View/Open

1

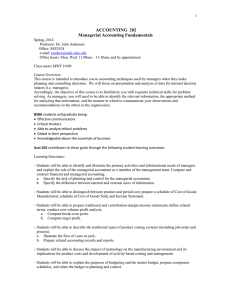

ACCOUNTING 202

Managerial Accounting Fundamentals

Spring, 2013

Professor: Dr. John Anderson

Office: SSE2424

e-mail: janders@mail.sdsu.edu

Office hours: Mon, Wed. 11:00am – 11:30am, and by appointment

Course Overview:

This course is intended to introduce you to accounting techniques used by managers when they make planning and controlling decisions. We will focus on presentation and analysis of data for internal decision makers (i.e. managers).

Accordingly, the objective of this course is to familiarize you with requisite technical skills for problem solving. As managers, you will need to be able to identify the relevant information, the appropriate method for analyzing that information, and the manner in which to communicate your observations and recommendations to the others in the organization.

BSBA students will graduate being:

Effective communicators

Critical thinkers

Able to analyze ethical problems

Global in their perspective

Knowledgeable about the essentials of business

Acct 202 contributes to these goals through the following student learning outcomes:

Learning Outcomes:

Students will be able to identify and illustrate the primary activities and informational needs of managers and explain the role of the managerial accountant as a member of the management team. Compare and contrast financial and managerial accounting. a.

Specify the task of planning and control for the managerial accountant. b.

Specify the difference between internal and external users of information.

Students will be able to distinguish between product and period cost; prepare a schedule of Cost of Goods

Manufactured, schedule of Cost of Goods Sold, and Income Statement.

Students will be able to prepare traditional and contribution-margin income statements; define related terms; conduct cost-volume-profit analysis. a.

Compute break-even point. b.

Compute target profit.

Students will be able to describe the traditional types of product costing systems (including job-order and process). a.

Illustrate the flow of costs in each. b.

Prepare related accounting records and reports.

Students will be able to discuss the impact of technology on the manufacturing environment and its implications for product costs and development of activity based costing and management.

Students will be able to explain the purposes of budgeting and the master budget, prepare component schedules, and relate the budget to planning and control.

2 a.

Prepare sales and production budget b.

Prepare raw material and labor budget c.

Prepare cash budget.

Students will be able to explain the development and use of standard costs, prepare and interpret variance analysis reports and relate them to responsibility accounting and control. a.

Prepare material price and quantity variance. b.

Prepare labor rate and efficiency variance.

Students will be able to compare and contrast absorption costing and variable costing, prepare income statements using both methods.

Students will be able to define relevant cost and benefits, giving proper treatment to sunk cost, opportunity costs, and unit costs; prepare analysis of special decisions. a.

Decide to accept or reject a special order. b.

Decide to outsource a product or service. c.

Decide to add or drop a service or product; and sell or process further a product.

Students will be able to explain the nature of capital expenditure decisions and apply and evaluate various methods used in making these decisions.

a.

Using the method of net present value. b.

Using the method of internal rate of return.

Required Text: R.Hilton, Managerial Accounting 9 th Edition,Textbook (make sure to get correct edition)

Optional: Study Guide (highly recommended for your study, additional practice and review; very useful in helping you prepare for exams)

The author’s website provides useful information for study and review (for example-outlines, multiple choice questions, etc.)

The website for the managerial accounting text is www.mhhe.com/hilton9e .

Select the student edition tab on the website, then select the chapter you are interested in, then select what you want (multiple choice quiz ,power point presentation, etc. )

Grading:

% Score X Points = Points Earned

Exam 1 16 points

Exam 2 16 points

Exam 3 16 points

Exam 4 18 points

Exam 5 17 points

Exam 6 17 points

------------

Total 100 points

At anytime, you can compute how you are doing in the class by computing the points earned as indicated above, and dividing that by the total possible points to date. There will be no plus or minus grades.

Anticipate no curve, with the final grades being assigned as follows (there is no rounding in calculation of points earned):

A = 90.0 points

B = 80.0 points

C = 70.0 points

D = 60.0 points

F = below 60.0 points

There is no “extra credit” available, the final grade is based totally on the above assignments.

3

Homework:

Homework should be prepared and brought to class as indicated on the syllabus. It is important to be thorough in the preparation of this homework.

In addition to those exercises and problems assigned as homework, you will be responsible for any other exercises and problems which are demonstrated in class.

Exams:

Bring your picture I.D. to the exam; you will be required to show it. Purchase the smaller pink Parscore exam form from the bookstore for the exams.

Exam dates and coverage are indicated on the class schedule below. You must take the exam at the scheduled time, only a valid medical reason (which you may be required to document) will allow you to take a make-up exam. You must notify me the day of the exam if there is a valid medical reason, leaving me an email message with your phone number, including the hours when I can reach you. No calculators with sophisticated programmable memory can be used during examinations. Any questions regarding the acceptability of your calculator should be resolved well before an examination. Standard financial calculators are acceptable.

Academic honesty:

It is expected that all exams are done individually. Copying someone else’s work is an instance of plagiarism. San Diego State University condemns plagiarism, and the penalties can include severance from the University and in some cases revocation of an advanced degree (see the San Diego State University

General Catalog and the San Diego State University Bulletin of the Graduate Division). For any violations, the student may receive an “F” for the assignment, examination, or the entire course.

Class Schedule:

The exercises and problems listed below are the assigned homework, due in class on the dates indicated.

This list may be added to by way of announcement in class. You are also responsible for the text chapters.

You are also responsible for any additional exercises and problems that are demonstrated in class.

Note: Be sure to bring the textbook to all classes and lectures. You may also find it useful to bring a printout of the powerpoint for taking notes during lecture (the powerpoint is available on the author’s website, www.mhhe.com/hilton9e .

Remember to have all homework ready at the beginning of class.

Some advice in the preparation of your homework:

Your attendance at the lectures is essential to inform you and guide you. This should be followed by a thorough study of relevant sections of the text before attempting the homework. This should help in making your homework preparation both effective and efficient.

1/18/13 F Introduction

1/21 M Martin Luther King, Jr. Day, No Class

1/23 W Ch 1,2 Lecture: Basis cost term and Concepts

Illustration of Job Order Costing System

1/25 F Ch 2 Lecture: Basis cost term and Concepts

Illustration of Job Order Costing System

Continued

4

1/28 M E2-24,25,31

1/30 W E2-26,P2-42

2/1 F Ch 3 Lecture: Product costing and Job order Costing Systems

2/4 M Ch 3 E3-23,E3-27,E3-30(part 1 and 2 only), E3-35

2/6 W Ch 3 E3-32, E3-34 (part 1 and 2 only), E3-24

2/8 F Ch 4 Lecture: Process Costing

2/11 M Ch 4 E4-18,20

2/13 W Ch 4 E4-22 (part 1 and 2 only), Case4-39 (Part 1 through 4 only)

2/15 F Ch 5 Lecture: Activity Based Costing and Cost Management

2/18 M Ch 5 Write brief answers for review questions 5-1 through 5-3,

5-5 through 5-8, 5-13; Ex 5-27, Pb 5-53 (part 1 only)

2/20 W Exam 1: Ch 1,2,3.Please remember to bring your picture i.d.

and the smaller, pink Parscore test form from the bookstore

2/22 F Exam 2: Ch 4,5

2/25 M Ch 6 Lecture: Activity Analysis, Cost behavior, and cost

estimation

2/27 W Ch 6 E6-24,25,26

3/1 F Ch 7 Lecture: Cost-Volume-Profit analysis

3/4 M Ch 7 E7-24,25,28

3/6 W Ch 9 Lecture Profit planning

3/8 F Ch 9 Exercises E9-24,27,29

3/11 M Ch 10 Lecture Standard costing, Operational performance

measures, balance scorecard

3/13 W Ch 10 E10-31, Pb10-44, Pb10-55(part 1 only)

3/15 F Ch 12 Lecture: Responsibility accounting, quality control

3/18 M Ch 12 E12-30, 33(part 1), 34

3/20 W Ch 12 E12-35, Pb12-49, (part 1 and 2 only)

3/22 F Exam 3: Ch 6 7 9

3/25 M Exam 4: Ch 9 10 12

3/27 W Ch 11 Lecture: Flexible budgeting

3/29 F Ch 11 Exercises 11-26 (part 1a and 1b only), E11-28, Pb11-36

Spring Break 4/1 – 4/5

4/8 M Ch 13 Lecture: Investment centers

4/10 W Ch 13 E13-24, 25, 26

4/12 F Ch 14 Lecture: Decision making: relevant cost and Benefits

4/15 M Ch 14 E14-35, 40

4/17 W Ch 14 E14-41, Pb14-44 (part 1 & 2 only)

4/19 F Ch 15 Lecture: Cost analysis and pricing decisions

4/22 M Ch 15 Review Questions 11, 12, 13, 14, E15-34, 36

4/24 W Ch 16 Lecture: Capital expenditure decisions

4/26 F Ch 16 E16-24, 25, 30

4/29 M Ch 16 E16-32, Pb16-44 (part 1 only), Pb16-45

5/1 W Ch 8 Lecture: Absorption variable and throughput costing

5/3 F Ch 8 Review Questions 8-1, 2, 4, 5, E8-19,13

5/6 M Exam 5 Ch 11 13 14

5/8 W Exam 6 Ch 15 16 8

5