Supply and Demand

Supply and Demand

Gas prices at record high

West Texas Intermediate (Bbl)

80.000

70.000

60.000

50.000

40.000

30.000

20.000

10.000

0.000

Ja n-

01

Ja n-

02

Ja n-

03

Ja n-

04

Ja n-

05

Ja n-

06

Prices of Oil and Gasoline continue to climb!

What happens if

Iranian oil is taken offline?

August 25, 2005

Rising Price of Oil Pushes S.&P. to Negative

Territory

By ERIC DASH

Oil prices climbed to another record yesterday, driving stocks lower and leaving the Standard &

Poor's 500-stock index down for the year.

All three major market gauges closed lower yesterday; the S.&. P.'s loss meant that for the first time since July 7, all three were in negative territory for the year. "Once oil decided that it was going to move higher and stay higher, that just took the starch out of any buyers in the stock market," said

Joseph Liro, the chief equity strategist at Stone &

McCarthy, an economic research firm in Princeton.

"Oil is just the biggest single depressant on the market except for the oil stocks."

To think about commodity prices, economists first think about the theory of competitive markets

• Competitive Markets have many buyers and many sellers who compete without barriers preventing rivals from entering or leaving the market.

• Participants in competitive markets are price takers, agents who behave as if their own behavior has no effect on market prices.

Law of Demand: There is always an inverse relationship between the price of a good and the quantity that consumers would like to purchase.

Reason:

•

Consumers have limited income.

•

The price that consumers will pay for an extra good will be no greater than the extra benefit that they receive from it.

•

People face diminishing returns from consuming any given good.

•

Each extra good consumed generates less marginal benefit than the good before

•

Consumers will be willing to pay less for each extra good than they were willing to pay for the good before.

Representation of a Hypothetical Oil

Demand Schedule

US$/bbl Mil. Bbl

P Q

30 31867.11

35 31568.86

40 31312.77

45 31088.6

50 30889.43

55 30710.37

60 30547.8

65 30399.01

70 30261.9

75 30134.8

80 30016.4

85 29905.6

90 29801.51

95 29703.39

100 29610.59

P

120

100

80

60

40

20

0

29000 29500 30000 30500 31000 31500 32000

Q

Law of Supply: There is a positive relationship between the price of a good and the quantity producers bring to the market.

• In a competitive market place, producers are willing to sell an extra good as long as the price is at least as large of the extra cost of producing it (marginal cost).

• Producers have decreasing returns to production and therefore increasing costs. To induce them to produce greater amounts, they must be compensated for these increasing costs with higher prices.

Why do supply curves slope up?

• Firms will only increase supply when prices rise because their costs as production increases.

• Producing extra goods generates increasing costs because some inputs are fixed and the flexible factors of production will have diminishing returns.

– Example: A busy McDonalds can sell more burgers by adding more McWorkers, but effectiveness of workers is limited by amount of Cash registers,

Ovens, and ultimately Space.

Representation of a Hypothetical Oil Supply

Schedule

US$/bbl Mil. Bbl

P Q

30 29893.38

35 30078.28

40 30239.36

45 30382.16

50 30510.48

55 30627.02

60 30733.8

65 30832.36

70 30923.89

75 31009.35

80 31089.51

85 31164.99

90 31236.32

95 31303.95

100 31368.24

120

100

80

60

40

20

0

29

89

3

30

14

3

30

39

3

30

64

3

30

89

3

Q

31

14

3

31

39

3

Equilibrium

• Equilibrium in the competitive market occurs when the price is set at a level (P*) such that the amount that consumers want to buy is equal to the amount that sellers want to sell (Q*).

Excess Supply If P were above equilibrium, sellers would want to sell more goods than buyers would want to buy. Competition between sellers would force prices down.

Excess Demand If P were below equilibrium, customers would want to buy more goods than people would want to sell. Competition between buyers would force prices up.

Competitive Market Equilibrium

(Geometry)

P

D S

P*

Q*

Q

P

P*

P

D

Excess Supply

S

Q* Q

P

Excess Demand

D S

P*

P

Q* Q

Market Equilibrium

(

Spreadsheet Problem

)

Supply Demand

30 29893.38 31867.11

35 30078.28 31568.86

40 30239.36 31312.77

45 30382.16

31088.6

50 30510.48 30889.43

55 30627.02 30710.37

60 30733.8

30547.8

65 30832.36 30399.01

70 30923.89

30261.9

75 31009.35

30134.8

80 31089.51

30016.4

85 31164.99

29905.6

90 31236.32 29801.51

95 31303.95 29703.39

100 31368.24 29610.59

At what price and quantity (to closest $5) will the oil market clear?

Elasticity: The Concept

• How strong is the effect of a change in price on the change in quantity supplied or quantity demand.

• If the price effect is strong, we say the supply/demand schedule is elastic.

• If the price effect is weak, we say it is inelastic.

Strict definition to come

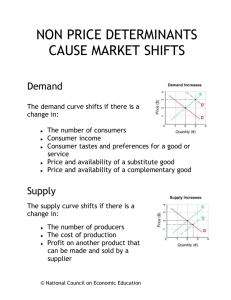

Shifting Curves/Changing Equilibrium

• Changes in equilibrium result from shifts in either the demand or supply schedule. We think of shifts in the curves as changes in supply or demand that are caused by factors other than changes in the price of the good.

– Shifts in the demand curve lead to movements along the supply curve resulting in changes in prices and quantities that move in the same direction.

– Shifts in the supply curve lead to movements along the demand curve resulting in changes in prices and quantities that move in different directions.

What shifts a demand curve?

1. Changes in consumer preferences

2. Changes in consumer income

3. Changes in the prices of other goods.

Hypothetical Demand Shift

• Consider that there is an increase in consumer income sufficiently large that oil demand would increase by 5% if the price level stayed the same. This event will increase the demand for oil at any given price level. Demand schedule shifts out/up.

• Equilibrium price and quantity rise.

• At the old price level, there is a situation of excess demand. As consumers, scramble to get more oil, producers are able to raise prices.

• Higher prices induce i) some cutbacks in oil use; and ii) some additional production until supply is equal to demand.

A Shift in the Demand Curve : A parallel increase in the demand schedule at every price point.

Equilibrium Effect: Movement along the supply curve

P

S

P**

P*

Shift in the demand curve

D′

Q* Q**

D

Q

A shift in the demand schedule

(

Spreadsheet

)

A 5% shift in the demand schedule

Supply Demand Demand'

30 29893.38 31867.11 33460.47

35 30078.28 31568.86 33147.31

40 30239.36 31312.77 32878.41

45 30382.16

31088.6 32643.03

50 30510.48 30889.43

32433.9

55 30627.02 30710.37 32245.88

60 30733.8

30547.8 32075.19

65 30832.36 30399.01 31918.96

70 30923.89

30261.9 31774.99

75 31009.35

30134.8 31641.54

80 31089.51

30016.4 31517.22

85 31164.99

29905.6 31400.88

90 31236.32 29801.51 31291.59

95 31303.95 29703.39 31188.56

100 31368.24 29610.59 31091.12

If price stayed constant, demand for oil would increase 5%.

But to get producers to produce more, price must go up which will have a counter-veiling effect on demand. .

What is the new equilibrium price?

Shifts in Supply Curves

•

Supply curves represent the extra cost of producing a good which increases in the number of goods produced. But other factors may affect cost besides scale.

•

Cost Shifters

1.

Changes in resource prices

2.

Changes in Technology

3.

Nature and Political Disruptions

4.

Changes in Taxes on Producers

A Shift in the Supply Curve is a Movement along the Demand curve-

Price and Quantity Move in opposite Directions

P

D

S′

S

P**

P*

Q** Q*

Q

Equilibrium Effects of an Decrease in

Supply

• When there is some disruption, oil companies produce less at any given price. Supply schedule shifts in/up.

• Equilibrium price rises/Equilibrium quantity falls.

• At the current price level, there is a situation of excess demand. As consumers, scramble to get more oil, producers are able to raise prices.

• Higher prices induce i) some cutbacks in oil use; and ii) some additional production from other sources; until supply is equal to demand.

Quantity of Oil Use Accelerating

Growth in World Oil Consumption

7.00%

6.00%

5.00%

4.00%

% 3.00%

2.00%

1.00%

0.00%

-1.00%

2000 2001 2002 2003

World OECD ROW

Source: BP Statistical Review 2005

2004 2005

Analysis

• Use observed information on oil prices and quantities to assess strength of supply and demand shocks in context of world events.

Learning Outcomes

• Solve for equilibrium price and quantities using graphical supply and demand model or spreadsheet supply and demand schedules.

• Explain qualitatively the likely consequences of exogenous shifts in supply and demand the likely causes of shifts in equilibrium prices and quantities.

Negative Supply Shock

• Negative supply shock like embargo on

Iranian oil would raise prices and reduce quantity of oil available.

– But how much?