Microsoft Word 2007

advertisement

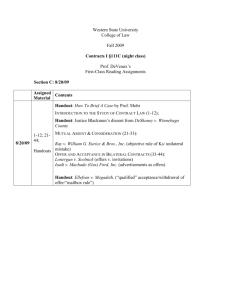

FEDERAL PERSONAL INCOME TAX – SPRING 2011 LAW 647-002 Professor Benjamin Leff SYLLABUS Required Texts: Casebook: Michael J. Graetz and Deborah Schenk, FEDERAL INCOME TAXATION: PRINCIPLES AND POLICIES (Foundation Press 6th Edition). Code and Regulations: Steven A. Bank and Kirk J. Stark, SELECTED SECTIONS: FEDERAL INCOME TAX CODE AND REGULATIONS (Foundation Press 2010-11, but a prior version will work). Also, the entire tax code is available online at various sites, including http://www4.cornell.edu/uscode/26; the regulations are available at http://www.gpoaccess.gov/cfr/retrieve.html (Treasury Regulations are Title 26). Recommended Text: Marvin A. Chirelstein, FEDERAL INCOME TAXATION (Foundation Press 11th, but a prior version will work). Classroom attendance/participation policy: Class meets Monday and Wednesday between 9:00 and 10:50 A.M. in room 401. I urge all students to come to class regularly having done the reading. Class attendance and participation are mandatory. If a student’s grade on the final exam is on the borderline between two grades, excellent attendance and preparation may result in an upward adjustment. Exam: The exam will be an in-class, open book, exam. Please confirm final exam time and date before exam period. Office Hours: Tuesdays 3:00 to 5:00 (or feel free to drop by or email for an appointment). Office: 404. Email: bleff@wcl.american.edu. Assignments Tentative: This syllabus is subject to change. Please note changes announced in class or posted on the course website. I. INTRODUCTION TO FEDERAL INCOME TAXATION a. Overview of class; overview of federal income taxation CB 1-4, 12-27 (introduction, current taxes, terminology); CB 71-74, 78-80, 85-88 (notes on administering the tax code) II. GROSS INCOME a. Compensation for services CB 28-41 (intro to income tax policy) CB 96-103 (Old Colony Trust Co. v. Comm’r, U.S. 1929). CB 130-133 (imputed income). IRC §61 b. Special Cases CB 133-139 (Gifts: Commissioner v. Duberstein, US 1960; notes (A) and (B)); IRC §§ 102(a), 102(c), 274(b) CB 142(H)-143; IRC §74(a) (Prizes and Awards) CB 144(C); IRC §117(a)-(c)(1) (Scholarships and Fellowships) Handout: Problem 1 c. Fringe Benefits -- §119, §132 CB 103-104 (“introductory note on fringe benefits”); CB 120-129 (U.S. v. Gotcher, 5th Cir. 1968, and notes). IRC §119 CB 111-118, stop before (C). Handout: Comm’r v. Kowalski, 434 U.S. 77 (1977). Handout: Turner v. Comm’r, Tax Court (1954) Handout: Obama’s Mother-in-law IRC §§132(a) through (e). Skim Treas. Regs. §§1.132-2, 1.132-6 (Bank, Stark, CODE AND REGS at 140-142; 581-583). d. Constitutional Issues Handout: Murphy v. IRS, DC Cir. 2006 and 2007 Handout: Constitution Art. I, §§2, cl. 3; §9, cl. 4; 16th Amendment Handout: TBA (Healthcare Constitutionality) IRC §104(a)(2). e. Recovery of Capital and Basis CB 145-151 (Notes on capital recovery and basis) Handout: Problem 2 (Basis and Gain) Handout: Raytheon v. Comm’r, 1st Cir. 1944 Handout: Garber v. United States, 5th Cir. 1979 IRC §§ 1001(a), 1012. f. Realization CB 154-166 (Note on realization requirement; Cesarini v. U.S., N.D. Oh 1969; Haverly v. U.S., 7th Cir. 1975; Eisner v. Macomber, US 1920) g. Illegal income, Discharge of Indebtedness CB 179-187 (Collins v. Comm’r, 2d Cir. 1993) CB 187-196 (Zarin v. Comm’r, TC 1989) Handout: Kirby Lumber, US 1931 III. DEDUCTIONS a. Profit-Seeking Expenditures CB 228-237 (Welch v. Helvering, US 1933; Gilliam v. Comm’r, TC 1986); Optional Handout: Tax Stories chapter on Welch v. Helvering CB 237-245 through (D) (Exacto Springs v. Comm’r, 7th Cir. 1999) Handout: Menard v. Comm’r, No. 08-2125 (7th Cir. 2009) IRC §§162(a), 162(m) b. Expenses Contrary to Public Policy CB 246-251 through (F) (Comm’r v. Tellier, US 1966); Handout: Tank Truck Rentals v. Comm’r, US 1958 Handout: Treas. Reg. §§ 1.162-1(a); 1.162-21(b) IRC §162(f) c. The Business/Personal Borderline: Lobbying, Clothes, Travel Introduction: CB 252-254 (“lobbying”); CB 258-266 through (C) (Pevsner v. Comm’r, 5th Cir. 1980) CB 268-270 (to top of page)(“ travel expenses”); CB 271-280 (travel and expenses while “away from home;” Hantsis v. Comm’r, 1st Cir. 1981) IRC §§162(e); 162(a)(2); 262 d. The Business/Personal Borderline: Meals, Gambling, Hobbies CB 281-289 (Moss v. Comm’r, TC 1983; Section 274(n)) IRC §274(a), (e), (k), (n) CB 376-383 (Plunkett v. Comm’r, TC 1984) IRC §183 e. Personal Deductions: Personal Interest, Taxes, Casualty Losses CB 421-423 CB 352-355, (personal interest) IRC §§163(h); 221 CB 431-433 stop before “Foreign tax credit” (taxes) IRC §§164; 67(b)(2) CB 383-388 (casualty losses) IRC §§165(c)(3); 165(h) f. Personal Deductions: Medical Expenses, Charitable Contributions CB 455-463 (medical expenses) IRC §213 CB 435-447 (charitable contributions) IRC §170, 501(c)(3) Handout: TBA g. The Business/Capital Expenditure Borderline i. Introduction to Capital Expenditures: CB 294-296(Tax Impact of the Capitalization Requirement); CB 301-306 (through A) (Note on the Distinction Between Deductible Expenses and Capital Expenditures; Woodward v. Comm’r, US 1970); IRC §§263(a), 263A(a) ii. Education and Job Seeking Expenditures: CB 314-315 (Note G); 327-328 (Rev. Rul. 75-120); 329-335 (Wassenar v. Comm’r, TC 1979 and notes) Handout: Sharon v. Comm’r, TC 1976 IRC §§162, 212; Treas. Reg. 1.162-5(b)(3) iii. Capital Recovery – Depreciation: CB 336-339; 340-341; in 343-347, read (C)(D)(E)(H). Handout: World Publishing v. Comm’r, 8th Cir. 1962 IRC §167(a), 168 iv. Business Interest: CB 350-352; 360-364 (Knetch v. US, US 1960, and notes) Handout: Tax Stories Chapter on Knetch IRC §163(a) v. Recovery of Business Losses: CB 166-171 (Cottage Savings through (B)); CB 388-392 (through (D)) (Fender v. US, 5th Cir. 1978) IRC §1001(a) IV. CAPITAL GAINS AND LOSSES a. Introduction: History and Rationale: CB 536-551 IRC §§1(h), 1001, 1011, 1012, 1016, 1211, 1212, 1221-1222 What is a Capital Asset: CB 551-565 b. What is a Capital Asset II: CB 571-585 c. What is Property: CB 595-614 Nonrecognition of Gain or Loss Handout: Klein, Bankman, Shaviro at 224-233 Handout: Calif. Fed. Life Ins. Co. v. Comm’r, 680 F.2d 85 (9th Cir. 1982) IRC §§ 1031, 1033, 121 V. FAMILIES AND THE TAX CODE a. Marriage: CB 464-476 IRC §§1(a)-(d), 2(b) Handout: CCA 201021050 (California Domestic Partners) Handout: Gill v. OPM (D. Mass. 2010) b. CB 476-488 Divorce and Innocent Spouse Handout: Banach v. Commissioner §§71, 1041 Handout: Estate of Aylseworth v. Comm’r, 24 TC 134 (1955) Handout: Porter v. Comm’r, 132 T.C. No. 11 (2009) IRC §6015 (not in our book, find online) c. Assignment of Income: CB 489-496; 497-504 Alternative Minimum Tax (AMT) CB 776-789 Handout: Bankman Example 82; Cameron Problem 244 d. Low-Income Taxpayers: CB 424-428 Handout: IRS Publication 596 (Earned Income Credit) Handout: Shaviro, Effective Marginal Tax Rates Handout: CBO Effective Tax Rates IRC §32 VI. TAX SHELTERS AND TAX LAWYER ETHICS a. Tax Shelters CB 790-823 Handout: IRC §7701(o) Handout: TBA b. Tax Lawyer Ethics: CB 823-838 Handout: Tax Shelter Registration Memo c. Final Day: TBA