have a Masters Degree • 1% have a PhD • 6% are CPA’s • Average age: 34 Statistics • More than 29,000 CMAs issued to date • Pass rates for the four parts of the exam range between 50% to 60% • 50% of exams taken outside U.S. CMAs – Who are we? • • • • • • • CFO, Foundations Behavioral Health CFO/Treasurer, First Savings Bank Director of Finance & Accounting, Marriott International Director of Technical Accounting & Reporting, Microsoft Finance Manager, Habitat for Humanity Financial Controller, Johnson & Johnson Vice President of Finance, Southeast Corporate Federal Credit Union Making Certification Work • Commitment by senior management to continuing professional development • Support for review programs • Company support for CMA exam process • Tangible recognition for successful completion CMA Exam Overview These exams may be taken in any order but must all be passed before registering for Part 4 • Part 1: Business Analysis - 3 hours, 110 multiple choice questions • Part 2: Management Accounting and Reporting - 4 hours, 140 multiple choice questions • Part 3: Strategic Management - 3 hours, 110 multiple choice questions Certification Exam Contents Part 1: Business Analysis Internal Controls 15% Quantitative Methods 15% Global Business 20% Financial Statement Analysis 25% Business Economics 25% Certification Exam Contents Part 2: Management Accounting & Reporting Information Management 15% Budget Preparation 15% Performance Measurement 20% Cost Management 25% External Reporting 25% Certification Exam Contents Part 3: Strategic Management Strategic Planning 15% Strategic Marketing 15% Investment Decisions 20% Corporate Finance 25% Decision Analysis 25% Certification Exam Contents Part 4 – Business Applications • Must complete Parts 1, 2, and 3 first • 3 hours, 4-7 essays/problems • All content from Parts 1, 2, and 3 included • Plus: Ethics, Organization Management, Organization Communication, and Behavioral Issues • Computer-based but no immediate scoring Becoming a CMA • • • • • • • Member of IMA Apply for admission into certification program Register for certification exam Fulfill educational credentials Pass the certification exam Satisfy the experience requirement Comply with the IMA Statement of Ethical Professional Practice • View IMA’s Webinar, “Navigating through the CMA Program” at www.imanet.org/certification_started.asp Fees • IMA Dues $195 per year • $140 registration fee per exam part in U.S. • $175 per part overseas • $125 entrance fee - College students exempt from this fee • $70 per part for college students • Dues $39 per year for college students Education Requirement • Bachelors degree • Certification equivalent to CMA or • Score in top 50th percentile on GMAT or GRE Experience Requirement • 2 years in a management accounting or financial management position or • 2 years in public accounting or • 2 years in academia Preparing for the CMA Exam • Make a Personal Commitment to Self-study • Sharpen Knowledge of Exam Topics • Restore Test-taking Skills • Take Self-administered or Instructor-guided Review Courses Remaining a CMA • Maintain IMA Membership • Meet the Continuing Education Requirement: 30 Hours/Year (Including 2 Hours in Ethics) • Comply with the IMA Statement of Ethical Professional Practice Take the Challenge Become a CMA www.imanet.org/certification